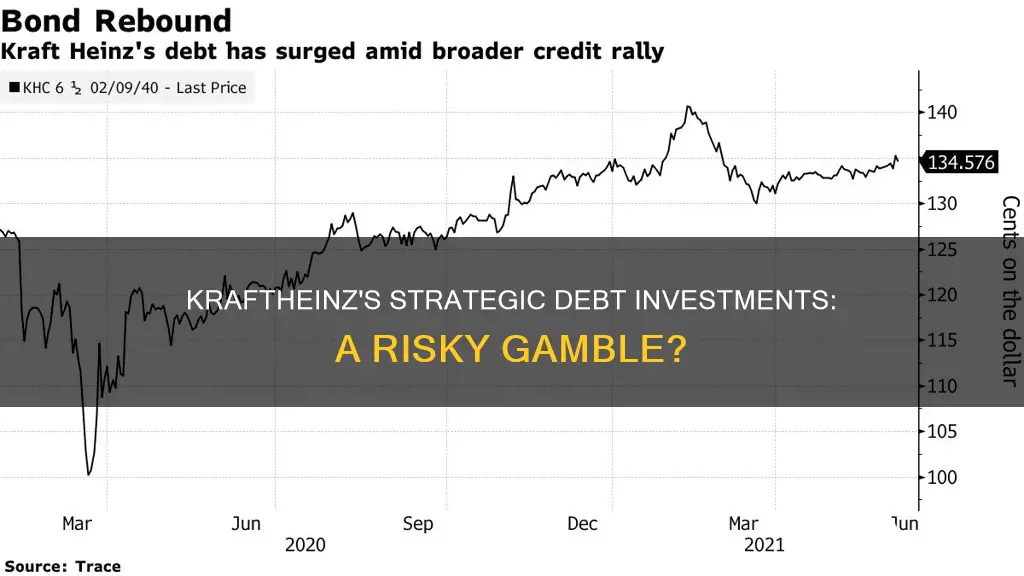

Kraft Heinz's use of debt for strategic investments is a complex issue that has sparked varying opinions among investors and analysts. The company's substantial debt, totalling nearly $31 billion in long-term debt, has raised concerns about its financial health and ability to sustain operations. While debt can be a strategic tool for investing in growth, it also poses risks, including the possibility of bankruptcy if debt obligations cannot be met. Kraft Heinz's decision to cut its dividend signals its intention to address its debt problem, but it remains to be seen if this will be enough to stabilise the company's financial situation.

| Characteristics | Values |

|---|---|

| Debt-to-equity ratio | 0.431 |

| Current ratio | 0.87 |

| Net debt | $18.9 billion |

| Total debt | $20.65 billion |

| Total assets financed by debt | 69% |

| Interest debt per share | N/A |

| Long-term debt | $14 billion |

| Long-term debt to capitalisation | 4.8 |

| Total debt to capitalisation | 4.4 |

| Credit rating | BBB |

What You'll Learn

Kraft Heinz's debt-to-equity ratio

As of June 30, 2024, Kraft Heinz's debt-to-equity ratio was 0.39. This is a decrease from the previous quarter, which had a ratio of 0.41. Over the past 13 years, the highest debt-to-equity ratio for Kraft Heinz was 2.30, the lowest was 0.38, and the median was 0.53.

In comparison to other companies in the Consumer Packaged Goods industry, Kraft Heinz's debt-to-equity ratio is higher than 50.93% of companies, with an industry median of 0.39.

The use of debt for strategic investments and acquisitions is common among large-cap companies, and Kraft Heinz, with a market cap of US$58 billion, falls into this category. The company's debt-to-equity ratio of 49% indicates that it is an above-average leveraged company. This is typical for large-cap companies, as debt can be a less expensive alternative to equity due to the tax deductibility of interest payments.

While Kraft Heinz's debt level is considered acceptable, the company has room for improvement in its cash flow coverage to better prepare for events that may require debt repayment.

The Power of Investing: Timing Cash Flows is Irrelevant

You may want to see also

The company's ability to pay off debt

Kraft Heinz's ability to pay off its debt has been a concern for investors and analysts. As of 2019, the company was facing a "mountain of debt" and a "debt problem", with a total debt of about $31 billion. This included both long-term and short-term debt, with long-term debt making up the majority.

The company's debt-to-equity ratio was 0.431, indicating that Kraft Heinz is highly leveraged and reliant on debt to finance its assets. This high level of debt resulted in significant interest payments, reducing the company's earnings per share (EPS). The interest coverage ratio, which compares a company's ability to pay interest on its outstanding debt, was at 5.23x, suggesting that Kraft Heinz's interest payments were adequately covered.

However, Kraft Heinz's operating cash flow was not sufficient to cover its total debt. The company's liquidity, or ability to meet financial obligations, was a concern, and it was projected that Kraft Heinz's Change to Liabilities would increase significantly.

To address its debt, Kraft Heinz took several steps, including slashing its dividend by 36% to save cash for debt repayment and selling off brands, such as the Maxwell House coffee business. The company also planned to dedicate proceeds from the sale of its India beverage and Canadian natural cheese businesses to reduce debt. Despite these efforts, analysts warned that it would take many years for Kraft Heinz to generate enough cash to significantly reduce its debt.

In summary, while Kraft Heinz exhibited some ability to meet its short-term obligations, its high debt levels, increasing liabilities, and insufficient cash flow to cover total debt raised concerns about its ability to pay off its debt in the long term.

Understanding Proceeds From Equipment Sales: Cash From Investing?

You may want to see also

Kraft Heinz's financial liquidity

Kraft Heinz's liquidity is a critical aspect of its future profitability and ability to meet its financial obligations. The company's cash, liquid assets, total liabilities, and shareholder equity can be used to assess the level of leverage it is employing to sustain its operations.

Kraft Heinz's current ratio, which is calculated as current assets divided by current liabilities, is 0.87, indicating that it does not have enough short-term capital to meet its financial commitments when they become due. The company's liquidity is also impacted by its debt obligations, with a significant portion of its assets financed through debt.

Kraft Heinz's ability to manage its liquidity is crucial. The company must ensure that its current assets are properly aligned with current liabilities. If there is a mismatch, Kraft Heinz may need to obtain alternative financing to maintain sufficient cash equivalents on its balance sheet to meet its obligations.

The company's cash flow and ability to generate cash are also essential factors in its liquidity. Kraft Heinz's operating cash flow over the last twelve months was US$1.4 billion, resulting in an operating cash to total debt ratio of 4.4%. This ratio suggests that the company's operating cash is not sufficient to cover its debt obligations.

Kraft Heinz's liquidity position has implications for its shareholders and investors. Higher-leverage indicators generally signify a higher risk to shareholders, while also providing insights to investors on how market shifts may impact the company's stakeholders.

Strategies for Investing Cash Without IRS Attention

You may want to see also

The impact of debt on the company's overall profitability

Kraft Heinz's use of debt has had a significant impact on the company's overall profitability. The company has a substantial amount of debt, with a net debt of $18.9 billion as of March 2024 and liabilities of $36.8 billion, which is a mountain of leverage relative to its market capitalization of $39.3 billion. This high level of debt has led to a downgrade in the company's credit rating and an increase in its cost of borrowing. The company's debt-to-equity ratio of 0.431 is considered OK given its industry classification, but it indicates that the company has a high level of financial leverage, which can amplify potential profits but also increases the risk of financial distress and bankruptcy.

Kraft Heinz's profitability has been affected by its debt service obligations, with high-interest payments reducing its earnings per share. The company's operating cash flow has not been sufficient to cover its debt, and it has had to cut its dividend by 36% to save cash for debt repayment. The company's ability to generate cash flow to service its debt has been a concern, and it has had to explore various options to meet its debt obligations, including asset sales and raising additional capital.

Kraft Heinz's debt has also impacted its ability to invest in its business and brands. With a significant portion of its cash flow going towards debt service, the company has had limited funds available for reinvestment and growth initiatives. This has affected its ability to innovate, market its products, and maintain its market position.

The company's high debt levels have also made it vulnerable to economic downturns and changes in the business environment. As interest rates rise, the company's debt service obligations increase, further impacting its profitability. Additionally, during economic downturns, the company may struggle to generate sufficient cash flow to meet its debt obligations, leading to a potential credit rating downgrade and higher borrowing costs.

Kraft Heinz's management has recognized the need to address its debt issues and has taken steps to improve its financial position. The company has implemented cost-cutting measures, divested non-core assets, and focused on improving its operational efficiency. These actions have helped the company generate cash flow and reduce its debt levels.

However, despite these efforts, Kraft Heinz continues to face challenges due to its debt burden. The company's credit rating remains under pressure, and its ability to raise additional capital may be limited. The high debt levels have constrained the company's financial flexibility and its ability to pursue strategic acquisitions or investments in new products and technologies.

In summary, Kraft Heinz's debt has had a significant impact on its overall profitability. The high debt levels have led to increased borrowing costs, constrained the company's financial flexibility, and impacted its ability to invest in growth initiatives. The company has taken steps to address its debt issues, but it continues to face challenges in reducing its debt burden and improving its overall profitability.

Cashing Out Investments: Using the Cash App to Withdraw Funds

You may want to see also

The role of debt in the company's capital structure

Kraft Heinz's capital structure has been a topic of discussion and concern for investors and analysts. The company has a significant amount of debt on its balance sheet, which has led to a highly leveraged position. As of 2024, Kraft Heinz's debt was reported to be around $20 billion, with a debt-to-equity ratio of 0.43, indicating that debt financing is a substantial part of the company's capital structure.

The role of debt in a company's capital structure is essential for several reasons. Firstly, debt can be a cheaper source of financing compared to equity, as interest payments on debt are often tax-deductible. This makes debt financing attractive for large companies like Kraft Heinz, as it can lower their overall cost of capital. Additionally, debt provides a way to invest in growth opportunities and strategic acquisitions. In the case of Kraft Heinz, debt has likely played a role in funding its mergers and acquisitions, such as the merger between Kraft and Heinz in 2015.

However, relying heavily on debt also carries risks. Kraft Heinz's high debt levels have led to concerns about its ability to meet its financial obligations. The company's interest coverage ratio, which compares earnings before interest and taxes (EBIT) to interest expenses, has been monitored by analysts to assess its ability to service its debt. While Kraft Heinz's EBIT has covered its interest expenses, a decline in operating income could impact its ability to meet interest payments.

To address its debt position, Kraft Heinz has taken several actions. The company has cut its dividend, freeing up cash to pay down debt. Additionally, they have sold off brands and assets to raise capital. Kraft Heinz has also implemented operational efficiencies and cost-cutting measures to improve profitability and cash flow, with the aim of reducing their net leverage ratio.

In summary, debt plays a significant role in Kraft Heinz's capital structure, offering both benefits and risks. The company's management has recognised the need to address its debt position and has taken steps to reduce leverage and improve financial health. However, the success of these actions in the long term remains to be seen, and Kraft Heinz's ability to manage its debt effectively will continue to be a key focus area for investors and analysts.

Positive Cash Flows: A Smart Investment Strategy?

You may want to see also

Frequently asked questions

Yes, Kraft Heinz has a lot of debt. As of March 2024, the company had US$20.5 billion in debt, with net debt (debt minus cash) of US$18.9 billion. The company's long-term debt is expected to rise to about US$14 billion.

Kraft Heinz's high debt levels impact its financial health and ability to invest in growth opportunities. The company's debt service obligations result in high-interest payments, reducing earnings per share (EPS). Additionally, the company's credit rating is at risk of being downgraded, which could increase its borrowing costs.

Kraft Heinz is taking several steps to manage its debt, including cutting its dividend, selling off brands, and reinvesting efficiency gains to accelerate its strategic plan. The company aims to reduce its net leverage ratio to below 4x.

Yes, Kraft Heinz's debt likely impacts its ability to make strategic investments. The company's high debt service obligations may limit its financial flexibility and ability to invest in growth opportunities. However, debt can also be a tool to invest in growth if managed effectively.