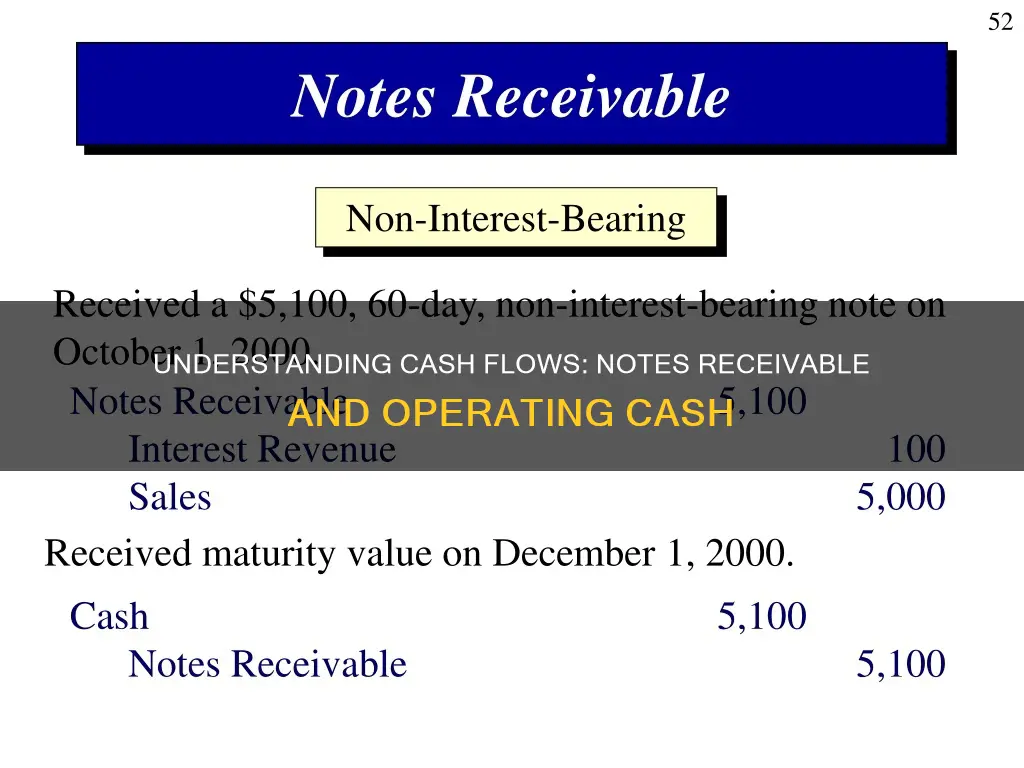

Understanding the statement of cash flows is essential for businesses to determine their cash position and make informed decisions. This statement comprises three primary sections: operating activities, investing activities, and financing activities. The focus here is on the second section, investing activities, and specifically, the treatment of cash paid on a note receivable within this context. Notes receivable are a type of asset account that arises when a business provides a loan or extended payment terms to a customer, who then signs a legally binding document, known as a promissory note, agreeing to repay the debt. This scenario is common when customers require more time to pay for a product or service than the standard billing terms. Now, when it comes to the statement of cash flows, investing activities involve transactions related to long-term assets, such as changes in fixed assets, long-term investments, and intangible assets. If a company collects cash on a note receivable, it is considered an investing activity and is reflected in this section of the statement. The classification of cash flows as operating or investing depends on the nature of the note receivable and the underlying transaction.

What You'll Learn

Notes receivable are a variation of accounts receivable

A note receivable is a written promise to pay cash to another party on or before a specified date in the future. It is a balance sheet item that records the value of promissory notes that a business is owed and should receive payment for. A note receivable is also known as a promissory note.

The key components of notes receivable are:

- Principal value: The face value of the note

- Maker: The person or business that makes the note and promises to pay

- Payee: The person or business that holds the note and is due to receive payment

- Stated interest: The predetermined interest rate that the maker must pay, in addition to the principal amount

- Timeframe: The length of time the note is to be repaid within

Notes receivable are recorded as an asset because they represent the monetary value that a business expects to collect. If they are due within a year, they are treated as a current asset. If they are due after a year, they are treated as a non-current asset.

Notes receivable are distinct from other forms of accounts receivable because a promissory note is involved. This is a legally binding document that adds another layer of commitment to pay on the part of the customer.

Understanding Cash Flow from Sales of Investments

You may want to see also

Notes receivable are asset accounts

Notes receivable are recorded as assets on a company's balance sheet because they represent monetary value that the business expects to collect in the future. The classification of this asset as current or non-current depends on the timeframe for repayment. If the note is due within a year, it is considered a current asset. If the repayment date is more than a year in the future, it is treated as a non-current asset.

The key components of a note receivable include the payee, who is the business or organisation owed the principal and interest, and the maker, who is the customer with the obligation to repay. The principal value, or the face value of the note, is the amount loaned by the payee to the maker. The interest rate applied to the principal balance determines the additional interest that the maker must pay. The timeframe for repayment, also known as the term or maturity date, is specified in the promissory note, and notes receivable are typically not subject to prepayment penalties.

In summary, notes receivable are asset accounts that reflect the value of promissory notes that a business is owed by its customers. They are recorded as current or non-current assets on the balance sheet, depending on the repayment timeframe. By offering extended payment terms, notes receivable can help businesses expand their customer base and generate more revenue.

Investments and Cash Equivalents: What's the Real Difference?

You may want to see also

Notes receivable are recorded as an asset on a balance sheet

Notes receivable are distinct from other forms of accounts receivable because a promissory note is involved. This is a legally binding document that adds another layer of commitment to pay on the part of the customer. A promissory note is a written promise to pay cash to another party on or before a specified future date. The note's principal amount is the amount the debtor promises to pay back.

The payee of a note receivable is the company or individual expected to receive payment from the debtor. The maker of the note is the customer who has the obligation to pay back the note. The maker of the note is also known as the borrower or debtor. The principal is the cash value loaned by the payee to the maker, which is to be paid back by the end of the defined time period.

Notes receivable will be listed first in the balance sheet along with other assets, followed by liabilities and equity. They will be reported as either current or non-current assets depending on the timeframe in which they are expected to be paid. If the note receivable is due within a year, then it is treated as a current asset on the balance sheet. If it is not due until a date that is more than a year in the future, then it is treated as a non-current asset.

The principal part of a note receivable that is expected to be collected within one year of the balance sheet date is reported in the current asset section of the lender's balance sheet. The remaining principal of the note receivable is reported in the non-current asset section entitled "Investments".

Converting Folio Investments: Strategies for Liquidating Your Portfolio

You may want to see also

Notes receivable are distinct from other forms of accounts receivable

Secondly, accounts receivable refer to informal credit extensions that are typically resolved in a short time frame, usually within a year and often in less than two months. On the other hand, notes receivable are formal extensions of credit with a legally binding agreement, including interest, and are often paid off over longer periods, sometimes exceeding one year.

Thirdly, the amount involved in notes receivable is generally much higher than in accounts receivable due to the interest component, which also results in a longer repayment period.

Finally, accounts receivable are considered "short-term assets", as they are usually converted to cash within a year or less. Notes receivable, on the other hand, can be classified as either current or non-current assets, depending on the term of issuance. If the note is issued for less than a year, it is considered a current asset. If it is issued for a longer period, the portion received within the year is classified as a current asset, while the remaining amount is classified as a non-current asset.

Unlocking Investment Opportunities with Cash-Out Refinancing

You may want to see also

Notes receivable are similar to accounts receivable

Notes receivable are a variation of accounts receivable. Both refer to the amounts owed to a company by its customers for goods or services provided on credit. They are considered assets on a company's balance sheet as they represent monetary value that the business expects to collect in the future.

Accounts receivable refer to any transaction where the customer has not paid in full for what they have received. The business extends credit to the customer, and they are given terms to pay off the debt. Accounts receivable are typically informal, short-term agreements without interest, and are usually collected in two months or less.

Notes receivable, on the other hand, are formal extensions of credit that involve a written, legally binding, and enforceable promissory note. They allow customers more time to pay for a product or service and include interest applied over the extended period. The promissory note outlines the expected payment deadline, with repayment periods extending to a year or longer.

Both notes receivable and accounts receivable are important for businesses to maintain liquidity and financial stability. They can be leveraged to shorten the cash collection period, improve cash flow, and enhance the asset potential. Notes receivable are also viewed as a representation of strength and can benefit a business beyond the current fiscal year.

On a balance sheet, notes receivable are classified as either current or non-current assets, depending on the timeframe in which they are expected to be paid. If the note is due within a year, it is treated as a current asset. If the due date is more than a year away, it is considered a non-current asset.

Liquidating US Investments: A Country's Cash Out Strategy

You may want to see also

Frequently asked questions

Notes receivable are a variation of accounts receivable, in which a business makes a loan or note to a customer that allows them an extended period of time to pay for a product or service they have received. Notes receivable are recorded as an asset because they represent monetary value that the business expects to collect.

Accounts receivable refer to informal (not interest-bearing) credit that is extended to a customer and expected to be paid off in the short term. Notes receivable, on the other hand, are formal extensions of credit that involve a written, legally enforceable promissory note. Interest accrues and the balance is often paid off over longer terms, sometimes more than a year.

Notes receivable are recorded as an asset account for the amount owed by the note "maker", also known as the debtor. If the note is due within a year, it is treated as a current asset on the balance sheet. If the due date is more than a year in the future, it is treated as a non-current asset.