Investing $150,000 short-term can be a strategic move for those seeking to maximize returns in a relatively short period. Whether you're a seasoned investor or new to the game, understanding the various investment options and strategies is crucial. This guide will explore different approaches, from high-yield savings accounts and certificates of deposit (CDs) to short-term stock market investments and real estate opportunities. We'll delve into the pros and cons of each, helping you make an informed decision based on your financial goals, risk tolerance, and the current economic climate.

What You'll Learn

- Market Analysis: Research trends, identify opportunities, and assess risks

- Asset Allocation: Diversify across stocks, bonds, real estate, and commodities

- Trading Strategies: Explore day trading, swing trading, and options trading

- Risk Management: Implement stop-loss orders, position sizing, and portfolio insurance

- Tax Optimization: Understand tax implications and consider tax-efficient investment vehicles

Market Analysis: Research trends, identify opportunities, and assess risks

When considering how to invest $150,000 for the short term, a comprehensive market analysis is crucial to guide your investment decisions. This process involves a thorough examination of various factors that can influence your returns and help you make informed choices. Here's a detailed breakdown of the steps involved:

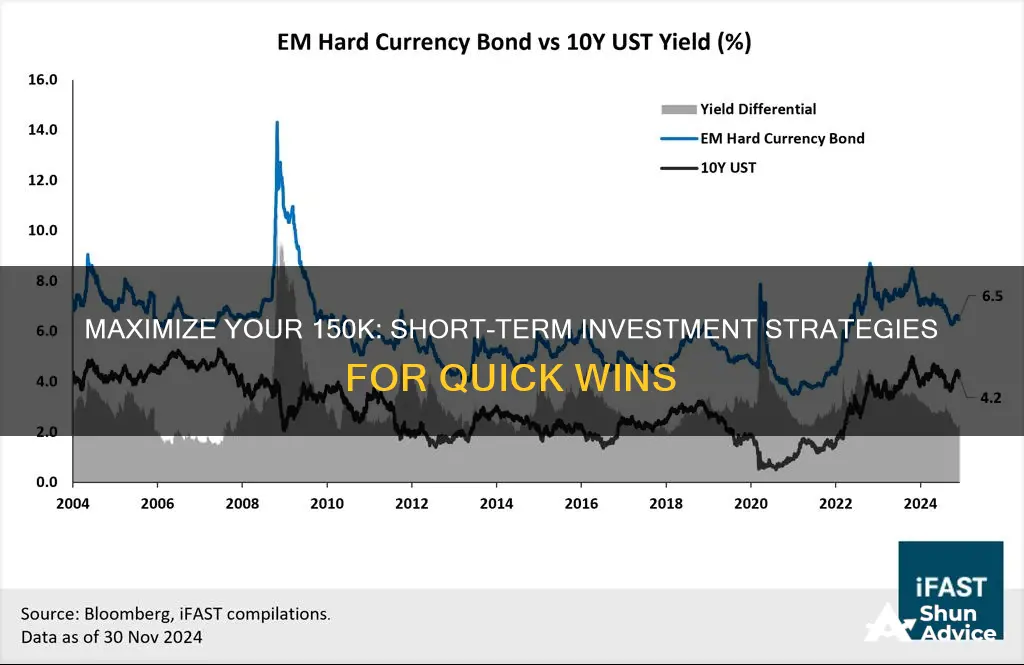

- Research Market Trends: Begin by studying current market trends and economic indicators. This includes analyzing stock market performance, interest rates, and economic growth forecasts. For instance, if you're considering a short-term investment, you might want to look at recent market volatility and identify any emerging patterns. Understanding these trends can provide insights into potential investment opportunities and risks. For example, a rising interest rate environment might impact bond prices, while a tech-focused market might offer short-term gains but also carries higher risks.

- Identify Opportunities: Short-term investments often focus on capital appreciation or income generation within a relatively short timeframe. Research and identify sectors or industries that are currently undervalued or experiencing growth. This could be emerging technologies, renewable energy, or sectors with strong fundamentals but temporarily overlooked by investors. Look for companies with innovative products, strong management teams, and a history of growth. Analyzing financial statements and industry reports can help you pinpoint these opportunities.

- Assess Risks: Risk assessment is a critical part of market analysis. In short-term investments, managing risk is essential to protect your capital and ensure potential gains. Evaluate the risks associated with each investment opportunity. This includes market risk, credit risk, liquidity risk, and operational risks. For instance, if you're investing in individual stocks, assess their financial health, management quality, and industry position. Diversification is key to managing risk, so consider spreading your investment across different sectors and asset classes.

- Analyze Competitive Landscape: Understanding the competitive environment is vital. Research and compare similar companies or industries to gauge their strengths and weaknesses. Identify market leaders and potential disruptors. This analysis can help you make informed decisions about where to allocate your funds. For instance, if you're investing in the tech sector, study the competitive landscape to understand market share, product differentiation, and customer loyalty.

- Stay Informed and Adapt: Market conditions can change rapidly, so staying updated is essential. Continuously monitor news, financial reports, and industry publications to keep track of market shifts. Be prepared to adapt your investment strategy based on new information. Short-term investments often require a dynamic approach, allowing you to capitalize on emerging opportunities while mitigating potential risks.

Mastering WACC Estimation: A Guide to Long-Term Investment Success

You may want to see also

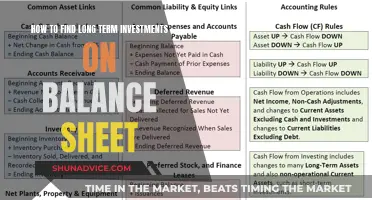

Asset Allocation: Diversify across stocks, bonds, real estate, and commodities

When you have a substantial amount like $150,000 to invest, a strategic approach to asset allocation is crucial for short-term gains. Diversification is key to managing risk and maximizing returns. Here's a breakdown of how to allocate your funds across different asset classes:

Stocks:

Investing in stocks can offer significant short-term growth potential. Consider the following:

- Index Funds or ETFs: These are excellent choices for beginners as they provide instant diversification across a broad market index. Look for low-cost, low-volatility ETFs that track the S&P 500 or another relevant index.

- Sector-Specific ETFs: If you want to target specific industries or sectors with high growth potential (e.g., technology, healthcare), sector-specific ETFs can be a good option. However, be mindful of the risk associated with individual sectors.

- Individual Stocks: Carefully research individual companies with strong growth prospects. Diversify your stock picks across different sectors to mitigate risk.

Bonds:

Bonds offer a more conservative investment option, providing stability and income through regular interest payments.

- Government Bonds: These are generally considered low-risk, offering a steady return. Treasury bonds are a popular choice for short-term investors.

- Corporate Bonds: These offer potentially higher yields than government bonds but come with a higher risk. Carefully assess the creditworthiness of the issuing company before investing.

Real Estate:

Real estate can be a lucrative investment for short-term gains, although it requires more upfront effort and research.

- Real Estate Investment Trusts (REITs): REITs allow you to invest in a portfolio of income-generating real estate properties without directly owning them. They offer diversification and the potential for both dividend income and capital appreciation.

- Real Estate crowdfunding platforms: These platforms allow you to invest in smaller pieces of real estate projects, often with lower minimum investment requirements.

Commodities:

Investing in commodities can provide a hedge against inflation and offer diversification benefits.

- Commodity ETFs: These funds track the performance of various commodities like gold, silver, oil, or agricultural products. They provide exposure to the entire commodity market with relatively low costs.

- Direct Commodity Investments: You can also invest directly in physical commodities like precious metals or futures contracts. This requires more research and risk management.

Important Considerations:

- Risk Tolerance: Assess your risk tolerance. Are you comfortable with potential short-term market fluctuations?

- Time Horizon: Remember that short-term investments may be more volatile. Ensure your investment strategy aligns with your financial goals and time horizon.

- Fees and Expenses: Be mindful of the fees associated with each investment vehicle. Lower fees generally translate to higher net returns.

- Regular Review: Regularly review your portfolio's performance and adjust your asset allocation as needed based on market conditions and your evolving financial situation.

Debt or Credit: Unlocking Short-Term Investment Strategies

You may want to see also

Trading Strategies: Explore day trading, swing trading, and options trading

When considering how to invest $150,000 in a short-term capacity, it's important to explore various trading strategies that can potentially generate returns within a relatively short timeframe. Here's an overview of three popular approaches:

Day Trading: This strategy involves taking advantage of small price movements in highly liquid stocks or currencies over the course of a single day. Day traders typically hold positions for a few minutes to a few hours, aiming to capitalize on intraday volatility. The key to success in day trading is speed and precision. Traders use advanced charting tools and algorithms to identify short-term price patterns and execute trades rapidly. It requires a deep understanding of market dynamics, risk management techniques, and the ability to make quick decisions. Due to the high-frequency nature of day trading, it's crucial to have a robust trading platform and low-latency connectivity to ensure timely order execution. While day trading can be lucrative, it also carries significant risks, including the potential for large losses in a short period.

Swing Trading: Swing traders aim to capture price movements that occur over a few days to a few weeks. This strategy involves identifying the swing high and low points in a security's price chart and then taking positions accordingly. Swing traders often use technical analysis to identify potential entry and exit points. They may employ indicators such as moving averages, relative strength index (RSI), or moving average convergence divergence (MACD) to generate buy and sell signals. The goal is to ride the price wave, taking profits as the security moves in the anticipated direction. Swing trading offers a balance between the short-term gains of day trading and the longer-term perspective of long-term investing. It requires a good understanding of market trends, chart patterns, and risk management to avoid getting caught in prolonged price consolidations.

Options Trading: Options provide traders with the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) before a certain date (expiration date). This strategy offers flexibility and leverage, allowing traders to potentially profit from both rising and falling markets. There are two main types of options: call options and put options. A call option gives the holder the right to buy the underlying asset, while a put option gives the holder the right to sell it. Options traders use various strategies, such as buying calls for potential upside, selling calls for income, buying puts for downside protection, or selling puts for additional income. Options trading can be complex and requires a solid understanding of risk management, as it involves leveraging your capital. It's crucial to carefully consider the potential risks and rewards before entering into options trades.

Each of these trading strategies has its own set of advantages and challenges. Day trading demands quick decision-making and a deep understanding of market dynamics, while swing trading provides a longer-term perspective with potential for substantial gains. Options trading offers flexibility and leverage but requires careful risk management. When investing $150,000, it's essential to choose a strategy that aligns with your risk tolerance, time commitment, and market analysis capabilities. Diversification across different asset classes and strategies can also help manage risk and optimize returns in the short term.

Unlocking Short-Term Gains: The Matching Concept's Role

You may want to see also

Risk Management: Implement stop-loss orders, position sizing, and portfolio insurance

When investing a substantial amount like $150,000, especially in a short-term capacity, risk management is paramount. This is where strategies like stop-loss orders, position sizing, and portfolio insurance come into play, offering a structured approach to safeguarding your capital and optimizing returns.

Stop-Loss Orders:

A stop-loss order is a powerful tool to limit potential losses. It involves setting a predetermined price at which you are willing to sell an asset if it moves against your position. For instance, if you purchase a stock at $100 and set a stop-loss at $95, if the stock price drops to $95, your position will automatically be sold, preventing further losses. This strategy is crucial for short-term traders as it provides a clear exit point, ensuring that even if the market takes an unexpected turn, your potential losses are capped.

Position Sizing:

Position sizing is about determining the appropriate amount of capital to allocate to each trade. It's a delicate balance between maximizing gains and minimizing risk. A common rule of thumb is the '1% rule,' where you risk no more than 1% of your total investment capital on any single trade. For a $150,000 portfolio, this means risking no more than $1,500 per trade. This approach ensures that even if a trade goes against you, the impact on your overall portfolio is minimized. It also allows for a more disciplined and controlled trading strategy.

Portfolio Insurance:

Portfolio insurance is a more advanced risk management technique. It involves using financial instruments to hedge against potential losses in your investment portfolio. For short-term traders, this could mean using options or futures contracts to protect against adverse market movements. For example, you might buy put options to protect against a potential decline in the value of a stock you're short-selling. This strategy provides an additional layer of security, allowing traders to sleep easier knowing their portfolio is protected against significant losses.

Implementing these risk management techniques is essential for short-term investors to navigate the volatile markets effectively. Stop-loss orders provide a safety net, position sizing ensures disciplined trading, and portfolio insurance offers a comprehensive approach to risk mitigation. By incorporating these strategies, investors can make informed decisions, manage their risk exposure, and potentially enhance their overall trading performance.

Understanding Short-Term Investments: A Brainly Guide

You may want to see also

Tax Optimization: Understand tax implications and consider tax-efficient investment vehicles

When it comes to short-term investments of $150,000, tax optimization is a crucial aspect to consider. Understanding the tax implications of your investment choices can significantly impact your overall returns. Here's a detailed guide on how to approach this:

Tax Implications of Short-Term Investments:

In many jurisdictions, short-term investments are typically taxed at your ordinary income tax rate. This means that any capital gains or dividends earned from these investments will be subject to taxation in the year they are realized. For instance, if you invest $150,000 in stocks and sell them at a profit within a short period, you'll likely be taxed on that gain as ordinary income. Similarly, if you receive dividends from your investments, these may also be taxable. It's essential to be aware of these tax consequences to ensure you make informed decisions.

Tax-Efficient Investment Strategies:

- Tax-Advantaged Accounts: Consider utilizing tax-advantaged investment accounts such as a Roth IRA or a Health Savings Account (HSA). These accounts offer tax benefits, allowing your investments to grow tax-free or tax-deferred. For example, contributions to a Roth IRA are made with after-tax dollars, but qualified distributions in retirement are tax-free. This strategy can be particularly useful for short-term investments, as it provides a potential long-term tax advantage.

- Tax-Efficient Funds: Explore mutual funds or exchange-traded funds (ETFs) that are designed to be tax-efficient. These funds often employ strategies to minimize taxable distributions, such as distributing capital gains less frequently or reinvesting dividends to defer taxes. By investing in such funds, you can potentially reduce the tax impact of your short-term gains.

- Tax-Loss Harvesting: This strategy involves selling investments that have experienced losses to offset capital gains and reduce your taxable income. You can then use the proceeds to reinvest in other tax-efficient investments. Tax-loss harvesting can be an effective way to manage taxes on short-term trades, especially if you have a diverse portfolio.

- Dividend Reinvestment Plans: If you're investing in dividend-paying stocks, consider enrolling in a dividend reinvestment plan. This allows you to automatically reinvest the dividends, which can help compound your returns over time. Since dividends are typically taxable, this strategy can help defer taxes until a more favorable tax situation arises.

Considerations:

- Always consult a tax professional or financial advisor to understand the specific tax laws applicable to your jurisdiction and to tailor your investment strategy accordingly.

- Stay updated on any changes in tax regulations that may impact your short-term investments.

- Diversification is key to managing risk and tax implications. Consider a mix of investment types, including stocks, bonds, and real estate, to create a well-rounded portfolio.

By implementing these tax-optimization strategies, you can make the most of your $150,000 short-term investment, potentially maximizing your returns while minimizing tax liabilities. It's a careful balance between short-term gains and long-term tax efficiency.

Unlocking Short-Term Investment Strategies: Understanding Time Horizons

You may want to see also