Considering the safety of investments in PNB Housing Finance is a crucial aspect for investors. This paragraph will explore the factors that contribute to the security of such investments, including the company's financial health, market position, and regulatory compliance. It will also discuss the potential risks and benefits, providing a comprehensive overview to help investors make informed decisions.

What You'll Learn

- Financial Stability: PNB Housing Finance's financial health and stability as a key indicator of safety

- Market Performance: Historical and current market performance of PNB Housing Finance

- Risk Management: Effective risk management strategies and practices of the company

- Regulatory Compliance: Adherence to regulatory standards and industry best practices

- Customer Reviews: Positive customer reviews and feedback on the company's services

Financial Stability: PNB Housing Finance's financial health and stability as a key indicator of safety

When considering the safety of investing in PNB Housing Finance, one of the most critical factors to evaluate is the company's financial stability. Financial stability is a key indicator of an organization's ability to withstand economic downturns and maintain its operations over the long term. It directly impacts the safety of your investment, as a financially stable company is more likely to honor its financial commitments and protect the interests of its investors.

PNB Housing Finance, a leading player in the Indian housing finance sector, has a robust financial health profile that reassures investors. The company's financial stability is evident through its consistent performance and adherence to regulatory standards. PNB Housing Finance maintains a strong capital base, which is a fundamental aspect of financial stability. A well-capitalized company is better equipped to absorb losses and navigate challenging economic conditions without compromising its operations. This financial strength is further bolstered by the company's prudent risk management practices, which help in maintaining a healthy loan portfolio and reducing potential defaults.

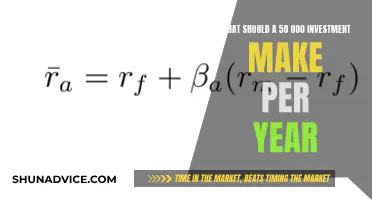

The company's financial statements provide valuable insights into its financial health. Investors should scrutinize key financial ratios such as the debt-to-equity ratio, return on assets, and net interest margin. These ratios offer a comprehensive view of the company's financial performance and its ability to generate profits. For instance, a low debt-to-equity ratio indicates a more financially stable company, as it suggests a lower reliance on debt financing. Additionally, a consistent and growing profit margin over time is a positive sign, indicating the company's ability to manage costs and generate sustainable returns.

Another critical aspect of financial stability is the company's liquidity, which refers to its ability to meet its short-term financial obligations. PNB Housing Finance's liquidity position can be assessed through its current ratio and quick ratio, which measure the company's ability to convert assets into cash quickly. A healthy liquidity ratio indicates that the company can easily cover its short-term debts, providing investors with a sense of security. Furthermore, the company's access to diverse funding sources and its ability to manage cash flows effectively contribute to its overall financial stability.

In summary, evaluating PNB Housing Finance's financial stability is essential for assessing the safety of your investment. The company's strong financial health, as indicated by its capital base, risk management practices, and financial ratios, suggests a low-risk investment opportunity. By analyzing financial statements and key financial indicators, investors can make informed decisions and choose PNB Housing Finance as a reliable and safe investment option in the housing finance sector. This approach ensures that investors can build a secure financial future while supporting the growth of the housing finance industry.

Savings and Investments: Two Sides of the Same Coin

You may want to see also

Market Performance: Historical and current market performance of PNB Housing Finance

PNB Housing Finance, a subsidiary of Punjab National Bank, has been a significant player in the Indian housing finance market for several decades. Its market performance, both historically and in recent times, is an essential consideration for investors looking to assess the safety and potential of their investments.

Historical Performance:

PNB Housing Finance's journey in the housing finance sector can be traced back to its establishment as a dedicated housing finance company. Over the years, the company has grown and evolved, becoming a trusted name in the industry. Historically, PNB Housing Finance has demonstrated resilience and steady growth. The company has successfully navigated through various economic cycles, including the global financial crisis of 2008, and has consistently delivered positive returns to its investors. Its strong balance sheet and prudent risk management strategies have been key factors in its historical performance. The company's ability to maintain a healthy loan-to-value ratio and manage credit risk has been particularly impressive, ensuring stability during turbulent market periods.

Market Share and Growth:

In terms of market share, PNB Housing Finance has established a solid position in the Indian housing finance landscape. As of the latest financial reports, the company holds a significant market share in the residential mortgage sector. This market presence is a result of its comprehensive understanding of the Indian real estate market and its ability to cater to diverse customer segments. The company's growth has been organic, focusing on expanding its customer base and product offerings. Over the past decade, PNB Housing Finance has consistently increased its market share, especially in the affordable housing segment, which has been a key driver of its success.

Recent Market Trends:

In recent years, the company has adapted to the changing dynamics of the housing finance market. The Indian government's initiatives to promote affordable housing and the growing demand for home loans have presented new opportunities. PNB Housing Finance has strategically aligned itself with these trends, introducing innovative products and services. The company's recent focus on digital transformation and technology integration has improved its operational efficiency and customer satisfaction. As a result, PNB Housing Finance has experienced a surge in loan disbursements and a healthy increase in its customer base, indicating strong market performance in the current economic climate.

Competitive Advantage:

One of the key factors contributing to the safety and potential of investing in PNB Housing Finance is its competitive advantage in the market. The company's strong brand reputation, coupled with its extensive branch network and digital banking capabilities, sets it apart from competitors. PNB Housing Finance's ability to offer tailored financial solutions and its commitment to customer satisfaction have fostered long-term relationships with borrowers. This competitive edge is likely to sustain the company's growth and market presence in the long term.

In summary, PNB Housing Finance's historical and current market performance showcases its resilience, market share growth, and adaptability to changing market trends. The company's strong financial position, combined with its strategic initiatives, makes it an attractive investment option for those seeking safety and potential returns in the housing finance sector.

Recording Equity Investments: A Comprehensive Guide

You may want to see also

Risk Management: Effective risk management strategies and practices of the company

When considering the safety of investing in PNB Housing Finance, it's crucial to delve into the company's risk management practices, as these strategies play a pivotal role in safeguarding the interests of investors and ensuring the long-term sustainability of the business. Effective risk management is a cornerstone of any successful financial institution, and PNB Housing Finance is no exception.

One of the key strategies employed by the company is a comprehensive risk assessment framework. This involves identifying and analyzing various types of risks, including credit, market, liquidity, and operational risks. By conducting thorough risk assessments, PNB Housing Finance can develop tailored mitigation plans. For instance, they might employ advanced data analytics to predict and manage credit risks associated with mortgage lending. This could include stress testing loan portfolios to assess potential losses during economic downturns.

Diversification is another critical aspect of their risk management approach. PNB Housing Finance likely diversifies its investment portfolio across various projects and geographic locations to minimize concentration risk. By spreading investments, the company can reduce the impact of any single project's failure or market downturn. This strategy ensures that the company's financial health is not overly reliant on a few specific ventures.

Additionally, PNB Housing Finance might implement robust internal controls and governance practices. This includes establishing clear policies and procedures, conducting regular audits, and ensuring compliance with relevant regulations. Strong governance helps prevent fraud, errors, and financial misstatements, thus reducing operational and reputational risks.

Furthermore, the company's risk management team should actively monitor market trends, economic indicators, and industry developments. This proactive approach enables them to identify emerging risks and adjust strategies accordingly. For instance, if interest rates rise significantly, the company can adapt its lending practices to mitigate potential losses. Regular risk reviews and scenario analyses are essential to staying agile in a dynamic market environment.

In summary, PNB Housing Finance's commitment to effective risk management is evident through its comprehensive assessment processes, diversification strategies, robust governance, and proactive monitoring. These practices contribute to the company's overall stability and resilience, making it a more attractive investment option for those seeking a safe and secure financial venture.

Portfolio Investment: A Long-Term Financial Journey

You may want to see also

Regulatory Compliance: Adherence to regulatory standards and industry best practices

When considering an investment in PNB Housing Finance, it is crucial to understand the regulatory compliance and adherence to industry standards. The company operates within a highly regulated environment, and investors should be aware of the legal and ethical frameworks that govern the housing finance sector. Regulatory bodies, such as the Reserve Bank of India (RBI) and the National Housing Bank (NHB), set guidelines and standards that PNB Housing Finance must follow. These regulations are in place to protect investors, ensure fair practices, and maintain the stability of the financial system.

Compliance with these regulations is essential for the company's operations and investor confidence. PNB Housing Finance must adhere to various rules and guidelines, including those related to capital adequacy, risk management, customer protection, and transparency. For instance, the company needs to maintain a certain level of capital reserves to mitigate financial risks and ensure its long-term viability. They should also implement robust risk assessment and management processes to identify and address potential hazards associated with lending and investment activities.

Industry best practices play a significant role in shaping the standards that PNB Housing Finance should aim to achieve. Adhering to these practices demonstrates a commitment to ethical and responsible business conduct. This includes maintaining high-quality customer service, providing clear and accurate information, and ensuring fair treatment of borrowers and investors. By following industry standards, the company can build trust and establish itself as a reliable and trustworthy financial institution.

Regular audits and internal controls are essential components of regulatory compliance. PNB Housing Finance should conduct thorough reviews of its processes and systems to identify any deviations from the required standards. This proactive approach helps in detecting and rectifying potential issues, ensuring that the company operates within the legal boundaries and maintains the integrity of its financial operations. Additionally, staying updated with the latest regulatory changes and industry trends is vital to adapt and comply with evolving standards.

In summary, when assessing the safety of investing in PNB Housing Finance, investors should consider the company's commitment to regulatory compliance and industry best practices. By adhering to the legal and ethical frameworks, the company ensures a secure and transparent environment for investors. It is advisable to review the company's compliance reports, understand their risk management strategies, and assess their track record in maintaining regulatory standards. This due diligence will enable investors to make informed decisions and contribute to a more stable and reliable housing finance market.

JP Morgan Mortgage-Backed Securities: A Safe Investment Choice?

You may want to see also

Customer Reviews: Positive customer reviews and feedback on the company's services

When considering an investment in PNB Housing Finance, it's essential to look at the experiences and opinions of other customers. Positive customer reviews can provide valuable insights into the company's services and help you make an informed decision. Here's a breakdown of what you might find in these reviews:

Customer Satisfaction and Trust: Many reviews highlight the high level of customer satisfaction with PNB Housing Finance. Investors often praise the company for its transparency, efficient processes, and reliable support. For instance, a review might state, "I was initially hesitant about investing in housing finance, but PNB's straightforward approach and timely updates put my worries at ease. Their commitment to customer satisfaction is evident throughout the entire journey." Such testimonials indicate that the company has built a strong reputation for trustworthiness and reliability.

Competitive Interest Rates and Loan Terms: Another common theme in positive reviews is the competitive interest rates and loan terms offered by PNB Housing Finance. Customers appreciate the company's ability to provide affordable financing options tailored to their needs. A satisfied customer might share, "I recently purchased my first home with PNB's housing finance, and the interest rate was remarkably lower than what I expected. Their loan terms were flexible, allowing me to repay the loan comfortably over a reasonable period." These reviews suggest that PNB Housing Finance offers competitive pricing, which is a significant factor for investors when evaluating investment opportunities.

Efficient Customer Support: The quality of customer support is often a critical aspect of any financial service. Positive reviews frequently mention the responsiveness and helpfulness of PNB Housing Finance's customer service team. For example, a review could read, "I had a few queries during the application process, and the support team was incredibly patient and knowledgeable. They provided clear explanations and guided me through the entire process, ensuring a smooth experience." Such feedback indicates that the company prioritizes customer satisfaction and is committed to addressing client concerns promptly.

Timely Disbursement and Smooth Process: Investors often appreciate the efficiency of the loan disbursement process, and PNB Housing Finance seems to excel in this area. Positive reviews might describe how quickly the company processed applications and disbursed funds, ensuring a seamless experience. A satisfied customer's review could state, "The entire process was remarkably swift, from the initial application to the final disbursement. PNB Housing Finance truly delivered on their promise of a hassle-free experience, and I received the funds within a week of submitting my documents."

In summary, positive customer reviews for PNB Housing Finance often emphasize the company's commitment to customer satisfaction, competitive pricing, efficient processes, and responsive customer support. These reviews can provide valuable insights for investors, indicating that PNB Housing Finance is a reliable and trusted choice in the housing finance sector.

Savings Transform to Investment: When and How?

You may want to see also

Frequently asked questions

Yes, PNB Housing Finance is a well-established and trusted name in the Indian financial services industry. It is a subsidiary of Punjab National Bank, one of the largest public-sector banks in India. The company has a strong presence and a long history, which adds to its credibility.

Investing in housing finance companies like PNB Housing Finance can be considered relatively safe compared to other financial instruments. These companies primarily deal with mortgage-backed securities, which are considered low-risk assets. They provide a stable source of income through interest payments and have a lower volatility profile compared to equity markets.

PNB Housing Finance maintains a robust risk management framework to safeguard investors' interests. They assess and manage credit risk by evaluating the creditworthiness of borrowers, ensuring that the loans are secured by real estate, and diversifying their loan portfolio. The company also adheres to regulatory guidelines and maintains a strong capital base to withstand market fluctuations.

While PNB Housing Finance is generally considered safe, like any investment, there are some risks to be aware of. Market risk is a possibility, as the performance of the company can be influenced by economic cycles and market conditions. Additionally, interest rate risk is a factor, as changes in interest rates can impact the company's profitability and the value of its investments. However, these risks are typically managed by the company's experienced management team.