John Hancock Investment Management is a company that offers a wide range of financial services. These services include mutual funds, retirement plans, 529 college savings, and life insurance. The company has been in business for over 160 years and is committed to helping its customers live longer, healthier, and better lives. John Hancock Investment Management provides access to tools and resources such as early cancer screening and offers a multimanager approach with a diverse lineup of highly-rated funds. The company also provides customer support through a dedicated phone line and online account access.

| Characteristics | Values |

|---|---|

| Number of employees | 526 |

| Location | Boston, Massachusetts |

| Services | Mutual funds, Institutional Accounts, 529 College Savings Plans, Retirement Solutions, Asset Management, Target Date Funds, ETFs, smart beta investing, esg investing, sustainable investing, equity investing, fixed-income investing, alternative investments, multimanager investing, and investor education |

| Customer service phone number | 800-225-5291 |

| Customer service hours | Monday through Thursday 8am to 7 pm, or Friday 8 am to 6 pm Eastern Time |

What You'll Learn

John Hancock Investment Management offers a multimanager approach

John Hancock Investment Management is a financial services company that offers a range of investment products and services to individuals, families, and businesses. The company has a long history of over 160 years, during which it has built a reputation for honesty, reliability, and a strong commitment to its customers.

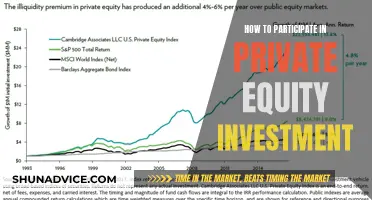

One of the key offerings of John Hancock Investment Management is its multi-manager approach. This approach leverages the talents and expertise of a diverse network of specialized asset managers, supported by rigorous investment oversight. By adopting this strategy, John Hancock Investment Management provides its clients with access to a broad range of time-tested investments from a trusted brand.

The multi-manager approach is designed to navigate the complexities of today's global markets. John Hancock Investment Management has spent decades cultivating a network of asset managers with specialized knowledge and skills. This network is backed by stringent investment oversight, ensuring that clients receive reliable and trustworthy investment advice.

The result of this approach is a diverse lineup of investment options, including mutual funds, institutional accounts, 529 college savings plans, retirement solutions, target-date funds, ETFs, smart beta investing, and more. Each investment option is carefully curated to meet the varying needs and goals of John Hancock's diverse clientele.

John Hancock Investment Management's multi-manager approach is, therefore, a key differentiator, providing clients with access to a wide range of investment opportunities and specialized expertise to help them navigate today's complex financial landscape.

Breaking into Investment Management: An ASU Student's Guide

You may want to see also

John Hancock Investment Management's online account access system

John Hancock Investment Management offers a unique multimanager approach across a diverse lineup of highly-rated funds. The company has spent the last three decades building an extensive network of specialised asset managers, backed by rigorous investment oversight. The result is a diverse range of time-tested investments from one of America's most trusted brands.

John Hancock Investment Management recently enhanced its online account access system. To log in, users must select their role, which can be an investor accessing their account, a financial professional, or a plan administrator.

For investors accessing their accounts, they can view their mutual fund, IRA, 529 college savings, closed-end fund, tender offer fund, or retirement plan/401(k) account. They can also access their John Hancock Investment Management dashboard, where they can access their followed funds, subscribe to email communications, and view exclusive website content.

For financial professionals, they can access their John Hancock Investment Management dashboard or DST Vision. Plan administrators can access John Hancock Simple Pay.

The login page for John Hancock Investment Management's online account access system can be found at https://jhinvestments.ssnc.cloud/index. On this page, users can log in to their existing accounts or register for a new account. The login process includes two-step verification, where users must enter their password and a 6-digit code sent to their email address.

If users forget their username or password, they can reset it by clicking on the "Forgot Username" or "Forgot/Reset Password" links below the respective fields. They will then be redirected to the Account Access page, where they must enter their account number as displayed on their Account Statement. After correctly answering the security challenge, users will be able to retrieve their username or reset their password.

BlackRock Investment Management: A Force to be Reckoned With?

You may want to see also

John Hancock's mutual funds

John Hancock Investment Management Services LLC offers a range of investment options, including mutual funds, IRAs, 529 college savings plans, closed-end funds, tender offer funds, and retirement plans/401(k) accounts.

The company's website provides investors with access to their mutual fund accounts, where they can view their portfolio holdings, track performance, and access exclusive website content. Investors can also set up a personal dashboard to customize their online experience, save recent activity, and receive automatic updates. Additionally, John Hancock offers a variety of tools and calculators to help investors make informed decisions and achieve their financial goals.

In addition to mutual funds, John Hancock offers a range of other investment products and services, including retirement planning, education savings, and life insurance. The company is committed to helping its customers achieve their financial goals and live longer, healthier, and better lives. With a history spanning over 160 years, John Hancock has built a reputation for honesty, reliability, and a strong commitment to its customers.

Becoming an Investment Manager: South Africa's Guide

You may want to see also

John Hancock's 401(k) accounts

John Hancock Investment Management Services LLC offers a range of services, including retirement plan services. John Hancock offers 401(k) accounts, which are employer-provided retirement plans. These plans allow employees to contribute a percentage of their salary on a tax-deferred basis, with the option to choose the type of investment funds within the plan.

John Hancock's website provides detailed information on how 401(k) contributions work, how often they should be changed, and what happens to the account if an individual leaves their job. They also address scenarios where an individual might need to access their 401(k) funds before the typical withdrawal age of 59½.

John Hancock's retirement services aim to help individuals create a plan for a secure financial future. Their website offers various resources, such as market insights, asset allocation views, and portfolio considerations, to support individuals in making informed investment decisions.

Investment Management: What You Need to Study and Know

You may want to see also

John Hancock's retirement plans

John Hancock offers a range of retirement plans and services to help individuals plan for their retirement. The company provides resources and tools to help customers navigate the pressures of long and short-term financial goals, so they can live their best life today and in the future.

John Hancock's retirement plan services include access to financial advisors, who can provide guidance on balancing financial priorities and choosing the right retirement savings plan. The company also offers a range of qualified retirement plans, such as pensions, 401(k)s, traditional IRAs, and Roth IRAs, each with different rules, limits, and tax implications.

For those who already have a retirement savings account, John Hancock provides online account access, allowing customers to manage their mutual fund, IRA, 529 college savings, closed-end fund, tender offer fund, or retirement plan/401(k) account. The company also offers a simple pay option and a dashboard for financial professionals and plan administrators to access.

In addition, John Hancock provides support for individuals leaving their jobs, helping them make choices about their retirement plan savings. This includes information on rollover IRAs and other options. The company also offers a quick quiz to help individuals determine the best retirement plan for their needs and goals.

John Hancock has been in the retirement plan business for nearly 50 years and is now one of the largest full-service providers in the industry. The company works with financial representatives on 100% of its plans, providing tools and resources to help build businesses and service book retirement plans. John Hancock also provides fiduciary training and support, as well as enrollment, education, consolidation, and distribution assistance to participants.

Managing Investment Biases: Strategies for Objective Financial Decisions

You may want to see also

Frequently asked questions

John Hancock Investment Management is a company that offers a unique multimanager approach across a diverse lineup of highly-rated funds. They have spent the past three decades building a network of specialised asset managers, backed by rigorous investment oversight.

The contact number for John Hancock Investment Management is 800-225-5291.

John Hancock Investment Management offers a range of services, including mutual funds, retirement solutions, 529 college savings plans, and more. They also provide access to early cancer screening for eligible members.