Investment funds are a great way to get exposure to a wide variety of stocks, greater diversification, and lower risk. They are also a good option for beginners as they don't require much knowledge about investing or financial markets to do well.

However, it's important to remember that all investments involve some degree of risk. Before investing, it's crucial to evaluate your comfort with taking on risk and ensure that your immediate financial circumstances are in order. It's also recommended to build an emergency fund and pay off any high-interest debt before investing.

By investing in an investment fund, you can benefit from having a professionally managed portfolio that provides access to a wide mix of assets. The fund's performance depends on how its collective assets are doing, and you can earn returns through capital gains, dividends, and interest income.

Some key advantages of investment funds include diversification, professional management, and the ability to invest in a wide range of assets. However, there are also fees and expenses associated with investment funds, which can impact your overall returns.

Overall, investment funds can be a worthwhile option, but it's important to carefully consider your financial situation, risk tolerance, and investment goals before making any decisions.

| Characteristics | Values |

|---|---|

| Risk | All investments involve some degree of risk. |

| Returns | Returns depend on the fund's performance. |

| Liquidity | Mutual funds are highly liquid investments. |

| Diversification | Mutual funds allow investors to diversify their portfolios. |

| Management | Mutual funds are professionally managed. |

| Fees | Mutual funds charge fees, including annual fees, expense ratios, and commissions. |

| Taxation | Mutual funds can have tax implications. |

What You'll Learn

The pros of investment funds

Investment funds, such as mutual funds, offer a range of benefits to investors. Here are some of the pros of investing in mutual funds:

Diversification

Mutual funds provide investors with access to a diversified portfolio of stocks, bonds, and other securities. This diversification helps to reduce investment risk by spreading it across multiple assets. By investing in a mutual fund, individuals can achieve diversification more quickly and cost-effectively than by purchasing individual securities. Diversification is a key advantage of mutual funds, as it allows investors to lower their exposure to risk by investing in a variety of assets.

Professional Management

Mutual funds are managed by professional investment managers who use their research and trading skills to make investment decisions. These managers are legally obligated to act in the best interests of the fund's shareholders and follow the fund's stated mandate. Mutual funds offer a relatively inexpensive way for small investors to access professional money management services. The investment minimums for mutual funds are typically much lower than other investment options, making them accessible to a wider range of investors.

Liquidity

Mutual funds are highly liquid investments, meaning investors can buy or sell their shares at any time. While redemptions can only take place at the end of the trading day, the ability to convert shares into cash provides flexibility and access to funds when needed. However, it's important to consider any fees or penalties associated with early withdrawals.

Variety of Offerings

Mutual funds offer a wide range of investment options to suit different risk tolerances, return expectations, and investment objectives. There are various types of mutual funds, including stock funds, bond funds, money market funds, index funds, and target-date funds. Investors can choose funds that align with their specific goals, whether they seek capital appreciation, income generation, or a balance of both.

Dollar-Cost Averaging

Mutual funds allow investors to benefit from dollar-cost averaging, a strategy that involves investing a fixed amount at regular intervals. This approach helps to smooth out market volatility by purchasing more shares when prices are low and fewer shares when prices are high. Dollar-cost averaging can be particularly effective for long-term investors who want to reduce the impact of short-term market fluctuations.

Renaissance Rief Fund: A Smart Investment Strategy

You may want to see also

The cons of investment funds

There are several drawbacks to investment funds that you should be aware of before deciding to invest.

Firstly, there is always the possibility that the value of your investment fund will depreciate. The stock market is volatile, and the value of your fund can fluctuate, leading to potential losses. This is a common risk associated with investing in the stock market, and it's important to remember that there are no guarantees of returns.

Secondly, investment funds, particularly mutual funds, often have high fees and expenses that can reduce your overall returns. These fees include annual fees, expense ratios, sales charges or loads, redemption fees, and other account fees. Actively managed funds tend to incur higher transaction costs, which can compound over time and eat into your profits. It's crucial to carefully review and consider these fees before investing.

Another disadvantage is the potential for dilution. When a fund becomes very successful and attracts a large influx of new money, the fund manager may struggle to find suitable investments for all the additional capital. This can lead to a dilution of returns as the fund may not be able to maintain its previous performance levels.

Additionally, investment funds may not provide the level of transparency you desire regarding their holdings. It can be challenging to compare different funds due to the diversity of portfolios, and some fund managers may use vague or misleading titles that don't accurately reflect the fund's investment strategy.

Finally, investment funds, such as mutual funds, usually only allow redemptions at the end of the trading day. This lack of flexibility may be inconvenient if you need to access your funds urgently.

While investment funds offer diversification and professional management, it's essential to carefully consider these cons and conduct thorough research before making any investment decisions.

SBI Bluechip Fund: A Guide to Investing in Reg G

You may want to see also

The risks of investment funds

Investment funds can be a great way to achieve financial independence and protect the value of your money as the cost of living rises. However, it's important to remember that all investments carry an element of risk. Here are some of the key risks associated with investment funds:

Market Risk

Market risk refers to the potential losses that can occur due to changing market conditions. This includes economic developments, governmental policies, regulatory changes, interest rate movements, investor sentiment, and external shocks such as natural disasters or wars. These factors can impact the performance of your investment fund, leading to potential losses.

Liquidity Risk

Liquidity risk is the risk that you may not be able to sell your investment at a particular point in time without incurring losses. Investment funds have two levels of liquidity risk: the investment manager's ability to buy or sell positions for the fund, and the investor's ability to buy or sell units in the fund. Poor liquidity can restrict your ability to exit an investment without losing money.

Inflation Risk

Inflation risk refers to the potential loss in the purchasing power of your investment due to a general increase in consumer prices. As inflation erodes the value of money over time, there is a risk that your investment returns will not keep up with the rising cost of living, resulting in a loss of purchasing power.

Credit and Counterparty Risk

Investment funds may enter into contracts that expose them to credit risk. If a counterparty defaults on its obligations, the fund may experience a decline in the value of its position, loss of income, and additional costs associated with asserting its rights. This can adversely affect the fund's performance and, consequently, your investment returns.

Currency Risk

Currency risk arises when the currency of the investment fund differs from that of the investor or the markets in which the fund invests. Changes in foreign currency exchange rates can negatively impact the value of a fund's investments and income. This type of risk is particularly relevant for funds that invest in securities denominated in currencies other than their base currency.

Fund Manager Risk

The performance of an investment fund is heavily influenced by the expertise and investment strategies employed by the fund manager. There is a risk that the fund manager may not meet your expectations or may make poor investment decisions, leading to underperformance or losses.

Regulatory Risk

Investment funds domiciled in certain jurisdictions may not provide the same level of regulatory protection as your home country. On the other hand, some funds may be subject to more restrictive regulatory regimes that limit their investment strategies. Understanding the regulatory environment of the fund is crucial to assessing the associated risks.

Non-Compliance Risk

Non-compliance risk refers to the potential for the fund manager or the fund itself to violate laws, rules, regulations, or internal policies. This type of risk can adversely affect the performance of the fund and harm the interests of investors.

Diversification Risk

Investing in a limited number of assets or a single asset class or market can expose you to the risk of underperformance. By diversifying your investments across different asset classes, markets, and sectors, you can mitigate this risk and reduce the impact of poorly performing investments on your overall portfolio.

It is important to carefully consider and understand these risks before deciding to invest in any investment fund. While investing in funds can provide potential returns, it is crucial to assess your risk tolerance and conduct thorough research to make informed investment decisions.

Invest Wisely: Accessing Dimensional Funds for Long-Term Growth

You may want to see also

The types of investment funds

Investment funds can be classified according to different criteria, such as their investment strategy, legal form, liquidity, and the types of assets they invest in. Here is an overview of some of the main types of investment funds:

Mutual Funds

Mutual funds are one of the most common types of investment funds. They pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other securities. Mutual funds are known for their variety of offerings, professional management, and relatively low investment minimums. They are also highly liquid, as investors can typically redeem their shares on demand. However, mutual funds charge various fees, such as annual fees, expense ratios, and commissions, which can reduce overall returns.

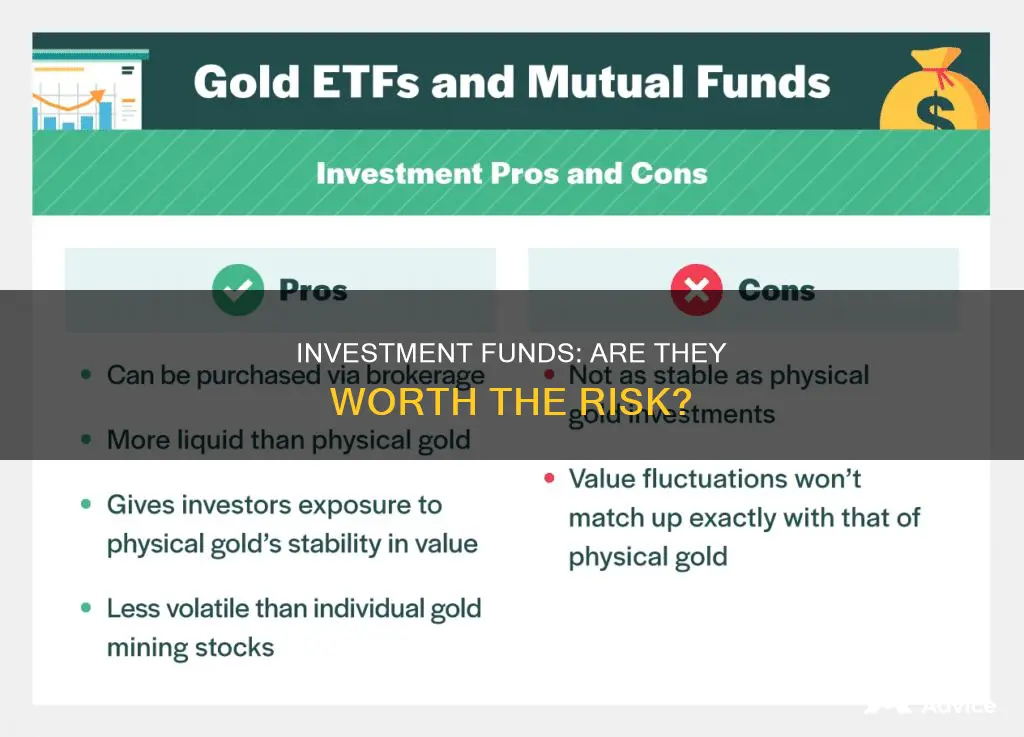

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds in that they are also diversified investment vehicles. However, ETFs are traded on stock exchanges like regular stocks, offering more flexibility and real-time pricing. They tend to have lower expense ratios than mutual funds, providing a cost advantage. ETFs can be bought and sold throughout the trading day, providing more control over the price of the fund.

Money Market Funds

Money market funds are a type of mutual fund that invests in short-term debt instruments, such as government Treasury bills, and cash equivalents. They offer relatively low risk and high liquidity, making them suitable for investors seeking capital preservation. Money market funds typically provide modest returns, slightly higher than regular savings accounts.

Hedge Funds

Hedge funds are actively managed investment funds that are distinct from mutual funds and ETFs. They face fewer regulations, allowing them to invest in a broader range of asset classes and employ diverse strategies. Hedge funds often invest in riskier assets, including derivatives and commodities, and may use leverage to increase potential returns.

Absolute Return Funds

Absolute return funds aim to achieve a specific return within a certain period while managing risk. They do not guarantee returns but strive to generate consistent profits regardless of the market conditions.

Guaranteed Funds

Guaranteed funds offer a guarantee of capital protection, either fully or partially. They can be classified as guaranteed fixed-income funds or guaranteed equity funds, depending on their investment focus.

These are just a few examples of the types of investment funds available. Each type of fund has its own characteristics, risks, and potential returns. Investors should carefully consider their financial goals, risk tolerance, and investment horizon before selecting the most suitable type of investment fund for their portfolio.

TSP Funds: Where to Invest for Maximum Returns

You may want to see also

How to invest in funds

Investing in funds can be a great way to build wealth over time, and it's a popular choice for retirement investors. Here's a step-by-step guide on how to invest in funds:

Step 1: Understand the Basics

Before investing in funds, it's important to understand what they are and how they work. A mutual fund is a collection of investors' money that fund managers use to invest in stocks, bonds, and other securities. Index funds, a type of mutual fund, aim to mirror the performance of an existing stock market index, such as the S&P 500.

Step 2: Evaluate Your Financial Situation

Before investing, take stock of your financial situation. Ensure you have paid off any short-term debts, especially high-interest credit card debt, and build an emergency fund of three to six months' worth of expenses.

Step 3: Set Clear Goals

Determine what you want to achieve with your investments. Are you investing for the short term or the long term? Do you want to focus on a specific sector or diversify your portfolio? Knowing your goals will help guide your investment choices.

Step 4: Research and Compare Different Funds

When choosing a fund to invest in, consider factors such as company size and capitalization (small-, mid-, or large-cap), geography, business sector, asset type, and market opportunities. Compare the fees, performance, and investment strategies of different funds to find the ones that align with your goals and risk tolerance.

Step 5: Choose a Brokerage or Fund Company

You can purchase funds directly from a mutual fund company or through a brokerage. Compare fees, fund selection, convenience, and impact investing options to find the best fit for your needs.

Step 6: Make the Investment

Once you've chosen a fund and a platform, you can proceed with making the investment. Decide how much you want to invest, taking into account the share price and your budget. You may be able to set up automatic investments and withdrawals to build your investment over time.

Step 7: Monitor and Adjust

While index funds are considered a passive investment strategy, it's important to periodically check in on your investments. Ensure that your index fund is performing as expected and review the fees to make sure they aren't eating into your returns.

Remember, investing carries risks, and there is no guarantee of profits. Always do your research and consider seeking advice from a qualified financial professional before making any investment decisions.

Invest in Fundsmith Equity Fund: A Comprehensive Guide

You may want to see also

Frequently asked questions

Investment funds can provide you with another source of income, fund your retirement, or even get you out of a financial jam. They can also help you grow your wealth, meet your financial goals, and increase your purchasing power over time.

All investments carry some degree of risk. With investment funds, there is always the possibility that the value of the fund will depreciate. There are also fees and expenses associated with investment funds, which can affect your overall returns. It's important to carefully consider the fund's prospectus and your own risk tolerance before investing.

When choosing an investment fund, it's important to consider your financial goals, risk tolerance, and investment horizon. You should also research the fund's performance, fees, and investment strategy to ensure it aligns with your objectives. Diversification is key, so look for funds that invest in a variety of assets to reduce risk.