The Fundsmith Equity Fund is a sub-fund of Fundsmith SICAV, which is actively managed, meaning that the investment manager has discretion over the investments. The fund's objective is to achieve long-term growth in value by investing in equities globally. It does not adopt short-term trading strategies but instead focuses on being a long-term investor in its chosen stocks. The fund has stringent investment criteria, aiming to invest in high-quality businesses with high returns, difficult-to-replicate advantages, low leverage, high growth certainty, resilience to change, and attractive valuations. While the fund takes sustainability and ESG characteristics into account, it does not provide currency hedging, and its performance may be impacted by exchange rate movements.

What You'll Learn

Investment criteria

Fundsmith Equity Fund is a sub-fund of Fundsmith SICAV ("Fund") that is actively managed, with investment selections made at the discretion of the investment manager. The fund's investment objective is to achieve long-term growth in value, with a focus on investing in equities on a global basis. The fund's approach is to be a long-term investor in its chosen stocks, avoiding short-term trading strategies.

The fund has stringent investment criteria, which can be summarised as follows:

- High-Quality Businesses: The fund seeks to invest in high-quality businesses that can sustain a high return on operating capital employed.

- Difficult to Replicate: It focuses on businesses whose advantages are difficult for competitors to replicate, creating a sustainable competitive edge.

- Low Leverage: The fund prefers businesses that do not require significant leverage to generate returns, reducing financial risk.

- High Certainty of Growth: Investments are made in businesses with a high degree of certainty of growth from reinvestment of their cash flows at high rates of return.

- Resilience to Change: The fund targets businesses that are resilient to change, particularly technological innovation, ensuring they can adapt to market dynamics.

- Attractive Valuation: The investment manager also considers the valuation of the business to be attractive, ensuring it aligns with the fund's value-oriented approach.

The fund takes sustainability risk and ESG characteristics into account during the selection process, promoting environmental and/or social characteristics as per the Sustainable Finance Disclosure Regulation (SFDR).

5G Funds: Where to Invest and How

You may want to see also

Long-term growth

The Fundsmith Equity Fund is a sub-fund of Fundsmith SICAV, which is actively managed, meaning that the investment manager has discretion over the investments made. The fund's objective is to achieve long-term growth in value, with a minimum investment horizon of 5 years. The fund invests in equities on a global basis and adopts a long-term investment strategy, avoiding short-term trading.

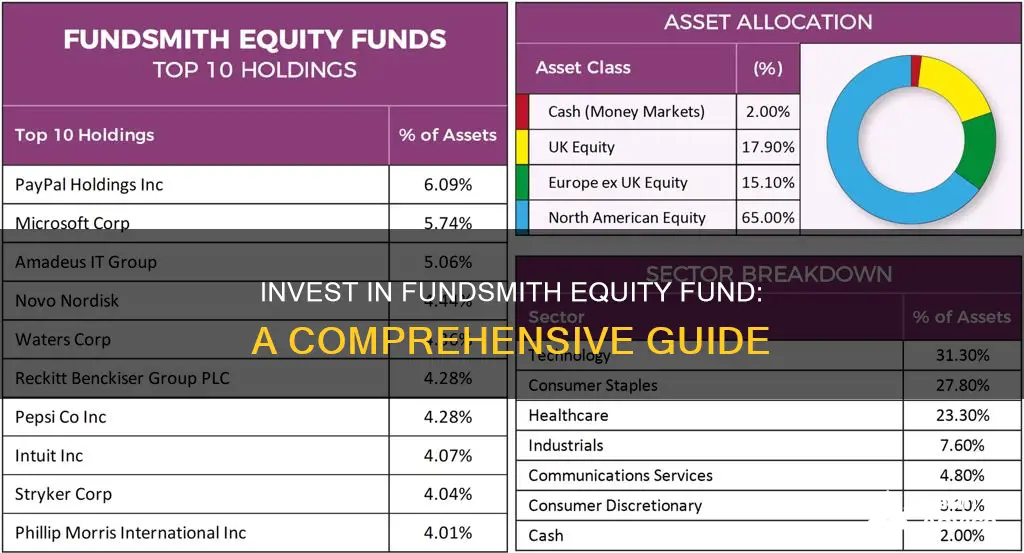

The fund's investment criteria are stringent, focusing on high-quality businesses with high returns on operating capital employed, advantages that are difficult to replicate, low leverage, high certainty of growth from reinvested cash flows, resilience to technological innovation, and attractive valuations. The fund typically holds 20 to 30 stocks, making it more concentrated than other funds, and it does not hedge currency risk.

To invest in the Fundsmith Equity Fund, you can buy or sell holdings through a Stocks and Shares ISA, Lifetime ISA, SIPP, or Fund and Share Account. Online registration is currently only available to investors domiciled in the United Kingdom. If you are investing from outside the UK, you will need to download and complete the Overseas Individual Investors form.

Funding Connection: The Superior Investment Strategy Over Funding Capture

You may want to see also

Active management

The investment criteria for the Fundsmith Equity Fund are stringent and aim to identify businesses that:

- Can sustain a high return on operating capital employed;

- Possess advantages that are difficult to replicate;

- Do not require significant leverage to generate returns;

- Have a high degree of certainty of growth from reinvestment of their cash flows;

- Are resilient to change, particularly technological innovation; and/or

- Are considered to have an attractive valuation by the Investment Manager.

The fund takes sustainability risk and ESG characteristics into account in its selection process, promoting environmental and/or social characteristics as per the Sustainable Finance Disclosure Regulation (SFDR).

It is important to note that the fund's global portfolio means that currency exchange rate movements can impact the value of shares. Additionally, the concentrated nature of the fund, with a smaller number of stocks than many other funds, means that the performance of a single stock can have a greater effect on the fund's price.

Investors are advised to carefully consider the suitability of the fund, as the value of companies and, consequently, the fund's value will fluctuate. An investment in the Fundsmith Equity Fund should only be made by those who can sustain a potential loss on their investment, and shares are recommended to be viewed as long-term investments (minimum 5 years).

What Makes Debentures Attractive for Surplus Fund Investments?

You may want to see also

No short-term trading

The Fundsmith Equity Fund is designed for long-term investors. The fund does not adopt short-term trading strategies. Instead, it focuses on being a long-term investor in its chosen stocks. The fund has stringent investment criteria that aim to ensure that it invests in high-quality businesses that meet specific criteria. These criteria include businesses that can sustain a high return on operating capital employed, have advantages that are difficult to replicate, do not require significant leverage to generate returns, have a high degree of certainty of growth from reinvestment of their cash flows, are resilient to change (particularly technological innovation), and are considered to have an attractive valuation.

The fund's portfolio is global, and many of the investments are not denominated in GBP. As such, there is no currency hedging, and the GBP price of the shares may rise or fall due to exchange rate movements. The fund generally invests in 20 to 30 stocks, which means it is more concentrated than many other funds, and the performance or underperformance of a single stock can have a greater effect on the fund's price.

The fund's objective is to achieve long-term growth over five years. While past performance is not a guarantee of future results, investors should consider their investment goals and time horizon before investing. It is important to note that the fund's value will rise and fall, and there is no guarantee that investors will get their investment back. Therefore, the fund is suitable for those who can sustain a loss on their investment, and the shares should be viewed as long-term investments (at least five years).

If you are unsure about the suitability of the fund for your specific circumstances, it is recommended to seek professional advice.

Investing in Vanguard: Target Retirement Funds Explained

You may want to see also

Currency risk

The Fundsmith Equity Fund does not hedge its currency exposure. This means that the fund does not use financial derivatives or other strategies to protect against adverse exchange rate movements. As a result, the fund's net asset value and the value of your investment can be directly impacted by fluctuations in exchange rates.

It is important to note that currency risk is a significant consideration for any international investment. Investing in a fund like Fundsmith Equity, which has a global portfolio, naturally carries a higher level of currency risk compared to investing in a fund that focuses on a single country or region.

When investing in the Fundsmith Equity Fund, it is essential to consider your own currency exposure and how exchange rate movements might impact your investment. If you are investing in a currency other than your local currency, you may want to consider the potential impact of exchange rate fluctuations on your returns. Additionally, if you are investing through a broker or platform that charges fees in a different currency, those fees may also affect your overall returns due to changes in exchange rates.

Will Smith's Investment Fund: A Star's Money Move

You may want to see also

Frequently asked questions

The Fundsmith Equity Fund aims to achieve long-term growth in value by investing in equities on a global basis. The fund takes a long-term investment approach and does not engage in short-term trading strategies.

The fund invests in high-quality businesses that meet specific criteria, including high returns on operating capital employed, difficult-to-replicate advantages, low leverage, high certainty of growth, resilience to technological change, and attractive valuations.

The fund is actively managed, meaning the investment manager has discretion in selecting investments. The fund is not managed with reference to any benchmark, and it generally invests in 20 to 30 stocks, resulting in a more concentrated portfolio compared to other funds.

As with any investment, there is no guarantee of returns, and the value of the fund may rise or fall. The fund's portfolio is global, and currency fluctuations can impact the value of the investment. Additionally, the concentrated nature of the portfolio means that the performance of a single stock can have a greater effect on the fund's overall performance.

You can buy or sell holdings in the Fundsmith Equity Fund through a Stocks and Shares ISA, Lifetime ISA, SIPP, or Fund and Share Account. Online registration is currently only available to investors domiciled in the United Kingdom. For investments from outside the UK, you will need to complete the Overseas Individual Investors form.