The 'magic formula' is an investment strategy developed by Joel Greenblatt, an investor, hedge fund manager, and business professor. It is a rules-based, disciplined investing strategy that teaches people a relatively simple and easy-to-understand method for value investing. The formula is designed to beat the stock market's average annual returns using the S&P 500 to represent the market return. It works by ranking stocks based on their price and returns on capital, focusing on finding good companies that are trading at attractive prices. Greenblatt outlines the strategy in his book, 'The Little Book That Beats the Market', and claims it has helped generate a 30% annual rate of return for investors who use it.

What You'll Learn

Joel Greenblatt's formula

Joel Greenblatt's 'Magic Formula' is a rules-based investing strategy that focuses on two things: stock price and the cost of capital. The formula is designed to help investors identify undervalued companies that are likely to offer high returns.

Greenblatt's formula uses three distinct criteria to rank companies: earnings before interest and taxes (EBIT), earnings per share (EPS), and return on capital. Earnings before interest and taxes is a measure of a company's profitability, while earnings per share calculates a company's value. Return on capital measures how well a company allocates its capital to profitable investments.

To use the magic formula, investors must first define the universe of stocks from which they will construct their portfolio. This could include all US-listed companies or only companies with a minimum market cap. Investors then rank each business in this universe based on the three criteria outlined above. Once ranked, investors buy stocks from the top 20-30 companies on a rolling basis over a 12-month period.

After a year, investors sell the losing and winning stocks, taking advantage of income tax provisions, before starting the process again.

The magic formula is designed to be a long-term strategy and is intended to be simple enough for anyone to use, from first-time investors to seasoned professionals. However, it is important to note that there is no guarantee of positive returns every time, and there is always the potential for gains or losses.

Liquid Cash Investment: Where to Place Your Money Wisely

You may want to see also

How to define your universe of stocks

The "Magic Formula" is a term used to describe an investment strategy outlined by Joel Greenblatt in his book, "The Little Book That Beats the Market". The strategy is designed to help investors identify undervalued or high-performing companies and create portfolios with the potential to outperform the market.

When defining your universe of stocks, there are a few key considerations to keep in mind. Here are the steps to help you get started:

Select Your Region and Market:

Start by deciding on the geographic region you want to focus on. This could be the US, UK, or any other region where you have access to reliable data. It's important to choose regions with established and transparent financial markets to ensure data accuracy.

Set a Minimum Market Capitalization:

Market capitalization, or market cap, represents the total value of a company's stock. You can include small-cap, mid-cap, or large-cap companies in your universe, but it's essential to set a minimum market cap to exclude illiquid stocks. Typically, a market cap of $50 million or above is considered a good threshold.

Exclude Specific Sectors or Industries:

Consider excluding certain sectors or industries that might have unique capital structures, making comparisons more challenging. For example, stocks in the financials and utilities sectors are often excluded due to their complex capital structures. You may also choose to exclude foreign companies as their data might be harder to obtain and compare.

Determine Recent Earnings Reports:

Remove companies that have recently reported earnings to minimize the chances of working with incorrect or untimely data. This ensures that you are making decisions based on the most up-to-date information available.

Assess Company Size and Liquidity:

While small-cap stocks are generally more likely to be mispriced, making them attractive investment opportunities, you should also consider their size and liquidity. Avoid stocks that are too small, as they may lack the necessary volume of shares in circulation, leading to sharp changes in share prices with large purchases.

Understand Your Risk Tolerance:

When defining your universe of stocks, it's crucial to consider your risk tolerance and investment goals. If you are comfortable with higher risk, you may include more volatile stocks in your universe. Conversely, if you prefer a more conservative approach, focus on established companies with a strong track record.

Research and Due Diligence:

Before finalizing your universe of stocks, conduct thorough research and due diligence on each company. Study their financial health, growth prospects, competitive advantages, and management capabilities. This will help you make more informed decisions about which stocks to include in your investment portfolio.

Remember, defining your universe of stocks is a crucial step in the Magic Formula investing strategy. It provides the foundation for your investment decisions and helps you identify companies that meet your specific criteria. Always refer to Greenblatt's book and consult with financial professionals for more detailed guidance on implementing the Magic Formula.

Apple's Excess Cash Strategy: Investing for Future Growth

You may want to see also

Earnings Yield as a measure of value

Earnings yield is a financial ratio that describes the relationship between a company's earnings per share over the last 12 months and its stock price per share. It is calculated by dividing a company's earnings by its stock price, or earnings per share divided by the current stock price. Earnings yield is the inverse of the P/E ratio.

Earnings yield is a good ROI metric and can be used to measure a stock's rate of return. It is particularly valuable when comparing potential returns among different securities. It is also used to calculate the dividend payout ratio, which indicates the proportion of a company's earnings distributed as dividends to shareholders.

Earnings yield is one indication of value. A low ratio may indicate an overvalued stock, while a high value may indicate an undervalued stock. Money managers often compare the earnings yield of a broad market index to prevailing interest rates, such as the current 10-year Treasury yield. If the earnings yield is less than the 10-year Treasury yield, stocks may be considered overvalued. If it is higher, stocks may be considered undervalued relative to bonds.

Earnings yield can be volatile due to fluctuations in earnings per share. It also only provides an indicative return, as actual returns may differ significantly. It is not as widely used as the P/E ratio, especially by equity investors, as earning periodic investment income may be secondary to growing their investment values over time.

Earnings yield can be a valuable tool for investors looking to invest in stocks with stable dividend income. It offers a direct look at the level of return dividend stocks may generate. A higher-than-typical earnings yield can indicate that a stock may be oversold and could be due for a bounce higher, assuming no negative news has occurred within the company.

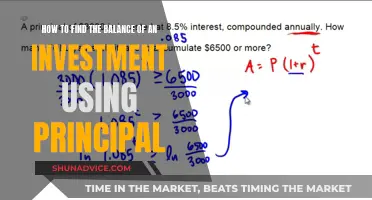

The magic formula investing strategy, developed by Joel Greenblatt, focuses on stock price and the cost of capital. It uses a set of quantitative screens to eliminate certain companies and ranks the remainder in order of the highest yield and returns. Earnings yield is one of the key metrics for investing with the magic formula method. It is calculated by dividing each company's earnings before interest and taxes by the total value of the enterprise.

Cash Investments: Good or Bad Idea?

You may want to see also

Return on Capital (ROC)

The ROC formula is:

> ROIC = NOPAT/Average Invested Capital

Where NOPAT (Net Operating Profit After Tax) is calculated as:

> After-tax operating income

And the Average Invested Capital is the average between the invested capital at the beginning and end of the year, calculated as:

> Book-value of the invested capital = Net fixed assets + Working capital

ROC is an important metric for investors, as it helps them identify companies with the potential to generate high returns. A company with an ROC higher than its cost of capital indicates a healthy and growing business, while an ROC lower than the cost of capital suggests an unsustainable business model.

The Magic Formula, a rules-based investing strategy developed by Joel Greenblatt, uses ROC as one of its key metrics for stock selection. This formula focuses on identifying undervalued companies with high potential for returns and is designed to beat the average annual returns of the stock market. While the Magic Formula provides a simplified approach to value investing, it does not guarantee investment success, and returns may vary.

Unequal Annual Cash Flows: Navigating Investment Challenges

You may want to see also

Pros and Cons of Magic Formula Investing

Pros of Magic Formula Investing

The magic formula investing strategy, developed by Joel Greenblatt, is designed to be simple and easy to follow for all investors, regardless of their level of experience. It is a rules-based, disciplined investing strategy that helps investors take a methodical and unemotional approach to value investing. The formula focuses on two main criteria: stock price and company cost of capital. It uses a set of quantitative screens to rank companies based on their earnings yield and return on capital, allowing investors to identify undervalued companies with high potential for returns.

The magic formula investing strategy has been found to generate better-than-market returns in multiple backtests. It outperformed the S&P 500 in several studies, with annualized returns ranging from 11.4% to 30.8%. The formula is also flexible, as investors can adjust certain parameters, such as the market capitalization threshold, to suit their preferences.

Cons of Magic Formula Investing

Despite its name, the magic formula is not a guarantee of investment success. The returns may not always match the high figures achieved by Greenblatt, and there is no certainty of positive results every time. Some analysts believe that the method can be improved by introducing new variables or rebalancing more frequently.

The magic formula investing strategy is also exclusionary, as it does not include foreign companies or companies in certain sectors, such as financials and utilities. It is a long-term strategy that may require investors to handle long stretches of underperformance and may not be suitable for those seeking quick results. Additionally, the formula can be cumbersome to track, and there is a risk of underperformance for extended periods, which may discourage some investors.

Exploring Federated US Treasury Cash Reserves: Worth the Investment?

You may want to see also

Frequently asked questions

The magic formula for investing is a rules-based investing strategy developed by Joel Greenblatt, an investor, hedge fund manager, and business professor. It focuses on finding good companies to invest in that are trading at attractive prices.

The magic formula uses a set of quantitative screens to eliminate certain companies and ranks the remainder in order of highest yield and returns. It involves calculating a company's earnings yield and return on capital, then ranking the companies based on these metrics.

The magic formula is simple and easy to follow, suitable for any investor. It facilitates rational, numbers-based investing without emotion or stress and has shown better-than-market returns in multiple backtests.

The magic formula may not always deliver the high returns claimed by Greenblatt. It may underperform due to changing market dynamics or an increased number of investors following the method. It is also exclusionary, as it does not include investing in foreign companies or companies in certain sectors.