Notes receivable are financial instruments that represent a promise to receive a specific amount of money from a borrower at a future date. While they are typically considered short-term assets on a company's balance sheet, the classification of notes receivable as a long-term investment can vary depending on the context and the company's financial policies. In this discussion, we will explore the factors that determine whether notes receivable can be classified as a long-term investment and the implications of such a classification for financial reporting and analysis.

What You'll Learn

- Definition and Characteristics: Notes receivable are short-term financial instruments, typically not considered long-term investments

- Maturity and Timing: The maturity of notes receivable is usually less than one year, making them short-term

- Investment Strategy: Long-term investments require a different strategy, focusing on growth and stability over time

- Risk and Return: Short-term notes receivable offer lower risk but less potential return compared to long-term investments

- Accounting Treatment: Accounting standards differentiate between short-term and long-term investments, impacting financial reporting

Definition and Characteristics: Notes receivable are short-term financial instruments, typically not considered long-term investments

Notes receivable are a type of financial asset that represents a promise to receive a payment from a debtor within a short period, usually within one year or less. They are essentially short-term debts owed to a company by its customers or clients. These instruments are an integral part of a company's accounts receivable, which refers to the total amount of money owed to the company by its customers.

The key characteristic that sets notes receivable apart from long-term investments is their maturity period. Long-term investments are financial assets that are expected to be held for an extended period, often more than a year, and provide a return through interest or dividends. In contrast, notes receivable are designed for quick liquidity and are not intended to be held for an extended duration. They are a form of short-term debt that allows companies to manage their cash flow and provide credit to customers while maintaining a relatively low-risk investment.

These financial instruments are typically issued by companies to their customers as a form of payment or credit. For example, if a company sells goods or services on credit, the customer may promise to pay back the amount within a specified time frame, which is documented as a note receivable. These notes often carry a maturity date, after which the company can demand full payment from the debtor. The terms and conditions of these notes can vary, including the interest rate, payment schedule, and any penalties for late payment.

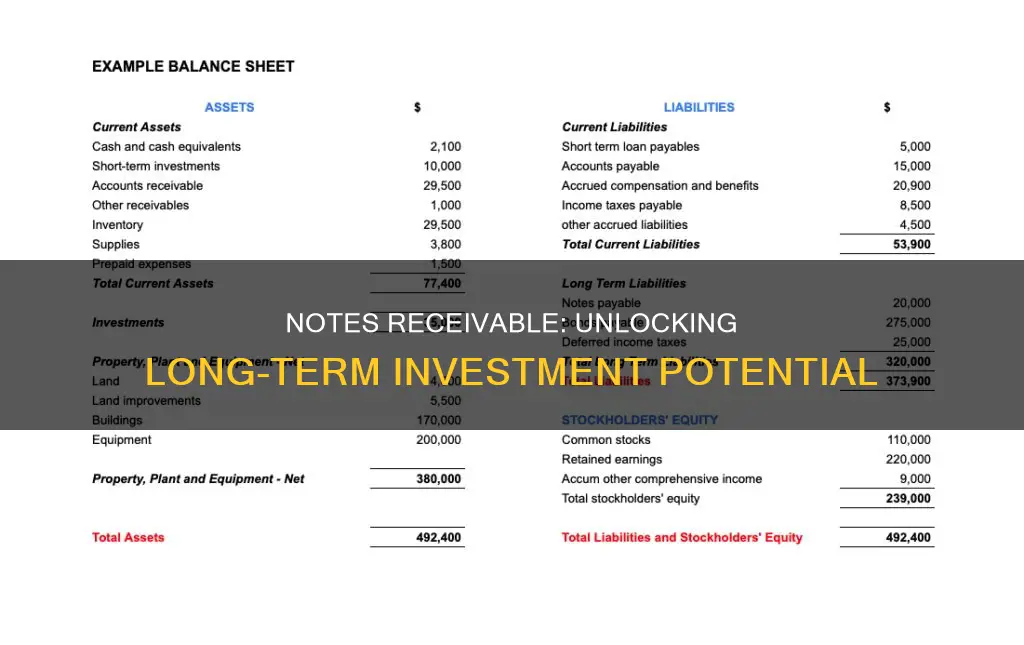

One of the critical aspects of notes receivable is their classification on a company's balance sheet. Unlike long-term investments, which are usually classified as non-current assets, notes receivable are considered current assets due to their short-term nature. This classification is essential for financial reporting and analysis, as it provides a clear picture of a company's short-term financial health and liquidity.

In summary, notes receivable are short-term financial instruments that represent debts owed to a company by its customers. They are not considered long-term investments due to their maturity period and the intent to provide quick liquidity. Understanding the characteristics of notes receivable is crucial for companies to manage their cash flow, offer credit to customers, and maintain a healthy financial position.

Maximize Your Wealth: Strategies for Short-Term Investment Success

You may want to see also

Maturity and Timing: The maturity of notes receivable is usually less than one year, making them short-term

The concept of notes receivable is an important aspect of financial management, particularly for businesses and investors. When considering whether notes receivable can be classified as a long-term investment, it is crucial to understand the maturity and timing of these financial instruments.

Notes receivable, by definition, are short-term financial assets that represent a promise to receive payment from a debtor within a relatively short period. This maturity period is typically less than one year, which sets it apart from long-term investments. The key characteristic that distinguishes notes receivable is their short-term nature, which is a fundamental factor in their classification.

In financial accounting and reporting, the maturity of an investment is a critical determinant of its classification. For notes receivable, the short maturity period means they are considered current assets rather than long-term investments. This distinction is essential for maintaining accurate financial statements and ensuring compliance with accounting standards.

The short-term nature of notes receivable is advantageous for businesses as it provides liquidity and flexibility. These notes are often used as a source of short-term financing, allowing companies to manage their cash flow effectively. Investors and creditors also benefit from this short maturity, as it indicates a lower risk of default compared to long-term investments.

In summary, the maturity and timing of notes receivable are key considerations when evaluating their investment characteristics. The short-term nature of these financial instruments makes them an essential tool for short-term financing and cash flow management, rather than a long-term investment strategy. Understanding this distinction is vital for financial professionals and investors to make informed decisions regarding their asset allocation and risk management.

Unraveling the Misconception: Treasury Bills as Long-Term Investments

You may want to see also

Investment Strategy: Long-term investments require a different strategy, focusing on growth and stability over time

When considering long-term investments, it's crucial to adopt a strategy that emphasizes growth and stability. This approach is distinct from short-term trading, where the focus is often on quick gains and frequent transactions. Long-term investments are typically made with a horizon of several years or more, aiming to build wealth over an extended period. Here's a detailed breakdown of the strategy:

Diversification: A key principle in long-term investing is diversification. This involves spreading your investments across various asset classes such as stocks, bonds, real estate, and commodities. By diversifying, you reduce the risk associated with any single investment. For instance, if you invest in a diverse portfolio of stocks, a decline in one stock's performance might be offset by the growth of another. This strategy ensures that your investment is not overly exposed to any single market or sector, providing a more stable foundation for long-term growth.

Risk Management: Long-term investors should also prioritize risk management. This includes assessing and mitigating various risks, such as market risk, credit risk, and liquidity risk. Market risk refers to the potential for losses due to fluctuations in the overall market. Credit risk is the possibility of default by borrowers in debt investments. Liquidity risk pertains to the ease of converting assets into cash without significant loss. Effective risk management involves setting stop-loss orders, regularly reviewing your portfolio, and making adjustments to protect your capital.

Long-Term Focus: The strategy for long-term investments is to maintain a consistent, disciplined approach. This means avoiding the temptation of short-term market volatility and focusing on the underlying fundamentals of the investments. For example, if you're investing in a company, consider its long-term growth prospects, competitive advantage, and financial health. Short-term price movements should not deter you from your long-term goals.

Compounding Growth: Long-term investments are particularly well-suited for taking advantage of compounding growth. This is the process where the returns on your investments earn additional returns, leading to exponential growth over time. For instance, reinvesting dividends from dividend-paying stocks can lead to significant growth over the years. The power of compounding is a key driver of long-term wealth creation.

Regular Review and Adjustment: Despite the long-term focus, it's essential to regularly review and adjust your investment strategy. Market conditions and personal circumstances can change, and your investment plan should adapt accordingly. Reviewing your portfolio at regular intervals allows you to ensure it remains aligned with your financial goals and risk tolerance. This process might involve rebalancing your portfolio to maintain the desired asset allocation or making strategic adjustments to optimize returns.

Mastering Long-Term Investing: Strategies to Outpace Inflation

You may want to see also

Risk and Return: Short-term notes receivable offer lower risk but less potential return compared to long-term investments

When considering the investment landscape, understanding the nuances between short-term and long-term notes receivable is crucial. Short-term notes receivable, often defined as those with a maturity of less than one year, are typically considered low-risk investments. This is because they are generally backed by the creditworthiness of the borrower and are less exposed to market fluctuations compared to longer-term investments. For instance, a 90-day note receivable is a short-term instrument that provides a relatively safe haven for investors seeking capital preservation.

The risk associated with short-term notes receivable is primarily credit risk, which is manageable due to the shorter duration. Investors can mitigate this risk by carefully assessing the financial health and credit history of the borrower. However, it's important to note that while short-term notes receivable offer lower risk, they also come with a trade-off. The potential for higher returns is significantly reduced compared to long-term investments. This is because short-term notes often provide lower interest rates, reflecting the shorter duration and reduced risk.

In contrast, long-term notes receivable, with maturities of one year or more, carry a higher level of risk but also offer the potential for greater returns. Long-term investments are more susceptible to market volatility, interest rate changes, and economic cycles. For example, a 5-year note receivable might provide a higher interest rate, but it also exposes the investor to potential downturns in the market or changes in the borrower's financial situation over the longer term.

The key to making an informed decision is to evaluate the risk-return profile of each investment type. Short-term notes receivable are ideal for investors seeking a safe, liquid asset with minimal risk, especially in volatile markets. On the other hand, long-term notes receivable are more suitable for investors willing to take on additional risk in exchange for potentially higher returns over an extended period. Diversifying one's portfolio with a mix of short-term and long-term investments can help balance risk and return, ensuring a more stable and potentially rewarding investment strategy.

In summary, while short-term notes receivable offer lower risk, they may not provide the same level of return as long-term investments. Investors should carefully consider their risk tolerance, investment goals, and the time horizon for their investments to make an informed choice between short-term and long-term notes receivable. This understanding will enable them to construct a well-rounded investment portfolio that aligns with their financial objectives.

Minimum Wage Wages: Long-Term Investment Barriers for Low-Income Earners

You may want to see also

Accounting Treatment: Accounting standards differentiate between short-term and long-term investments, impacting financial reporting

The classification of notes receivable as a long-term investment is a critical aspect of financial reporting, and it varies depending on the accounting standards and the specific circumstances of the entity. Accounting standards, such as those set by the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP), provide guidelines to help accountants determine the appropriate classification.

In general, notes receivable are considered short-term assets and are classified as current assets on the balance sheet. This classification is based on the assumption that these notes are expected to be converted into cash or settled within one year. However, there are situations where notes receivable can be considered long-term investments. For example, if the entity has a specific business relationship with the issuer of the notes, and there is a high likelihood of extending the maturity date beyond one year, the notes may be reclassified as long-term investments.

When classifying notes receivable as long-term investments, accountants must consider several factors. Firstly, the entity's business model and investment strategy play a crucial role. If the entity primarily invests in long-term securities, and the notes receivable align with this strategy, they may be classified accordingly. Secondly, the creditworthiness of the issuer is essential. If the issuer has a strong credit rating and a low risk of default, the notes may be considered more stable and less likely to be classified as short-term.

The impact of this classification on financial reporting is significant. When notes receivable are classified as long-term investments, they are typically reported at fair value through profit or loss. This means that any changes in the market value of the investment are recognized in the income statement. In contrast, if classified as short-term, they are usually carried at amortized cost, with any changes in value impacting the other comprehensive income. Proper classification ensures that financial statements provide a true and fair view of the entity's financial position and performance.

In summary, the accounting treatment of notes receivable as a long-term investment requires careful consideration of various factors, including business strategy, issuer creditworthiness, and the likelihood of extending the maturity date. Accurate classification is essential to ensure compliance with accounting standards and to provide meaningful financial reporting, allowing users of the financial statements to make informed decisions.

Long-Term Investing: A Strategy for Financial Security

You may want to see also

Frequently asked questions

Notes Receivable refers to written promises to pay a specific amount of money, typically within a short-term period, often used in business transactions.

In financial accounting, Notes Receivable is generally considered a current asset, as it is expected to be converted into cash within one year or the operating cycle of the business, whichever is longer.

No, Notes Receivable is not typically classified as a long-term investment. Long-term investments are usually held for extended periods, often with the expectation of capital appreciation or income generation over time. Notes Receivable, being a short-term asset, is more focused on immediate cash flow and liquidity.

While both are related to the money owed to a business, Notes Receivable is a specific type of written promise to pay, often with a maturity date, whereas Accounts Receivable refers to the balances due from customers for goods or services provided on credit. Accounts Receivable is usually more liquid and shorter-term, while Notes Receivable may have a defined repayment schedule.