When considering whether to invest in a Productive and Progressive Fund (PPF), it's important to understand the safety and potential risks associated with this investment option. PPFs are typically considered a safe investment, especially for those seeking a secure and stable return on their money. These funds are designed to provide a steady income stream and are often seen as a low-risk alternative to other investment vehicles. However, as with any investment, there are factors to consider, such as market conditions, fund management, and individual risk tolerance. This introduction aims to explore these aspects to help investors make informed decisions about the safety of PPFs.

What You'll Learn

- Regulation: Government oversight ensures PPF's safety and transparency

- Security: PPF's security measures protect investors' funds and data

- Returns: PPF offers competitive returns, typically higher than savings accounts

- Liquidity: Investors can access their PPF funds without penalties

- Risk Management: PPF's risk-mitigation strategies minimize potential losses

Regulation: Government oversight ensures PPF's safety and transparency

The safety and transparency of Public Provident Funds (PPFs) are primarily ensured through robust government oversight and regulation. This regulatory framework plays a crucial role in maintaining the integrity of the PPF system, providing investors with a secure and reliable investment option. Here's a detailed look at how government regulation safeguards PPFs:

Legal Framework and Licensing: Governments establish a comprehensive legal framework specifically designed for PPFs. This framework includes licensing and registration processes for financial institutions offering PPFs. Only licensed and registered entities are permitted to operate, ensuring that investors deal with reputable and regulated financial institutions. This licensing process involves stringent criteria, including financial stability, security measures, and compliance with regulatory standards.

Supervision and Monitoring: Regulatory bodies actively supervise and monitor PPF operations. They regularly review the activities of PPF providers, ensuring compliance with the established regulations. This oversight includes checking for fair practices, accurate reporting, and the security of investors' funds. By conducting periodic audits and assessments, the government can identify and address any potential risks or issues promptly.

Transparency and Disclosure: Government regulations mandate that PPF providers maintain high levels of transparency. This involves disclosing all relevant information to investors, such as fees, terms and conditions, and performance metrics. Investors are provided with clear and accessible documentation, enabling them to make informed decisions. Regular financial reports and updates are often required, ensuring that investors stay informed about their PPF investments.

Investor Protection Measures: To safeguard investors' interests, governments implement various protection measures. These may include insurance schemes or guarantees on PPF investments, ensuring that investors' money is protected even in the event of financial institution failure. Additionally, regulations may specify dispute resolution mechanisms, providing investors with avenues to address any concerns or grievances.

Regular Review and Updates: The regulatory framework for PPFs is not static; it undergoes regular reviews and updates to adapt to changing market conditions and global financial standards. This ensures that the regulations remain effective and relevant, addressing any emerging risks or challenges in the financial sector. By staying proactive, governments can maintain the safety and reliability of PPFs over time.

In summary, government oversight is a critical component of ensuring the safety and transparency of PPFs. Through licensing, supervision, transparency mandates, investor protection measures, and regular reviews, governments provide a robust regulatory environment. This environment fosters trust in the PPF system, allowing investors to participate with confidence, knowing their interests are protected and their investments are secure.

Private Equity Investments: Revocable Trust Pros and Cons

You may want to see also

Security: PPF's security measures protect investors' funds and data

When considering investing in Public Provident Funds (PPFs), security is a top priority for investors. PPFs are known for their robust security measures, which are designed to safeguard investors' funds and personal data. Here's an overview of the security aspects that make PPFs a relatively safe investment option:

PPFs are backed by the Indian government, which provides a layer of security and stability. This government guarantee ensures that investors' money is protected, and it significantly reduces the risk associated with the investment. The Indian government's financial strength and commitment to the PPF scheme make it a reliable and secure investment avenue.

The PPF scheme offers a high level of data security for investors. Personal and financial information is stored in secure databases, protected by advanced encryption techniques. This ensures that sensitive data, such as account details and transaction history, remains confidential and is accessible only to authorized individuals. The use of encryption and secure data storage methods minimizes the risk of data breaches and unauthorized access.

PPFs also implement strict access controls and authentication processes to ensure that only legitimate investors can access their accounts. This includes secure login procedures, such as two-factor authentication, to verify the identity of investors. By employing these measures, PPFs significantly reduce the risk of fraud and unauthorized transactions, providing investors with peace of mind.

Additionally, PPFs have a comprehensive fraud detection system in place. This system continuously monitors transactions and account activities for any suspicious behavior or anomalies. Any potential fraudulent activity is promptly identified and investigated, allowing for swift action to be taken. The proactive approach to fraud detection further enhances the security of investors' funds.

In summary, PPFs offer a secure investment environment through their government backing, robust data protection measures, strict access controls, and advanced fraud detection systems. These security features collectively contribute to the safety and reliability of investing in PPFs, making it an attractive option for those seeking a secure and stable investment opportunity.

Understanding Investment Risk and the Risk Matrix

You may want to see also

Returns: PPF offers competitive returns, typically higher than savings accounts

Public Provident Fund (PPF) is a popular investment option in India, known for its safety and attractive returns. When considering investment avenues, one of the primary concerns is the potential for growth and earning competitive returns. Here's an in-depth look at how PPF stacks up in terms of returns compared to other investment options, particularly savings accounts.

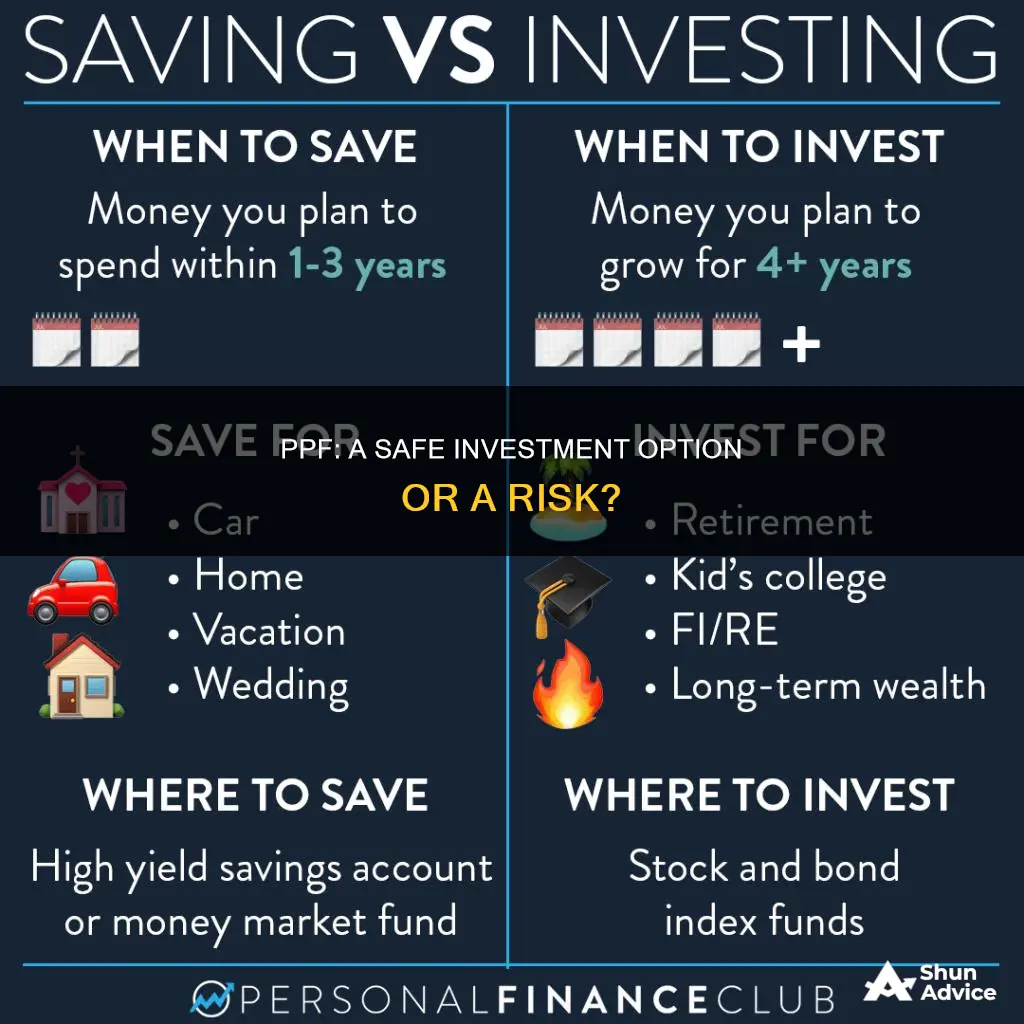

PPF is a long-term investment scheme offered by the Indian government. It provides a fixed rate of interest, which is typically higher than what one would earn on a regular savings account. The current interest rate for PPF is set at 7.1% per annum, which is quite competitive in the current market. This rate is fixed for a minimum period of 15 years, ensuring a stable and predictable return on investment. For instance, if you invest a lump sum of ₹1,00,000 in PPF, you can expect to earn a fixed interest of ₹7,100 annually, which is significantly more than the interest earned on a savings account.

Savings accounts, while offering a basic level of safety, generally provide lower interest rates. The interest rates on savings accounts are often variable and can fluctuate, making it challenging to predict the exact returns. As of my last update, the average interest rate on savings accounts in India is around 4-5%, which is substantially lower than the PPF rate. This means that over a 15-year period, the difference in returns between PPF and a savings account can be substantial, favoring PPF as a more lucrative investment choice.

The higher returns of PPF are particularly beneficial for long-term financial goals. For example, if you're saving for your child's education or planning for retirement, PPF can help accumulate a substantial amount of wealth over time. The compound interest effect, where interest is earned on both the initial investment and the accumulated interest, further enhances the returns, making PPF an excellent choice for those seeking both safety and growth.

In summary, PPF offers competitive returns, often surpassing those of savings accounts. Its fixed interest rate and long-term investment nature provide a reliable and attractive way to grow your money. While it is essential to consider other factors like liquidity and tax benefits when making investment decisions, PPF's superior returns make it a strong contender for those seeking a safe and profitable investment option.

The Role of an Investment Operations Manager Explained

You may want to see also

Liquidity: Investors can access their PPF funds without penalties

The Public Provident Fund (PPF) is a popular investment option in India, offering a safe and secure way to grow your money over time. One of the key advantages of PPF is its liquidity, which allows investors to access their funds without any penalties or restrictions. This feature is particularly beneficial for those who may need to withdraw their money for unexpected expenses or other financial needs.

Liquidity refers to the ease with which an investment can be converted into cash without any significant loss in value. In the case of PPF, investors have the freedom to withdraw their funds at any time, providing a sense of financial security and flexibility. Unlike some other investment options that may impose penalties or fees for early withdrawals, PPF allows investors to access their money without any financial burden.

The process of withdrawing funds from PPF is straightforward. Investors can submit a written application to the PPF office, providing details of the account and the amount they wish to withdraw. The PPF authorities will then process the request, and the funds will be transferred to the investor's bank account. This quick and efficient process ensures that investors can access their money when needed, making PPF a reliable investment choice.

It's important to note that while PPF offers excellent liquidity, the funds are typically locked in for a fixed period, usually 15 years. This means that investors can withdraw their principal amount and accumulated interest at maturity, but they cannot withdraw the money before the maturity date without incurring penalties. However, the flexibility of accessing funds during the investment period provides a safety net for investors, allowing them to make financial decisions without the fear of penalties.

In summary, the liquidity aspect of PPF is a significant advantage, ensuring that investors can access their funds without any financial penalties. This feature, combined with the safety and growth potential of PPF, makes it an attractive investment option for individuals seeking a secure and flexible way to save and grow their money. Understanding the liquidity provisions of PPF can help investors make informed decisions and maximize the benefits of this popular investment scheme.

Equities to Invest in for Long-Term Growth

You may want to see also

Risk Management: PPF's risk-mitigation strategies minimize potential losses

When considering the safety of investing in Public Provident Funds (PPFs), it's important to understand the inherent risks associated with any investment and how these risks can be managed. PPFs are a popular investment option in India, offering a relatively safe and secure way to grow your savings over time. However, like any investment, PPFs come with certain risks that investors should be aware of.

One of the primary risks associated with PPFs is the potential for loss due to market volatility. While PPFs are considered a low-risk investment, they are not entirely immune to market fluctuations. The interest rate on PPFs is fixed and determined by the government, which means that if market interest rates rise significantly, the returns on PPFs may become less competitive compared to other investment options. This risk can be mitigated by diversifying your investment portfolio and regularly reviewing and adjusting your asset allocation.

Another risk to consider is the impact of inflation. Over time, inflation can erode the purchasing power of your PPF investments. To combat this, it's essential to invest in PPFs for the long term, allowing the power of compounding to work in your favor. Additionally, investing in a variety of assets, including PPFs, can help reduce the impact of inflation on your overall portfolio.

PPFs also carry the risk of early withdrawal penalties. If you need to access your PPF funds before the maturity date, you may incur a penalty, which can reduce your overall returns. To minimize this risk, it's advisable to plan your investments carefully and ensure that you have a clear understanding of the withdrawal rules and penalties associated with PPFs.

To manage these risks effectively, investors can employ several strategies. Firstly, diversifying your investment portfolio is crucial. By spreading your investments across different asset classes, such as equity, debt, and gold, you can reduce the impact of any single investment's performance on your overall portfolio. Regularly reviewing and rebalancing your portfolio can help ensure that it remains aligned with your risk tolerance and financial goals.

Additionally, staying informed about market trends and economic conditions can help you make more informed investment decisions. Keeping track of interest rate changes, inflation rates, and economic indicators can provide valuable insights into the potential performance of PPFs and other investment options. By staying proactive and making adjustments to your investment strategy as needed, you can effectively manage the risks associated with PPFs and maximize your chances of achieving your financial objectives.

CDs: Investment or Saving?

You may want to see also

Frequently asked questions

While PPFs are generally considered low-risk investments, they are not entirely risk-free. The safety of your investment depends on the specific PPF and the underlying assets it holds. It's important to carefully review the fund's terms, including its investment strategy, management team, and historical performance. Diversification within the PPF and a thorough understanding of your risk tolerance can help mitigate potential risks.

Assessing the safety of a PPF involves several key steps. Firstly, understand the fund's investment objectives and the types of assets it invests in. Look for a strong track record and a transparent reporting structure from the fund manager. Evaluate the fund's risk management strategies and the measures in place to protect investors' capital. Additionally, consider the fund's liquidity and withdrawal policies to ensure you can access your funds when needed.

Yes, there are certain warning signs that may indicate potential risks. These include high fees and expenses, especially if they are not clearly disclosed. Be cautious of PPFs with complex structures or those that promise unusually high returns without a clear explanation of the risks involved. Always verify the credentials of the fund manager and ensure they are registered with relevant financial authorities.

The liquidity of PPFs can vary. Some PPFs offer regular withdrawal options, allowing investors to access their funds periodically. However, certain PPFs may have restrictions or penalties for early withdrawals. It's crucial to review the fund's terms and conditions regarding liquidity to understand your rights and any associated costs.