Prepaid insurance is a unique financial product that can be both a short-term and long-term investment strategy. It involves purchasing insurance coverage in advance, typically for a specific period, which can offer immediate benefits and potential savings. This concept is particularly relevant for individuals seeking to manage their financial resources effectively, as it allows them to plan and budget for future expenses while potentially earning interest or rewards on the prepaid amount. Understanding the nature of prepaid insurance and its implications for short-term and long-term financial goals is essential for making informed decisions about personal finance.

What You'll Learn

- Prepaid Insurance Basics: Understanding prepaid insurance policies and their unique features

- Short-Term vs. Long-Term: How prepaid insurance differs in nature from traditional long-term investments

- Risk and Rewards: Evaluating the risks and potential returns of prepaid insurance

- Tax Implications: Exploring tax benefits and considerations for prepaid insurance investments

- Market Trends: Analyzing current market trends and their impact on prepaid insurance

Prepaid Insurance Basics: Understanding prepaid insurance policies and their unique features

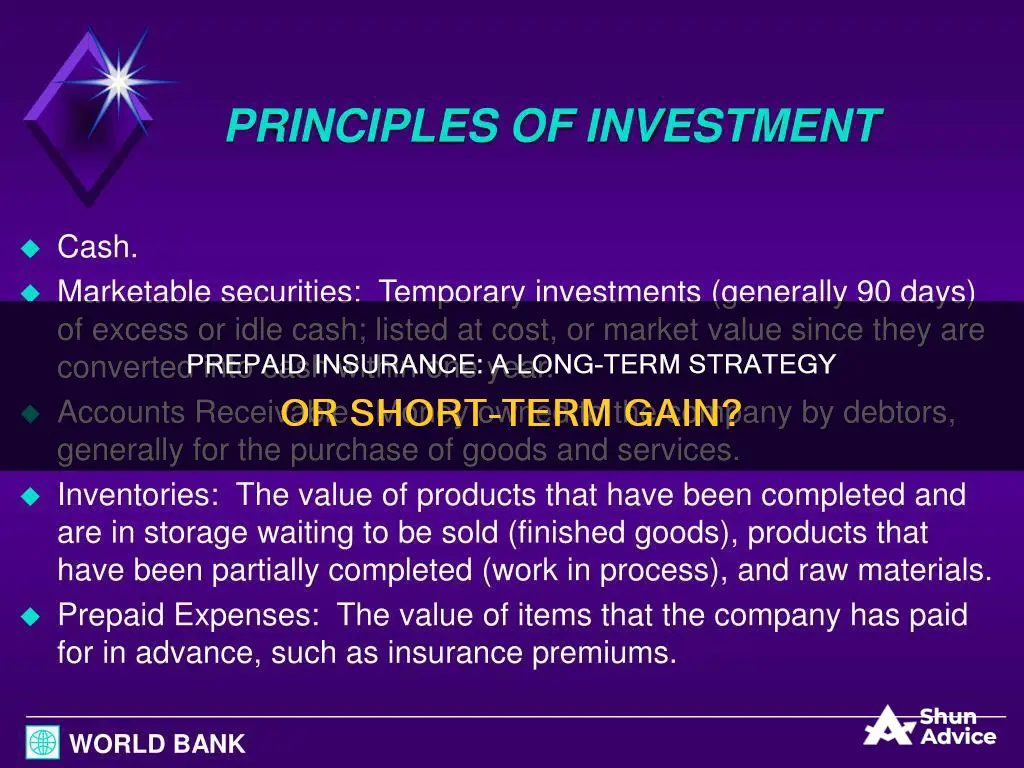

Prepaid insurance is a unique financial product that offers a different approach to traditional insurance coverage. It involves paying for insurance benefits in advance, typically in a lump sum or through regular installments, before any potential claims are made. This concept can be particularly useful for individuals and businesses seeking to secure insurance protection for various risks, such as health, life, or property. Understanding the basics of prepaid insurance policies is essential to grasp their advantages and how they differ from conventional insurance arrangements.

One of the key features of prepaid insurance is its pre-payment nature. Instead of paying premiums monthly or annually, policyholders contribute a fixed amount upfront. This upfront payment ensures that the insurance coverage is in place from the beginning, providing immediate protection. For instance, a person purchasing a prepaid health insurance policy would pay the entire annual premium at once, receiving coverage for the entire year without the need for subsequent monthly payments. This model can be especially beneficial for those who prefer a more straightforward and immediate approach to insurance.

The unique aspect of prepaid insurance lies in its long-term commitment. Once the policy is activated, it remains in effect for the specified duration, often with the option to renew. This is in contrast to traditional insurance, where coverage may be limited to a specific period, and premiums are adjusted based on the policy's performance. With prepaid insurance, the coverage is guaranteed, and the policyholder is protected for the entire term, providing a sense of financial security and stability. This feature makes prepaid insurance an attractive option for those seeking consistent and reliable insurance protection.

Another important consideration is the investment component of prepaid insurance. In some cases, prepaid insurance policies can offer investment opportunities. Policyholders may have the option to invest a portion of their prepaid premiums in various financial instruments, such as stocks, bonds, or mutual funds. This investment aspect can potentially provide additional returns over time, making prepaid insurance a more comprehensive financial solution. However, it's crucial to carefully review the terms and conditions of such policies to understand the risks and potential benefits associated with the investment component.

When considering prepaid insurance, it is essential to evaluate its suitability for your specific needs and financial goals. While prepaid insurance offers unique advantages, it may not be the best fit for everyone. Factors such as the length of coverage required, the level of risk tolerance, and the potential investment opportunities should be carefully considered. Consulting with insurance professionals can provide valuable insights and help individuals and businesses make informed decisions regarding prepaid insurance policies, ensuring they understand the implications and benefits of this alternative insurance approach.

Crafting Your Future: A Guide to Long-Term Investment Success

You may want to see also

Short-Term vs. Long-Term: How prepaid insurance differs in nature from traditional long-term investments

Prepaid insurance is a unique financial product that often raises questions about its classification as a short-term or long-term investment. Unlike traditional investments, prepaid insurance involves a different approach to managing financial risks and offers a distinct set of advantages and disadvantages.

In the context of short-term investments, prepaid insurance can be considered a strategic tool for individuals seeking immediate financial protection. It provides a way to secure insurance coverage for a specific period, typically ranging from a few months to a year. For example, a traveler might purchase a prepaid travel insurance plan to cover potential medical emergencies or trip cancellations during an international vacation. This short-term approach allows individuals to manage risks associated with unforeseen events without committing to long-term financial obligations.

On the other hand, long-term investments are characterized by a more extended commitment and a focus on wealth accumulation over time. Traditional long-term investments include options like stocks, bonds, or real estate, which are typically held for several years or even decades. These investments aim to grow in value, providing investors with potential capital gains and regular income through dividends or rental payments. In contrast, prepaid insurance does not align with the long-term wealth-building strategy. It is not designed to appreciate in value or generate substantial returns over an extended period.

The nature of prepaid insurance lies in its ability to provide immediate coverage and peace of mind. It is a form of financial protection that individuals can purchase to safeguard themselves against specific risks. For instance, health insurance premiums can be prepaid for a year, ensuring continuous coverage for medical expenses. This approach is particularly useful for those who prefer a more hands-on, proactive approach to managing their financial risks.

However, it is essential to understand that prepaid insurance may not offer the same level of flexibility and growth potential as traditional long-term investments. Once the prepaid insurance period is over, the coverage expires, and the individual must decide whether to renew or seek alternative insurance options. This aspect sets it apart from long-term investments, which can be held indefinitely, allowing investors to benefit from market growth and compounding returns.

In summary, prepaid insurance serves as a valuable short-term financial tool, offering immediate risk management solutions. It provides a convenient way to secure insurance coverage for specific periods, ensuring individuals are protected against potential risks. However, it differs significantly from long-term investments in terms of its nature, duration, and potential for wealth accumulation. Understanding these distinctions is crucial for individuals to make informed financial decisions and choose the right investment strategies based on their goals and risk tolerance.

Equity Investments: Long-Term Growth or Short-Term Volatility?

You may want to see also

Risk and Rewards: Evaluating the risks and potential returns of prepaid insurance

Prepaid insurance, often associated with life, health, or disability coverage, can be a complex financial product with various implications for investors. When considering prepaid insurance as a short-term investment, it's essential to evaluate both the risks and potential rewards to make an informed decision.

One of the primary risks associated with prepaid insurance is the potential for underperformance. Prepaid insurance policies often have specific terms and conditions, and the actual benefits received may not align with the initial expectations. For instance, a prepaid health insurance policy might offer limited coverage or exclude certain pre-existing conditions, leading to higher out-of-pocket expenses when needed. This risk is particularly relevant for short-term investments, where the policyholder may not have the opportunity to fully utilize the benefits before the investment period ends.

Additionally, prepaid insurance products can be illiquid, making it challenging to access the funds before the policy maturity. This lack of liquidity can be a significant drawback for investors seeking flexibility and quick access to their investments. In contrast, short-term investments typically offer more accessible and liquid options, allowing investors to withdraw their funds without incurring substantial penalties.

However, prepaid insurance can also present potential rewards. These policies often provide a guaranteed benefit, ensuring that the insured individual or their beneficiaries receive a specified amount in the event of a covered loss. This guarantee can be particularly valuable for individuals seeking stable and predictable financial protection. Moreover, prepaid insurance may offer tax advantages, as premiums paid can often be deducted from taxable income, providing a financial benefit in the short term.

To evaluate the risks and rewards, investors should carefully review the policy documents, understand the terms and conditions, and assess their specific needs and financial goals. It is crucial to consider the potential impact of inflation and changing market conditions on the value of the prepaid insurance over time. Short-term investors might want to explore alternative investment options that offer more flexibility and potential for growth while still providing some level of financial security.

In summary, prepaid insurance can be a valuable tool for financial protection, but it may not be the best short-term investment due to potential risks and limited liquidity. A thorough understanding of the policy, its terms, and the investor's financial objectives is essential to make an informed decision regarding prepaid insurance as a short-term investment strategy.

Axie Infinity: A Long-Term Investment Strategy?

You may want to see also

Tax Implications: Exploring tax benefits and considerations for prepaid insurance investments

Prepaid insurance, often considered a unique investment opportunity, presents specific tax implications that investors should carefully navigate. When an individual purchases prepaid insurance, they essentially pre-pay for future insurance coverage, which can be seen as an investment in the insurance policy itself. This prepayment is a form of savings, allowing investors to secure future protection at a potentially lower cost compared to paying for insurance annually. However, understanding the tax treatment of this investment is crucial for making informed financial decisions.

One of the key tax benefits associated with prepaid insurance is the potential for tax deductions. In many jurisdictions, the cost of prepaid insurance can be deducted as a business expense if the insurance is related to the individual's trade or profession. For example, if a freelance graphic designer purchases prepaid health insurance, they may be able to claim this expense as a business deduction, thus reducing their taxable income. This deduction can be particularly advantageous for self-employed individuals or small business owners who rely on prepaid insurance to protect their operations.

Additionally, prepaid insurance can be treated as a form of long-term savings or an investment in certain tax-advantaged accounts. For instance, in the United States, contributions to a Health Savings Account (HSA) are tax-deductible, and funds in an HSA can grow tax-free. If an individual purchases prepaid insurance and then contributes the proceeds to an HSA, they can benefit from tax-free growth and tax-deductible contributions. This strategy allows individuals to save for future medical expenses while also investing in prepaid insurance, potentially providing both short-term and long-term tax advantages.

However, it is essential to consider the timing of the tax implications. Prepaid insurance investments may have different tax treatments depending on the jurisdiction and the specific insurance policy. In some cases, the tax benefits might be realized upfront, allowing for immediate deductions. In other instances, the tax advantages may be deferred, where the investment grows tax-free until the insurance coverage is utilized. Understanding the tax laws in your region and consulting with a tax professional is crucial to ensure compliance and maximize the tax benefits associated with prepaid insurance.

In summary, prepaid insurance investments offer potential tax advantages, including deductions and the ability to utilize tax-advantaged accounts. Investors should carefully review the tax laws applicable to their jurisdiction and seek professional advice to optimize their tax position. By understanding the tax implications, individuals can make informed decisions about prepaid insurance, combining insurance protection with potential tax savings.

Mastering Short-Term Put Options: A Beginner's Guide to Profitable Trading

You may want to see also

Market Trends: Analyzing current market trends and their impact on prepaid insurance

The prepaid insurance market is experiencing a shift towards more short-term, flexible products as consumer preferences evolve. This trend is particularly notable in the context of the broader financial services industry, where consumers are increasingly seeking convenience, customization, and cost-effectiveness. One of the key drivers of this change is the growing popularity of digital payment methods and the rise of fintech solutions. As a result, insurance companies are adapting their offerings to cater to this new market dynamic.

In the past, prepaid insurance policies were often long-term commitments, requiring customers to pay for coverage over an extended period. However, the current market trend indicates a preference for shorter-term policies that align with the frequency of premium payments. This shift is evident in the increasing demand for monthly or quarterly prepaid insurance plans, allowing customers to manage their finances more effectively and adapt to changing circumstances. For instance, many individuals now prefer to pay for insurance on a per-month basis, especially for travel or event-based coverage, which provides flexibility and avoids long-term financial commitments.

Another significant trend is the integration of technology into the prepaid insurance space. Insurtech startups are disrupting the industry by offering innovative solutions that streamline the insurance buying process. These companies utilize advanced algorithms and data analytics to provide personalized insurance products, often with automated underwriting and claims processing. As a result, customers can access quick quotes, purchase policies instantly, and receive faster payouts, all of which enhance the overall user experience. This technological advancement has made prepaid insurance more accessible and appealing to a broader audience.

The impact of these market trends on prepaid insurance is profound. Firstly, the shift towards shorter-term policies and flexible payment options has increased customer satisfaction and loyalty. By providing more control and customization, insurance companies are attracting a younger, tech-savvy demographic that values convenience and immediate gratification. Secondly, the integration of technology has improved operational efficiency, reducing costs and allowing for more competitive pricing. This, in turn, can lead to increased market share and customer acquisition for insurance providers.

However, there are challenges associated with these trends. The short-term nature of prepaid insurance policies may require insurers to carefully manage their risk portfolios to ensure profitability. Additionally, the rapid pace of technological innovation demands constant adaptation and investment in new systems and processes. Despite these challenges, the prepaid insurance market is poised for growth, driven by the changing preferences of consumers and the opportunities presented by technological advancements. As the industry continues to evolve, insurance companies that successfully navigate these trends will likely gain a competitive edge in the market.

Unlocking Short-Term Profits: A Beginner's Guide to BDNS Investing

You may want to see also

Frequently asked questions

No, prepaid insurance is not typically classified as a short-term investment. It is a form of insurance premium paid in advance for coverage that spans a specific period, usually a year. This type of payment is more about securing future insurance benefits rather than an investment strategy.

Prepaid insurance can be seen as a pre-payment for a service (insurance coverage) that will provide benefits over a defined period. It is not an investment in the traditional sense, as it doesn't generate returns or appreciate in value. Instead, it ensures financial protection against potential risks during the coverage period.

Absolutely. Paying insurance premiums upfront can offer several benefits. Firstly, it provides financial peace of mind, knowing that you are covered for the entire policy term without the worry of missed payments. Secondly, some insurance providers offer discounts for early payments, which can result in potential savings. Additionally, it simplifies your financial planning as you won't have recurring monthly expenses for insurance.