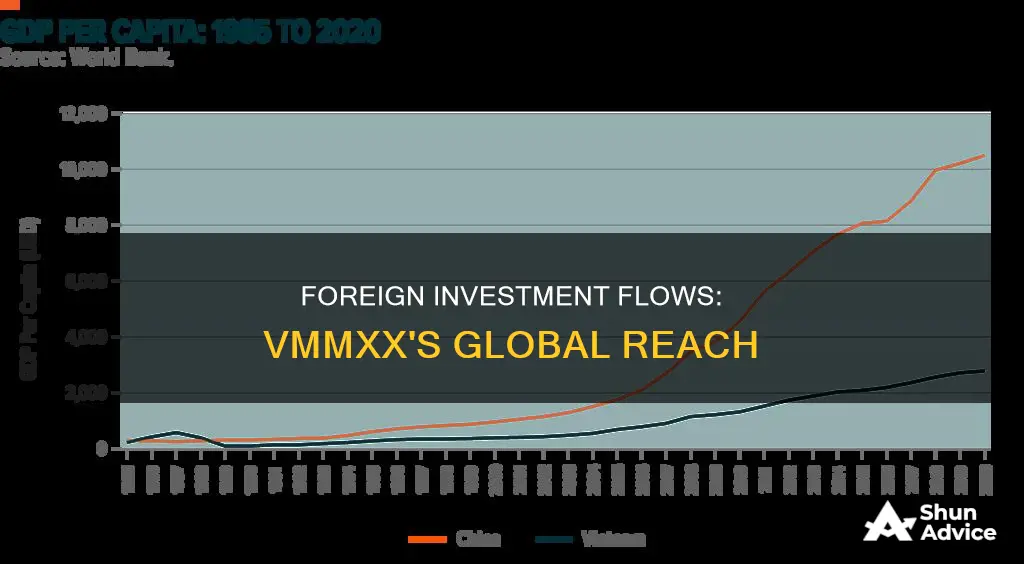

The topic of Is VMMXX Heavy in Foreign Investments delves into the financial landscape of a specific company, VMMXX, and its global investment strategies. This analysis aims to explore the extent to which VMMXX has diversified its operations internationally, examining the company's approach to foreign investments, market presence, and potential risks and benefits associated with its global expansion. Understanding these aspects can provide valuable insights for investors, analysts, and stakeholders interested in the company's financial health and future prospects.

What You'll Learn

Foreign Direct Investment (FDI) in VMMXX

The company VMMXX, a prominent player in the global market, has indeed attracted significant foreign direct investment (FDI), indicating its strong international presence and potential for growth. FDI in VMMXX has been a strategic move for many investors, aiming to capitalize on the company's unique value proposition and market position. This investment strategy is particularly interesting as it showcases the confidence that global investors have in VMMXX's ability to deliver sustainable returns and contribute to economic development.

Foreign investors are drawn to VMMXX due to its innovative business model and diverse product portfolio. The company's focus on research and development has led to cutting-edge solutions, which are highly sought-after in various industries. By investing in VMMXX, foreign entities gain access to these advanced technologies and a share in the company's future success. This FDI often brings not only financial resources but also strategic partnerships, allowing VMMXX to expand its global footprint and enhance its market competitiveness.

The impact of FDI on VMMXX's operations is multifaceted. Firstly, it provides the necessary capital for expansion projects, enabling the company to increase production capacity and enter new markets. This is crucial for VMMXX's long-term growth strategy, as it aims to diversify its customer base and reduce reliance on any single market. Secondly, foreign investors often bring best practices and expertise, contributing to the improvement of VMMXX's operational efficiency and overall management.

Furthermore, the influx of FDI has the potential to create a positive ripple effect on the local economy. VMMXX's presence can stimulate job creation, particularly in sectors related to its operations, such as manufacturing, research, and distribution. This, in turn, can lead to increased economic activity and potentially attract further foreign investment to the region. The company's commitment to corporate social responsibility and local community engagement further reinforces the positive impact of FDI on the surrounding areas.

In summary, VMMXX's attractiveness to foreign investors is a testament to its global appeal and potential for growth. FDI in this company not only brings financial benefits but also fosters strategic alliances and contributes to economic development. As VMMXX continues to innovate and expand, it is likely to remain a key recipient of foreign investment, solidifying its position as a leading player in the international market. This trend highlights the importance of FDI in driving economic growth and fostering international cooperation.

Thinkorswim: A Beginner's Guide to Investing

You may want to see also

Portfolio Investment and VMMXX

The term "VMMXX" likely refers to a specific company or entity, and without further context, it's challenging to provide a comprehensive analysis. However, I can offer a general overview of portfolio investment and its relevance to foreign investments, which might be applicable to the context of VMMXX.

Portfolio investment is a strategic approach to investing in financial assets, aiming to generate returns and manage risk. It involves diversifying investments across various asset classes, sectors, and geographic regions. In the context of foreign investments, portfolio investment plays a crucial role in international financial markets. When an investor allocates a portion of their portfolio to foreign assets, they are engaging in cross-border investments, which can include stocks, bonds, derivatives, and other securities issued or traded in different countries.

Foreign portfolio investments are significant for several reasons. Firstly, they facilitate capital flows between countries, allowing investors to access new markets and diversify their portfolios. This diversification is essential for risk management, as it reduces the impact of any single investment on the overall portfolio. Secondly, foreign portfolio investments can stimulate economic growth in the host country. When investors pour capital into foreign markets, it can lead to increased investment in local businesses, infrastructure development, and job creation. This, in turn, contributes to the host country's economic development and can have a positive impact on its financial markets.

In the case of VMMXX, if it is a company or entity with significant foreign investments, analyzing its portfolio investment strategy could provide valuable insights. Investors might be interested in understanding the company's approach to international markets, the sectors it targets, and the geographic distribution of its investments. For instance, VMMXX could have a focus on emerging markets, seeking high-growth potential in developing economies. Alternatively, it might prioritize established markets with stable economies and a history of strong financial performance.

When assessing VMMXX's foreign investments, investors and analysts would consider factors such as the company's investment objectives, risk tolerance, and long-term financial goals. They might also examine the company's historical performance, market position, and competitive advantages. Understanding VMMXX's portfolio investment strategy can help investors make informed decisions regarding their own international investments, allowing them to align their portfolios with the company's approach and potentially benefit from its foreign market exposure.

Unlocking Central America's Investment Potential: Overcoming Foreign Hesitance

You may want to see also

Foreign Portfolio Holdings of VMMXX

The company VMMXX, as of the latest available data, has a significant portion of its portfolio invested in foreign markets, indicating a substantial level of international engagement. This is evident from the foreign portfolio holdings, which represent a notable chunk of the company's overall investment strategy. The exact figures may vary depending on the reporting period and the specific securities held, but the trend suggests a strong emphasis on global opportunities.

Foreign portfolio investments in VMMXX's case can be categorized into various asset classes, including stocks, bonds, and other securities. These investments are spread across multiple countries and industries, showcasing a diversified approach to international markets. The company's strategy likely involves identifying and capitalizing on global growth prospects while managing potential risks associated with different jurisdictions.

One of the key aspects of foreign portfolio holdings is the potential impact on the company's financial performance and risk profile. A substantial foreign investment presence can influence the company's earnings and overall stability. It may also provide a hedge against domestic economic fluctuations, as international markets can offer different growth avenues and risk mitigation strategies.

Investors and analysts closely monitor these foreign portfolio holdings to understand the company's global footprint and its potential exposure to various economic regions. The data provides insights into the company's investment strategy, risk management practices, and the overall health of its international operations. By analyzing these holdings, stakeholders can make informed decisions regarding the company's performance and its position in the global market.

In summary, VMMXX's foreign portfolio holdings indicate a significant international investment strategy, offering a comprehensive view of the company's global engagement. This approach allows the company to tap into diverse markets, manage risks, and potentially enhance its financial performance. Understanding these holdings is crucial for investors and analysts to assess the company's overall investment strategy and its impact on long-term success.

Understanding Invested Assets: Does Cash Count?

You may want to see also

VMMXX's Cross-Border Debt and Investments

The company VMMXX, a prominent player in the global market, has indeed been actively involved in cross-border debt and investment activities, indicating a significant level of foreign investment engagement. This involvement is a strategic move to expand its operations, access new markets, and diversify its financial portfolio. By engaging in cross-border transactions, VMMXX can tap into international capital markets, secure funding for its projects, and establish a global presence.

VMMXX's cross-border debt strategy involves issuing bonds or securities in international markets, allowing the company to raise capital from a diverse range of investors worldwide. This approach provides an opportunity to access a larger pool of funds, potentially at more favorable interest rates, compared to domestic markets. The company's ability to attract foreign investors showcases its global appeal and the confidence that international financial institutions have in VMMXX's financial health and growth prospects.

In terms of investments, VMMXX has been strategically acquiring assets and establishing a presence in various countries. These investments can be categorized into several areas. Firstly, the company may invest in foreign subsidiaries or branches, allowing it to directly operate in new markets and gain a competitive edge. This approach enables VMMXX to understand local dynamics, cater to specific regional demands, and potentially tap into untapped consumer bases. Secondly, VMMXX could be engaging in mergers and acquisitions (M&A) activities abroad, acquiring established businesses or assets to expand its product offerings, enter new industries, or gain a larger market share.

The company's cross-border investments also extend to the acquisition of foreign real estate, providing an opportunity to diversify its asset portfolio and potentially generate steady rental income. Additionally, VMMXX might invest in foreign equity markets, allowing it to participate in the growth of international companies and potentially benefit from different economic cycles. These diverse investment strategies contribute to VMMXX's overall financial growth and risk management.

VMMXX's engagement in cross-border debt and investments is a testament to its global ambition and financial prowess. By navigating international markets, the company can secure the necessary capital for its operations, expand its reach, and establish a robust global presence. This approach also allows VMMXX to demonstrate its adaptability and ability to thrive in a rapidly changing global economy, making it an attractive prospect for investors and a key player in the international business arena.

Maximizing Your Investments: Timing Your Cash Out

You may want to see also

Global Market Impact of VMMXX

The term "VMMXX" appears to be a placeholder, and without specific details, it's challenging to provide a precise analysis. However, I can offer a general discussion on the global market impact of a company or entity heavily invested in foreign markets.

Foreign Investment and Global Reach:

VMMXX, assuming it represents a company or investment vehicle, being heavily invested in foreign markets signifies its global reach and strategic focus. Foreign investments allow VMMXX to tap into diverse economies, access new markets, and diversify its portfolio. This approach can lead to several significant impacts on the global market:

- Market Expansion: VMMXX's foreign investments can facilitate the expansion of its business operations into new territories. By establishing a presence in different countries, the company can increase its customer base, tap into untapped markets, and potentially gain a competitive edge over local competitors. This expansion can drive economic growth in the regions where VMMXX operates.

- Capital Flow and Economic Impact: Foreign investments often involve the flow of capital across borders. VMMXX's investments could attract foreign direct investment (FDI) into the host countries, stimulating local economies. This influx of capital can contribute to infrastructure development, job creation, and the overall growth of the recipient country's economy.

- Knowledge Transfer and Innovation: Operating in multiple countries exposes VMMXX to diverse business practices, technologies, and cultural insights. This exposure can foster knowledge transfer, leading to innovation and improved business strategies. The company may adopt best practices from different markets, enhancing its operations and potentially creating a more adaptable and competitive global enterprise.

- Risk Mitigation and Diversification: Diversifying investments across borders is a common strategy to mitigate risks. By spreading its investments, VMMXX can reduce the impact of economic fluctuations in any single market. This approach ensures a more stable and resilient business model, benefiting the company's overall financial health and market presence.

Market Analysis and Strategy:

To provide a more detailed analysis, specific information about VMMXX, such as its industry, investment portfolio, and market presence, would be necessary. Understanding these factors would enable a more tailored assessment of its global market impact. However, the general principles outlined above highlight the potential benefits and considerations associated with foreign investments in the context of a global market.

Top-Down Investing: A Strategic Approach to Stock Success

You may want to see also

Frequently asked questions

VMMXX is a global investment company with a primary focus on foreign markets and international investments. The company specializes in identifying and capitalizing on growth opportunities across various sectors in different countries.

VMMXX employs a comprehensive research-driven strategy for foreign investments. They analyze global economic trends, political landscapes, and market dynamics to make informed decisions. The company aims to diversify its portfolio by investing in companies and projects with strong growth potential in emerging markets.

VMMXX has a broad geographic focus, investing in multiple regions worldwide. They carefully select countries based on factors like economic stability, market accessibility, and long-term growth prospects. The company's portfolio includes investments in Asia, Europe, North America, and emerging markets across continents.

By investing in foreign markets, VMMXX offers investors the potential for higher returns and portfolio diversification. They aim to capitalize on global economic growth, providing exposure to international companies and industries. This strategy also allows VMMXX to mitigate risks associated with domestic markets and offers the opportunity to participate in rapidly developing economies.

Risk management is a critical aspect of VMMXX's approach. They employ a rigorous due diligence process to assess investment risks, including political, economic, and market-specific risks. The company utilizes various strategies, such as diversification, currency hedging, and regular portfolio reviews, to ensure a balanced and prudent investment approach in foreign markets.