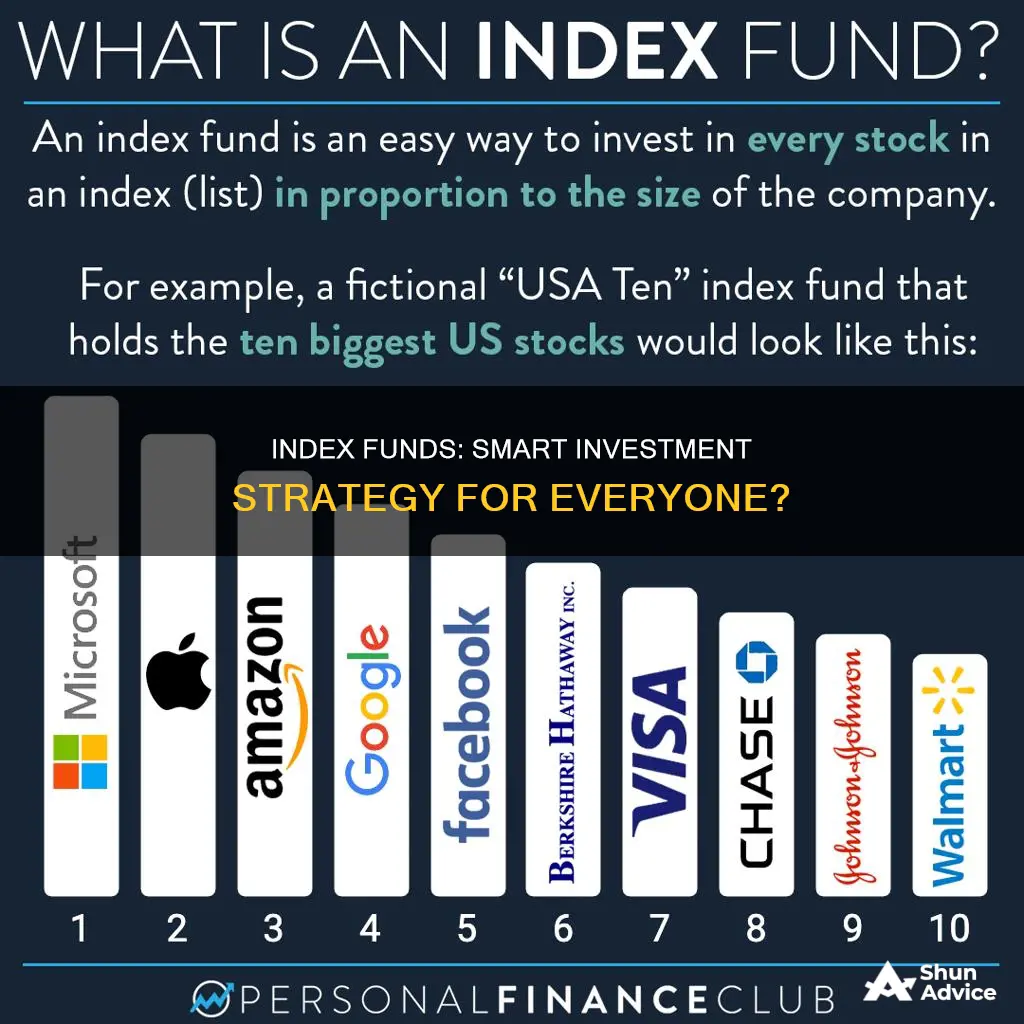

Index funds are a popular investment choice, especially for beginners, due to their low cost, diversification, and passive investment strategy. They are a type of mutual or exchange-traded fund (ETF) that tracks a market index, such as the S&P 500, by holding a representative sample of stocks or bonds. Index funds are designed to mirror the performance of their target index, and they have become an increasingly common investment vehicle over the past decade.

Index funds are often recommended for those seeking a simple, long-term investment strategy. They are easy to invest in, have low fees, and can perform very well over time. However, they also have some drawbacks, including a lack of downside protection during market downturns and limited flexibility to pivot away from a declining market.

When considering whether to invest in index funds, it is essential to understand their advantages and disadvantages and how they fit within your overall financial goals and risk tolerance.

| Characteristics | Values |

|---|---|

| Investment type | Mutual funds or exchange-traded funds (ETFs) |

| Investment strategy | Passive |

| Investment aim | Track the performance of a market index |

| Management | Fund managers ensure the fund performs the same as its target index |

| Investment scope | Stocks, bonds, commodities, cash, large/small/medium companies, international exchanges, specific sectors or trends |

| Costs | Low fees, low expense ratio, low transaction costs |

| Returns | Consistently high returns, especially over the long term |

| Risk | Low risk due to diversification, but vulnerable to market drops |

| Suitability | Beginners, long-term investors, retirement investors |

What You'll Learn

Index funds: pros and cons

Index funds are a popular investment option, but they come with advantages and disadvantages. Here are some pros and cons to help you understand if index funds are a good fit for your financial goals.

Pros of Index Funds:

- Low Fees and Costs: Index funds have lower expense ratios than actively managed funds because they are passively managed and don't require a manager or research team. This makes them an excellent option for cheap equity exposure.

- Diversification: Index funds allow investors to invest in multiple companies across different sectors, sizes, and growth patterns, reducing the risk of investing in individual stocks.

- Simplicity and Convenience: Index funds are easy to invest in and offer a simple way to create a diverse portfolio without much effort. They are also readily available through major custodians and workplace retirement plans.

- Predictable Long-Term Returns: Index funds have generally outperformed other types of mutual funds over the long term. For example, the S&P 500 has earned approximately 10% in average annual returns over 90 years.

- Tax Advantages: Index funds generate less taxable income and have tax advantages when selling securities due to having multiple lots to choose from.

Cons of Index Funds:

- Lack of Downside Protection: Index funds rise and fall with the market, leaving investors vulnerable during market downturns.

- Lack of Reactive Ability: Index funds cannot take advantage of opportunities or react to overvalued stocks as they are set portfolios.

- No Control Over Holdings: Investors cannot pick, add, or remove specific companies from the fund, limiting their ability to align investments with personal preferences or values.

- Limited Exposure to Different Strategies: Index funds may not provide access to successful investing strategies as they focus on broad market performance.

- Concentration Risk: Index funds tend to gravitate towards high-performing stocks, which can become overvalued as more money flows into them.

- High Minimum Requirements: Some index funds require sizable starting investments, which can range from $1,000 to $10,000.

Mutual Fund App Investments: Safe or Scam?

You may want to see also

How index funds work

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. They are defined as investments that mirror the performance of benchmarks like the S&P 500 by mimicking their makeup. Index funds are considered passive investments, meaning they use a long-term strategy without actively picking securities or timing the market.

Index funds are designed to be a low-cost investment option. They have lower expenses and fees than actively managed funds because they are passively managed. Instead of having a manager actively trading, index funds have a portfolio manager who simply matches the underlying index's performance over time. This means they have much lower management fees than other funds. Index funds also have lower transaction costs because they hold investments until the index itself changes, which doesn't happen very often.

Index funds are also well-known for their diversification benefits. They provide broad market exposure and diversification across various sectors and asset classes according to their underlying index. This helps to reduce the overall risk of the investment.

To invest in an index fund, you can purchase it directly from a mutual fund company or a brokerage, or through an online brokerage platform. When choosing an index fund, it's important to consider factors such as company size and capitalization, geography, business sector or industry, asset type, and market opportunities. It's also crucial to compare the fees and performance of different index funds before investing.

NRIs in the USA: Mutual Fund Investment Block

You may want to see also

Are index funds good for beginners?

Index funds are a great investment option for beginners. They are a low-cost, easy way to build wealth over the long term. Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them.

- Low costs and fees: Index funds have lower expense ratios because they are passively managed. They are automated to follow the shifts in value in an index, so you don't have to pay for active management.

- Broad market exposure and diversification: Index funds aim to mirror the performance of a specific index, offering broad market exposure. This helps to minimize risk and volatility in your portfolio.

- Historical performance: Over the long term, index funds have often outperformed actively managed funds, especially after accounting for fees and expenses.

- Tax efficiency: Index funds generally don't trade as frequently as actively managed funds, so they generate fewer capital gains distributions, making them more tax-efficient.

- Simplicity and ease of use: Index funds are straightforward to invest in and don't require a lot of research or expertise, making them suitable for beginners.

When investing in index funds, it's important to have a long-term investment horizon. Dips or highs in the market become less relevant when you're investing for the long term. It's also crucial to choose an index fund with low costs that aligns with your investment objectives and to consider diversifying your portfolio by investing in multiple index funds.

Life Investment Funds: Your Best Long-Term Investment Option

You may want to see also

How much does it cost to invest in an index fund?

Index funds are a great investment for building wealth over the long term. They are a low-cost, easy way to build wealth. The costs of investing in an index fund are as follows:

- Investment minimum: The minimum required to invest in a mutual fund can run from nothing to a few thousand dollars. Most funds allow investors to add money in smaller amounts once the initial threshold is crossed.

- Account minimum: This is different from the investment minimum. A brokerage's account minimum may be $0, but that doesn't remove the investment minimum for a particular index fund.

- Expense ratio: This is one of the main costs of an index fund. Expense ratios are fees that are subtracted from each fund shareholder’s returns as a percentage of their overall investment.

- Tax-cost ratio: Owning the fund may trigger capital gains taxes if held outside tax-advantaged accounts, such as a 401(k) or an IRA.

Index funds are passively managed, meaning they don't require active fund managers to decide which investments to buy or sell. This results in lower fees than actively managed funds. According to data from the Investment Company Institute in 2024, the average fee for an index fund is 0.05%, with some index funds offering even lower expense ratios.

Investing in Your 20s: Index Funds for Early Investors

You may want to see also

Are index funds safer than stocks?

Index funds are generally considered safer than stocks because they are diversified and don't rely too heavily on the performance of any individual stock. Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a specific index, such as the S&P 500. By investing in an index fund, you are investing in a diversified portfolio of securities that mirrors the index's performance. This means that if one stock in the index performs poorly, it will have a minimal impact on the overall performance of the index fund.

Additionally, index funds have lower fees than actively managed funds because they are passively managed. The fund's portfolio simply duplicates that of its designated index, and the fund does not need to actively decide which investments to buy or sell. This passive management strategy can lead to better returns over the long term for index funds compared to actively managed funds.

However, it is important to note that investing in an index fund does not guarantee protection from market corrections and crashes. If the index that the fund is tracking performs poorly, the fund will also perform poorly. Therefore, it is crucial to conduct thorough research before investing in any index fund and to ensure that it aligns with your investment goals and risk tolerance.

Overall, while index funds are considered safer than stocks due to their diversification and passive management, it is still possible to lose money when investing in index funds, and they may not be suitable for everyone's investment needs.

Contingency Fund Investment: Where to Place Your Safety Net?

You may want to see also

Frequently asked questions

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them.

Index funds are a low-cost, easy way to build wealth. They are passively managed, meaning they don't require active decision-making, and have low fees. They are also well-suited for diversification and long-term investing.

Index funds lack downside protection, meaning they are vulnerable to market downturns. They also offer limited control over holdings and lack the ability to react to market changes. Additionally, diversification can smooth out volatility but may also limit upside potential.

You can invest in index funds by opening a brokerage account or purchasing them directly from a mutual fund company. It is important to research and analyze different index funds, consider costs and performance, and monitor your investments periodically.