High-yield bond funds, also known as junk bond funds, are an investment option that promises impressive cash flow, a relatively high degree of price stability, and instant diversification. They are issued by corporations and provide a higher yield than investment-grade bonds, but they are also riskier. High-yield bond funds tend to have lower credit ratings, such as below BBB- from Standard & Poor's and Fitch, or below Baa3 from Moody's. While they offer the potential for higher returns, they also carry a number of risks, including default risk, higher volatility, interest rate risk, and liquidity risk. When deciding whether to invest in high-yield bond funds, it is important to consider your individual financial situation, including your income, net worth, investment goals, and risk tolerance.

| Characteristics | Values |

|---|---|

| Risk | High-yield bonds are riskier than investment-grade bonds, as they have a higher likelihood of defaulting. |

| Returns | High-yield bonds offer the potential for higher returns compared to safer bonds. |

| Coupon Rates | Due to the increased risk, these bonds typically carry higher coupon rates. |

| Diversification | High-yield bond mutual funds and ETFs can help to reduce risk by pooling bonds from multiple issuers. |

| Credit Ratings | High-yield bonds typically have credit ratings below BBB- from Standard & Poor's and Fitch, or below Baa3 from Moody's. |

| Default Risk | Default is the most significant risk for high-yield bond investors. Diversification is one way to mitigate this risk. |

| Volatility | High-yield bonds have historically been more volatile than investment-grade bonds, with volatility similar to the stock market. |

| Interest Rate Risk | All bonds face interest rate risk, but longer-term bonds have higher interest rate risk due to the potential for more significant interest rate changes. |

| Liquidity Risk | High-yield bonds generally have higher liquidity risk than investment-grade bonds, and even high-yield bond mutual funds and ETFs carry liquidity risk. |

What You'll Learn

Advantages of high-yield bonds

High-yield bonds, also known as junk bonds, are debt securities issued by corporations with lower credit ratings than investment-grade bonds. They are characterised by their higher interest rates and higher risk of default. Despite the risks, high-yield bonds offer several advantages to investors:

- Higher payouts: The primary advantage of high-yield bonds is the potential for higher returns compared to traditional investment-grade bonds. The higher payout compensates investors for the increased risk associated with lower-rated bonds.

- Improving credit standing: Investing in high-yield bonds of companies that are improving their credit standing can be a strategic move. As the company's credit rating increases, the value of the bond may also appreciate, resulting in higher returns.

- Priority in payouts: In the event of a company default, bondholders are paid out before stockholders during the liquidation of assets. This makes high-yield bonds a relatively safer investment option compared to stocks, despite their higher risk of default.

- Dependable returns: High-yield corporate bonds offer a more consistent payout than stocks. While stock payouts vary based on company performance, high-yield bonds provide a fixed payout at each pay period, unless the company defaults.

- Recession-resistant companies: Some companies that issue high-yield bonds are recession-resistant, such as discount retailers and gold miners. Investing in these companies during economic downturns can be attractive as they are less vulnerable to recessionary pressures.

While high-yield bonds offer these advantages, it is important to carefully consider the associated risks, such as higher default rates, lower liquidity, and higher sensitivity to changes in the interest rate environment.

Launching an Investment Fund: A Guide for South Africa

You may want to see also

Disadvantages of high-yield bonds

High-yield bonds, also known as "junk bonds", are not without their disadvantages. Here are some key disadvantages to consider:

Default Risk

The biggest risk associated with high-yield bonds is the possibility of default by the bond issuer. This means that the company may fail to make interest payments, return the principal, or both. The risk of default is higher for companies that issue high-yield bonds, and in the event of a default, the bonds become worthless.

Interest Rate Risk

Bond prices generally move in the opposite direction of interest rates. When interest rates increase, bond prices tend to decrease. High-yield bonds are susceptible to interest rate risk, and while they are less affected by interest rate moves due to their shorter maturities and higher interest payouts, they can still be impacted.

Economic Risk

During economic downturns or periods of uncertainty, investors may rush to sell their high-yield bonds and switch to safer options, such as U.S. Treasury bonds. This can result in a drop in high-yield bond prices if the market supply exceeds demand.

Liquidity Risk

High-yield bonds may have lower liquidity compared to investment-grade bonds, making it more challenging for investors to resell them. The traditional stigma associated with "junk bonds" can make these bonds less attractive to potential buyers.

Migration Risk

The value of a high-yield bond is closely tied to the credit rating of the issuer. If the credit rating of the company issuing the bond decreases further, the price of the bond can also go down, negatively impacting the return on investment.

Recession Risk

During a recession, the high-yield bond market is typically hit hard. While other bonds may see an increase in value as investors seek safer options, high-yield bonds often begin to fail as investor preferences shift. Unless the companies issuing these bonds are in recession-resistant industries, they face a higher risk of becoming worthless during economic downturns.

Energy Funds: A Smart Investment for Your Future

You may want to see also

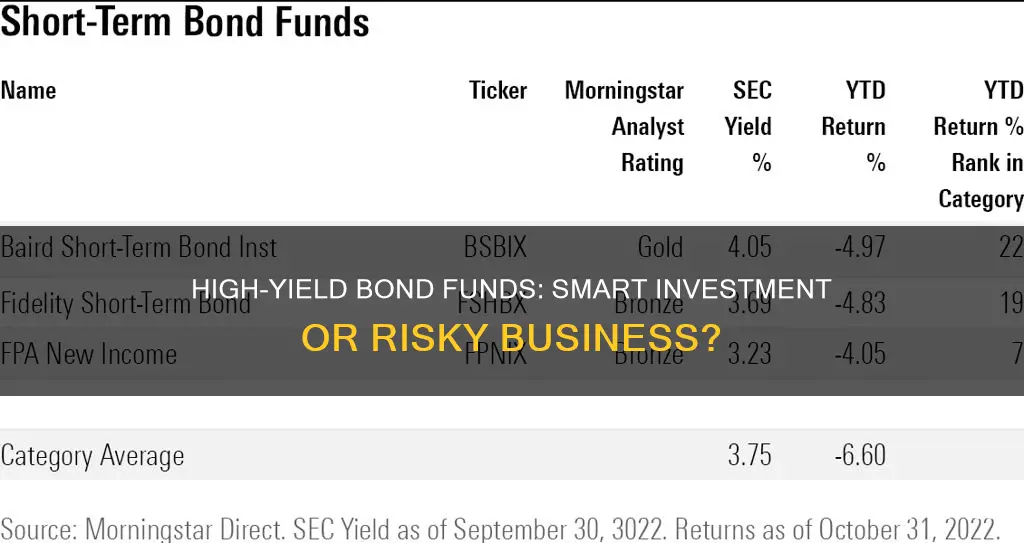

High-yield bond mutual funds vs. individual bonds

High-yield bond mutual funds and individual bonds both have their own advantages and disadvantages. Here is a detailed comparison between the two:

High-Yield Bond Mutual Funds

High-yield bond mutual funds, also known as junk bond funds, offer a way for investors to diversify their portfolios and earn higher returns by taking on additional credit risk. These funds pool together high-yield bonds from multiple issuers, reducing the overall risk for investors. Mutual funds are actively managed by fund managers who choose which bonds to include in the fund and conduct thorough research and analysis on each bond issue. This provides investors with access to professional money management, which can be beneficial for those who may not have the time or expertise to conduct extensive due diligence on individual bond issues.

Mutual funds also offer benefits such as monthly distributions, transparency, and diversification across several high-yield bonds. The diversification provided by mutual funds can help cushion the impact of any one poor-performing bond, reducing the overall risk of the investment. Additionally, mutual funds can provide access to certain bond issues that may only be available to institutional investors.

However, investing in high-yield bond mutual funds comes with its own set of risks. These funds are vulnerable to economic and credit risk, and investors may suffer during economic downturns or recessions as more issuers default on their interest payments. High-yield bond mutual funds also carry liquidity risk, which means that investors may not be able to sell their fund shares at the desired time and price. Additionally, mutual funds typically have fees and expenses associated with them, which can impact overall returns.

Individual High-Yield Bonds

Investing in individual high-yield bonds, also known as junk bonds, offers the potential for higher returns compared to investment-grade bonds. These bonds are issued by corporations with lower credit ratings, such as startup companies or capital-intensive firms with high debt ratios. Individual high-yield bonds can provide more attractive yields than safer bonds, making them appealing to investors with a high-risk tolerance.

Investing in individual bonds allows investors to have more control over their investments and avoid the fees associated with mutual funds. Building a bond ladder with individual bonds can also help reduce interest rate risk. Additionally, individual bonds can be purchased directly from broker-dealers, making them more accessible to investors.

However, investing in individual high-yield bonds carries a higher risk of default. The possibility of default makes individual bonds riskier than investing in bond funds, and small investors may want to avoid buying individual high-yield bonds directly due to this risk. Individual bonds also have higher liquidity risk, which means that they may be more difficult to sell compared to safer bonds.

In conclusion, both high-yield bond mutual funds and individual bonds offer advantages and come with certain risks. Mutual funds provide diversification and professional management, while individual bonds offer higher control and potentially lower fees. Investors should carefully consider their financial goals, risk tolerance, and level of expertise before deciding whether to invest in high-yield bond mutual funds or individual bonds.

A Monthly Guide to Index Fund Investing

You may want to see also

High-yield bonds and interest rates

High-yield bonds, also known as "junk" bonds, are debt securities issued by companies with uncertain prospects and a higher probability of defaulting. They are rated below BBB- or Baa3 by established credit rating agencies like Moody's, Standard & Poor's, and Fitch. These bonds are inherently riskier than those issued by more creditworthy companies but offer the potential for higher returns.

When considering investing in high-yield bonds, it is essential to understand the relationship between these bonds and interest rates. High-yield bonds are influenced by interest rates, but not to the same extent as other investment options. Here are some key points to consider:

Interest Rate Sensitivity: High-yield bonds have relatively low sensitivity to interest rate changes compared to other bond types. While a rise in interest rates typically causes bond prices to decline, the impact on high-yield bonds is less pronounced due to the dominant influence of credit and default risk on their valuations.

Economic Cycle: In a rising interest rate environment, high-yield bonds are expected to outperform other fixed-income classes. This is because a rising interest rate environment usually indicates an improving economy, which can enhance the financial health of high-yield bond issuers.

Credit Risk: High-yield bonds are subject to credit risk, which is influenced by the issuer's creditworthiness. As interest rates change, the creditworthiness of issuers may also change, impacting the risk associated with high-yield bonds.

Call Risk: High-yield bonds often have call provisions, allowing issuers to redeem them at their discretion before maturity. Issuers typically call bonds when interest rates fall, which can result in capital losses or reduced income for investors.

Liquidity Risk: The market for high-yield bonds is generally less liquid than that of investment-grade or government bonds. During periods of rising interest rates, liquidity risks can increase, making it more challenging to sell high-yield bonds.

Overall, while high-yield bonds are influenced by interest rates, their performance is more strongly tied to the creditworthiness and financial health of the issuing companies. When considering investing in high-yield bonds, it is crucial to carefully assess the risks, monitor the issuers' financial health, and ensure adequate diversification across issuers, industries, and regions.

A Guide to Investing in the 10T Fund

You may want to see also

High-yield bonds and liquidity risk

High-yield bonds, also known as junk bonds, are corporate debt securities that pay higher interest rates than investment-grade bonds. They are issued by corporations with lower credit ratings, typically below BBB- from Standard & Poor's and Fitch, or below Baa3 from Moody's. These bonds are considered non-investment grade and carry a higher risk of default, which is reflected in their lower credit quality.

Liquidity risk is a significant concern for high-yield bonds. Liquidity refers to the ability of a bond to be easily traded or sold in the market without causing significant price changes. High-yield bonds generally have higher liquidity risk than investment-grade bonds. Even high-yield bond mutual funds and exchange-traded funds (ETFs) are subject to liquidity risk.

The impact of liquidity on yield spreads has been extensively studied, and researchers have found a strong link between systematic liquidity risk and the pricing of securities in the corporate bond market. Illiquidity, particularly during periods of market volatility or financial stress, can significantly affect yield spreads. While AAA-rated bonds can weather financial stress better, high-yield bonds with lower credit ratings tend to fare poorly during such periods.

Illiquidity can impact all bonds, except those rated AAA. However, the liquidity of corporate bonds varies, especially during uncertain economic conditions. The credit ratings of these bonds play a crucial role in how they respond to illiquidity shocks. Shorter-term and higher-yielding bonds are more susceptible to idiosyncratic illiquidity, as observed by Heck et al.

Overall, high-yield bonds carry a higher liquidity risk due to their lower credit ratings and the nature of the corporate bond market. This risk is an essential factor for investors to consider when evaluating the potential returns and stability of high-yield bond investments.

Short-Term Fed Funds: Smart Strategies for 100K Investors

You may want to see also

Frequently asked questions

High-yield bonds, also known as junk bonds, are bonds that provide higher interest rates but carry a greater risk of default. They are issued by companies with lower credit ratings and are considered non-investment grade.

The main advantage of high-yield bond funds is the potential for higher returns compared to investment-grade bonds. However, they also carry a higher risk of default, higher volatility, interest rate risk, and liquidity risk.

There are two main ways to invest in high-yield bonds: buying individual bonds directly from broker-dealers or investing in a mutual fund or exchange-traded fund (ETF) that holds high-yield bonds. Mutual funds and ETFs offer greater diversification and are generally recommended for retail investors.