Investing in commodities funds is a complex and risky endeavour, but it can be a good way to diversify your portfolio and protect against inflation. Commodities funds invest in a broad basket of commodities and natural resources, including precious metals, energy and agricultural goods. They can be a good hedge against downturns in bigger asset classes like stocks and bonds, as they have a low correlation to them. However, commodities are also notoriously volatile and difficult to understand, as they are traded using derivatives known as futures contracts. They are also physical goods that must be transported, stored, managed and insured, which can be costly. For these reasons, commodities funds are generally recommended for sophisticated investors only.

| Characteristics | Values |

|---|---|

| Types of commodity funds | Commodity funds with direct holdings in commodities; commodity funds that hold futures; natural resource funds; combination funds |

| Investment strategies | Active management; passive management |

| Pros | Portfolio diversification; upside potential; hedge against inflation |

| Cons | Volatile; subject to wild, short-term price swings and long lulls; complex; no interest or dividends; additional fees; not a great hedge over time; lack of liquidity; some markets are manipulated |

What You'll Learn

Commodities funds vs stocks and bonds

Commodities funds, stocks and bonds are all items traded on a stock exchange market and represent an investable and tradable asset. However, there are some key differences between them.

Commodity Funds

Commodity funds are a broad category that includes several distinct types of investments. These can include funds that hold direct holdings in commodities, such as gold bullion, or funds that hold futures contracts, which allow investors to profit from price changes without taking delivery of the physical commodity. Natural resource funds, which invest in companies operating in commodity-related fields, and combination funds, which hold a mix of actual commodities and futures contracts, are also types of commodity funds.

Commodities offer portfolio diversification as they have historically had a low correlation to traditional equity markets. They also offer upside potential as they are subject to the laws of supply and demand, and they can act as a hedge against inflation. However, the commodities market is highly volatile and subject to wild price swings due to various factors such as supply and demand, speculation, and political instability.

Stocks

Stocks, also known as capital stock, shares, or equities, represent ownership interest in a corporation. They are issued in return for money, which is used to fund corporate growth and investment. Stocks are typically bought and sold, held in a portfolio, and accumulated over time. Some stocks pay out dividends as a profit share.

Bonds

Bonds, on the other hand, are debt promises issued by a company or government. They are secured against the assets of the issuer and offer a guaranteed rate of return. Bonds are traded openly on the markets and are considered a longer-term investment, paying a fixed yield per annum. Government bonds, also known as Treasuries or T-bills, are generally regarded as the safest investment option.

Commodity Funds vs Stocks and Bonds

The main difference between commodity funds, stocks, and bonds lies in their risk and return profiles. Stocks and bonds are more traditional investment options, with stocks typically offering higher potential returns but also carrying higher risks. Bonds, on the other hand, are considered safer and provide more stable returns. Commodity funds offer a middle ground, providing diversification and a hedge against inflation, but they come with higher volatility and more complex dynamics due to their reliance on physical supply and demand.

The decision to invest in commodity funds, stocks, or bonds depends on an investor's risk tolerance, time horizon, and overall investment strategy. A balanced portfolio often includes a mix of these asset classes to optimise returns and manage risk.

The Global Investment Hub: Where Funds Call Home

You may want to see also

The pros and cons of investing in commodities funds

Commodities funds are a way to invest in a broad basket of commodities and natural resources, including precious metals, energy, and agricultural goods. They can be a good way to diversify your portfolio and protect against inflation, but there are also some risks to consider.

Pros:

- Commodities have historically been viewed as a hedge against inflation, as rising consumer prices are often linked to rising commodity prices.

- Commodities offer portfolio diversification. Investing in futures contracts or actual commodities provides exposure to a different type of asset that is not correlated with traditional stocks and bonds.

- Commodities offer upside potential. The raw materials used in construction, agriculture, and other industries are subject to the laws of supply and demand, which can drive up prices and result in profits for investors.

- Commodities funds can be a simpler way for investors to gain exposure to various commodities without directly owning the physical assets.

Cons:

- Commodities markets can be volatile and subject to wild, short-term price swings and long lulls.

- Commodities do not pay interest or dividends, so the only return on investment comes from selling at a higher price.

- Commodities are physical goods that must be transported, stored, managed, and insured, which incurs additional costs for the investor.

- Many commodities indexes are heavily weighted towards a handful of commodities, such as crude oil, which can impact the overall performance of the fund.

- Commodities might not offer a great hedge over time. While they have a low correlation with other asset classes, their performance is tied to the global economy and can be affected by supply and demand issues.

- Some commodities markets are manipulated by cartels, which can impact prices and may not be influenced solely by supply and demand.

Mutual Funds: Where Are Your Investments Going?

You may want to see also

Commodities funds as a hedge against inflation

Commodities funds can be a good hedge against inflation as they are negatively correlated with stocks and bonds. This means that when the value of stocks and bonds decreases, commodities tend to increase in value. Commodities are an indicator of inflation to come; as the price of a commodity rises, so does the price of the products that the commodity is used to produce.

Goldman Sachs Research analysed five inflationary periods over the past 50 years and found that commodities outperformed equities and bonds across all five episodes. They also found that a 1% increase in US inflation has, on average, led to a real return gain of 7% for commodities.

Commodities are produced or extracted products, often natural resources or agricultural goods, that are used as inputs into other processes. Commodities that tend to be good inflation hedges include precious metals and energy products.

However, it is important to note that not all commodities respond the same to higher inflation. For example, gold typically only guards against very high inflation and large inflation surprises caused by losses in central bank credibility and geopolitical supply shocks.

Commodities funds can be a good way to gain exposure to a broad basket of commodities, including precious metals, energy and agricultural goods. However, it is important to note that commodities funds can be volatile and subject to wild price swings. Therefore, investors should exercise caution and conduct thorough research before investing.

Venture Capital Funds: Smart Investment for Future Growth

You may want to see also

The volatility of commodities funds

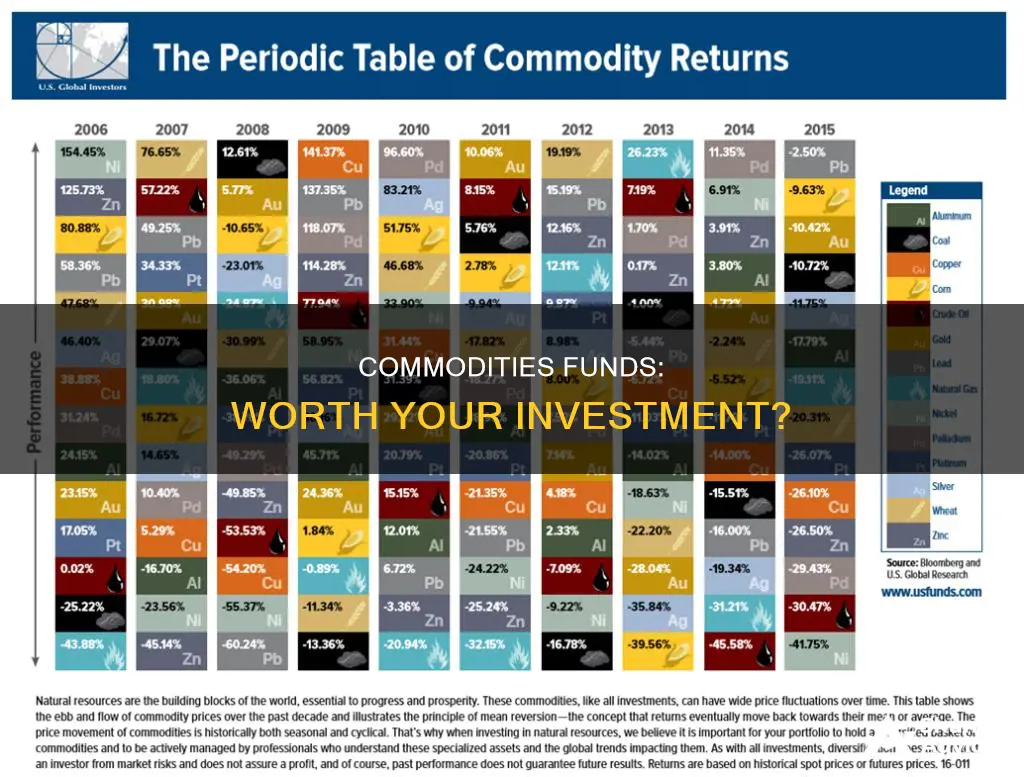

Commodities funds are considered a volatile investment option. They are subject to wild, short-term price swings and long lulls, and prices can go from record highs to record lows in just a few days.

Commodities funds are influenced by a variety of factors, including supply and demand, exchange rates, inflation, and the overall health of the economy. They are also sensitive to world events, import controls, worldwide competition, government regulations, and economic conditions. This means that the value of an investment in a commodities fund can fluctuate significantly and quickly.

For example, the price of gold over the past 30 years and the price of copper in 2008 are often cited as examples of the volatility of commodities.

Due to the volatile nature of commodities funds, investors are advised to limit their holdings to a small percentage of their total portfolio.

Unlock Real Estate Funding: Strategies for Investors

You may want to see also

How to invest in commodities funds

There are several ways to invest in commodities, which are raw materials that are either used directly, such as food, or indirectly to produce another product.

Futures Contracts

Futures contracts are a high-risk, high-reward way to speculate on a given commodity. Futures contracts are an agreement to buy or sell a specified amount of a commodity at a specified price and date in the future.

Physical Commodities

It is possible to own physical commodities, such as gold, although this can be impractical and difficult to store for some commodities.

Exchange-Traded Funds (ETFs)

ETFs are a convenient way to gain exposure to a commodity or a group of them. ETFs trade like stocks and enable speculation on commodity price fluctuations without investing directly in futures contracts.

Stock of Commodity Producers

Stocks can be purchased in commodity-producing companies, such as oil and gas producers or miners of precious metals.

Mutual Funds

Mutual funds can be used to invest in commodities, although they may not offer direct investment and are not always diversified.

Exchange-Traded Notes (ETNs)

ETNs are similar to ETFs and trade like stocks but are backed by the issuer. They are another way to gain exposure to commodities without direct investment.

Setting Up a Family Investment Fund: A Guide

You may want to see also

Frequently asked questions

Commodity funds are investments in crops, metals, energy, currencies and other tangible things. They are often viewed as a hedge against inflation.

Commodities offer portfolio diversification, upside potential and a hedge against inflation. They also tend to go up when stocks and bonds go down.

The commodities market can be volatile and subject to wild, short-term price swings. Commodities also don't pay interest or dividends.

You can invest in commodities funds by purchasing varying amounts of physical raw commodities, such as precious metal bullion, or through the use of futures contracts or exchange-traded products (ETPs) that directly track a specific commodity index.