LIC and mutual funds are both popular investment options in India, but they cater to different financial needs. LIC, or the Life Insurance Corporation of India, is a public sector life insurance provider that offers financial security to the policyholder's family in the event of their death. Mutual funds, on the other hand, are investment instruments that pool funds from multiple investors to create diversified portfolios of stocks, bonds, or other securities. While LIC policies offer guaranteed returns, tax benefits, and lower risk, mutual funds have the potential to generate higher returns but come with higher risk and market volatility. The decision to invest in LIC or mutual funds depends on an individual's financial goals, risk tolerance, and investment horizon.

| Characteristics | Values | |

|---|---|---|

| Type of company | LIC is a life insurance company | Mutual funds are investment vehicles |

| Ownership | LIC is owned by the Indian government | Mutual funds pool money from various investors |

| Objective | LIC provides insurance to protect and provide financial security to policyholders | Mutual funds aim to generate returns for investors |

| Products | Insurance-based investment products | Market-linked investment products |

| Examples of products | Term, endowment, ULIPs, whole life, and money-back plans | Equity, debt, hybrid, and other mutual fund schemes |

| Investment objective | Long-term financial protection and savings for policyholders and their families | Wealth creation and capital appreciation for investors |

| Returns | Fixed or guaranteed returns on insurance products | Not guaranteed, but market-linked returns that depend on the performance of the underlying assets |

| Risk | Lower risk due to guaranteed returns, but may not provide higher returns in line with market growth | Higher risk due to market-linked returns, but may offer higher returns if the market performs well |

| Lock-in period | Minimum lock-in period of 5 years for most policies | No mandatory lock-in period, but may vary depending on the scheme |

| Liquidity | Limited liquidity due to lock-in periods and surrender charges | Higher liquidity as investments can be redeemed at any time, subject to exit loads and market conditions |

| Tax benefits | Tax benefits available under Section 80C and Section 10(10D) of the Income Tax Act | Taxation depends on the type of mutual fund and the holding period, with indexation benefits available for long-term capital gains |

| Regulation | Regulated by the Insurance Regulatory and Development Authority (IRDAI) | Regulated by the Securities and Exchange Board of India (SEBI) |

What You'll Learn

Pros and cons of LIC and mutual funds

LIC (Life Insurance Corporation of India) and mutual funds are both popular investment options in India, each with its own set of advantages and disadvantages. Here is a detailed look at the pros and cons of LIC and mutual funds to help you make an informed decision about which option is better suited to your financial goals and risk tolerance.

LIC (Life Insurance Corporation of India)

Pros:

- Financial security and stability: LIC policies are designed to provide financial protection for the policyholder's family in the event of their demise. This includes a guaranteed death benefit and, depending on the type of policy, maturity benefits if the policyholder survives the policy term.

- Low risk: LIC policies offer guaranteed returns and are generally considered a low-risk investment option.

- Tax benefits: LIC policies offer tax advantages such as tax-free insurance benefits and tax-deferred growth dividends, making them attractive for tax planning.

- Long-term savings: LIC policies typically have a long-term horizon and provide maturity benefits, making them suitable for those seeking a long-term savings option.

- Predictable returns: LIC policies offer predictable returns, so investors can expect stable returns instead of dealing with market fluctuations.

Cons:

- Lower returns: LIC policies may offer only modest or lower returns compared to market-linked investments like mutual funds.

- Limited investment growth: LIC policies focus on financial security and stability rather than investment growth.

- Lower liquidity: LIC policies are long-term products and may have lower liquidity compared to other investment options.

- Limited flexibility: LIC policies may not offer the same level of flexibility and diversification as mutual funds.

Mutual Funds

Pros:

- Higher returns: Mutual funds have the potential to generate higher returns compared to LIC policies due to their market-linked investments.

- Diversification: Mutual funds pool funds from multiple investors to create diversified portfolios of stocks, bonds, or other securities, reducing risk and enhancing returns.

- Flexibility and liquidity: Mutual funds offer investors the flexibility to buy or sell units as needed, providing easier liquidity (except for specific types of funds).

- Professional fund management: Mutual funds benefit from professional fund management, ensuring that investment decisions are based on thorough market analysis.

- Wide range of options: Mutual funds offer a variety of options, including equity, debt, hybrid, money market, and international funds, allowing investors to diversify their investment portfolios.

Cons:

- Higher risk: Mutual funds are subject to market risk and volatility, and investors may lose money if the market performs poorly.

- Fees and charges: Mutual funds typically involve various fees and charges, such as management fees, exit loads, and fund-related charges, which can impact overall returns.

- No guaranteed benefits: Unlike LIC policies, mutual funds do not offer guaranteed death or maturity benefits.

- May not suit conservative investors: Mutual funds are generally better suited to investors with a higher risk tolerance and a long-term investment horizon.

A Guide to Index Fund Investing in Australia

You may want to see also

LIC for financial security

LIC, or the Life Insurance Corporation of India, is a public sector life insurance provider that has been the industry leader for decades. LIC policies are ideal for those who prioritise their family's financial security. LIC policies are designed to protect the policyholder's family financially in the event of their death. The insurer pays out death benefits guaranteed under the plan to the policyholder's nominee. LIC policies also often come with maturity benefits, where the policyholder receives a lump sum if they survive the policy term.

LIC policies are centred around financial security and stability. They are a low-risk investment with guaranteed returns. LIC policies offer tax benefits under Section 80C of the Income Tax Act, making them attractive for tax planning. LIC policies are suitable for those seeking life insurance coverage, predictable returns, long-term savings, and financial security for their family.

LIC offers various life insurance plans, including term insurance, endowment, money-back, whole life, unit-linked insurance, pension, health, and micro-insurance plans. These plans cater to different needs, such as high coverage, savings components, money-back benefits, and regular pension income.

In summary, LIC policies provide financial security and peace of mind by ensuring that your family will be taken care of financially in the event of your demise. They offer guaranteed returns, tax benefits, and maturity benefits, making them a stable and reliable choice for long-term savings and family protection.

A Guide to Investing in Vanguard Funds from South Africa

You may want to see also

Mutual funds for higher returns

When it comes to investing, one option to consider is mutual funds. These funds offer an attractive combination of features that make them a popular choice for investors seeking higher returns. Here are some key things to know about mutual funds and how they can help you achieve your financial goals:

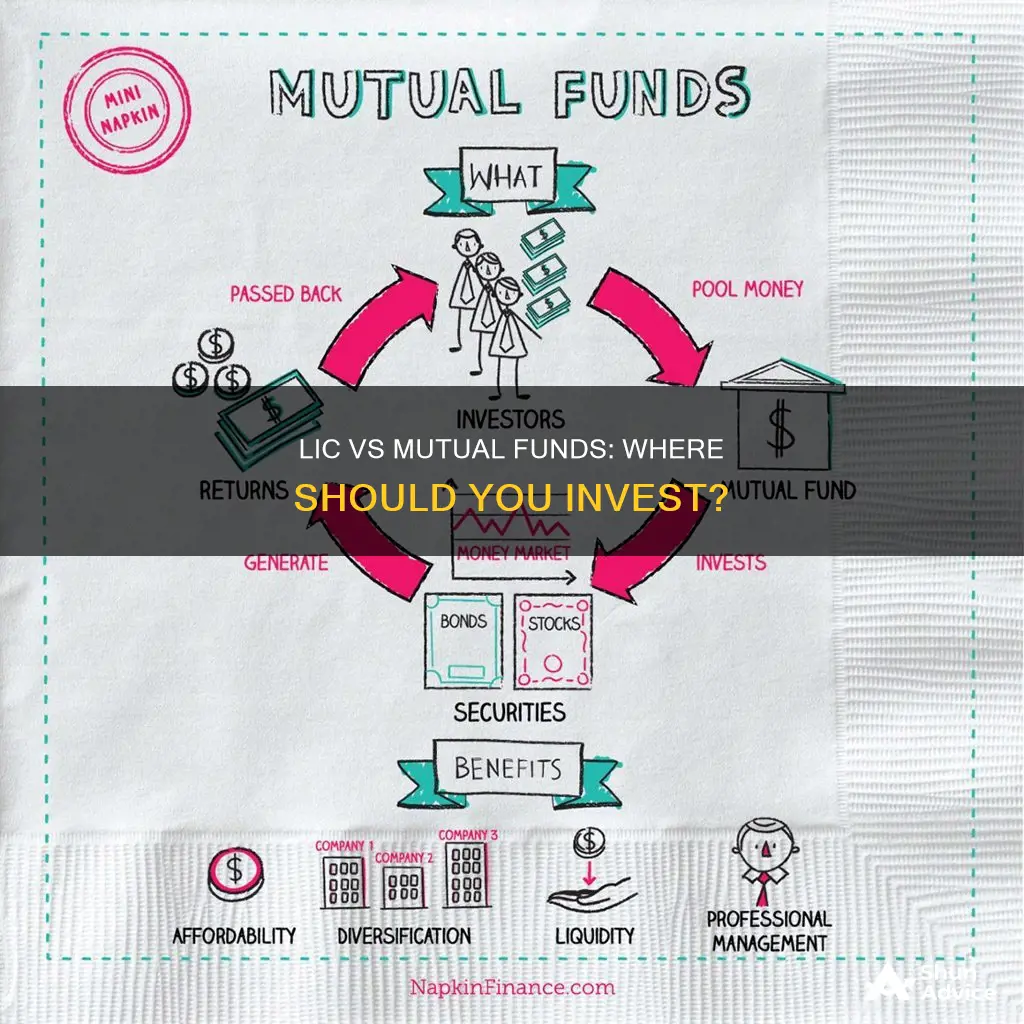

Mutual funds are investment vehicles that pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, and other securities. By investing in a mutual fund, you buy shares of the fund, which represent a proportional ownership stake in the fund's holdings. This provides instant diversification, as your investment is spread across a wide range of securities.

Each mutual fund share represents a prorated amount of all the investments within the fund. For example, if 10% of a mutual fund's portfolio is invested in Tesla, 5% in Comcast, and 2% in The Cheesecake Factory, each shareholder will receive returns or losses from these holdings in proportion to their investment. It's important to remember that you don't directly own the underlying securities; you own a share of the fund itself.

Benefits of Mutual Funds:

- Diversification: Mutual funds provide instant diversification by investing in a broad range of companies and industries, helping to lower investment risk and potentially boost returns.

- Affordability: Mutual funds typically have low minimum investment requirements and reasonable fees, making them accessible to a wide range of investors.

- Professional Management: Mutual funds are managed by investment professionals who have the expertise and experience to navigate the markets and make informed investment decisions.

- Liquidity: Mutual fund shares can be easily redeemed at any time, providing flexibility and access to your investment.

Now, let's focus on how mutual funds can help you achieve higher returns:

- High-Risk, High-Return Funds: Some mutual funds focus on investing in small and medium-sized companies, which tend to have higher risk but also offer the potential for significant growth. These funds are suitable for aggressive investors with a long-term investment horizon and the ability to tolerate volatility.

- Large-Cap Funds: Large-cap mutual funds invest in the largest and most established companies, which are generally considered less risky. These funds are suitable for investors seeking high returns while also being prepared for potential moderate losses.

- Growth Funds: Growth funds target stocks with above-average growth potential, making them attractive for investors seeking higher returns over the long term.

- Actively Managed Funds: Actively managed mutual funds employ professional fund managers who actively select and monitor investments to maximize returns. Their expertise can help identify high-potential investments and time the market to enhance returns.

- Long-Term Investment: Mutual funds are typically well-suited for long-term investment goals. By investing for decades, you can take advantage of compound interest and potentially achieve higher returns over time.

Factors to Consider:

When choosing mutual funds for higher returns, consider the following:

- Risk and Return Trade-off: Remember that risk and return are directly proportional. Higher returns often come with higher risk. Carefully assess your risk tolerance and investment horizon before selecting a fund.

- Fees and Expenses: Mutual funds charge various fees, such as expense ratios, sales loads, and redemption fees. These fees can eat into your returns, so it's essential to consider funds with lower expense ratios and no-load fees.

- Investment Objectives: Different mutual funds have different investment objectives. Ensure that the fund's objectives align with your financial goals and return expectations.

- Past Performance: While past performance doesn't guarantee future results, it can give you an idea of the fund's historical returns and volatility. Look for funds that have consistently outperformed their benchmarks and peer groups.

- Fund Managers: Research the fund managers' track record and investment strategy. Choose funds with managers who have a history of success and a disciplined approach to investing.

Examples of High-Return Mutual Funds:

- Nippon India Small Cap Fund: This fund has delivered impressive returns by investing in high-risk, high-potential small and mid-cap stocks.

- Edelweiss Mid Cap Fund: Another fund focusing on mid-cap stocks, offering high returns with a slightly lower risk compared to small-cap funds.

- Fidelity International Index Fund (FSPSX): This fund provides exposure to mid- and large-cap companies in international markets, with a low expense ratio, resulting in strong returns over the past decade.

- Schwab S&P 500 Index Fund (SWPPX): This fund offers investors diversified exposure to the 500 largest U.S. companies at a very low fee, with a 10-year average annual return above 12%.

- T. Rowe Price Mid-Cap Growth Fund (RPMGX): With a disciplined focus on valuations, this fund has consistently outperformed its mid-cap growth category, offering higher returns with lower risk.

In conclusion, mutual funds can be an excellent way to achieve higher returns, especially when combined with proper research, a long-term investment horizon, and a careful consideration of risk and fees. By selecting the right mutual funds and aligning them with your financial goals, you can increase your potential for substantial returns over time.

Invest Wisely: Choosing the Right Army Fund

You may want to see also

LIC for predictable returns

LIC, or the Life Insurance Corporation of India, is a public sector life insurance provider that has been the industry leader for decades. LIC policies are ideal for those who want to prioritise their family's financial security. LIC policies offer life insurance coverage and ensure that the policyholder's family is financially protected in the event of the policyholder's death. This coverage is in the form of a death benefit, which is a guaranteed payout to the nominee. LIC policies also often come with maturity benefits, where the policyholder receives a lump sum if they survive the policy term. LIC policies are a good option for investors who want to ensure the financial security of their families and enjoy tax benefits on their investments. LIC policies are also suitable for those seeking predictable returns instead of dealing with market fluctuations.

LIC policies offer several benefits that are centred around financial security and stability. They provide life insurance coverage, ensuring that the policyholder's family is financially protected in the event of the policyholder's death. LIC policies also often come with maturity benefits, where the policyholder receives a lump sum if they survive the policy term. These policies offer tax benefits, making them attractive for tax planning. LIC policies are also suitable for those seeking predictable returns, as the returns are fixed and not dependent on market performance.

LIC policies are a good option for investors who want the peace of mind that comes with knowing that their family will be financially secure in the event of their death. LIC policies offer guaranteed death benefits, which means that the policyholder's family will receive a payout regardless of the circumstances of the policyholder's death. This can provide much-needed financial support during a difficult time.

LIC policies are also suitable for those who want to enjoy tax benefits on their investments. The premiums paid towards LIC policies are eligible for tax deductions under Section 80C of the Income Tax Act. Additionally, the maturity benefits received from LIC policies are also tax-free under Section 10(10D) of the Income Tax Act. This can result in significant tax savings over the long term.

In summary, LIC policies offer predictable returns, financial security for your family, and tax benefits, making them a good choice for investors who want a stable and secure investment option. However, it is important to note that LIC policies may offer only modest returns compared to other investment options like mutual funds. Therefore, if you are seeking higher returns, you may need to consider other investment avenues in addition to or instead of LIC policies.

Vanguard Index Funds: Best Bets for Your Money

You may want to see also

Mutual funds for flexibility and liquidity

When deciding between investing in LIC or mutual funds, it's important to understand the differences between the two. LIC (Life Insurance Corporation of India) is a public sector life insurance provider that offers financial security and death benefits to the policyholder's family in the event of their death. LIC policies are low-risk investments with guaranteed returns and tax benefits under section 80C of the Income Tax Act. On the other hand, mutual funds are investment instruments that pool funds from multiple investors to create diversified portfolios of stocks, bonds, or other securities. Mutual funds offer the potential for higher returns through market-linked investments but come with higher risk.

If you are seeking flexibility and liquidity in your investments, mutual funds may be the better choice. Mutual funds offer a wide range of options, allowing you to diversify your investment portfolio. They also provide the benefit of professional fund management, ensuring that investment decisions are based on thorough market analysis. The variety of mutual funds available gives you the flexibility to choose funds that align with your risk tolerance and investment goals. For example, if you have a conservative investment style and want to avoid taking on too much risk, you can consider investing in debt mutual funds or equity-oriented hybrid schemes. These options offer relatively lower risk while still providing the potential for higher returns compared to LIC policies.

Another advantage of mutual funds is their liquidity. While LIC policies are long-term products with lower liquidity, mutual funds are generally easier to liquidate, providing you with quicker access to your funds if needed. This liquidity, however, may vary depending on the type of mutual fund, as certain types such as Equity Linked Savings Schemes (ELSS) and close-ended funds have restrictions on liquidation. Nonetheless, mutual funds typically offer more liquidity options than LIC policies.

When deciding between LIC and mutual funds, it's important to consider your financial goals and risk tolerance. LIC policies are ideal if you prioritise financial security for your family and prefer guaranteed returns with low risk. On the other hand, mutual funds offer flexibility, liquidity, and the potential for higher returns, making them suitable for investors seeking to create wealth over the long term. By understanding your investment objectives and risk appetite, you can make an informed decision between LIC and mutual funds to meet your financial needs.

Liquid Funds India: A Smart Investment Guide

You may want to see also

Frequently asked questions

LIC is the Life Insurance Corporation of India, a public sector life insurance provider. LIC policies are designed to protect the policyholder's family financially in the event of their death. LIC policies may also include maturity benefits.

Mutual funds are investment instruments that pool funds from multiple investors to create a portfolio of stocks, bonds, or other securities. Mutual funds have the potential to generate higher returns compared to LIC but carry a higher risk.

LIC policies offer financial security and stability by providing life insurance coverage. They offer guaranteed death benefits and may include maturity benefits. LIC policies also offer tax benefits and are suitable for those seeking a low-risk investment with predictable returns.

Mutual funds offer the potential for higher returns through market-linked investments. They provide flexibility and liquidity, allowing investors to diversify their investment portfolios. Mutual funds are suitable for investors with a higher risk tolerance seeking wealth creation over the long term.