Private equity is a form of investment that takes place outside of the public stock market, allowing investors to gain an ownership stake in private companies. It is an attractive option for high-net-worth individuals and institutional investors due to its potential for high returns. However, it is essential to remember that private equity investments are high-risk and often illiquid. Before investing, individuals must be prepared to lose all the money they put in.

| Characteristics | Values |

|---|---|

| Risk | High |

| Returns | Historically higher than other assets |

| Portfolio diversification | Helps to diversify against market and cyclical risk |

| Access | Only for institutional investors and high-net-worth individuals |

| Investment minimums | Very high, ranging from hundreds of thousands to millions of dollars |

| Investor requirements | Accredited investors with a net worth of over $1 million or an annual income of over $200,000 in the last two years |

| Investment period | Long-term, often over 10 years |

| Liquidity | Low |

| Regulation | Not registered with the SEC and not subject to public disclosure requirements |

What You'll Learn

Private equity vs public equity

Investing in a private equity fund is a high-risk endeavour and you should be prepared to lose all your money. Private equity is considered an "alternative" asset class, while public equity is one of the three main asset classes.

Who can invest?

Anyone with a brokerage account can invest in public equity, but private equity is limited to "accredited" investors—high-net-worth individuals and institutional investors.

Liquidity

Public equity is widely known and highly liquid, making it a viable option for most investors. In contrast, private equity is geared towards sophisticated investors and often requires accreditation.

Investor influence

Investors in private companies often have a say in strategy, with influence increasing alongside stake size. In public companies, investors remain passive owners and have influence only at general shareholders' meetings.

Information disclosure

Private companies are not required to disclose information to anyone. Public companies, on the other hand, are subject to disclosure obligations and must publish financial reports.

Stage of company growth

Publicly-owned companies are typically well-established, mature businesses that have achieved a size and stature appropriate for public ownership. Private companies are generally earlier in their growth stage, from those preparing for an IPO to those just starting up.

Returns

Private equity has historically outperformed public equity. Private equity firms have access to a larger pool of unknown opportunities and can invest at an earlier stage, driving up returns.

Active ownership

Private equity firms almost always take on a level of active ownership, ranging from advisory to fully restructuring and running the company. Public equity investors have marginal control and may have no influence if they choose not to exercise voting rights.

Alignment of interests

Private equity fund managers earn a percentage of the fund's profits, aligning their interests with those of investors. Public equity fund managers, however, often earn a fee regardless of the fund's performance, creating a "principal-agent problem".

Funding Your Capital One Investing Account: A Guide

You may want to see also

High-risk, high-reward

Private equity is a high-risk, high-reward form of investment. It is important to understand the risks before investing. Private equity investments are illiquid and speculative, and there is no guarantee that the companies you invest in will succeed. If something goes wrong, you are unlikely to be protected and may lose all your money.

However, private equity funds have historically resulted in higher returns than public market investments. Private equity funds have outperformed public equity by a significant margin over 5-, 10-, 15- and 20-year periods. Private equity has also exhibited returns similar to emerging market equities and higher than all other traditional asset classes.

One reason for the higher returns is that private equity firms focus on acquisitions that have been undermanaged or undervalued, presenting a one-time opportunity to increase a business's value. Once that gain has been realised, the firm sells for a maximum return.

Another reason is that private equity firms take an active role in the companies they invest in, almost always taking on a level of active ownership. They may bring in new management, sell off underperforming parts of the business, or make other changes to increase the company's value.

Private equity funds also have a strong alignment of interests with investors. The general partner of a private equity fund earns a percentage of the fund's profits, usually 20%, in the form of "carry". This ensures that the interests of the fund manager are aligned with those of the investors.

In addition, private equity can help to diversify an investment portfolio by mitigating public market risk and cyclical risk. Private equity funds have a lower correlation with public market movements, as they invest in private companies and take a long-term approach to capitalising new businesses, developing innovative business models, and restructuring distressed businesses.

For these reasons, institutional investors and wealthy individuals are often attracted to private equity investments. This includes pension funds, endowment funds, sovereign wealth funds, and family offices.

However, it is important to note that private equity funds typically have very high minimum investment requirements, ranging from a few hundred thousand to several million dollars. As a result, private equity investing is not easily accessible to the average investor.

Wellington Fund: A Vanguard Investment Guide

You may want to see also

Who can invest?

Private equity funds are an alternative investment class, and as such, they are highly illiquid and carry substantial risk. The general consensus is that private equity is only suitable for investors with a high net worth who can afford to take on additional risk and have a long-term investment horizon.

So, who can invest in private equity funds? The simple answer is accredited investors. These are individuals with a net worth exceeding $1 million, excluding their primary residence, or those with an annual income of at least $200,000 ($300,000 with a spouse) for the last two years, and an expectation of earning the same in the current year. This definition, as set out by the US Securities and Exchange Commission, is a common standard used by private equity funds to determine eligibility.

The rationale behind this requirement is that accredited investors are deemed to have sufficient financial knowledge and experience to understand the risks involved in private equity investments. They are also considered capable of absorbing potential financial losses without significant adverse effects on their lifestyle.

However, it's not just about wealth. Private equity funds often require investors to have a certain level of financial sophistication. This means that potential investors should have a good understanding of financial and investment concepts and experience in evaluating and managing investment risk. This ensures that investors can make informed decisions about their investments and are aware of the potential risks and rewards.

Additionally, some private equity funds may have specific eligibility requirements, such as a minimum investment amount, which can range from $250,000 to millions of dollars. These funds target ultra-high-net-worth individuals or institutions, like pension funds or university endowments, that can commit large sums of capital.

A Beginner's Guide to Investing in Funding Circle

You may want to see also

How to invest

Private equity is a high-risk, illiquid investment with the potential for high returns. It is not easily accessible for the average investor, with minimum investment requirements ranging from $25,000 to $25 million.

There are several ways to invest in private equity, each with its own advantages and drawbacks:

Mutual Funds and Exchange-Traded Funds (ETFs)

Mutual funds have restrictions on buying private equity directly due to SEC rules regarding illiquid securities holdings. However, some mutual funds, known as funds of funds, hold shares of many private partnerships that invest in private equities, providing greater diversification and potentially lower risk. The disadvantage is additional layers of fees and minimum investments, which can range from $100,000 to $250,000.

ETFs that track an index of publicly traded companies investing in private equities are another option. These can be purchased as individual shares on the stock exchange, eliminating minimum investment requirements. However, they also add an extra layer of management expenses.

Special Purpose Acquisition Companies (SPACs)

SPACs are publicly traded shell companies that make private-equity investments in undervalued private companies. They can be risky due to a lack of diversification and the potential for rushed investment decisions to meet deadlines.

Crowdfunding

Crowdfunding platforms allow individual investors to contribute relatively small amounts to private equity investments. While these investments can be highly risky, they offer a way to access private equity with a lower capital commitment.

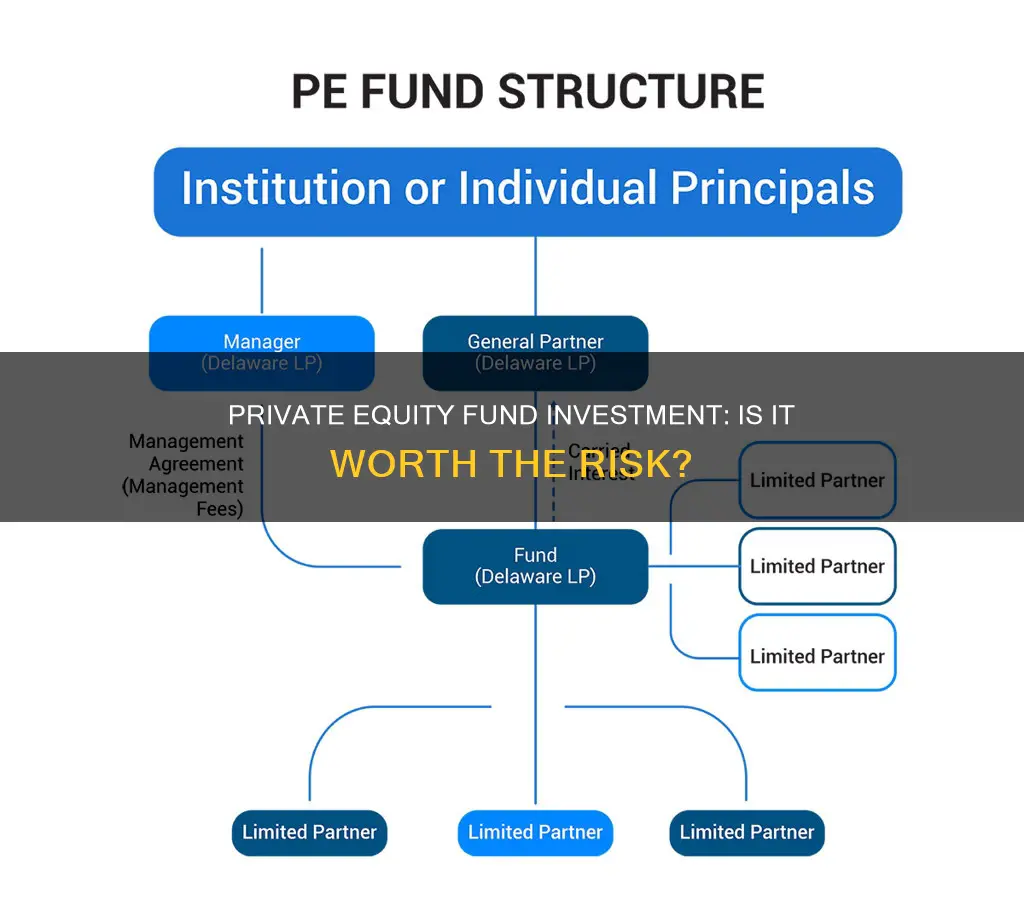

Private Equity Funds

Traditional private equity funds require investors to commit a large sum of money for the life of the fund, typically 10-12 years. The fund is managed by a general partner, who invests the pooled capital from limited partners into various private equity instruments. The general partner typically takes about 20% of the profits, with the rest distributed among limited partners based on their contribution.

Primary, Co-Investments, and Secondary Investments

Building a diversified private equity portfolio requires access to a broad array of investment opportunities. Primary investments involve investing in private equity funds managed by general partners, providing diversified exposure to various sectors. Co-investments provide exposure to a single portfolio company alongside a general partner. Secondary investments involve acquiring existing interests in a private equity fund through the secondary market, allowing for diversification into a more mature portfolio of identified assets.

Key Considerations

Before investing in private equity, it is essential to conduct thorough due diligence and understand the risks involved. Private equity investments are illiquid, and investors should be prepared to hold their investment for at least 10 years. The fees associated with private equity investments that cater to smaller investors can also reduce returns.

Additionally, investors should carefully evaluate the private equity fund's performance using metrics such as Multiple on Invested Capital (MOIC) and Internal Rate of Return (IRR).

Index Funds: Diversify Your Portfolio with Smart Investing

You may want to see also

Risks of private equity

Private equity investments are considered high-risk, and investors need to be aware of the possibility of losing all their money. There is also little protection for investors if something goes wrong. Here are some of the key risks of investing in private equity:

Funding Risk

Unlike public equity, private equity funds do not require an investor's total capital commitment at the outset. The General Partner (GP) of the fund will issue capital calls over time as they identify and acquire assets. This unpredictable timing creates a funding risk, as investors need to keep funds liquid and readily available. It could also reduce returns on that capital. Additionally, if an investor cannot meet a capital call, they may be subject to default and prevented from investing further capital in the fund.

Liquidity Risk

Private equity investments are illiquid, and investors are typically ''locked-in' for long periods, ranging from five to ten or more years. During this time, investors cannot redeem their capital, and there is a lack of an active secondary market to sell their shares. Exits from private equity investments often involve IPOs or acquisitions, which take a considerable amount of time to implement. This lack of liquidity is a significant difference from public equity funds, where investors can usually sell their shares quickly on an exchange.

Market Risk

Private equity firms invest in small companies with high growth potential, often early-stage ventures or distressed businesses. Many of these companies are unproven, and there is a high risk of failure. Only a small percentage of these companies may provide significant returns, and investors could face substantial losses if the management team is ineffective, a new product launch fails, or a new technology becomes obsolete.

Capital Risk

Capital risk refers to the possibility of a realised loss of the original capital at the end of a fund's life. It is closely related to market risk. The failure of underlying companies within the private equity portfolio and unfavourable equity prices that make exits less attractive can impact capital risk. The quality of the fund manager and their ability to select companies with good growth prospects and create value are critical factors in mitigating capital risk.

Operational Risk

Operational risk arises from inadequate processes and systems within the organisation. It is a key consideration for investors, regardless of the asset classes that private equity funds invest in.

A Beginner's Guide to Mutual Fund Investing

You may want to see also

Frequently asked questions

Private equity is a form of investment that takes place outside of the public stock market. Investors gain an ownership stake in private companies.

Traditional private equity funds have very high minimum investment requirements, ranging from a few hundred thousand to several million dollars. As such, most private equity investing is reserved for institutional investors (e.g. pension funds) or high-net-worth individuals.

Private equity is a high-risk investment. There is no guarantee that the companies you invest in will succeed, and there are few protections if they fail. You should be prepared to lose all of your money.

Private equity funds historically have resulted in higher returns than public market investments. Private equity firms aim to add value to the companies they invest in, for example, by bringing in a new management team or cutting costs.