The decision to put cash in a house mortgage or invest depends on an individual's financial situation, the current market and their personal preferences. Paying cash for a house can speed up the buying process, lower your long-term costs and give you instant 100% home equity. Getting a mortgage allows you to save that cash for other financial goals, offers tax deductions and can enhance your credit score.

Paying all cash for a property means you won’t have a mortgage loan and the accompanying interest payments. However, this also means you can’t claim the mortgage interest deduction to lower your tax bill. Getting a mortgage can reduce what you owe since mortgage interest payments are tax-deductible. This can be very important for high earners who typically itemize and want to maximize their deductions.

If you have the means to pay cash without negatively impacting your financial health, it could be an ideal option. A cash offer could also make financial sense if you’re looking to buy an investment property in need of substantial repairs but can’t get approved for financing.

That said, if you want to use the funds for other financial goals or invest them elsewhere, a mortgage could be a better fit. Taking out a home loan also means you can capitalize on tax benefits and build your credit over time as you make monthly payments.

| Characteristics | Values |

|---|---|

| Advantages of using cash to buy a home | No monthly payments or interest fees |

| Own the property outright | |

| Faster closing | |

| Cheaper closing | |

| No lender-related closing costs | |

| No mortgage approval needed | |

| More appealing to sellers | |

| Advantages of getting a mortgage | Save cash for other financial goals |

| Tax benefits | |

| Enhance credit score | |

| Other considerations | State of the housing market |

| Long-term cost of a mortgage | |

| Personal financial situation | |

| Peace of mind |

What You'll Learn

- Paying cash for a house can be faster and simpler than getting a mortgage

- A cash offer on a house is often more appealing to sellers

- Paying cash for a house means you avoid interest fees

- Getting a mortgage allows you to save cash for other financial goals

- Getting a mortgage can help you reduce your tax bill

Paying cash for a house can be faster and simpler than getting a mortgage

No loan approval needed

When you pay in cash, you don't need to go through the process of getting a loan approved by a lender. This can save you time and streamline thesection home-buying process.

No lender requirements to meet

Cash purchases don't have to meet a lender's requirements, which can include providing extensive financial documentation and undergoing a credit check.

Faster closing

With a cash purchase, there's no need to wait for the lender to process and approve the loan, which can take weeks or even months. It's possible to close on a home in as little as a week or two when paying in cash.

No interest or mortgage payments

Paying in cash means you'll avoid paying interest on a loan, which can add up to significant savings over time. You'll also eliminate the need for monthly mortgage payments, giving you more financial flexibility.

Lower closing costs

When you pay in cash, you won't have to deal with lender-related closing costs, such as origination fees, application fees, and loan origination fees. This can result in thousands of dollars in savings.

More attractive to sellers

Sellers often prefer cash offers because they You may want to see also You may want to see also Paying cash for a house is a significant financial decision that can have a substantial impact on your financial situation. One of the key advantages of paying cash for a house is that you can avoid paying interest fees on a mortgage loan. Here are some key points to consider regarding the benefit of avoiding interest fees: However, it is important to consider the potential downsides of paying cash for a house, such as tying up a large amount of money in a single asset, reducing your liquidity, and missing out on potential tax benefits associated with mortgage interest deductions. Carefully weigh the advantages and disadvantages based on your financial situation, risk tolerance, and long-term goals before making a decision. You may want to see also Before you buy a house in cash, consider various factors, including the state of the local real estate market and the long-term cost of a mortgage. If you're thinking about making a cash offer on a house, you're not alone. All-cash deals made up 28% of home purchases as of March 2024, according to the National Association of Realtors (NAR). If you get a mortgage, you can save that cash for other financial goals, such as investing in the stock market or other asset classes, which may offer higher returns than the mortgage rate a lender will offer you. You can also use the cash for other financial goals, such as funding your children's education or boosting your retirement savings. Another advantage of getting a mortgage is the tax benefits. If you normally itemize deductions on your tax return, getting a mortgage can reduce what you owe since mortgage interest payments are tax-deductible. This can be very important for high earners who typically itemize and want to maximize their deductions. Finally, getting a mortgage can help improve your credit score. Making regular payments on your mortgage will make you look great in the eyes of the major credit reporting agencies, and managing your mortgage debt over time can help boost your credit score. You may want to see also The interest you pay on your mortgage can be deducted from your taxable income, lowering the amount of tax you owe. This is known as the mortgage interest deduction. The mortgage interest deduction is a tax incentive for homeowners. It allows them to subtract the interest charged by their home loan from their taxable income. This reduces their tax bill for the year. To claim the mortgage interest deduction, you must itemize your deductions on a Schedule A form rather than taking the standard deduction. You will need to keep records of the interest you have paid, which your lender should provide in the form of a 1098. The mortgage interest deduction is subject to limits, which have changed over time. For mortgages taken out since December 16, 2017, you can deduct the interest on the first $750,000 if you are single or married filing jointly, or $375,000 if you are married and filing separately. The following expenses do not qualify for the mortgage interest deduction: You may want to see also Paying cash for a house can speed up the buying process, lower your long-term costs and give you instant 100% home equity. Getting a mortgage allows you to save that cash for other financial goals, offers tax deductions and can enhance your credit score. Take stock of your current financial situation, your financial goals, alternative investments, and do your due diligence on the house. Ask yourself what's the state of the housing market, how much more will you pay with a mortgage, and how much money will you have left if you pay in cash?Investing vs. Saving: Where Should Your Cash Go?

A cash offer on a house is often more appealing to sellers

Investing Cash During Inflation: Strategies for Success

Paying cash for a house means you avoid interest fees

Is Your Cash App Investing Insured? Know the Facts

Getting a mortgage allows you to save cash for other financial goals

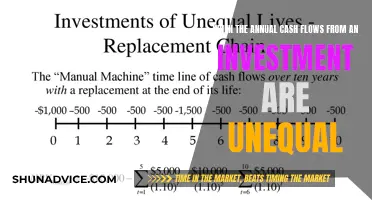

Understanding Cash Flow: Investing Activities Analysis

Getting a mortgage can help you reduce your tax bill

Buyers' Strategies to Minimize Cash Outlay During Acquisitions

Frequently asked questions