The S&P 500 is a stock market index that tracks the performance of 500 of the largest U.S. public companies by market capitalization. It is one of the most popular indices for investors to gain exposure to large-cap U.S. stocks. The index includes well-known companies such as Apple, Amazon, Microsoft, and Johnson & Johnson.

There are two main ways to invest in the S&P 500: through an index fund or an exchange-traded fund (ETF). Index funds are typically mutual funds that aim to replicate the performance of the S&P 500 index by investing in all or most of the stocks included in the index. ETFs, on the other hand, trade on an exchange like stocks and can be bought and sold throughout the day. Both options offer low costs and instant diversification for investors.

When deciding whether to use an investor or just invest in the index yourself, it is essential to consider the benefits and drawbacks of each option. Index funds and ETFs provide broad exposure to the S&P 500, instant diversification, and low fees. However, the S&P 500 is dominated by large-cap companies, and investing in the index may not provide exposure to small-cap and mid-cap stocks with higher growth potential. Additionally, the S&P 500 only includes U.S. companies, limiting international diversification.

Ultimately, the decision to use an investor or invest in the index depends on your investment goals, risk tolerance, and preferences for active or passive investing. It may be worth consulting a financial advisor to determine the best approach for your specific situation.

| Characteristics | Values |

|---|---|

| Number of companies | 500 large public U.S. companies |

| Investment options | Index funds, ETFs, individual stocks |

| Index fund fees | Expense ratio, investment minimum, account minimum |

| ETF fees | Expense ratio, share price, trading costs |

| Index fund advantages | Exposure to dynamic companies, consistent long-term returns, no intricate analysis required, can serve as a core holding |

| Index fund disadvantages | Dominated by large-cap companies, risks inherent in equity investing, only includes U.S. companies |

| Best S&P 500 ETFs | State Street SPDR S&P 500 ETF (SPY), Vanguard S&P 500 ETF (VOO) |

| Average annual return | ~10% |

What You'll Learn

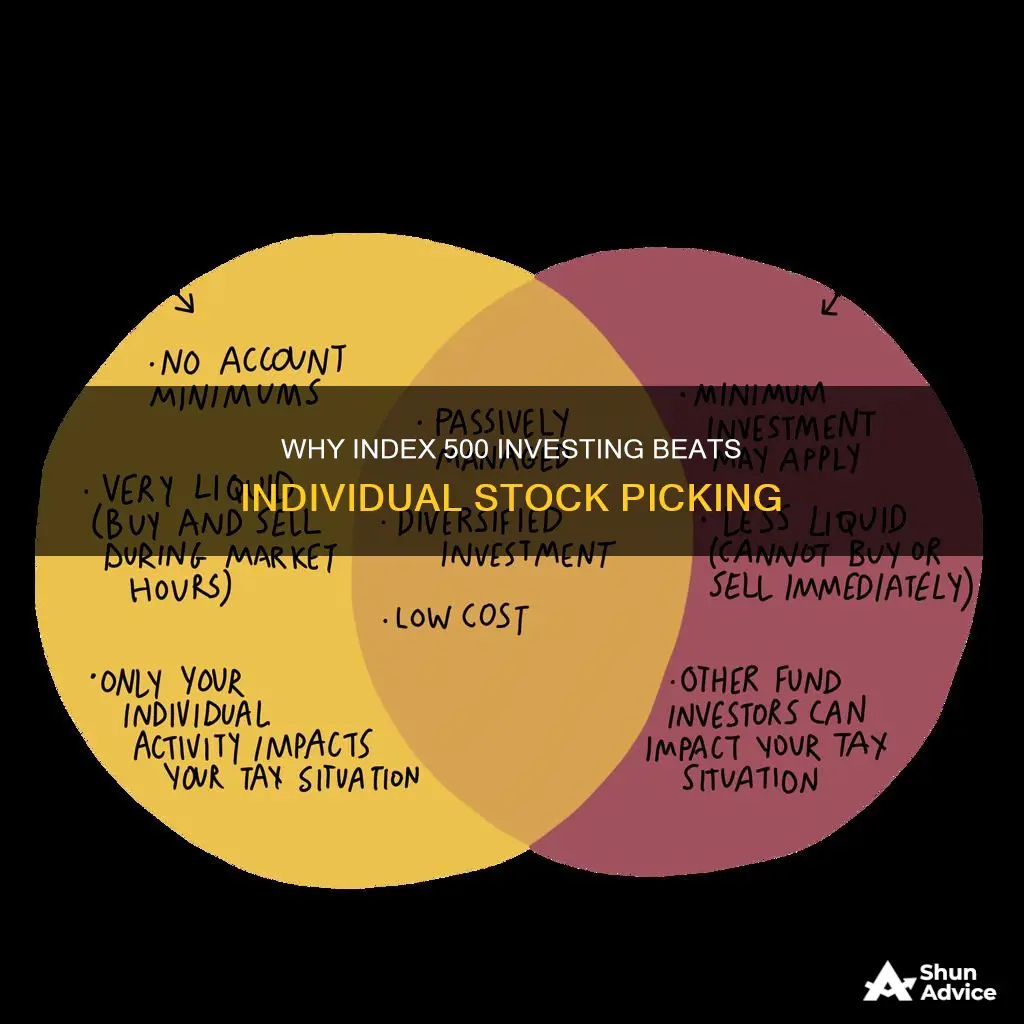

Index funds vs. individual stocks

Index funds and individual stocks are two very different investment strategies. Here is a detailed comparison of the two:

Index Funds

Index funds are a type of investment fund that tracks the performance of a specific stock market index, such as the S&P 500. Index funds are passively managed, meaning that the fund's managers simply buy and sell stocks to keep the fund's asset allocation in line with the chosen index. This means that index funds have very low expense ratios, as there is no intensive research or active trading involved.

The S&P 500, for example, tracks the performance of 500 of the largest US public companies by market capitalization, giving investors broad exposure to a diverse range of stocks. Index funds that track the S&P 500 typically own most or all of the stocks included in the index, allowing investors to mimic the performance of the index as closely as possible.

Some advantages of investing in index funds, particularly those that track the S&P 500, include:

- Broad exposure to a diverse range of stocks, providing excellent diversification.

- Very low costs due to passive management.

- Superior long-term performance compared to actively managed funds.

- No need for intricate analysis or stock-picking.

- Can serve as a core holding in an investment portfolio due to liquidity and tight bid-ask spreads.

However, there are also some disadvantages to consider:

- The S&P 500 is dominated by large-cap companies, with limited exposure to small-cap and mid-cap stocks that may have higher growth potential.

- The index only includes US companies, providing no international exposure.

- Inherent risks of equity investing, such as volatility and downside risk, which may be challenging for newer or risk-averse investors.

Individual Stocks

Investing in individual stocks involves directly purchasing shares of a single company, rather than a basket of stocks like an index fund. This approach can be more exciting and engaging for investors who are interested in specific companies or sectors. It can also provide the potential for higher returns if the chosen stocks perform well.

Some advantages of investing in individual stocks include:

- The potential for higher returns if the chosen stocks outperform the market.

- The ability to target specific companies or sectors that align with an investor's interests or expertise.

However, there are also significant disadvantages to consider:

- Higher risk: Picking individual stocks is generally much riskier than investing in an index fund, as the performance of a single stock can be difficult to predict and more susceptible to company-specific issues.

- Time and research-intensive: Successfully picking individual stocks requires a significant amount of time and effort to research and analyze companies and their prospects.

- Competition with professional investors: When picking individual stocks, individual investors are competing with professional investors and institutions that have far more resources and expertise.

- Lack of diversification: Investing in individual stocks may lead to a lack of diversification, as the performance of a single stock or sector can be more volatile and unpredictable.

Both index funds and individual stocks have their advantages and disadvantages. Index funds offer broad diversification, low costs, and superior long-term performance, while individual stocks offer the potential for higher returns and the ability to target specific companies. Ultimately, the decision between the two depends on an investor's risk tolerance, time horizon, and investment goals. Many investors choose a combination of both approaches, allocating a certain percentage of their portfolio to individual stocks while maintaining a core holding of index funds.

Factor Investing with ETFs: Strategies and Benefits

You may want to see also

Advantages of investing in the S&P 500

Investing in the S&P 500 has several advantages. Here are some key benefits:

Exposure to Dynamic Companies

The S&P 500 includes some of the world's most dynamic and successful companies, such as Apple, Amazon, Microsoft, and Johnson & Johnson. Investing in the index provides exposure to these industry leaders, allowing investors to benefit from their growth and performance.

Consistent Long-Term Returns

Over time, the S&P 500 has consistently performed well, providing positive returns for investors. While individual years may vary, the index has a strong track record of delivering solid returns over the long term.

Simplified Investment Strategy

Investing in the S&P 500 through exchange-traded funds (ETFs) or index funds simplifies the investment process. Investors do not need to conduct intricate analysis or spend time picking individual stocks. The index funds and ETFs are designed to replicate the performance of the S&P 500, making it easier for investors to gain exposure to a diverse range of companies.

Core Holding for Portfolios

S&P 500 index funds and ETFs are highly liquid and trade with tight bid-ask spreads. This liquidity makes them ideal as core holdings for most investment portfolios. They provide a solid foundation for investors to build upon with other investment strategies.

Broad Market Representation

The S&P 500 is considered the leading barometer for judging the performance of the U.S. stock market. It tracks 500 large U.S. companies across various sectors, providing a broad view of the economic health of the country. This diversity helps investors mitigate the risk associated with investing in individual stocks.

Discount Cash Flow Analysis: Investment Bankers' Go-To Tool

You may want to see also

Disadvantages of investing in the S&P 500

Investing in the S&P 500 has its disadvantages. Here are some key drawbacks to consider:

Market Volatility

The S&P 500 is susceptible to market volatility and is not immune to downturns. This means that periods of market decline can lead to significant drops in the index value. Therefore, investing in the S&P 500 requires a long-term perspective and the ability to weather short-term fluctuations.

Lack of Individual Stock Selection

Investing in the S&P 500 means giving up control over individual stock choices. While this provides diversification, it may also result in missing out on potential gains from specific stocks that outperform the broader market. Investors seeking more control and the potential for higher returns may prefer strategies that include individual stock selection.

Concentration in Large-Cap and U.S. Stocks

The S&P 500 is heavily concentrated in large-cap companies, with its 10 largest constituents making up about one-third of the index. This limits exposure to small-cap and mid-cap stocks, which may have higher growth potential. Additionally, the index only includes U.S.-based companies, potentially limiting international diversification.

Inclusion of Underperforming Stocks

While the S&P 500 committee periodically reviews and adjusts the index constituents, there may be times when underperforming stocks remain in the index for extended periods. This can impact the overall performance of the index during those times.

Inherent Risks of Equity Investing

The S&P 500, like any equity investment, carries inherent risks such as volatility and downside risk. Newer investors, in particular, may find it challenging to tolerate the volatility associated with equity investing.

Cashing Out on Robinhood: A Guide to Withdrawing Your Investments

You may want to see also

How to invest in the S&P 500

The S&P 500 is a stock market index that tracks the performance of the 500 largest U.S. public companies by market capitalisation. It is considered the best single gauge of large-cap U.S. equities and represents nearly 85% of the total U.S. stock market capitalisation.

The best way to invest in the S&P 500 is to buy exchange-traded funds (ETFs) or index funds that track the index. Here are the steps to investing in the S&P 500:

Understand the S&P 500 Index

The S&P 500 Index includes 500 leading U.S. companies, although the number may fluctuate. The index is based on market capitalisation, or the total market value of a company's outstanding shares. The index also considers other factors such as sector allocation and liquidity. It is important to understand the composition and performance of the index before investing.

Choose an Investment Vehicle: ETFs or Index Funds

Both ETFs and index funds offer a way to invest in the S&P 500 by tracking the index. ETFs are exchange-traded funds that trade like stocks, with values that fluctuate throughout the day. Index funds, on the other hand, trade only once a day at the end of the trading day. ETFs are generally considered more liquid than index funds, but both offer low costs and broad diversification.

Compare Fees and Performance

When selecting an ETF or index fund, it is important to consider the expense ratio, which is the annual fee charged by the fund manager. Look for funds with low expense ratios, as these fees can eat into your investment returns. You should also consider the fund's performance over time, including its dividend yield and how it has weathered different market cycles.

Open a Brokerage Account

To purchase an S&P 500 ETF or index fund, you will need to open a brokerage account if you don't already have one. You can use a taxable brokerage account or take advantage of the tax benefits offered by retirement accounts such as a 401(k) or IRA.

Evaluate Your Investment Amount

Consider the minimum investment required for the ETF or index fund you have selected. Some funds have no minimum, while others may have a minimum investment amount. You should also be aware of any loads or commissions charged by the fund, as these can impact your overall returns.

Monitor and Diversify Your Portfolio

Once you have purchased your S&P 500 investment, it is important to regularly review its performance and make adjustments as needed. Remember that the S&P 500 consists only of large-cap U.S. stocks, so you may need to diversify your portfolio by investing in other areas such as small-cap and mid-cap stocks, international stocks, and bonds.

Strategies for Investing Surplus Corporate Cash: A Comprehensive Guide

You may want to see also

S&P 500 vs. other indexes

The S&P 500 is a stock market index that tracks the performance of 500 of the largest U.S. public companies by market capitalisation. It is the leading barometer for judging the performance of the U.S. stock market and accounts for roughly 80% of the overall value of the U.S. stock market.

The S&P 500 is considered the best overall benchmark of how the U.S. stock market is doing. However, there are several other indexes that can be useful for investors, including the Dow Jones Industrial Average, the Nasdaq Composite Index, and the Russell 2000 (a small-cap index).

S&P 500 vs. Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA) is a price-weighted index, meaning that companies with the highest stock prices have the most influence on the index regardless of their valuations. The DJIA only lists 30 companies and excludes some of the largest stocks in the market, such as Amazon, Alphabet, and Berkshire Hathaway. In contrast, the S&P 500 is a market-capitalization-weighted index, giving a higher percentage allocation to companies with the largest market capitalisations. Due to its broader scope and different weighting structure, the S&P 500 is considered a more representative benchmark of the U.S. equity markets.

S&P 500 vs. Nasdaq Composite Index

The Nasdaq Composite Index includes stocks that are listed exclusively on the Nasdaq market, whereas the S&P 500 is a mix of both Nasdaq and New York Stock Exchange (NYSE) stocks. The Nasdaq has a higher proportion of technology stocks, so it is considered a more tech-heavy index. The Nasdaq Composite also contains stocks across a wider range of market capitalisations, as it includes all qualified stocks listed on the Nasdaq exchange.

S&P 500 vs. Russell 2000

The Russell 2000 is an index of small-cap stocks and is considered the best benchmark of how small-cap U.S. stocks are performing. Collectively, the Russell 2000 and the Russell 1000 (an index of large-cap stocks) are known as the Russell 3000, which is a broad stock market benchmark index. The Russell 3000 provides a broader range of stocks than the S&P 500, which focuses on large-cap stocks.

In summary, while the S&P 500 is widely regarded as the leading indicator of the overall U.S. stock market performance, other indexes such as the Dow Jones Industrial Average, the Nasdaq Composite Index, and the Russell 2000 can provide additional insights into specific segments of the market, such as large-cap or small-cap stocks, or technology-focused exchanges.

Cash Investment Options: Exploring Safe and Smart Strategies

You may want to see also

Frequently asked questions

The S&P 500 is a stock market index that tracks the performance of 500 of the largest U.S. public companies by market capitalization. It covers nearly 80-85% of the total capitalization of the U.S. stock market and is considered the leading barometer for judging the performance of the U.S. stock market.

Investing in the S&P 500 through index funds or exchange-traded funds (ETFs) offers instant diversification and is generally considered less risky than purchasing individual stocks directly. It provides exposure to some of the world's most dynamic companies, has consistently performed well over the long term, and does not require intricate analysis or stock-picking. S&P 500 funds are also highly liquid and ideal as core holdings for investment portfolios.

You can invest in the S&P 500 by purchasing individual stocks of companies within the index or by buying an S&P 500 index fund or ETF. Index funds and ETFs aim to replicate the returns of the S&P 500 by tracking it. You can purchase these funds through a taxable brokerage account or a tax-advantaged retirement account like a 401(k) or IRA.