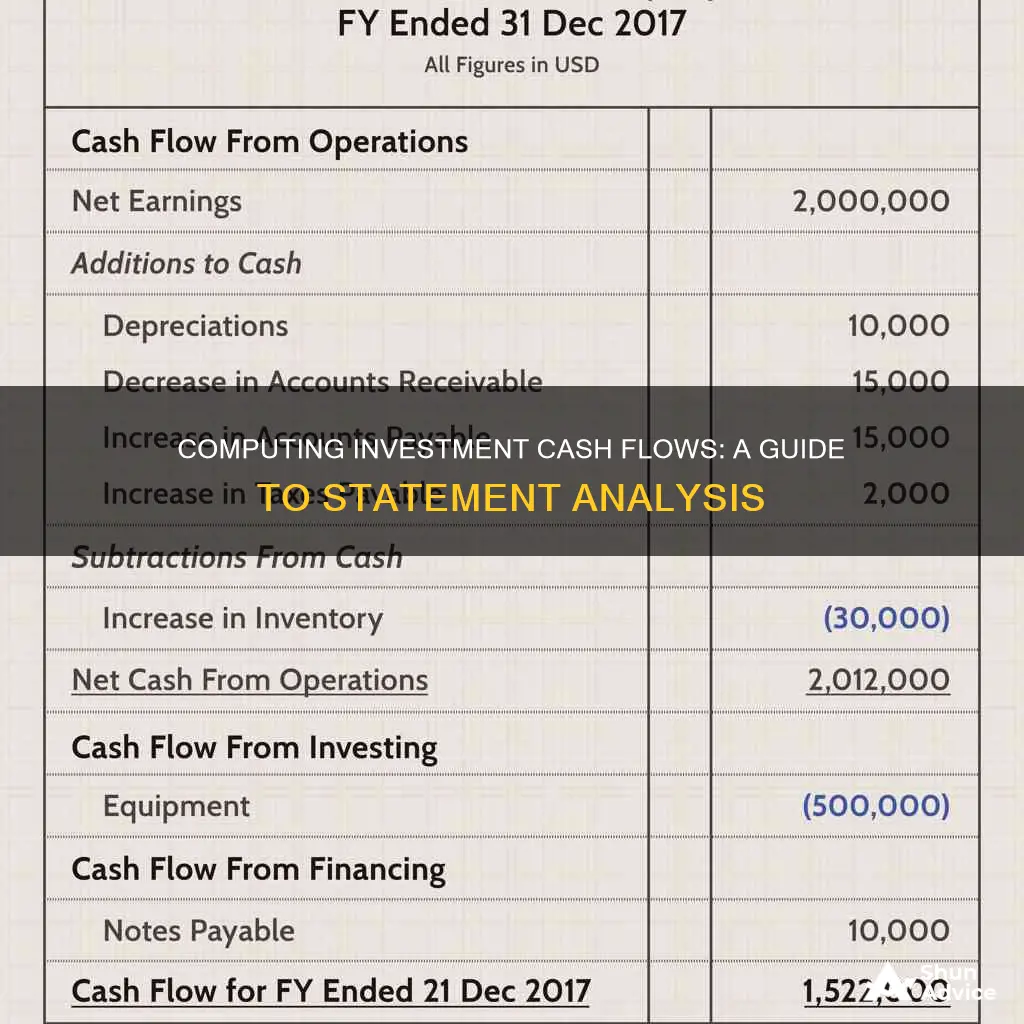

The cash flow statement is one of the three fundamental financial statements used by business leaders to understand their company's value and overall health. It provides a detailed breakdown of how cash moves into and out of a business during a specific period. The statement is divided into three sections: cash flow from operations, cash flow from investing, and cash flow from financing. This article will focus on how to compute the investment portion of the statement of cash flows.

| Characteristics | Values |

|---|---|

| Purpose | To provide a detailed picture of what happened to a business's cash during an accounting period |

| Types of Cash Flow | Operating Cash Flow, Investing Cash Flow, Financing Cash Flow |

| Sections of the Cash Flow Statement | Cash Flow from Operating Activities, Cash Flow from Investing Activities, Cash Flow from Financing Activities |

| Calculation Methods | Direct Method, Indirect Method |

| Cash Flow Formula | Net Cash Flow = Total Cash Inflows – Total Cash Outflows |

What You'll Learn

Calculating cash flow from operating activities

Direct Method

The direct method is a straightforward process that involves taking all the cash inflows from operations and subtracting the cash outflows. This method lists all the transactions that resulted in cash being paid or received during the reporting period. This includes cash received from customers, interest received, and cash paid to suppliers, employees, and for expenses such as rent and utilities.

Indirect Method

The indirect method is a more common approach, where the net income from the income statement is adjusted to "undo" the impact of accruals made during the reporting period. This method starts by taking the net income figure and making adjustments for items that affect net income but do not involve actual cash transactions. Some common adjustments include:

- Depreciation and amortisation: Adding back depreciation and amortisation charges as they are non-cash items.

- Changes in working capital: Taking into account changes in current assets and current liabilities, such as increases or decreases in inventory, accounts receivable, and accounts payable.

- Non-operating gains and losses: Considering gains or losses from the sale of non-current assets.

Example Calculation

A company wants to calculate its cash flow from operating activities for a given month. They gather their receipts and find that they earned $20,000 from customer payments. Their expenses for the month include $5,000 in wages, $1,500 in supplier payments, and $500 in utilities.

Calculation:

Net cash flow from operating activities = Cash inflows - Cash outflows

= $20,000 (customer payments) - ($5,000 + $1,500 + $500)

= $20,000 - $7,000

= $13,000

So, the net cash flow from operating activities for the month is $13,000.

Understanding Cash Flow: Investing Activities Explained

You may want to see also

Calculating cash flow from investing activities

The cash flow statement is one of the three fundamental financial statements used by financial leaders to understand a company's value, health, and overall financial situation. It is a financial report that details how cash entered and left a business during a reporting period.

The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. This answer will focus on calculating the cash flow from investing activities.

The "Cash Flow from Investing Activities" section of the cash flow statement details the amount of cash used or generated from investment-related activities in a specific period. It includes purchases and sales of long-term assets, such as property, facilities, equipment, and marketable securities. It also includes acquisitions or sales of other businesses.

To calculate the cash flow from investing activities, you need to identify and analyze the cash transactions related to these investments. Here are the steps to calculate it:

- Identify Cash Transactions for Investments: List all the cash transactions related to investments during the reporting period. This includes cash spent on purchasing fixed assets, cash received from selling assets, and cash spent on or received from investing in securities or other businesses.

- Calculate Net Cash Flow from Investing Activities:

- Add up all the cash inflows from investments (cash received from sales or proceeds).

- Add up all the cash outflows from investments (cash spent on purchases).

- Subtract the total cash outflows from the total cash inflows to get your net cash flow from investing activities.

> Cash Flow from Investing Activities = (Purchase)/Sale of Long-Term Assets (Capex) + (Purchase)/Sale of Other Businesses (M&A) + (Purchase)/Sale of Marketable Securities

Example:

Let's say a company, XYZ, had the following transactions for the year ending 20X7:

- Purchased a crane for $20,000

- Sold a manufacturing machine for $30,000

- Bought $5,000 worth of marketable securities

- Sold marketable securities for $25,000

The net cash flow from investing activities would be calculated as follows:

- Cash Inflows: $30,000 (sale of manufacturing machine) + $25,000 (sale of marketable securities) = $55,000

- Cash Outflows: $20,000 (purchase of crane) + $5,000 (purchase of marketable securities) = $25,000

- Net Cash Flow from Investing Activities: $55,000 (cash inflows) - $25,000 (cash outflows) = $30,000

So, for the given period, the company's net cash flow from investing activities is $30,000.

Important Notes:

- A positive cash flow in this section indicates that the company is divesting, while a negative number suggests heavy investment in long-term assets to generate future revenue growth.

- It's important to note that debt, equity, interest payments, dividends, and regular business operation expenses are not included in this section.

Understanding Cash Flow: Investing Activities Analysis

You may want to see also

Calculating cash flow from financing activities

The cash flow statement is one of the three fundamental financial statements used by business leaders, alongside the income statement and balance sheet. It provides a detailed picture of how cash entered and left a business during a reporting period.

The third section of the cash flow statement focuses on cash inflows and outflows related to financing activities. This includes cash flows from both debt and equity financing, such as raising cash and paying back debts to investors and creditors. Dividend payments are also included in this section.

The formula for calculating cash flow from financing activities is:

> Cash flow from financing activities = net debt + net equity + net capital leases - dividend payments

Net debt, net equity, and capital leases refer to the amount the company has repurchased minus the amount it has issued. Dividend payments only refer to the amount issued, as companies typically do not repurchase dividend payments.

To calculate cash flow from financing activities, the following steps can be taken:

- Determine issuances of equity: Equity is a percentage of ownership in an organization that allows owners to profit from business growth and influence operations. Organizations often issue equity to investors to raise capital.

- Calculate repurchases of equity: Repurchases of equity may occur when a business with investors plans to regain a majority percentage of ownership.

- Determine issuances of debt: Issuance of debt is money borrowed from a financial institution or private party, with a plan to repay.

- Calculate repayments of debt: Repayments of debt may occur when businesses no longer need capital infusions or when loan terms expire.

- Calculate capital lease issuances: Capital leases give temporary ownership of an asset to the purchaser, with the option to buy ownership back at a discounted price at the end of the lease.

- Calculate capital lease repurchases: Organizations may repurchase capital leases to claim depreciation of an asset, reducing taxable income.

- Subtract issuances from repurchases: To calculate net amounts of equity, debt, and capital leases, subtract issuances from repurchases.

- Determine dividend payments: Dividend payments are distributed to shareholders at regular intervals, allowing them to profit without selling stock.

- Plug values into the formula: Add net totals from equity, debt, and capital leases, then subtract total dividend payments to find the net total cash flow from financing activities.

Interpreting the Results

A positive cash flow from financing activities indicates that a business has engaged in more new debt or equity financing activities, bringing cash into the business. This can be beneficial for cash on hand, but it may also signal that the company's operating activities are not particularly effective.

On the other hand, a negative cash flow from financing activities might demonstrate that the business is servicing debt and could indicate that the organization is using profitability from operating activities to pay down existing debt or make dividend payments to investors.

Cash or Invest: Where Should Your Money Go?

You may want to see also

Determining the starting balance

The first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period. This starting cash balance is crucial when using the indirect method of calculating cash flow from operating activities, but it is not required when using the direct method. The value can be found on the income statement of the same accounting period.

The starting balance is the amount of cash available at the start of the period you have chosen for your cash flow statement. It is the beginning of the reporting period, which could be monthly, quarterly, or annually. This starting cash balance is also referred to as the opening cash balance, and it is derived from the previous year's closing cash balance, found on the previous year's cash flow statement and balance sheet.

The cash flow statement is one of the three fundamental financial statements used by financial leaders, alongside the income statement and balance sheet. It provides a detailed picture of the cash flow generated and spent during a specific period, acting as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business.

The cash flow statement is particularly important for management, analysts, and investors to review, as it provides insights into the company's financial health and operational efficiency. It helps answer vital business questions, such as whether the company is generating enough cash from its core operations to sustain itself, and whether the financial strategy is effective in the long term.

CDs: Cash or Investment?

You may want to see also

Determining the ending balance

The ending balance of a cash flow statement is the final step in the process of creating a cash flow statement. It is calculated by adding the net cash flows from operating, investing, and financing activities to determine the overall change in cash and cash equivalents for the period. This value, which represents the total amount of cash gained or lost during the reporting period, is then added to the beginning cash balance to arrive at the ending cash balance. A positive net cash flow indicates that a company had more cash flowing in than out, while a negative net cash flow indicates the opposite.

For example, consider a company with a starting cash balance of $10.7 billion. During the reporting period, the company generated $53.7 billion from operating activities, spent $33.8 billion on investing activities, and spent $16.3 billion on financing activities. The net cash flow for the period would be $3.5 billion ($53.7 billion - $33.8 billion - $16.3 billion), indicating a positive cash flow. The ending cash balance would then be calculated as $14.3 billion ($10.7 billion + $3.5 billion).

The ending cash balance is a critical figure in financial analysis, as it provides insights into the company's liquidity and operational efficiency. It helps creditors and investors assess the company's ability to fund its operations, pay down debts, and make informed decisions about their investments.

It is important to note that the ending cash balance should match the cash balance reported on the company's balance sheet to ensure accurate financial reporting and analysis.

Corporations' Cash Investment Strategies: Unlocking Business Growth

You may want to see also