Discounted Cash Flow (DCF) analysis is a popular valuation method used by investment bankers to determine whether a potential merger or acquisition is worth pursuing. It is a type of financial model that calculates the present value of future cash flows, allowing bankers to assess the potential profitability of an investment. DCF analysis is based on the concept that money in the future is worth less than money today due to its earning potential and the possibility of changing interest rates. By using DCF, investment bankers can make informed decisions about mergers and acquisitions, ensuring that the expected future cash flows justify the investment cost.

What You'll Learn

- DCF analysis is used to determine if a merger or acquisition is worth it

- DCF analysis can be used to make budget decisions and project a company's value

- DCF analysis is a core skill for investment bankers

- DCF analysis is used to determine if an investment is worthwhile in the long run

- DCF analysis is used to evaluate acquisition targets

DCF analysis is used to determine if a merger or acquisition is worth it

Discounted Cash Flow (DCF) analysis is a popular capital budgeting methodology used to determine the value of an investment. It is based on the notion that money in the present is worth more than money in the future due to its earning potential and the possibility of fluctuating interest rates.

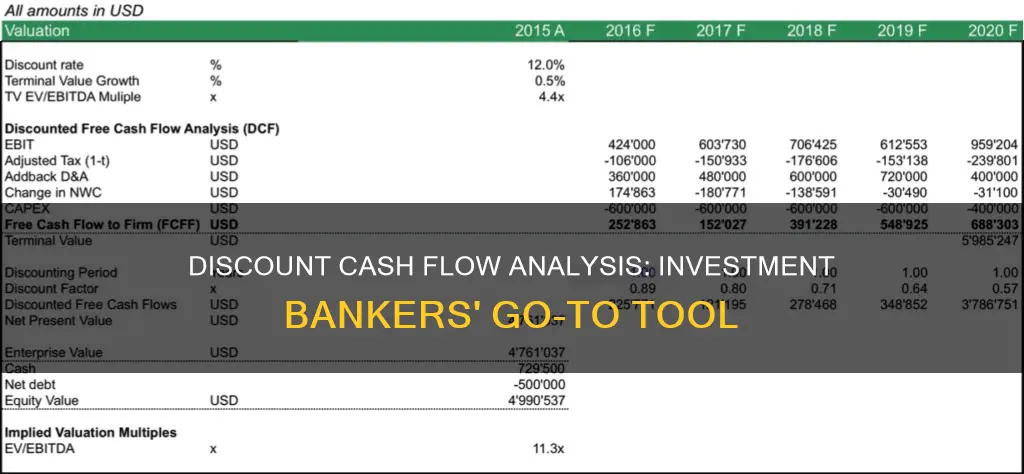

DCF analysis is used by investment bankers to determine if a potential merger or acquisition is worth pursuing. This involves several steps:

Future Cash Flows

First, the future cash flows that can be generated from the investment are estimated. These cash flows include revenue, operating expenses, and taxes, as well as capital expenditures. The returns on the investment are estimated based on the sector, value chain, market dynamics, and other factors that might influence the business.

Discount Rate

The discount rate, also known as the required rate of return or cost of capital, is then applied. This rate represents the risk of losing the money invested and is influenced by factors such as the industry's beta, market conditions, and risk level.

Present Value

The discount rate is used to convert all future cash benefits into their present value, providing an estimation of the intrinsic value of the investment. This is calculated by determining the net present value (NPV) of the investment.

Sum the Present Values

The present values of the future cash flows are summed up to determine the total present value of the investment.

Terminal Value

Depending on the situation, the terminal value of an investment may be considered. This represents the value of the investment at the end of the given time frame and can be calculated using methods such as the Gordon Growth Model or the Exit Multiple Method.

Calculate Net Present Value (NPV)

Finally, the NPV is calculated by deducting the initial investment or cost from the total present value of the future cash flows. A positive NPV indicates that the investment is expected to generate returns greater than the required rate of return, making it an attractive opportunity.

DCF analysis allows investment bankers to make informed decisions about potential mergers and acquisitions by quantifying the value of an investment and comparing it to the cost. It provides a structured process for estimating the value of an asset and is a valuable tool for assessing investment opportunities and financial planning.

General Partners: Cash Investment Strategies and Decisions

You may want to see also

DCF analysis can be used to make budget decisions and project a company's value

Discounted Cash Flow (DCF) analysis is a popular capital budgeting methodology that determines the value of an investment based on its future cash flows. DCF analysis is used by investment bankers, corporate finance professionals, and business owners to make informed decisions about potential investments, mergers, and acquisitions.

DCF analysis can be particularly useful for budget decisions and projecting a company's value. Here's how:

Budget Decisions

DCF analysis helps evaluate the profitability of a project or investment by comparing its discounted cash flows to the initial investment cost. If the DCF is higher than the current cost, the project or investment is considered profitable. This analysis allows business owners and managers to make capital budgeting decisions and determine if a project aligns with their budget constraints.

Projecting a Company's Value

DCF analysis values a company by forecasting its future cash flows and discounting them to arrive at a present value. This present value represents the amount investors should be willing to pay for the company. By comparing the company's market value with its intrinsic value, analysts can assess whether the company is overvalued or undervalued.

DCF analysis is based on the concept of time value of money, which assumes that money in the future is worth less than money today due to its earning potential and the uncertainty of interest rates. By discounting future cash flows to their present value, DCF analysis provides a more accurate representation of an investment's worth.

To perform DCF analysis, analysts must estimate future cash flows, determine an appropriate discount rate, and calculate the present value of future cash flows. This process involves financial modelling and a thorough understanding of the company's financial statements and market metrics.

In conclusion, DCF analysis is a valuable tool for budget decisions and projecting a company's value, providing a structured process for estimating the worth of an investment or business venture.

Investing Activities: Sources of Cash Revealed

You may want to see also

DCF analysis is a core skill for investment bankers

DCF analysis is based on the idea that a company's value is determined by how well it can generate cash flows for its investors in the future. By using DCF analysis, investment bankers can estimate the profit they could make with an investment, adjusted for the time value of money. The value of expected future cash flows is calculated using a projected discount rate.

The DCF approach requires forecasting a company's future cash flows and discounting them to arrive at a present value, which is the amount investors should be willing to pay. This present value is then compared to the company's market value to assess whether the company is overvalued or undervalued.

DCF analysis is widely used in both academia and practice, and it is considered a core skill not only for investment bankers but also for private equity, equity research, and "buy-side" investors. It is a valuable tool for making informed financial decisions and understanding the complexities of the investment world.

To perform DCF analysis effectively, investment bankers need to follow a structured process that includes forecasting future cash flows, determining the discount rate, calculating the present value of future cash flows, and making adjustments to arrive at the equity value. It is important to be diligent when making assumptions and projections, as small changes can have a significant impact on the valuation.

Overall, DCF analysis is a crucial skill for investment bankers, enabling them to make quantitative-based decisions and assess the potential of investment opportunities.

US Treasury Cash Reserves: Worthy Investment Option?

You may want to see also

DCF analysis is used to determine if an investment is worthwhile in the long run

Discounted Cash Flow (DCF) analysis is a valuation method used to determine whether an investment is worthwhile in the long run. It does this by estimating the value of an investment based on its expected future cash flows.

DCF analysis is based on the idea that a dollar today is worth more than a dollar tomorrow. This is known as the "time value of money" concept. By applying a discount rate to future cash flows, DCF analysis allows investors to determine whether an investment is likely to generate higher or lower returns than the initial investment.

DCF analysis involves forecasting future cash flows, selecting an appropriate discount rate, and then calculating the present value of those cash flows. The discount rate is typically the company's cost of capital, or how much the company needs to make to justify its operating costs.

DCF analysis is widely used by investment bankers, financial analysts, corporate finance professionals, and business owners to assess the potential profitability of investments, mergers, acquisitions, and budget decisions. It provides a structured process for estimating the value of an asset or investment and is considered a core skill for investment bankers.

While DCF analysis is a valuable tool, it is important to note that it relies on estimates and assumptions about future cash flows, discount rates, and terminal values. These estimates may not always be accurate, and small changes in assumptions can lead to significant variations in the valuation. Therefore, DCF analysis should be used alongside other valuation techniques to ensure a comprehensive assessment of an investment opportunity.

Cash in Your Investment Allocation: Wise or Unwise?

You may want to see also

DCF analysis is used to evaluate acquisition targets

Discounted Cash Flow (DCF) analysis is a popular capital budgeting methodology used to evaluate the value of an investment. It is based on the idea that money in hand today is worth more than the same amount in the future due to its earning potential and the possibility of changing interest rates. DCF analysis is widely used in investment banking to assess potential merger and acquisition targets.

DCF analysis involves forecasting a company's future cash flows and discounting them to arrive at a present value. This present value is considered the amount investors should be willing to pay for the company. The discount rate used in DCF analysis is known as the weighted average cost of capital (WACC), which takes into account the cost of debt and equity.

When evaluating acquisition targets, investment bankers use DCF analysis to determine the intrinsic value of a target company. This involves projecting the company's future cash flows and discounting them to present value, taking into account the time value of money. By comparing the DCF value to the current cost of the investment, bankers can assess if the acquisition will be profitable.

DCF analysis allows investment bankers to make informed decisions about potential acquisitions by quantifying the future cash flows and discounting them to their present value. It provides a structured process for estimating the value of a target company and helps bankers assess if the acquisition will generate positive returns.

In addition to evaluating acquisition targets, DCF analysis is also used in investment banking for internal corporate finance, business development, and academic research. It is a versatile tool that can be applied to various scenarios and is considered a core skill for investment bankers.

Understanding Cash Equivalent Investments: Basic Features Explained

You may want to see also

Frequently asked questions

DCF analysis is a valuation method that estimates the value of an investment using its expected future cash flows. Analysts use DCF to determine the value of an investment today, based on projections of how much money that investment will generate in the future.

DCF analysis is a direct valuation technique that values a company by projecting its future cash flows and then using the Net Present Value (NPV) method to value those cash flows. It is the most theoretically correct valuation method available as the value of a firm ultimately derives from the inherent value of its future cash flows to its stakeholders. It is also the most broadly used valuation technique because of its theoretical underpinnings and its ability to be used in almost all scenarios.

The valuation obtained from DCF analysis is very sensitive to a large number of assumptions and forecasts and can therefore vary over a wide range. If even one key assumption is significantly off, it can lead to a very different valuation. DCF analysis also does not take into account any market-related valuation information, such as the valuations of comparable companies.

DCF analysis is a core skill for investment bankers. They use it to determine whether a potential merger or acquisition is worth it. DCF analysis is also used to calculate the fair value of a company's stock.