In today's globalized world, the question of whether to increase foreign investment is a critical one for many nations. Foreign investment can bring a multitude of benefits, including capital inflows, technology transfer, and job creation, which can stimulate economic growth and development. However, it also raises concerns about potential negative impacts, such as environmental degradation, labor exploitation, and the loss of cultural identity. This complex issue requires a nuanced approach, balancing the potential advantages with the need to protect local interests and ensure sustainable development.

What You'll Learn

- Economic Growth: Increased foreign investment can boost GDP, create jobs, and improve infrastructure

- Technology Transfer: Foreign investors bring advanced technology, enhancing local industries and innovation

- Market Access: Access to new markets can expand export opportunities and reduce trade barriers

- Foreign Exchange Reserves: Inflows of foreign currency can strengthen a country's financial stability and reduce debt

- Environmental Impact: Sustainable practices can be promoted, but potential environmental risks must be managed

Economic Growth: Increased foreign investment can boost GDP, create jobs, and improve infrastructure

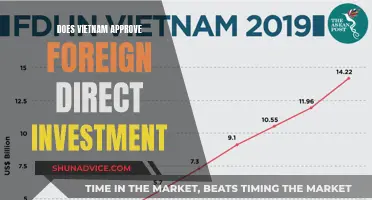

Increased foreign investment can significantly contribute to a country's economic growth and development, offering a multitude of benefits that extend beyond the immediate financial gains. One of the most direct impacts is the boost in Gross Domestic Product (GDP). When foreign investors inject capital into a country's economy, it stimulates economic activity, leading to increased production, higher output, and ultimately, a rise in GDP. This is particularly important for developing nations striving to accelerate their economic growth and catch up with more advanced economies.

The influx of foreign investment often results in the creation of numerous job opportunities, which is a critical factor in economic growth. As foreign companies establish operations or expand their existing businesses in the host country, they require a local workforce to support their operations. This not only reduces unemployment rates but also empowers local communities by providing skills and experience, which can have long-lasting positive effects on the labor market. Moreover, the creation of jobs can lead to increased consumer spending, further stimulating the economy and creating a positive feedback loop.

Infrastructure development is another area that can significantly benefit from increased foreign investment. Many foreign investors are attracted to countries with robust and improving infrastructure, as it provides a stable and secure environment for their operations. Improved infrastructure, such as transportation networks, communication systems, and energy facilities, not only facilitates the movement of goods and services but also enhances the overall productivity of the economy. Well-developed infrastructure can attract more foreign investment, creating a cycle of continuous improvement and development.

In addition to the direct economic benefits, foreign investment can also foster technology transfer and knowledge sharing. Foreign companies often bring advanced technologies, management practices, and expertise to the host country, which can be transferred to local businesses and institutions. This knowledge transfer can lead to improved productivity, innovation, and the development of new industries, further enhancing the country's economic growth potential. Furthermore, foreign investment can encourage the adoption of international standards and best practices, which can make the local economy more competitive and attractive to global markets.

However, it is essential to approach foreign investment with a strategic and sustainable mindset. The benefits of increased foreign investment should be accompanied by policies that ensure the investment is directed towards sectors that have the most significant impact on economic growth and development. This includes sectors such as manufacturing, agriculture, and renewable energy, which can create jobs, improve infrastructure, and contribute to long-term economic sustainability. Balancing the benefits of foreign investment with the need for local control and ownership is crucial to ensure that the economic growth is inclusive and benefits the broader population.

Preventing Cash Crunch in Illiquid Investments: Strategies for Success

You may want to see also

Technology Transfer: Foreign investors bring advanced technology, enhancing local industries and innovation

Foreign investment has the potential to significantly impact a country's technological landscape, particularly in the realm of technology transfer. When foreign investors enter a market, they often bring with them advanced technologies and innovative practices that can be a catalyst for local industries. This influx of technology can lead to a series of positive outcomes, including the enhancement of local industries and the stimulation of innovation.

One of the primary benefits of foreign investment in technology transfer is the introduction of cutting-edge solutions. Foreign investors often have access to the latest advancements in their respective fields, which they can then implement in the local market. For instance, a technology company from a developed country might introduce a new software platform that streamlines operations or a manufacturing process that increases efficiency and reduces waste. These innovations can quickly become industry standards, pushing local businesses to adopt similar practices to remain competitive.

Moreover, foreign investors can facilitate the transfer of knowledge and skills to local workers. Through training programs, mentorship, and collaboration, these investors can help build a skilled workforce capable of maintaining and further developing the introduced technologies. This knowledge transfer is invaluable, as it not only improves the capabilities of local employees but also fosters a culture of innovation and continuous improvement. Over time, this can lead to the emergence of local talent that can compete on a global scale.

The impact of technology transfer through foreign investment extends beyond individual companies. It can lead to the development of entire industries, creating a ripple effect of growth and development. For example, the introduction of advanced manufacturing techniques by a foreign investor might inspire local competitors to invest in similar technology, leading to a more robust and competitive local manufacturing sector. This, in turn, can attract further foreign investment, creating a positive feedback loop that drives economic growth.

In summary, foreign investment in the form of technology transfer can be a powerful tool for enhancing local industries and fostering innovation. By bringing advanced technologies and knowledge, foreign investors can help local businesses improve their operations, increase productivity, and remain competitive in the global market. This, in turn, can lead to a more dynamic and resilient economy, benefiting both the investors and the local population.

Owner Cash Investment: Is It an Expense?

You may want to see also

Market Access: Access to new markets can expand export opportunities and reduce trade barriers

Market access is a critical aspect of foreign investment, as it directly impacts a country's ability to expand its export opportunities and reduce trade barriers. When a country opens up its markets to foreign investors, it gains access to a wider range of products and services, which can significantly boost its economy. This is particularly beneficial for developing nations, as it allows them to diversify their export base and reduce their reliance on a few key industries. By attracting foreign investment, these countries can tap into new markets, increase their global presence, and create a more resilient and sustainable economic environment.

One of the primary benefits of market access is the potential to expand export opportunities. Foreign investors often bring with them advanced technologies, expertise, and access to global supply chains. This enables local businesses to enhance their production processes, improve product quality, and meet international standards. As a result, companies can produce goods that are more competitive in the global market, leading to increased exports and revenue. For instance, a foreign investor might introduce cutting-edge manufacturing techniques, allowing local manufacturers to produce higher-quality products that can compete with imports, thus boosting the country's export performance.

Reducing trade barriers is another significant advantage of market access through foreign investment. Many countries have implemented various trade restrictions, such as tariffs, quotas, and licensing requirements, which can hinder the flow of goods and services. By attracting foreign investment, nations can negotiate and establish more favorable trade agreements, which may include reduced tariffs, easier access to government procurement, and streamlined customs procedures. These agreements can significantly lower the cost of doing business internationally and encourage more companies to venture into the global market. As a result, the country's exports become more competitive, and its businesses can thrive in a more open and accessible trade environment.

Furthermore, market access through foreign investment can lead to the transfer of knowledge and skills. Foreign investors often bring their own management practices, business strategies, and cultural norms, which can be shared with local employees. This knowledge transfer can enhance the capabilities of the local workforce, improve productivity, and foster innovation. Well-trained and skilled workers can contribute to the overall growth of the economy, making it more attractive to foreign investors and further driving market access.

In summary, market access is a powerful tool for countries to leverage the benefits of foreign investment. By expanding export opportunities and reducing trade barriers, nations can attract more foreign investors, leading to economic growth and development. This process can create a positive feedback loop, where increased investment leads to improved market access, which, in turn, attracts more investors. Ultimately, this can result in a more prosperous and globally integrated economy, benefiting both local businesses and the overall population.

Understanding Dividend Investing: Yield on Cash

You may want to see also

Foreign Exchange Reserves: Inflows of foreign currency can strengthen a country's financial stability and reduce debt

Foreign exchange reserves play a crucial role in a country's economic stability and resilience, especially in the context of foreign investment. These reserves are essentially a store of wealth in the form of foreign currencies, gold, and other assets held by a country's central bank. When a country experiences a significant influx of foreign currency through various channels, it directly contributes to the accumulation of these reserves, which can have several positive impacts.

One of the primary benefits of having substantial foreign exchange reserves is the enhanced financial stability it provides. Countries with larger reserves are often seen as more creditworthy and financially secure. This is because these reserves act as a buffer against potential economic shocks, such as sudden capital outflows or financial crises. During times of economic turmoil, having a substantial reserve can help a country maintain its currency's value and prevent a currency crisis. For instance, if a country's currency is under pressure due to external factors, its central bank can intervene by selling its foreign exchange reserves to support the currency, thus avoiding a rapid depreciation.

Moreover, foreign exchange reserves can directly contribute to reducing a country's debt burden. When a country receives foreign direct investment (FDI) or other forms of foreign capital inflows, it can use these funds to purchase foreign exchange reserves. Over time, this can lead to a substantial increase in the country's reserve holdings. As these reserves grow, the country's ability to service its external debt becomes more manageable. With a larger reserve, the country can afford to repay its debts in foreign currencies, reducing the risk of default and maintaining a stable credit rating. This stability can attract even more foreign investment, creating a positive feedback loop.

In addition to financial stability and debt reduction, foreign exchange reserves can also influence a country's monetary policy. Central banks can use their reserves to manage the money supply and interest rates, ensuring price stability and controlling inflation. By having a significant reserve, a country's central bank has the flexibility to intervene in the foreign exchange market, which can help stabilize the domestic currency and control exchange rate volatility. This, in turn, can make the country's financial environment more attractive to foreign investors, as a stable currency and controlled inflation are essential for long-term economic planning.

In summary, increasing foreign investment can have a positive impact on a country's foreign exchange reserves, which, in turn, strengthens its financial stability and reduces debt. The influx of foreign currency through investment and trade contributes to the accumulation of reserves, providing a safety net during economic crises and helping to manage external debt. Additionally, the potential for monetary policy intervention and the overall economic stability can further encourage foreign investors, creating a mutually beneficial relationship.

Investment Casting: When to Use This Method for Your Project

You may want to see also

Environmental Impact: Sustainable practices can be promoted, but potential environmental risks must be managed

The potential environmental impact of increasing foreign investment is a critical consideration that should not be overlooked. While foreign investment can bring significant economic benefits, it is essential to approach it with a sustainable and responsible mindset to ensure that the environment is not compromised. Sustainable practices can indeed be promoted through foreign investment, but this must be coupled with a comprehensive understanding and management of potential environmental risks.

One of the key advantages of foreign investment in the context of environmental impact is the potential for the transfer of sustainable technologies and practices. Foreign investors often bring advanced knowledge and expertise in various sectors, including renewable energy, waste management, and eco-friendly agriculture. By encouraging these investors to adopt and implement sustainable practices, we can foster a more environmentally conscious approach to development. For example, foreign investment in renewable energy projects can lead to the establishment of wind farms, solar parks, or hydroelectric power plants, reducing reliance on fossil fuels and decreasing carbon emissions.

However, alongside the promotion of sustainable practices, there is a need for robust risk management strategies. Foreign investment projects can have unforeseen environmental consequences, especially in regions with unique ecological systems or those facing environmental challenges. It is crucial to conduct thorough environmental impact assessments (EIAs) before and during the investment process. These assessments should identify potential risks, such as habitat destruction, water pollution, or the release of hazardous substances, and propose mitigation measures. Effective monitoring and regular reviews of these measures are essential to ensure that any identified risks are managed effectively.

To manage these risks, governments and investors should collaborate closely. This collaboration can lead to the development of environmental standards and regulations that are tailored to the specific context of the investment. For instance, implementing strict guidelines for waste management in industrial zones or creating protected areas to preserve biodiversity can help minimize the environmental footprint of foreign investment. Additionally, providing incentives for investors who adopt and exceed these standards can encourage a culture of environmental responsibility.

In conclusion, while increasing foreign investment can bring economic growth and the potential for sustainable practices, it is imperative to approach this with a balanced perspective. By recognizing and addressing the environmental risks associated with such investments, we can ensure that the benefits are long-lasting and environmentally sound. Effective management of these risks through collaboration, assessments, and tailored regulations will play a vital role in achieving a sustainable future while reaping the rewards of foreign investment.

Investing Apps: A Guide to Getting Started

You may want to see also

Frequently asked questions

Foreign investment can bring numerous advantages to a country. Firstly, it can stimulate economic growth by creating jobs, increasing productivity, and fostering innovation. Foreign investors often bring advanced technologies, management expertise, and access to global markets, which can enhance local industries and boost exports. Additionally, it can lead to infrastructure development, improve the business environment, and attract further investment, creating a positive cycle of growth.

While foreign investment is generally beneficial, there are some considerations. One concern is the potential loss of control over domestic industries, especially if foreign investors gain significant ownership. This could lead to the erosion of local businesses and jobs. Another risk is the possibility of environmental degradation or social issues if proper regulations and oversight are not in place. It is crucial for host countries to have robust legal frameworks and policies to ensure responsible investment practices.

There are several strategies to encourage foreign investment. Governments can focus on creating a favorable business environment by offering incentives such as tax breaks, streamlined regulations, and special economic zones. Investing in infrastructure, improving the ease of doing business, and ensuring political stability are also essential. Building strong relationships with international organizations and trade partners can enhance a country's attractiveness to foreign investors.

Foreign investment is a powerful catalyst for economic development. It can provide the necessary capital and expertise to support local industries, especially in sectors where domestic resources are limited. This investment can help bridge the gap between developing and developed countries, accelerate industrialization, and promote technological advancement. Moreover, it fosters knowledge transfer, skills development, and the creation of local supply chains, contributing to long-term economic growth and poverty reduction.