The cash flow statement is a crucial financial report that offers insights into a company's cash flow from investing activities, one of its three main sections, alongside operating and financing activities. This segment of the cash flow statement outlines the cash inflows and outflows resulting from investment-related decisions, such as purchasing or selling securities, assets, or investments in other businesses. These activities are essential for a company's growth and capital, and understanding them provides a more comprehensive view of the company's financial health beyond revenue and expenses.

| Characteristics | Values |

|---|---|

| Section of a company's cash flow statement | Cash Flow from Investing Activities (CFI) |

| What it records | How much cash has been generated or spent from various investment-related activities in a specific period |

| Types of activities | Purchase of physical assets, investments in securities, or the sale of securities or assets |

| Investments can be made to generate income or they may be long-term investments in the health or performance of the company | |

| Capital expenditures (CapEx) | |

| Lending money | |

| Expenditures in property, plant, and equipment | |

| Acquisitions of other businesses | |

| Proceeds from the sale of marketable securities | |

| Proceeds from the sale of other businesses (divestitures) |

What You'll Learn

Purchase of physical assets

Physical assets are items of economic, commercial, or exchange value that have a material existence. They are also referred to as tangible assets. For most businesses, physical assets include properties, equipment, and inventory.

Physical assets are recorded as either current or fixed assets. Current assets are items such as cash, inventory, and marketable securities, which are typically used within a year and can be sold to raise cash for emergencies. Fixed assets, on the other hand, are non-current assets used in business operations for more than a year. They include items such as trucks, machinery, office furniture, and buildings.

When purchasing physical assets, businesses can choose to buy or lease. Leasing can be a good option if a business needs equipment quickly or if the equipment is very expensive. Buying, on the other hand, is a good option if the business has enough cash or credit available and is confident about using the assets for a long time.

When recording the purchase of physical assets, the cost of acquisition is important. For current assets, the cost incurred to acquire them is recorded. For fixed assets, the cost may include transportation, installation, and insurance costs in addition to the purchase price. Fixed assets also receive special accounting treatment since they have a useful life of more than a year. This involves a process called depreciation, where the expense of the asset is allocated over each year of its useful life.

How Much Cash Should You Keep in Your Investment Portfolio?

You may want to see also

Investments in securities

Investment securities are a category of securities, which are financial assets that can be traded. They are purchased with the intention of holding them for investment.

Investment securities are often bought by banks to hold in their portfolios, and they can also be used as collateral. They can take the form of equity (ownership stakes) in corporations or debt securities.

There are two broad categories of investment securities: equity securities and fixed-income investments.

Equity Securities

Equity securities are financial assets that represent ownership of a corporation. The most common type of equity security is common stock. If you own an equity security, you own a percentage of the issuing company's earnings and assets. Other assets, such as mutual funds or ETFs, may also be considered equity securities if their holdings are composed of pooled equity securities.

Fixed-Income Investments

Fixed-income investments are debt instruments, where a lender (investor) lends money to a borrower or issuer (often a government or corporation) in exchange for regular interest payments. The principal is returned to the investor at maturity. The most common types of fixed-income securities are government and corporate bonds.

Fixed-income securities carry risks, including price risk and credit risk. Not all fixed-income investments include a fixed periodic payment; some have no payment at all, but instead, the interest effect is incorporated into the sale price upfront. Examples include US government-issued Treasury bills, floating-rate notes, and variable-rate demand obligations.

Unlocking Cash Flow Secrets for Smart Investments

You may want to see also

Sale of securities or assets

The sale of securities or assets is a part of a company's cash flow statement, which is one of the three main financial statements used by businesses. This statement provides an overview of the cash generated by or spent on investment activities, including the sale of securities or assets.

When a company sells securities or assets, it can result in either a positive or negative cash flow. A positive cash flow occurs when the sale of securities or assets generates income, while a negative cash flow happens when the sale involves spending money.

The treatment of the sale of securities or assets in accounting depends on the classification of the securities. If the securities are classified as available-for-sale, the sale will be recorded differently compared to trading securities or held-to-maturity securities. Available-for-sale securities are those that are not expected to be sold before maturity but could be sold if needed. In this case, the sale of securities would be recorded as a credit to the cash account and a debit to the AFS securities account. Any gains or losses from the sale would be recorded in the "accumulated other comprehensive income" component of the equity section of the balance sheet.

It is important to note that negative cash flow from the sale of securities or assets is not always a negative indicator of a company's financial health. It could indicate that the company is investing in long-term strategies, such as research and development, that may lead to significant growth in the future.

Negate Investing: Cash Flow Conundrum?

You may want to see also

Capital expenditures

CapEx is important for companies to grow and maintain their business by investing in new property, plants, equipment, products, and technology. Financial analysts and investors pay close attention to a company's capital expenditures as they can have a significant impact on cash flow.

CapEx is typically found on a company's cash flow statement under "investing activities". It can be calculated using data from a company's income statement and balance sheet. Find the amount of depreciation expense recorded for the current period on the income statement and locate the current period's property, plant, and equipment line-item balance on the balance sheet.

The amount of capital expenditures a company has depends on its industry. Some of the most capital-intensive industries with the highest levels of CapEx include oil exploration and production, telecommunications, manufacturing, and utilities.

CapEx is different from operating expenses (OpEx), which are shorter-term expenses required for the day-to-day operations of a business. Operating expenses can be fully deducted from a company's taxes in the same year they occur, whereas capital expenditures are not directly tax-deductible but can indirectly reduce taxes through depreciation.

Smart Strategies to Invest Cash for High Yield Returns

You may want to see also

Proceeds from the sale of marketable securities

The proceeds from the sale of marketable securities are classified as positive investing cash flow and are reported in the investing activities section of the statement of cash flows. The line item used for this is "proceeds from the sale of marketable securities".

The sale of marketable securities can result in a gain or loss, depending on their fair market value at the time of sale. If the securities are sold for a higher price than their cost, the difference represents a gain, and the cash account is debited, with the marketable securities account and gain on sale of investment account credited. Conversely, if the securities are sold at a lower price than their cost, the difference represents a loss, and the cash account and loss on sale of investment account are debited, while the marketable securities account is credited.

The gains or losses on the sale of marketable securities are reported in the income statement and, therefore, impact the net income of the seller. They also appear in the operating activities section of the statement of cash flows, where they form part of the calculation to reconcile net income or loss with net cash provided or used by operating activities.

Marketable securities are financial assets that can be sold or converted to cash within a year. They are typically bought or sold on an exchange, with common examples including stocks, bonds, certificates of deposit, or commodities contracts. These securities are a component of current assets on a company's balance sheet and help determine the company's liquidity and ability to pay expenses or debts.

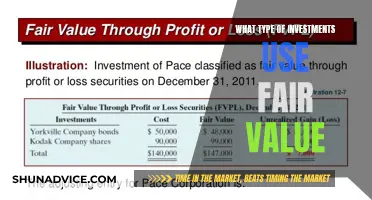

The accounting treatment for the sale of marketable securities depends on the type of security involved. Trading securities, available-for-sale securities, and held-to-maturity securities are the three main categories. Trading securities are short-term marketable securities that a business intends to resell within a year, while available-for-sale securities are those that cannot be classified as trading or held-to-maturity securities. Held-to-maturity securities are held by an investor until a fixed maturity date, and interim fluctuations in their fair value are not recognised.

Understanding Dividend Investing: Yield on Cash

You may want to see also

Frequently asked questions

A cash flow statement is one of the sections of a company's financial report. It shows how much cash has been generated or spent from various investment-related activities in a specific period.

CFI stands for Cash Flow from Investing Activities.

Investing activities include the purchase of physical assets, investments in securities, or the sale of securities or assets.