Whether a cash investment from the owner is considered an expense depends on the type of business structure. In a sole proprietorship, the business profits count as income for the owner, and the owner's personal money is put into the business bank account. This is called an owner investment and is not considered an expense. However, if the owner uses their personal funds to pay for a business expense, it is considered an expense and is recorded as such. In a partnership, a similar process is followed, with each partner having their own owner investment and owner's draw accounts. For corporations, the terminology is slightly different, and the investment is typically not considered an expense, but rather an exchange for shares in the company.

What You'll Learn

Owner's investment vs. expense

When an owner invests their own money into their business, this is generally considered an "owner investment" rather than an expense. This is true for sole proprietorships, partnerships, and corporations.

In accounting, an expense is defined as an outflow of cash or other valuable assets from a person or company to another person or company, usually in exchange for products or services. An expense reduces a company's equity. In contrast, an owner investment is an inflow of cash or assets into the business, for which the owner receives shares of the company in return.

For example, if an owner invests $100,000 into their business, this would be recorded as a transfer from their personal "contributed capital" account to their business bank account. This would be categorised as an "owner investment" or "equity investment".

On the other hand, when an owner takes money out of the business, this is called an "owner's draw" and would be recorded as a transfer from the business bank account to the owner's personal account. This could be considered an expense, as it is an outflow of cash from the company to the owner.

It is important to note that the specific accounting treatment may vary depending on the business structure and local tax regulations. For example, in the United States, business expenses may be tax-deductible, while owner investments and expenses are treated differently for tax purposes in a sole proprietorship compared to a corporation. Consulting with an accounting and tax professional is recommended to ensure compliance with the relevant regulations.

Preventing Cash Crunch in Illiquid Investments: Strategies for Success

You may want to see also

Sole proprietorships and owner investment

Sole proprietorships are unincorporated businesses with a single owner. They are a popular choice for small businesses, individual contractors, and consultants. This is because they are easy to establish and profits flow directly to the owner. However, the owner is also liable for all debts and losses incurred by the business.

When it comes to owner investment, a sole proprietorship is not considered a separate entity from its founder. This means that investing in a sole proprietorship is done differently from investing in a corporation or limited liability company, where shares of stock can be owned.

If an owner of a sole proprietorship, Amy Ott, for example, puts money into her business, the business will debit Cash and credit Amy Ott, Capital. If Amy lends money to the business, the entry will be to debit Cash and credit a liability account such as Notes Payable. It is important to consult with accounting, tax, and legal professionals when considering investing or lending to a new business.

As a sole proprietor, you are personally responsible for any losses your business incurs due to investments. Therefore, it is recommended to have substantial capital and avoid investing funds needed for the daily operation of the business or personal living. Sole proprietors pay personal income taxes on their business profits, so any substantial investment income will be taxed at a higher rate than partnerships or corporations.

Sole proprietors have the freedom to make investment decisions without consulting others, but this also means they bear the full responsibility for those decisions.

Depreciation's Impact on Cash Flow: Investing Activities

You may want to see also

Owner's draw

An owner's draw is a way for a business owner to withdraw money from their business for personal use. This method is typically used by owners of sole proprietorships, partnerships, or limited liability companies (LLCs) to pay themselves instead of taking a regular salary. However, an owner's draw can also be taken in addition to receiving a regular salary.

The owner's draw method offers flexibility, as owners can withdraw money as needed and as profits allow. There is no limit to how much or how often an owner can take a draw, as long as there are sufficient funds available. However, taking too much from the business can cause cash flow problems and affect its ability to operate. Therefore, it is important for owners to consider their business cash flow patterns and upcoming expenses when determining the amount of their draw.

In terms of taxation, the owner's draw method requires more personal tax planning. Draws are not subject to payroll taxes, but they are subject to federal, state, local, and self-employment taxes, including Federal Insurance Contributions Act (FICA) taxes (Social Security and Medicare). Owners need to file their tax returns on a quarterly estimated basis and report the income on their personal tax returns.

For sole proprietorships and partnerships, the owner's draw is the only way to receive income from the business. In an LLC, owners are not allowed to pay themselves a regular salary and must use the draw method. On the other hand, S corporations (S-corps) and C corporations cannot take draws and must pay owners through salaries and dividend distributions.

Strategies for Investing Cash Reserves: A Guide to Opportunities

You may want to see also

Owner's equity

Owners' equity is one of the three main sections of a sole proprietorship's balance sheet and one of the components of the accounting equation: Assets = Liabilities + Owner's Equity. It is calculated by subtracting a company's liabilities from its assets.

Owners' equity is the amount of money left over if a business liquidates its assets and pays off any debts. It is also the amount of money that would be returned to a company's shareholders in the case of liquidation or acquisition.

The term "owners' equity" is typically used for a sole proprietorship. For LLCs or corporations, the term used is "shareholders' equity" or "stockholders' equity". Owners' equity is not considered an asset on a company's balance sheet; instead, it is considered a liability to the business.

The formula for calculating owners' equity is:

Owners' Equity = Investment by Owner + Net Income - Money taken out of the business by the owner - Money owed to others

For example, if a sole proprietorship's accounting records indicate assets of $100,000 and liabilities of $70,000, the amount of owners' equity is $30,000.

Owners' equity can be negative if a business's liabilities are greater than its assets. In this case, the owner may need to invest additional money to cover the shortfall.

Smart Ways to Invest 40K: Strategies for Success

You may want to see also

Accounting for owner's investment

When an owner invests their own money into a company, this is recorded differently depending on the type of company. If the company is a sole proprietorship, the company will debit Cash and credit the owner's name followed by "Capital". If the owner lends money to the company, the entry will be to debit Cash and credit a liability account such as Notes Payable. If the owner invests an asset other than cash, the business will record the cash equivalent or fair market value of the asset.

If the company is a regular corporation, Cash will be debited and the account Common Stock will be credited. If the common stock has a par value, Paid-in Capital in Excess of Par is also used. If the owner lends cash to the corporation, Cash will be debited and the liability account Notes Payable to Stockholder will be credited. If the owner invests an asset other than cash, the corporation will record the cash equivalent or fair market value of the asset, unless the fair value of the common stock being issued has a more clear value.

For a company taxed as a sole proprietor or partnership, it is recommended to have the following owner/partner equity accounts: [name] Equity (do not post to this account, it is a summing account) >> Equity >> Equity Drawing - you record the value you take from the business here >> Equity Investment - record value you put into the business here. Use the drawing account as the expense for the fund transfer and the investment account as the source (from) account for a deposit.

An owner's investment is also called owner's investment or contributed capital. It is the amount of assets that the owner puts into the company, either to start it or to keep it running. The owner's investment account is a temporary equity account with a credit balance. This means that the investment account is closed out at the end of each year, increasing the balance in the owner's capital account. Each time the owner gives money to the company, the owner's capital account (their stake in the business) grows. Withdrawals or distributions work in the opposite way: each withdrawal decreases the capital account balance and reduces the owner's stake in the company assets.

Understanding the Relationship Between Cash and Investments

You may want to see also

Frequently asked questions

No, a cash investment from the owner is not considered an expense. An expense is an outflow of money or assets from a person or company to another person or company. A cash investment from the owner is an inflow of money.

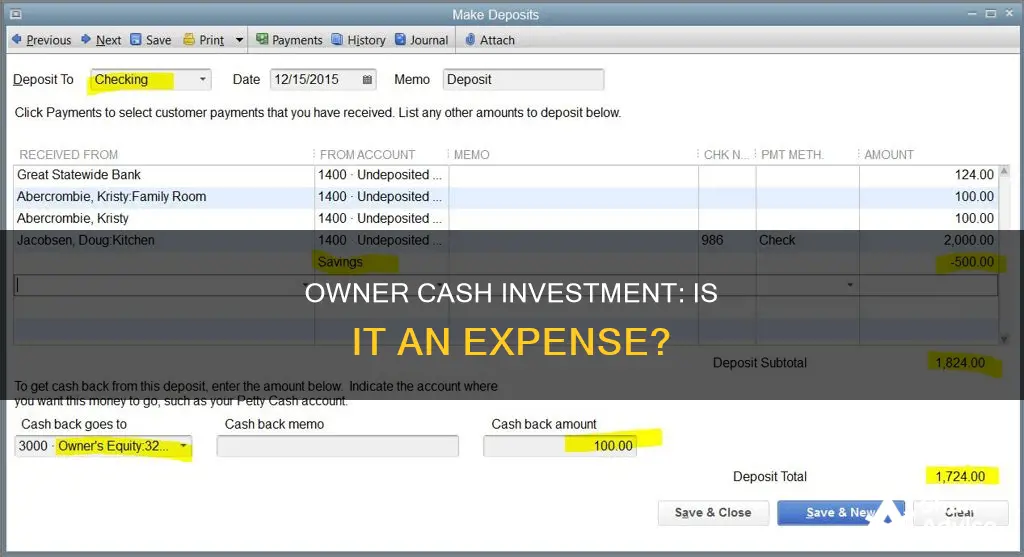

To record an owner's cash investment in a sole proprietorship, you would debit Cash and credit the owner's capital account.

To record an owner's cash investment in a corporation, you would debit Cash and credit the Common Stock account.

An owner investment is when an owner puts their personal money into the business, such as through a deposit into the business bank account or by paying for a business expense. An owner's draw is when the owner takes money out of the business, such as by transferring money from the business bank account to their personal bank account or by paying for a personal expense.