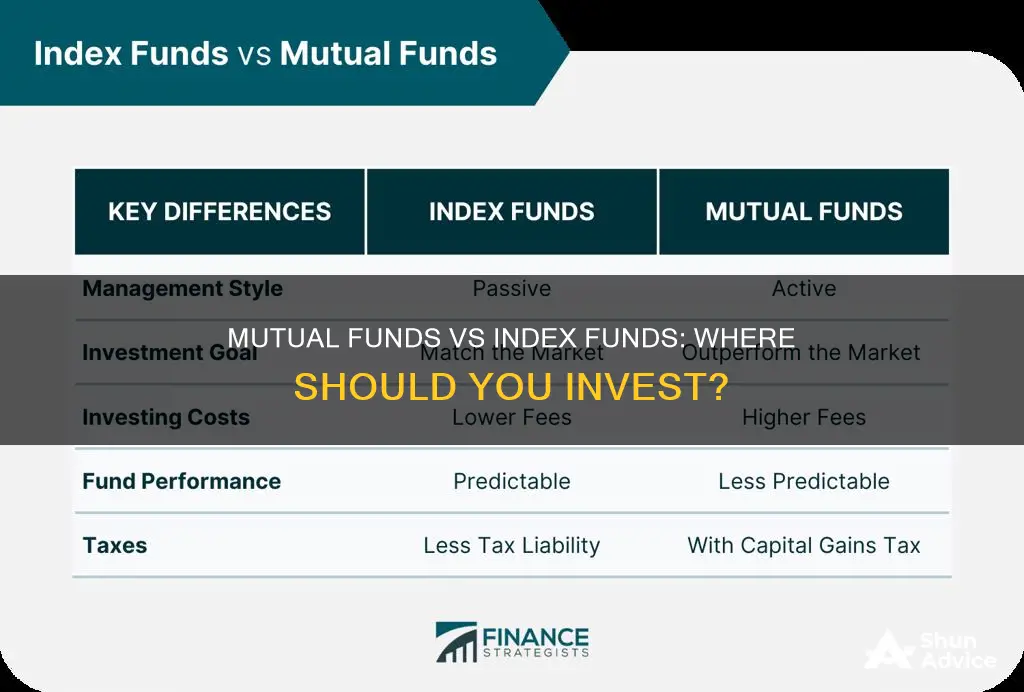

Index funds and mutual funds are both popular investment options for those looking to diversify their portfolios. While they share similarities, there are also some key differences to consider. Understanding these differences is crucial for investors to make informed decisions about their financial goals and risk tolerance.

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500 or the Dow Jones Industrial Average. They aim to replicate the returns of their chosen benchmark and are passively managed, meaning they have lower fees and are more tax-efficient than actively managed funds.

On the other hand, mutual funds are financial products that pool money from investors to purchase a diversified portfolio of stocks, bonds, or other securities. These funds can be actively or passively managed, with the goal of either outperforming the market or mirroring a specific market index. Actively managed mutual funds tend to have higher fees due to the active trading and research involved.

When deciding between index funds and mutual funds, investors should consider their investment objectives, risk tolerance, and cost sensitivity. Index funds are often favoured for their low fees and consistent returns, while mutual funds offer the potential for higher returns but come with higher costs and the possibility of underperforming the market.

| Characteristics | Values |

|---|---|

| Management Style | Index funds are passively managed, whereas mutual funds can be actively or passively managed. |

| Investment Objective | Index funds aim to replicate the performance of a market index. Mutual funds aim to outperform the market. |

| Cost | Index funds have lower costs and fees than actively managed mutual funds. |

| Performance | Index funds have lower performance variability than actively managed mutual funds. |

| Risk | Index funds have higher market risk but less strategy risk than actively managed mutual funds. |

| Taxes | Index funds are more tax-efficient than actively managed mutual funds. |

What You'll Learn

- Management style: Index funds are passively managed, while mutual funds can be actively or passively managed

- Investment objective: Index funds aim to match market performance, mutual funds aim to beat it

- Cost: Index funds have lower fees and expense ratios

- Performance: Index funds are more predictable, mutual funds are less so

- Risk: Index funds have higher market risk, mutual funds have higher strategy risk

Management style: Index funds are passively managed, while mutual funds can be actively or passively managed

Index funds are passively managed, meaning they are designed to mirror the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. They do this by holding a diversified portfolio of securities weighted to represent the index they track. Index funds are passively managed because they are not actively traded; instead, they track an index, and if a stock is in the index, it will be in the fund too. This passive management strategy means that index funds are considered a more hands-off investment approach.

Mutual funds, on the other hand, can be actively or passively managed. Actively managed mutual funds employ professional managers who actively trade securities to try and outperform the market. The managers of these funds conduct extensive research and analysis to pick securities they believe will deliver superior performance. Actively managed mutual funds are therefore a more hands-on investment approach.

In contrast, passively managed mutual funds do not aim to beat the market. Instead, they aim to replicate the performance of a specific market index, just like index funds. These funds are also sometimes referred to as index mutual funds.

The management style of an investment fund is an important consideration for investors, as it will impact the level of fees and risk associated with the fund. Actively managed funds tend to have higher fees due to the active trading, research, and management involved, whereas passively managed funds tend to have lower fees and are often more tax-efficient.

Investments Funding Social Security: State-Sponsored Retirement Plans

You may want to see also

Investment objective: Index funds aim to match market performance, mutual funds aim to beat it

Index funds and mutual funds are both popular options for diversifying investment portfolios. They are similar in that they allow investors to spread their investments across various assets and industries, reducing their level of risk. However, there are some key differences between the two.

Index funds are a type of mutual or exchange-traded fund (ETF) that tracks the performance of a market index, such as the S&P 500. They aim to match the returns of a specific benchmark index, like the S&P 500, by holding the same stocks or bonds or a representative sample of them. The sole objective of an index fund is to mirror the performance of the underlying index. Index funds are passively managed, meaning there is no active management involved. Instead, their holdings automatically track an index, and their performance is based on the price movements of the individual stocks in that index. This passive investing strategy leads to lower costs for investors, as there are no full-time fund manager salaries or marketing materials to pay for. Index funds also tend to be more tax-efficient than actively managed funds.

On the other hand, mutual funds can be actively or passively managed. Actively managed mutual funds aim to beat the returns of a benchmark index by having investment professionals select the investments for the fund. These funds typically come with higher fees to cover the costs of the fund managers and their teams. While active management may lead to higher returns in the short term, especially when the overall market is down, it is difficult for fund managers to consistently outperform passive market returns. According to the S&P Indices versus Active (SPIVA) scorecard, only 12.02% of actively managed funds outperformed the S&P 500 in the last 15 years.

In summary, the main difference in investment objectives between index funds and mutual funds is that index funds aim to match market performance, while mutual funds aim to beat it. Index funds are passively managed and have a lower-cost structure, while actively managed mutual funds have higher fees and aim to outperform the market through active management.

Short-Term Bond Funds: Worth the Investment?

You may want to see also

Cost: Index funds have lower fees and expense ratios

Index funds have lower fees and expense ratios than mutual funds. This is because index funds are passively managed, meaning they track a specific market index, such as the S&P 500, without needing human oversight or active trading. As a result, they have lower administrative expenses and don't require research analysts, leading to reduced costs for investors.

The expense ratio of a fund is an ongoing fee paid to the fund company, which is charged as a percentage of the assets under management. Index funds typically have lower expense ratios because they are passively managed and don't require large staffs or complicated trades. Actively managed mutual funds, on the other hand, have higher expense ratios due to the active trading, research, and management involved.

For example, the average expense ratio for actively managed equity mutual funds was 0.68%, while the average for index funds was just 0.06%. This means that for every $1,000 invested, the fees would be $6.80 and $0.60, respectively—a significant difference that can add up over time.

In addition to expense ratios, mutual funds may also charge sales loads or commissions, which can eat into investors' returns. Index funds, on the other hand, tend to be more tax-efficient due to their buy-and-hold approach, resulting in lower taxable events.

Overall, the lower fees and expense ratios of index funds make them a more cost-effective option for investors, particularly those seeking long-term, passive investment strategies.

Index Funds vs Rental Property: Where Should You Invest?

You may want to see also

Performance: Index funds are more predictable, mutual funds are less so

Index funds and mutual funds differ in their investment objectives and management styles, resulting in varying levels of predictability in performance. Index funds aim to mirror the performance of a specific market index, such as the S&P 500, by holding the same stocks or bonds or a representative sample of them. This passive investment strategy means that index funds have a relatively predictable performance, as it is based on the price movements of the individual stocks in the index.

On the other hand, mutual funds are actively managed, meaning a fund manager or management team makes all the investment decisions. These funds aim to outperform the market by strategically selecting and actively trading stocks, bonds, or other assets. The performance of mutual funds tends to be less predictable due to the active management and the potential for human error or poor decision-making.

Index funds are passively managed, meaning they are designed to track a specific market index without any active buying or selling of securities. This passive approach leads to lower fees and expenses for index funds compared to mutual funds. The passive nature of index funds also results in lower turnover rates, which makes them more tax-efficient.

While index funds offer broad market exposure and instant diversification bysection:hidden:on holding a high number of securities, mutual funds vary in their diversification strategies. Actively managed mutual funds, in particular, may focus on specific sectors or niches, leading to a more concentrated portfolio.

In summary, the performance of index funds is more predictable due to their passive nature and objective of mirroring a market index. Mutual funds, on the other hand, have a less predictable performance due to their active management and objective of outperforming the market.

Short-Term Investment Strategies: Where to Invest Your Money

You may want to see also

Risk: Index funds have higher market risk, mutual funds have higher strategy risk

Index funds and mutual funds differ in terms of their management style, investment objective, and cost. While index funds are passively managed, mutual funds are actively managed. This means that index funds aim to replicate the performance of a chosen market index, whereas mutual funds seek to outperform the market. This fundamental difference leads to variations in market and strategy risk between the two types of funds.

Index funds have higher market risk than mutual funds. They are designed to mirror the performance of a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. This means that when the market declines, the value of index funds will also decrease. In contrast, mutual funds have the potential to outperform the market during market downturns due to active management strategies. However, this also means that mutual funds have higher strategy risk.

Active management in mutual funds involves fund managers making investment decisions based on extensive research, analysis, and market timing. They have the flexibility to select securities and adjust holdings to align with the fund's objectives and respond to market conditions. This strategy introduces the risk that the fund manager's decisions may not yield the desired results or may underperform the market. On the other hand, index funds have lower strategy risk because they passively follow a predetermined market index, reducing the risk associated with individual investment choices.

Additionally, index funds tend to be more tax-efficient than mutual funds. The passive nature of index funds leads to lower turnover rates, resulting in fewer taxable events for investors. In contrast, the active trading and higher turnover of mutual funds can trigger more capital gains distributions, which are taxable.

In summary, index funds have higher market risk due to their direct correlation with the performance of the underlying market index. On the other hand, mutual funds have higher strategy risk because their returns depend on the investment decisions and strategies employed by fund managers, which may or may not outperform the market.

Index Funds: A Guide to Direct Investing

You may want to see also

Frequently asked questions

Mutual funds are financial products that pool money from investors to purchase a portfolio of stocks, bonds or other securities. They can be actively or passively managed. Actively-managed funds aim to beat the market, while passively-managed funds aim to replicate the performance of a market index. Index funds are a type of mutual fund or exchange-traded fund (ETF) that is passively managed to mirror the performance of a specific market index.

Index funds are often cheaper than actively-managed mutual funds (aka active funds) because they are passively managed, meaning they track a market index without intervention from a fund manager. This passive management style also means that index funds tend to be more tax-efficient than active funds, as there are fewer taxable events like capital gains distributions. Index funds are also more diversified than active funds, as they hold a high number of securities in the same proportions as the index they track.

Actively-managed mutual funds have the potential to outperform the market and generate higher returns than index funds. They also offer more flexibility, as the fund manager can respond to market changes and adjust the fund's holdings.

Over the long term, index funds have often outperformed actively-managed mutual funds, especially after accounting for fees and expenses. According to the S&P Indices Versus Active (SPIVA) scorecard, about 9 out of 10 actively-managed funds didn't match the returns of the S&P 500 benchmark over the past 15 years. However, in the past year, 40.32% of active funds have outperformed the market.

Your choice between index funds and mutual funds will depend on your investment goals, risk tolerance, and personal preferences. Index funds are generally better for investors who want a low-cost, passive investment that mirrors the performance of a market index. Actively-managed mutual funds are better for investors who want the potential for higher returns and are willing to pay higher fees for active management strategies.