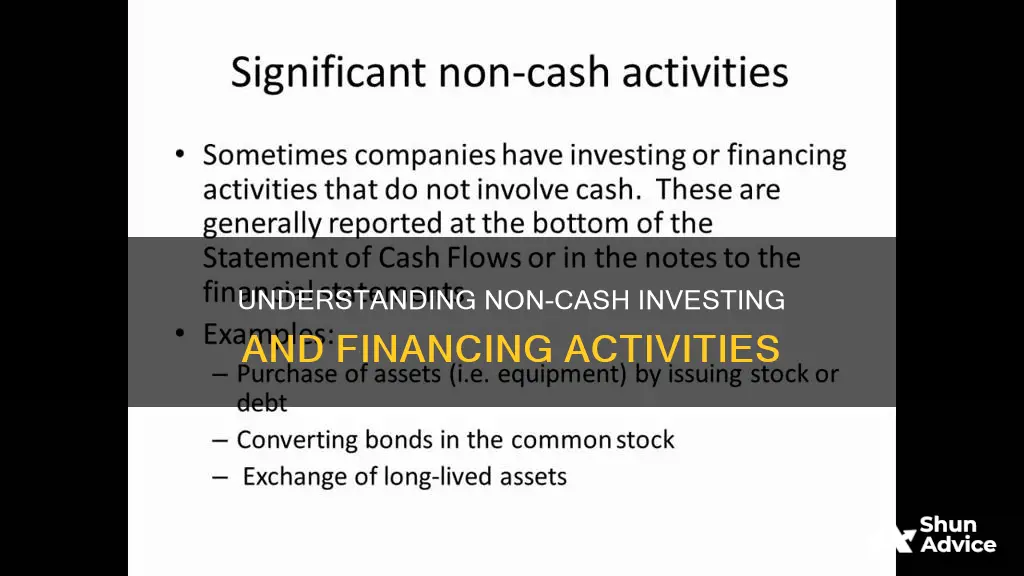

Non-cash investing and financing activities are transactions that do not generate any cash inflows or outflows for a company but can still significantly impact its financial position and capital composition. These activities are not reported on the cash flow statement but must be disclosed separately. Examples of non-cash activities include the issuance of shares, the conversion of bonds, and the exchange of non-monetary assets.

What You'll Learn

Issuing stock for stock compensation plans

Stock compensation is often subject to a vesting period, which encourages employees to stay with the company for a longer period. During this time, employees may purchase a predetermined number of shares at a set price. Vesting schedules can be set according to company-wide or individual performance targets, time-based criteria, or a combination of both. Typically, vesting periods are between three and four years, starting after the first anniversary of the date an employee became eligible for stock compensation.

There are two main types of stock compensation: non-qualified stock options (NSOs) and incentive stock options (ISOs). With NSOs, employees are required to pay income tax on the difference between the exercise price and the value of the stock when exercised. On the other hand, ISOs offer special tax advantages, such as lower tax rates, and are only available to employees.

Stock compensation plans can be an effective way to align the interests of employees with those of the company, encouraging employee retention, motivation, and performance. Employees with stock ownership have a direct stake in the company's success, as the value of their stocks can increase with the company's growth and performance.

Cashing in an Investment ISA: A Step-by-Step Guide

You may want to see also

Acquiring assets by assuming related liabilities

For example, a company might acquire a piece of equipment by taking out a loan from the seller, or by exchanging non-cash assets or liabilities for the desired asset. This allows companies to obtain assets without having to use their immediate cash resources.

Another example is when a company obtains a right-of-use asset, such as a building, in exchange for taking on a lease liability. This is considered a non-cash investing activity as the company is taking on a financial obligation in order to acquire the asset, rather than paying with cash.

Noncash investing activities also include instances where a company obtains a beneficial interest as consideration for transferring financial assets (excluding cash). This could involve the transfer of trade receivables, commonly known as a holdback or deferred purchase price.

These types of transactions are important for companies to understand and properly disclose in their financial statements. They provide flexibility in acquiring assets without requiring immediate cash outflows, but they also come with financial obligations that need to be carefully managed.

EM Cash: Investing Strategies for Beginners

You may want to see also

Exchanging non-monetary assets

Non-cash investing and financing activities are those that do not generate any cash inflows or outflows but can still significantly affect a company's financial position and capital composition. They are not reported on the cash flow statement but must be disclosed in a separate note or supplementary schedule.

Examples of non-monetary assets include tangible assets such as a company's property, plant, equipment, and inventory, as well as intangible assets such as intellectual property, copyrights, design patents, trademarks, brand recognition, and goodwill. These assets are important for a company's operations and revenue generation, but their dollar value may fluctuate substantially over time and is subject to changes in economic and market conditions.

When a company exchanges one non-monetary asset for another, it is engaging in a non-cash transaction that can impact its financial position. For example, a company may exchange a piece of equipment for another asset of the same value. While this transaction does not involve any cash changing hands, it still affects the composition of the company's assets. Therefore, it is important for companies to disclose such non-cash activities in their financial statements to provide a comprehensive understanding of their financial activities and position.

Cash Investment: Revenue or Asset?

You may want to see also

Converting debt to equity

Non-cash investing and financing activities are investing or financing activities that do not result in cash flows. These activities are disclosed separately and may be presented in a narrative or tabular format. One such non-cash investing and financing activity is the conversion of debt to equity.

A debt-to-equity swap can be an effective way for a company to restructure its capital and borrowings, strengthen its balance sheet, and address issues such as over-gearing. It provides an opportunity for the company to proactively deal with creditors and avoid the costs associated with debt recovery processes. The swap ratio between debt and equity can vary depending on individual cases, and companies may offer advantageous trade ratios to entice creditors.

When implementing a debt-for-equity swap, careful planning and engagement with shareholders and participating creditors are crucial. The process can be complex and costly, especially when using a statutory procedure, which is typically administered by an insolvency practitioner. Key terms to be decided include the value of the company, the amount of debt to be substituted for equity, the type of equity interest to be acquired, and the rights and restrictions attached to that interest.

Cash App Investing: A Guide to Getting Started

You may want to see also

Acquiring a business through stock issuance

When acquiring a business through stock issuance, the acquiring company issues new shares to the target company's shareholders in exchange for ownership of the target company. This means that the acquiring company does not need to use cash to purchase the target company, but instead uses its own stock as currency.

The process of acquiring a business through stock issuance can be complex and typically involves the following steps:

- The acquiring company will need to get approval from its board of directors to issue new shares.

- The company will then set the terms of the acquisition, including the number of new shares to be issued and the exchange ratio.

- The target company's shareholders will receive the new shares and become shareholders of the acquiring company.

- The acquiring company will take ownership of the target company, including its assets and operations.

It is important to note that the issuance of new shares can dilute the ownership percentage of existing shareholders, impacting their voting rights and control in the company. Therefore, it is crucial to carefully consider the potential effects of stock issuance on all stakeholders involved.

Additionally, the acquiring company must comply with state and federal securities laws, providing full disclosure to prospective investors about the company and the risks of the investment. Proper documentation and approval are essential to ensure good corporate housekeeping and a smooth due diligence process.

Overall, acquiring a business through stock issuance can be a strategic move for a company, allowing it to expand its operations and diversify its capital structure without incurring additional debt.

Owner Cash Investment: Is It an Expense?

You may want to see also

Frequently asked questions

Non-cash investing and financing activities are activities undertaken by companies that do not generate cash inflows or outflows. These include the issuance of common shares for dividends, the conversion of bonds or preferred shares, and the exchange of non-monetary assets.

While these activities do not generate cash flows, they can still significantly impact a company's financial position and capital composition.

Non-cash investing and financing activities are disclosed in a company's cash flow statement. They can be included in a separate note, a supplementary schedule, or a footnote.

An example of a non-cash activity is the issuance of common stock in relation to the conversion of preferred stock.

Other examples include acquiring property, plant, or equipment by assuming related liabilities, obtaining an asset by entering into a capital lease, and retiring debt by issuing additional debt.