Hedge funds are a type of alternative investment vehicle that pools capital from accredited investors and institutional investors to pursue a variety of investment strategies. They are designed to achieve high absolute returns, regardless of market conditions, and can employ a wide variety of risky investment strategies to do so.

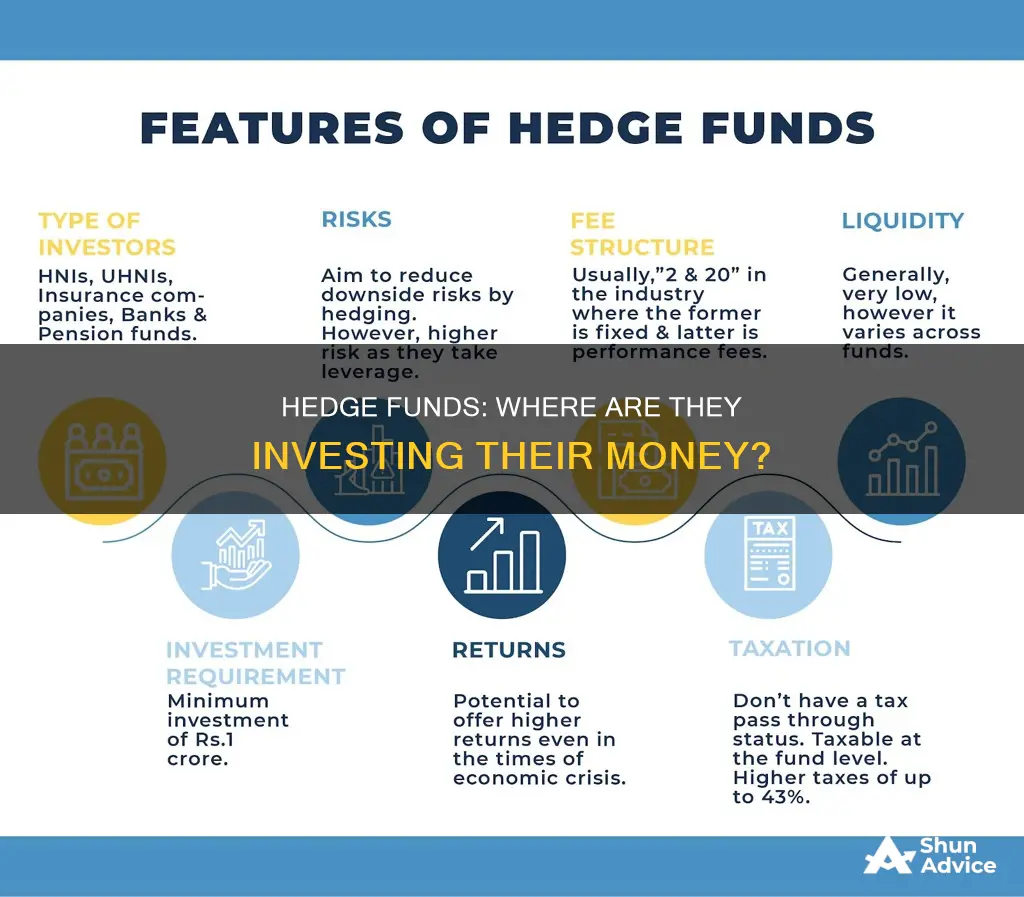

Hedge funds are not subject to the same regulations as mutual funds and may not be required to file reports with the U.S. Securities and Exchange Commission (SEC). They are known for the high fees they charge investors, with a typical fee structure of two and 20, where managers get 2% of the assets under management annually plus 20% of the profits of the fund above a set minimum.

Some of the largest and most well-known hedge funds include Citadel, Bridgewater, AQR, and D.E. Shaw.

| Characteristics | Values |

|---|---|

| Number of hedge funds worldwide | 30,077 |

| Number of Burger King restaurants worldwide | 18,700 |

| Number of hedge funds in the US | 65% of the total |

| Number of equity long/short hedge funds | >1,000 |

| Number of hedge funds focused on credit, quant or macroeconomics | Hundreds |

| Average annualized return of Millennium Management LLC | 14% |

US Treasury Bonds

Treasury bonds can be purchased at auctions held by the government or on the secondary market. They come in maturities of 4 weeks to 30 years, with longer maturities usually offering higher coupons. There are also zero-coupon bonds, which are sold at a discount to their face value; investors receive the full face value at maturity.

Hedge funds have played an increasingly important and diverse role in US Treasury markets. According to the Federal Reserve, hedge funds' US Treasury exposures doubled from early 2018 to February 2020, reaching $1.45 trillion in long exposure and $0.94 trillion in short exposure. This increase was primarily driven by relative value arbitrage trading and was supported by corresponding increases in repo borrowing.

The extent of hedge funds' US Treasury activities can be measured by their gross Treasury exposures, which include both long and short exposures of cash Treasury securities and US Treasury derivatives. Hedge funds typically finance their cash Treasury holdings with repo, with the majority of this borrowing taking place in the bilateral repo market.

During the March 2020 Treasury market turmoil, hedge funds' US Treasury holdings declined by an estimated $141 billion, or 13% of their total estimated holdings from February 2020. This was likely due to funds exiting their basis trades and selling Treasury securities to dealers.

Despite the decline, hedge funds continue to maintain a significant presence in the US Treasury market. As of December 2020, hedge funds had a gross US Treasury exposure of $1.6 trillion, with estimated holdings of Treasury securities at $793 billion.

Property Investment: Raising Capital for Your Dream

You may want to see also

Equities

Hedge funds are known to invest in a wide range of assets, including equities, bonds, commodities, currencies, derivatives, and alternative assets. Equities, in particular, are a popular choice for hedge funds, and there are several strategies they employ to maximise returns in this asset class.

One common strategy is long/short equity, where hedge funds take long positions in stocks they believe will increase in value and short positions in stocks they believe will decrease in value. This allows hedge funds to profit regardless of market direction. Another strategy is equity arbitrage, which involves investing in the entire capital structure of a company, often using derivatives. This can include merger arbitrage, event-driven strategies, convertible arbitrage, and option-volatility trading.

Hedge funds also employ quantitative strategies, using mathematical and statistical models to identify investment opportunities and manage risk. They may also take a fundamental approach, conducting in-depth research and analysis of companies before investing.

Some of the most common equity investments for hedge funds include well-known companies such as Microsoft, Amazon, Meta Platforms, Walmart, Bank of America, and Netflix. These companies are often targeted by hedge funds due to their strong financial performance, growth potential, or attractive valuations.

By utilising these strategies and investing in a diverse range of equities, hedge funds aim to achieve high absolute returns and outperform traditional investment vehicles.

Fidelity Freedom Fund: A Smart Investment Strategy?

You may want to see also

Derivatives

There are two types of derivatives commonly used in funds: futures and options. Futures give the investor an obligation to buy or sell a particular asset at an agreed future date. Options are similar but give the investor the right, rather than the obligation, to buy or sell an asset at a specific price at or before a given date.

Hedge funds invest in derivatives because they offer asymmetric risk. For example, a fund manager might buy a call option on 1,000 shares, rather than purchasing the shares outright. If the stock price rises, they can exercise the option and make a profit. If the stock price falls, they simply let the option expire, and the loss is limited to the small premium paid for the option.

While derivatives can be valuable tools for fund managers, they have also been criticised as "financial weapons of mass destruction" by famed investor Warren Buffett. In the lead-up to the 2008 financial crisis, derivatives played a significant role, with major US banks and hedge funds repackaging sub-prime mortgages into mortgage-backed securities, which eventually defaulted and contributed to the global financial crisis.

Best American Funds: Where to Invest Your Money

You may want to see also

Quantitative analysis

At its core, quantitative analysis in hedge funds revolves around developing complex mathematical models that leverage large datasets and statistical techniques. These models aim to identify patterns, trends, and relationships in various types of data, such as historical data series, financial metrics, and economic indicators. By analysing these data points, hedge funds can make more informed decisions about when to buy or sell specific assets.

One common approach is factor-based modelling, where predictor variables like price-earnings ratios or inflation rates are used to predict the value of a dependent variable, such as stock price changes. Hedge funds also use quantitative analysis to evaluate absolute and relative returns, considering factors like total return, risk-adjusted performance, and comparison with other investments or benchmarks.

It's important to note that while quantitative analysis provides a systematic and automated approach to investing, it still relies on human expertise. Individuals known as "quants" are responsible for conducting research, selecting data, and developing the mathematical models that drive investment strategies. Additionally, quantitative analysis should be complemented by qualitative analysis and risk assessment to make well-rounded investment decisions.

In conclusion, quantitative analysis in hedge funds is a powerful tool that leverages data and modelling to identify investment opportunities. By incorporating various data points and employing sophisticated algorithms, hedge funds can make strategic decisions with the aim of maximising returns while managing risk. However, it's crucial to recognise the limitations of purely quantitative approaches and integrate them with broader investment strategies for a comprehensive understanding of hedge fund performance.

Thematic Funds: Worth the Investment Risk?

You may want to see also

Risk management

- Portfolio Risk Mitigation: Hedge funds often employ portfolio risk mitigation strategies to navigate volatile market conditions. For example, during periods of market turmoil, funds may use hedging techniques, such as long/short strategies, to generate uncorrelated returns and protect against downside risks.

- Risk Parity and Portfolio Construction: Bridgewater Associates, a prominent hedge fund, is known for its risk-parity investing approach. This strategy involves constructing a portfolio that performs well across different economic conditions, aiming for uncorrelated returns.

- Quantitative Analysis and Modelling: Some hedge funds, like Two Sigma Investments and AQR Capital Management, utilise quantitative analysis and mathematical models to identify investment opportunities and manage risk. These models help analyse historical price patterns, predict future outcomes, and make data-driven investment decisions.

- Multi-Strategy Approach: Millennium Management, a leading hedge fund, employs a multi-strategy approach, including fundamental equity, equity arbitrage, fixed income, and quantitative strategies. By diversifying their strategies, they aim to manage risk and capture returns from various sources.

- Focus on Risk Management: Mariner Investment Group, another top hedge fund, emphasises risk management as an integral part of its investment strategies. They employ fixed-income multi-strategy and relative value approaches to identify idiosyncratic dislocations in the markets and make informed investment decisions.

- Event-Driven Strategies: Hedge funds often capitalise on market events and special situations, such as mergers and acquisitions, to make strategic investments. Event-driven strategies allow funds to identify and act on short-term opportunities while managing risk.

- Long-Term Focus: Some hedge funds, like Farallon Capital Management, take a long-term approach to investing. By focusing on absolute returns and having a higher average length of ownership, they aim to generate risk-adjusted returns over the long term rather than engaging in short-term trading.

Regulatory and Investor Considerations

Hedge funds, due to their complex nature and potential risks, are subject to specific regulatory and investor considerations:

- Limited Regulatory Oversight: Hedge funds operate with less regulatory oversight compared to traditional investment vehicles like mutual funds. This allows them to employ riskier strategies but also requires a higher level of due diligence and understanding from investors.

- Accredited Investors: Access to hedge funds is typically limited to accredited investors who meet specific net worth and income requirements. These investors are presumed to have a higher risk tolerance and a better understanding of the risks involved.

- High Fees: Hedge funds are known for charging high fees, often following a "two and 20" structure, which includes a management fee (e.g., 2% of assets under management) and a performance fee (e.g., 20% of the fund's profits). These fees incentivise fund managers to generate positive returns but also contribute to the overall risk profile of the investment.

- Due Diligence and Expertise: Individuals considering investing in hedge funds should conduct thorough due diligence and carefully assess their risk tolerance. Given the specialised nature of hedge funds, investors may benefit from seeking advice from financial professionals who have expertise in alternative investments.

Funding vs Investment: What's the Difference?

You may want to see also

Frequently asked questions

Hedge funds are invested in a broad range of assets, including stocks, bonds, commodities, currencies, derivatives and alternative assets.

Some of the most owned stocks by hedge funds include Microsoft, Amazon, Meta, Netflix, Berkshire Hathaway, Apple, Nvidia, and Alphabet.

Some of the largest hedge funds in the world include Citadel, Bridgewater, AQR, and D.E. Shaw.

Hedge fund investors are typically high-net-worth individuals, pension funds, and institutions.