The 2017 Tax Cuts and Jobs Act established Qualified Opportunity Funds (QOFs) to encourage investment in economically distressed communities. QOFs are investment vehicles that allow investors to defer and reduce their tax liability on capital gains by investing in real estate or business developments in designated opportunity zones. To qualify for these tax benefits, investors must reinvest their capital gains into a QOF within 180 days of realizing the gain. The amount of time an investment is held in a QOF determines the tax benefit received. For instance, holding an investment for over 5 years results in a 10% exclusion of the deferred gain, while holding for over 7 years increases this exclusion to 15%. If an investment is held for at least 10 years, investors may be able to permanently exclude gains resulting from the sale or exchange of the investment.

| Characteristics | Values |

|---|---|

| Purpose | Investing in Qualified Opportunity Zone property |

| Investment Vehicle | Corporation or partnership |

| Investment Location | Qualified Opportunity Zone |

| Investment Type | Real estate or business development |

| Investment Timing | Within 180 days of realizing the gain |

| Minimum Investment Period | 5 years |

| Tax Deferral | Until December 31, 2026 |

| Tax Exclusion (5 years) | 10% of deferred gain |

| Tax Exclusion (7 years) | 15% of deferred gain |

| Tax Exclusion (10 years) | No federal income taxes on fund's appreciation |

| Eligible Gains | Capital gains and qualified 1231 gains |

| Reporting Requirements | Annual filing of Form 8997 |

What You'll Learn

Eligible gains must be recognised before January 1, 2027

To be eligible for tax deferral, investors must recognise their gains before January 1, 2027. This is a key date, as it determines whether investors are eligible for the tax benefits of a Qualified Opportunity Fund (QOF).

QOFs were established as part of the 2017 Tax Cuts and Jobs Act to encourage investment in underfunded, low-income, and distressed communities. These areas are designated as "opportunity zones" and can include certain types of land or business development.

Investors can defer their tax payments on prior investment gains if those gains are then invested in a QOF within 180 days after the sale. Taxes are then deferred until either the day the fund investment is sold or exchanged, or December 31, 2026, whichever comes first.

The eligible gains must be recognised for federal income tax purposes before January 1, 2027, and cannot be from a transaction with a related person. This means that only capital gains or qualified 1231 gains recognised before this date will count towards the tax benefits of a QOF.

It's important to note that not all investments are eligible for QOF tax benefits. To be eligible, the investment must be in exchange for equity interest (not debt interest) within 180 days of realising the gain. Additionally, the amount of time an investor holds the QOF investment determines the tax benefit they receive.

By investing in a QOF, investors can benefit from tax deferral, a step-up in tax basis, and potentially no tax on appreciation if certain conditions are met.

Index Funds: Invest Now or Miss Out?

You may want to see also

Gains from related persons are ineligible

To be eligible for tax deferral on capital gains, the gains must be recognised for federal income tax purposes before January 1, 2027, and must not be from a transaction with a related person.

The Internal Revenue Service (IRS) defines a related person as an individual and the members of the individual's family and their spouses. Members of an individual's family include the individual's spouse, brothers and sisters (whole or half), ancestors, and lineal descendants. Membership in the individual's family can be the result of a legal adoption.

In the context of selling depreciable property, related persons also include:

- A person and all controlled entities with respect to that person.

- A taxpayer and any trust in which such taxpayer (or taxpayer’s spouse) is a beneficiary, unless that beneficiary's interest in the trust is a remote contingent interest.

- Except in the case of a sale or exchange in satisfaction of a pecuniary bequest, an executor of an estate and a beneficiary of that estate.

- Two or more partnerships in which the same person owns, directly or indirectly, more than 50% of the capital interests or the profits interests.

For information about which entities are controlled entities, see section 1239(c).

If you sell depreciable property to a related person and the sale is an instalment sale, you may not be able to report the sale using the instalment method. If you sell property to a related person and the related person disposes of the property before you receive all payments with respect to the sale, you may have to treat the amount realised by the related person as received by you when the related person disposes of the property.

If you sell depreciable property to certain related persons, you generally can't report the sale using the instalment method. Instead, all payments to be received are considered received in the year of sale. However, you can use the instalment method to report a sale of depreciable property to a related person if no significant tax deferral benefit will be derived from the sale. You must show to the satisfaction of the IRS that avoidance of federal income tax wasn't one of the principal purposes of the sale.

Retirement Funds: Risky Business for Long-Term Investors

You may want to see also

File Form 8997 annually

If you hold a qualifying investment in a Qualified Opportunity Fund at any point during the tax year, you must meet annual investor reporting requirements. This means filing Form 8997, Initial and Annual Statement of Qualified Opportunity Fund (QOF) Investments, with your timely filed federal tax return (including extensions).

Form 8997 is used to report the following:

- The amount of eligible gain that is being deferred

- The date of the inclusion event

- The fair market value of the qualifying investment

- The adjusted basis of the qualifying investment

- The amount of the reportable deferred gain

It is important to note that the timing of investments is crucial. To defer tax on an eligible gain, you must invest in a Qualified Opportunity Fund in exchange for equity interest within 180 days of realizing the gain. If you don't defer the gain, it would generally be recognized for federal income tax purposes on the first day of the 180-day period.

Additionally, the amount of time you hold the Qualified Opportunity Fund investment will determine the tax benefit you receive. When you elect to defer the gain, the basis in the Qualified Opportunity Fund investment becomes zero. However, the basis increases the longer you hold your interest in the fund. For example, if you hold your investment for at least 5 years, your basis will increase by 10% of the deferred gain. If you hold it for at least 7 years, your basis will increase by an additional 5%.

Best Mutual Funds for Short-Term Investment Goals

You may want to see also

Invest in a QOF within 180 days of realising gains

To qualify for tax advantages, you must invest in a Qualified Opportunity Fund (QOF) within 180 days of realising gains. This 180-day period is crucial for investors looking to defer their tax payments on prior investment gains. It's important to note that not all gains are eligible for this benefit. Only capital gains or qualified 1231 gains (gains on certain types of business properties) recognised for federal income tax purposes before January 1, 2027, will count. These gains also cannot be generated from transactions with a related person.

The process of investing in a QOF within the 180-day window is straightforward. You exchange your eligible gains for equity interest in the QOF, not debt interest. This distinction is essential for tax deferment. Once you've made the investment, you can elect to defer the gain on your federal income tax return using Form 8949. If you've already filed your tax return, you can still take advantage of this opportunity by filing an amended return or an Administrative Adjustment Request (AAR).

It's worth noting that the tax deferral benefit is temporary. You can defer your taxes until December 31, 2026, or until an inclusion event occurs, whichever comes first. An inclusion event is any occurrence that reduces or terminates your qualifying investment in the QOF. Examples of inclusion events include sales, gifts, or liquidation of the QOF.

By investing in a QOF within 180 days of realising gains, you not only defer your taxes on those gains but also take advantage of the potential for tax savings. The longer you hold your investment in the QOF, the greater your tax benefits become. If you hold your investment for at least five years, your basis (the amount of your investment) will increase by 10% of the deferred gain. This means you'll pay taxes on 10% less of your original gain. If you hold your investment for more than seven years, your basis will increase by an additional 5% of the deferred gain, resulting in a total tax exclusion of 15%.

Additionally, if you hold your investment in the QOF for at least ten years, you may be able to permanently exclude gain resulting from a qualifying investment when it is sold or exchanged. This exclusion occurs if you elect to adjust the basis of your QOF investment to its fair market value on the date of the sale or exchange.

Strategies for Investing in Average Mutual Funds Wisely

You may want to see also

Only 90% of assets need be in a Qualified Opportunity Zone

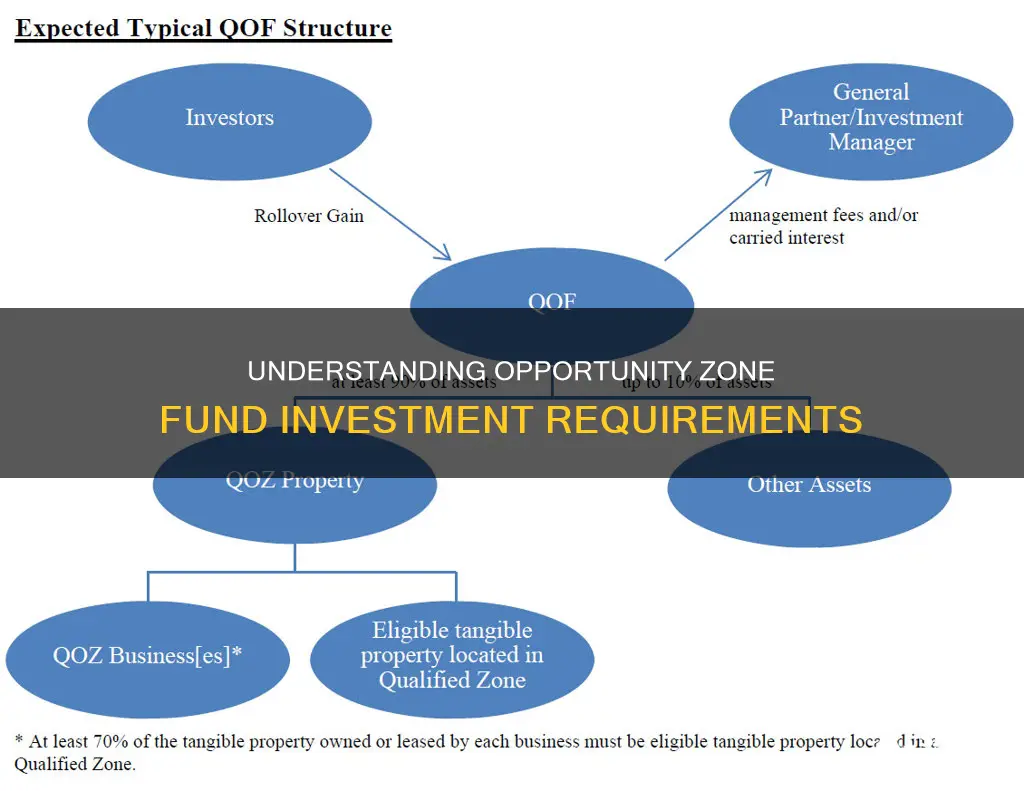

To become a Qualified Opportunity Fund, an investment fund must satisfy certain requirements. Firstly, it must be created by a corporation or partnership and file IRS Form 8996 with its federal income tax return. Secondly, it must invest at least 90% of its assets in Qualified Opportunity Zone properties. This is determined by the average percentage of Qualified Opportunity Zone property held on the last day of the first 6-month period of the tax year and the last day of the tax year of the fund.

A Qualified Opportunity Zone property refers to Qualified Opportunity Zone stock, a Qualified Opportunity Zone partnership interest, and Qualified Opportunity Zone business property. To meet the definition of Qualified Opportunity Zone business property, tangible property must be used in a trade or business and meet several requirements. These include the timing of acquisition, with property acquired after 31 December 2017 being eligible; the type of asset, which must be original or improved; and location in a Qualified Opportunity Zone, with the property located in the zone for the majority of the holding period.

It is important to note that certain types of businesses are excluded from Qualified Opportunity Zone investments, such as racetracks, gambling facilities, and liquor stores.

IRA and Mutual Funds: A Smart Investment Strategy

You may want to see also

Frequently asked questions

A Qualified Opportunity Fund (QOF) is an investment vehicle that drives business and real estate investments towards low-income or economically distressed areas of the country.

There are two main tax benefits of investing in Qualified Opportunity Funds: firstly, investors can defer paying taxes on their original capital gain until the tax year 2026; secondly, the longer you hold onto your investment, the greater your overall tax benefit. If you keep your investment for more than 5 years, your cost basis increases by 10%, excluding you from paying taxes on 10% of your realised capital gain. If you keep your investment longer than 7 years, your cost basis increases by an additional 5%, bringing your capital gains tax exclusion up to 15%. If you hold your investment beyond 10 years, you won't owe any capital gains tax on the fund's appreciation.

To be certified and maintained as a Qualified Opportunity Fund, an entity must file a federal income tax return as a partnership, corporation, or LLC treated as a partnership or corporation. It must be organised for the purpose of investing in Qualified Opportunity Zone property and must hold 90% of its assets in Qualified Opportunity Zone property.

A Qualified Opportunity Zone is a community nominated by the state and certified by the Treasury Department as qualifying for this program. Zones have been certified in all 50 states, Washington, D.C., and U.S. territories.

Qualified Opportunity Zone property refers to property that is a Qualified Opportunity Zone stock, a Qualified Opportunity Zone partnership interest, or a Qualified Opportunity Zone business property acquired after December 31, 2017, and used in a trade or business conducted in a Qualified Opportunity Zone.