Passive management investment vehicles, also known as passive investing, is a strategy that aims to maximise returns by minimising the costs of buying and selling securities. It is a passive strategy because managers who use this approach do not need to actively hunt for investments; they simply buy and sell the investments that their target benchmark trades. Passive management investment vehicles are associated with mutual and exchange-traded funds (ETFs) and are the opposite of active management, where a fund manager selects stocks and other securities to include in a portfolio. Passive management investment vehicles are cheaper, highly tax-efficient, and have generally outperformed active investments since the 2008 Financial Crisis.

| Characteristics | Values |

|---|---|

| Definition | An investment strategy that aims to maximise returns by minimising the costs of buying and selling securities |

| Type of Funds | Mutual funds or exchange-traded funds (ETFs) |

| Investment Strategy | Buy-and-hold approach, seeking to build wealth gradually |

| Costs | Lower fees and greater tax efficiency |

| Returns | Smaller short-term returns but superior after-tax results over medium to long time horizons |

| Risk | Subject to market risk, lack of flexibility, and smaller potential returns |

| Advantages | Less expensive and complex than active management, greater tax efficiency, lower fees, transparency, simplicity |

| Disadvantages | Smaller potential returns, lack of flexibility, over-exposure to a small number of sectors or stocks |

| Examples | S&P 500, Vanguard 500 Index Fund, FTSE 100, MSCI World Index |

What You'll Learn

Passive funds are cheaper to invest in than active funds

Passive management, also known as passive investing, is an investment strategy that aims to cut the costs of buying and selling securities. Passive funds are cheaper to invest in than active funds for several reasons.

Firstly, passive funds tend to have lower fees than active funds. Passive funds follow a market-weighted index or portfolio, which means they do not need to pay for extensive research and analysis to beat index returns. The lack of costly research also means that passive funds have lower operating costs. Passive funds also tend to have lower transaction costs due to reduced buying and selling. Passive funds often take a long-term, buy-and-hold approach, which means lower costs in the form of transaction fees, commissions, and taxable capital gains.

Secondly, passive funds benefit from economies of scale, as they are larger on average than actively managed funds. This means that passive funds can distribute costs across a larger fund, reducing relative costs.

The combination of these factors makes passive funds a cheaper option for investors than active funds.

Technology and Data Revolutionize Investment Management Strategies

You may want to see also

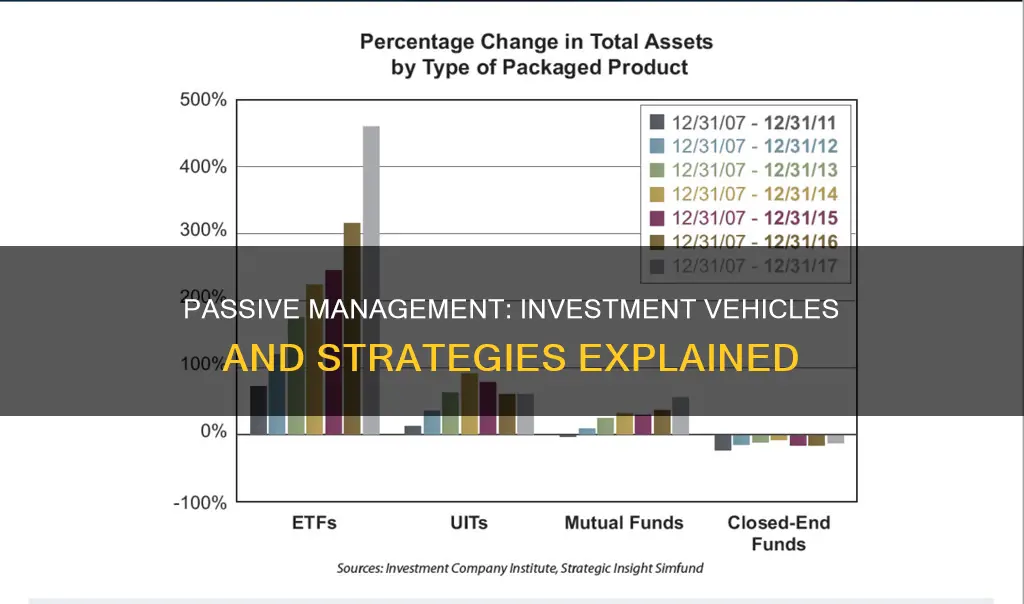

Passive funds are becoming more popular

Passive funds are becoming increasingly popular due to their various benefits over active funds. Passive funds aim to maximise returns by minimising the costs of buying and selling securities. They are also less expensive and complex than active funds, and they often produce superior after-tax results over medium to long time horizons.

Passive funds have gained traction among investors due to their low fees, transparency, and tax efficiency. The low-cost nature of passive funds, including ETFs and index funds, makes them an attractive option for investors, as they often outperform active fund managers. The competition among passive funds has also driven fees lower for active managers.

Another advantage of passive funds is diversification. By following a broad market index, passive funds invest in a diverse range of stocks across different sectors, reducing the risk associated with the performance of any single stock. This diversification benefit is particularly appealing to novice investors who may not have the expertise to select individual stocks.

Additionally, passive funds offer steady returns that are consistent with the broader market. While they may not generate higher returns during bull markets, they tend to outperform active funds during market downturns. This stability is attractive to investors seeking long-term financial goals.

The rise of passive funds can also be attributed to technological advancements. Innovations in technology have made it easier for investors to start their investment journey online. Platforms now offer detailed information and streamlined processes for investing in passive funds, making them more accessible to a wider range of investors.

Furthermore, passive funds are considered a low-effort investment strategy. They do not require the same level of active research and decision-making as active funds, making them appealing to investors who prefer a more hands-off approach.

The popularity of passive funds has shifted the investing industry, which was traditionally built on the expertise of stock-and-bond pickers aiming to beat the market. However, the growing trend towards passive investing has resulted in a concentration of power among a few large firms, which has raised concerns about investor herding and increased market volatility.

In summary, passive funds have gained popularity due to their low costs, diversification benefits, steady returns, ease of use, and alignment with long-term financial goals. These advantages have made passive funds an attractive option for investors seeking a simpler and more cost-effective approach to investing.

Actuaries: Investment Portfolio Management, a Necessary Skill?

You may want to see also

Passive funds are less complex than active funds

Passive investing is typically done by investing in a mutual fund or exchange-traded fund (ETF) that mimics the index's holdings. Passive investors simply buy and sell the investments that their target benchmark trades. This means that passive investors do not have to actively hunt for investments or conduct extensive research. Passive investing seeks to reduce the costs of selecting investments by simplifying the portfolio construction process and reducing fees triggered by frequent trading.

Passive investing is often, but not always, a long-term, buy-and-hold approach. This means holding securities for relatively long time periods to build wealth gradually. Avoiding frequent trading reduces costs in the form of transaction fees, commissions, and taxable capital gains. Passive investors do not seek to profit from short-term price fluctuations or market timing. Instead, they rely on the market's history of posting positive returns over time.

Passive funds are also more transparent than active funds, as it is always clear which assets are in a passive fund. They are also more tax-efficient, as their buy-and-hold strategy does not typically result in a massive capital gains tax for the year.

However, passive funds are limited to a specific index or predetermined set of investments with little to no variance. This means that investors are locked into those holdings, regardless of what happens in the market. Passive funds also offer smaller returns, as they rarely beat the market.

Presenting an Investment Portfolio: Strategies for Success

You may want to see also

Passive funds are less risky than active funds

Passive management, also known as passive investing, is an investment strategy that tracks a market-weighted index or portfolio. It is most common on the equity market, where index funds track a stock market index, but it is also used for other investment types, including bonds, commodities, and hedge funds.

Passive funds also benefit from greater diversification, as they track an index and, therefore, hold a broad market index or indices. This diversification reduces risk by spreading it across a wider variety of securities. Passive funds also have the benefit of low turnover, which helps to keep down internal transaction costs.

Additionally, passive funds are less risky because they are not subject to the same manager risk as active funds. Active funds are dependent on the skill of their manager, who may fall ill, move to a different fund, or develop personal problems that could impact the fund's performance. Passive funds, on the other hand, are not dependent on a single person in this way.

It is important to note that passive investing does come with its own risks. Passive funds will rise and fall with the market, and they lack the flexibility of active funds, as they are limited to a specific index or set of investments. However, despite these risks, passive funds have consistently outperformed active funds. Over three-quarters of active mutual fund managers are falling behind benchmarks such as the S&P 500 and the Dow Jones Industrial Average.

In summary, passive funds are less risky than active funds due to their lower fees, greater diversification, low turnover, and lack of manager risk. These factors contribute to the superior performance of passive funds over active funds, making passive funds a less risky choice for investors.

Savings vs Investments: What's the Real Difference?

You may want to see also

Passive funds are more tax-efficient than active funds

Passive management, also known as passive investing, is an investment strategy that aims to maximise returns by minimising the costs of buying and selling securities. It is a long-term, buy-and-hold strategy that seeks to build wealth gradually by avoiding frequent trading and reducing costs in the form of transaction fees, commissions, and taxable capital gains.

The tax efficiency of passive funds is further enhanced by their structure, which includes externalisation and in-kind redemptions. Externalisation refers to the trading of ETFs in the secondary market, insulating the fund from individual investors' trading activity. In-kind redemptions allow ETFs to satisfy redemption requests through in-kind deliveries of securities, rather than cash, resulting in tax-free transactions for remaining investors.

Additionally, passive funds have very low fees compared to active funds. Passive funds do not require extensive research and analysis of securities, as they simply track a market index. This lack of active management results in significantly lower fees, which can enhance overall returns for investors.

While passive funds offer greater tax efficiency and lower fees, it is important to consider the trade-offs. Passive funds may have smaller potential returns compared to active funds, as they are limited to tracking a specific market index. Active funds, on the other hand, have the flexibility to actively manage their investments and aim for higher returns, but this comes at the cost of higher fees and potentially higher taxes.

International Investment Management Services: Global Financial Strategies

You may want to see also

Frequently asked questions

Passive management is a style of management associated with mutual and exchange-traded funds (ETFs). With passive management, a fund's portfolio mirrors a market index. Passive management is the opposite of active management, where a fund manager selects stocks and other securities to include in a portfolio.

Passive management investment vehicles are funds that track a market index or a specific market segment to determine what to invest in. Examples of passive management investment vehicles include tracker funds, exchange-traded funds (ETFs), and index funds.

Passive management investment vehicles are typically cheaper to invest in than active funds, as they require less time and effort from fund managers. They also benefit from ease of trade and high transparency.