Investing in mutual funds is a popular choice for many, especially those looking to diversify their portfolios. While mutual funds offer several benefits, they also come with various costs and expenses that can impact your overall returns. These costs can be broadly categorised into management fees, trading fees, and sales charges.

Management fees, also known as expense ratios, are charged annually for fund management and administrative costs. Trading fees, or trading expense ratios, are incurred when the fund's management team buys and sells stocks within the fund. Sales charges, or loads, are fees paid when buying or selling shares in the fund.

Other costs may include redemption fees, account fees, and commissions. It is important to carefully review the fund's prospectus, which outlines all associated fees and expenses, to make informed investment decisions. Understanding these costs is crucial, as they can significantly affect your investment returns over time.

| Characteristics | Values |

|---|---|

| Management expense ratio (MER) | The fee charged to manage the money invested in a mutual fund. |

| Trading expense ratio (TER) | The amount of trading commissions incurred when the portfolio management team buys and sells equities (stocks) within a given fund. |

| Sales charges | A load is a sales charge that an investor may incur when buying or redeeming units or shares in a mutual fund. |

| No-load funds | No sales charges are paid when a no-load fund is purchased or redeemed. |

| Front-end load | A sales charge paid upon purchase of a fund and is expressed as a percentage of the amount you invest (ranging from 0% to 5%). |

| Back-end load | A fee incurred when selling. |

| Commissions | Fees paid to the broker for their services. |

| Redemption fees | A fee when you sell shares within a short period (usually 30 to 180 days) after purchasing them. |

| Other account fees | Some funds or brokerage firms may charge extra fees for maintaining your account or transactions, especially if your balance falls below a certain minimum. |

| Annual fees | $25 to $90 a year. |

| Custodian fees | $10 to $50 per year. |

What You'll Learn

Management expense ratio (MER)

The MER is made up of the fund's management fee, operating expenses, and taxes. The management fee is paid to the fund's managers for their role in researching and buying assets with an eye toward beating the market. Operating expenses include administrative costs, marketing expenses, and distribution costs. Taxes include payments to the government, such as capital gains tax.

MERs can vary significantly from fund to fund and are an important consideration when choosing a mutual fund. A high MER will reduce the returns on an investment over time. For example, if a mutual fund returns 8% and has an MER of 1.5%, the investor will only earn 6.5% on their shares.

It is important to note that MERs are often not tied to performance. If the assets of a fund decrease, the fund managers may raise the MER to make up for the loss. This means that investors could end up paying more for poorer performance.

When considering investing in a mutual fund, it is crucial to carefully review the fund's prospectus, which contains a fee table listing all the charges associated with the fund. By law, this must include the MER.

Saudi Wealth Fund: Where is it Invested?

You may want to see also

Trading expense ratio (TER)

The Trading Expense Ratio (TER) is a measure of the total costs associated with managing and operating a mutual fund. These costs include management fees, trading fees, legal fees, auditor fees, and other operational expenses. The TER is calculated by dividing the total cost of the fund by its total assets, and it is expressed as a percentage. The TER is meant to capture the entire cost that an investor can expect from owning a mutual fund, although some charges such as commission, stockbroker fees, securities transfer tax, and annual advisor fees are not included.

The TER is important to investors because it affects their returns. For example, if a fund generates a 7% return in a year but has a TER of 4%, then the gain is diminished to roughly 3%. The TER is also known as the net expense ratio or the after-reimbursement expense ratio.

The TER of a mutual fund depends on various factors, including the fund's inflows and outflows, the liquidity of the securities it holds, and the efficiency of its trading desk. The more actively managed a fund is, the higher its TER will be due to increased personnel costs and transaction-based fees. In contrast, an automated or passive fund has significantly lower costs of operation, resulting in a lower TER.

TERs typically only apply to funds that hold equities (stocks). Most fixed-income funds do not have a TER because commissions for these funds are already embedded in the price of a bond.

Mutual fund investors need to be aware of the various fees and expenses that can impact their returns. The TER is one of these costs, and it is important for investors to consider when evaluating potential investments.

Hedge Funds: Why Investors Take the Plunge

You may want to see also

Sales charges

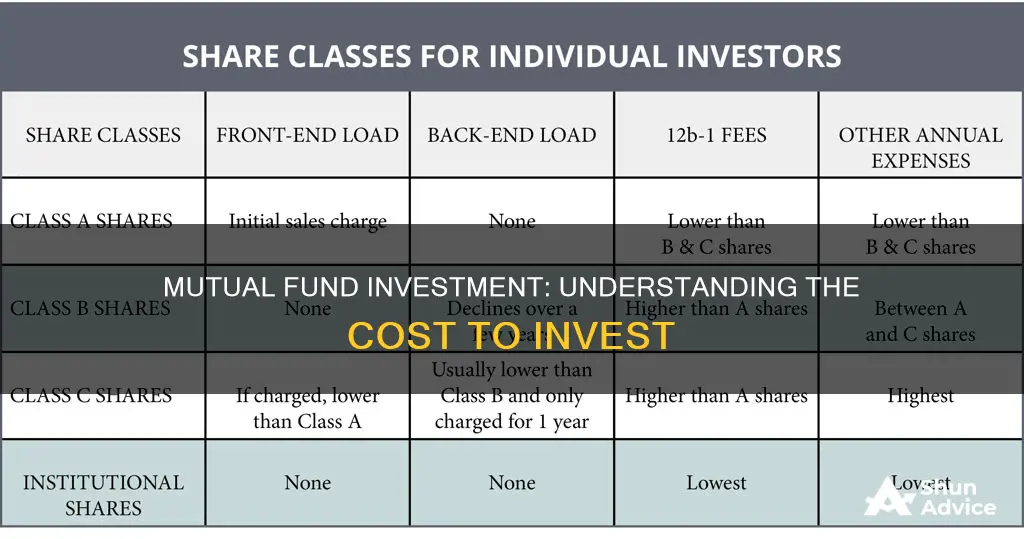

There are two main types of sales charges: front-end sales charges and back-end sales charges. Front-end sales charges are paid as a percentage of the purchase price at the time of investment, while back-end sales charges are paid as a percentage of the selling price at the time of sale. Back-end sales charges are also referred to as deferred sales charges, as they decline over time, eventually reaching zero.

Investors should carefully review the fund's prospectus to understand all the charges that may apply, including sales charges and other fees. Some funds, known as no-load funds, do not charge any type of sales load. However, it's important to note that even no-load funds may charge other types of fees, such as purchase fees, redemption fees, exchange fees, and account fees.

In addition to sales charges, mutual funds may also have other costs associated with them, such as management fees, distribution fees, and service fees. These fees are typically included in the fund's annual fund operating expenses, which cover the cost of paying managers, accountants, legal fees, marketing, and more.

Citadel Hedge Fund: A Guide to Investing with the Best

You may want to see also

Annual and custodian fees

Annual fees are typically low, ranging from $25 to $90 per year, but every dollar adds up. Custodian fees, which are usually applied to retirement accounts such as IRAs, cover the costs of complying with IRS reporting regulations and typically cost between $10 and $50 per year.

Custodian fees are among the operating expenses that are deducted from a fund's assets, reducing investment returns. These fees are paid to service providers such as custodians, transfer agents, and accountants.

Mutual funds also incur trading costs when buying and selling portfolio securities, and these costs are factored into the fund's overall performance.

Index Funds: A Smart Investment Strategy for Your Money

You may want to see also

Advisory fees

The expense ratio of a mutual fund is not always easy to identify upfront, but it is worth the effort to understand, as these fees can eat into your returns over time. For example, if a mutual fund returns 8% and has an expense ratio of 1.5%, you will only earn 6.5% on your shares.

In addition to advisory fees, there are other costs associated with investing in mutual funds, such as sales charges, trading expense ratios, and redemption fees. It is important for investors to carefully consider all the costs involved before investing in mutual funds, as these costs will impact their overall returns.

Mutual Funds in the Philippines: Best Places to Invest

You may want to see also

Frequently asked questions

There are several costs associated with investing in mutual funds, including:

- Management expense ratio (MER)

- Trading expense ratio (TER)

- Sales charges, also known as loads

- Annual fees

- Custodian fees

- Commissions

- Redemption fees

- Account fees

These costs can vary depending on the type of mutual fund and the brokerage firm. It's important to carefully review the fund's prospectus and consider the impact of these costs on your investment returns.

Mutual funds typically charge an expense ratio, which is a percentage of the fund's assets used to cover administrative and operating expenses. This is different from other investments, such as stocks or bonds, which may have different types of fees and commissions. However, it's important to note that mutual funds may also incur additional costs, such as trading costs and custodian fees.

To minimise the costs of investing in mutual funds, investors can consider the following strategies:

- Choose no-load funds, which do not incur sales charges or commissions.

- Opt for passive investing, which often entails lower fees than active investing.

- Compare different brokerage firms and funds to find those with lower fees and expenses.

- Understand the tax implications of your investments and consider using tax-deferred or tax-exempt accounts.

- Buy and hold your investments for the long term to avoid frequent trading costs.