Investing your savings in mutual funds can be a great way to diversify your portfolio and protect your savings. Mutual funds are a popular investment option as they are relatively hands-off and allow you to invest in many different assets at once. They are also considered safer than investing in individual stocks due to the inherent diversification they offer. However, it's important to remember that all investments carry some risk, and you can potentially lose money in mutual funds. The right investment choice for you will depend on your individual financial situation, goals, and risk tolerance.

| Characteristics | Values |

|---|---|

| Instant diversification | Mutual funds invest across dozens or hundreds of individual stocks, bonds, or other securities |

| Reduced risk | Large groups of stocks tend to ride out market volatility better than individual stocks |

| Access to different markets | Mutual funds provide access to many different parts of the market, even within the broad asset classes of stocks and bonds |

| Professional management | Mutual fund managers can save investors time and effort, and they are guided by disciplined rules rather than emotions |

| Affordability | Mutual funds offer diversification and convenience at a low cost |

| Tax implications | Mutual funds that sell investments that have increased in price may impact the capital gains taxes you owe |

What You'll Learn

Diversification and convenience

Mutual funds are a good investment option for those looking to diversify their portfolios. They are a safer option than investing in individual stocks as they invest across dozens or even hundreds of individual stocks, bonds, or other securities. This means that if one stock declines, it will not have a large impact on your investment performance.

Mutual funds also provide access to different markets and asset classes, reducing the risk of your investment being affected by bad news in one sector. They can give you exposure to large or small companies, those focused on growth or paying out dividends, and companies in developed or emerging markets.

Another benefit of mutual funds is that they are professionally managed. It would take a lot of time and effort to replicate the diversification that mutual funds offer by buying individual stocks. Mutual fund managers can do this work on your behalf, and because they buy and sell in large blocks, their transaction costs are generally minimal. They are guided by disciplined rules when picking investments, so they are not subject to the same emotional influences as individual investors.

Mutual funds are also a convenient option as they are relatively hands-off. They are a good choice for investors who don't want to spend time picking and choosing individual investments but still want to benefit from the stock market's high average annual returns.

When deciding whether to invest in mutual funds, it's important to consider your individual situation and goals. There are different types of mutual funds, such as index funds and actively managed funds, each with its own advantages and disadvantages. It's also crucial to understand the fees associated with mutual funds, such as expense ratios and sales commissions, which can impact your returns.

Mutual Fund Investment: Taxable or Not?

You may want to see also

Access to different markets

Investing in mutual funds can provide access to a wide range of different markets, even within the broad asset classes of stocks and bonds. This means that you can gain exposure to different sectors and industries, which can help to diversify your portfolio and reduce risk.

For example, within the stock market, mutual funds can give you access to large or small companies, those focused on growth or paying out dividends, and companies located in large developed or emerging market countries. This allows you to invest in a variety of businesses and potentially reduce the impact of any one company's performance on your portfolio.

Mutual funds also offer access to different types of bonds, including corporate bonds, government bonds, international bonds, and inflation-protected bonds. These different bond classes can provide a more stable rate of return and are considered a safer investment than stocks, as governments and companies typically pay back their debt.

Additionally, mutual funds can provide access to other asset classes, such as real estate investment trusts (REITs) and commodities. This diversification across different markets and asset classes can help to further reduce risk and provide a more stable investment portfolio.

By investing in mutual funds, you can gain exposure to many different parts of the market, allowing you to invest in a wide range of companies and assets that may be difficult to access individually. This access to different markets can provide a level of diversification that is often challenging to achieve through individual stock or bond investing.

Low-Cost Index Funds: When to Steer Clear

You may want to see also

Professional management

One of the primary benefits of investing in mutual funds is that they offer professional management. Mutual funds are overseen by professional fund managers who make investment decisions based on extensive research and analysis. These fund managers are responsible for deciding how to invest your money to generate returns. This can be a significant advantage for investors who may not have the time, expertise, or inclination to actively manage their investments.

When you invest in a mutual fund, you are entrusting your money to a professional money manager who will make investment decisions on your behalf. These managers are typically highly experienced and skilled in financial research, strategy development, and market analysis. They have the resources and expertise to monitor the markets, evaluate potential investments, and make informed decisions about when to buy or sell assets. This level of expertise can be beneficial, especially for those who are new to investing or who have limited time to actively manage their investments.

The professional management provided by mutual funds offers several advantages. Firstly, it allows investors to leverage the expertise of fund managers, who often have access to sophisticated research tools and market data. This can lead to more informed investment decisions and potentially better returns. Secondly, professional management saves investors time and effort. Active investing requires a significant time commitment to research, monitor, and adjust your portfolio, which may not be feasible for everyone. Mutual funds handle these tasks for you, allowing you to focus on other financial goals or priorities.

Additionally, professional management can help mitigate risks. Fund managers employ strategies to diversify portfolios, balance risk, and maximize returns. They consider various factors, such as economic conditions, market trends, and individual asset performance, to make investment decisions. By diversifying across different assets, sectors, and industries, fund managers can reduce the impact of market volatility on your investments. This diversification also helps spread your risk, as a decline in one sector may be offset by gains in another.

It is important to remember that professional management does not guarantee market-beating returns. The performance of a mutual fund depends on various factors, including the specific holdings, the manager's skill, and overall market conditions. While professional management can enhance your investment strategy, it is not a guarantee of success. It is always essential to consider your financial goals, risk tolerance, and time horizon when deciding whether to invest in mutual funds.

Vanguard Dividend Growth Fund: A Comprehensive Investment Guide

You may want to see also

Types of mutual funds

There are several types of mutual funds, each with its own unique characteristics and potential benefits. Here are some of the most common types:

Equity Mutual Funds

Equity mutual funds primarily invest in stocks, including common stock, preferred stock, and securities that can be converted into common stock. They are often categorised based on the size and style of the companies they invest in, such as large-cap, mid-cap, or small-cap funds. Equity funds generally have a higher potential for growth but also come with more potential volatility in value.

Fixed-Income Mutual Funds

Fixed-income mutual funds, including bond funds, invest in government and corporate debt. They are considered safer and less volatile than equity funds but typically offer lower potential returns. Bond funds are suitable for investors seeking a more stable investment option.

Money Market Mutual Funds

Money market mutual funds are a type of fixed-income fund that invests in high-quality, short-term debt instruments, such as U.S. Treasuries and certificates of deposit. They are considered one of the safest investment options and often provide returns between 1% and 5% annually.

Balanced or Hybrid Funds

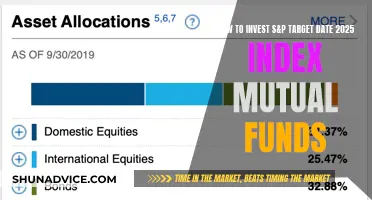

These funds invest in a combination of stocks and bonds, maintaining a fixed ratio of investments, such as 60% stocks and 40% bonds. Target-date funds are a popular type of balanced fund that automatically adjusts the asset allocation based on the investor's retirement timeline.

Index Funds

Index funds aim to match or track the performance of a specific market index, such as the S&P 500. They have gained popularity due to the rise of passive investing strategies, which have shown to earn better returns over time compared to actively managed funds.

Specialty or Alternative Funds

This category includes various types of funds that do not fall into the traditional categories, such as hedge funds, managed futures, commodities, and real estate investment trusts. Socially responsible investing funds, which focus on environmental and labour practices, are also gaining traction among investors.

Putnam Short Duration Fund: A Safe Investment Bet?

You may want to see also

Mutual funds vs savings accounts

There are several factors to consider when deciding whether to put your savings into a mutual fund or a savings account. Here are some key points to help you make an informed decision:

Diversification: Mutual funds offer instant diversification by investing in dozens or even hundreds of individual stocks, bonds, or other securities. This reduces the risk associated with investing in just a handful of stocks. Additionally, history shows that large groups of stocks tend to ride out market volatility better than individual stocks, providing a more stable investment option.

Access to Different Markets: Mutual funds provide access to various parts of the market, including large or small companies, growth-focused or dividend-paying companies, and businesses in developed or emerging markets. This allows you to invest in different asset classes, which helps further diversify your portfolio.

Professional Management: Mutual fund managers handle the buying and selling of stocks and securities on your behalf, saving you time and effort. They make investment decisions based on disciplined rules, rather than emotional factors, and their transaction costs are generally minimal due to the large volume of trades they make.

Fees and Expenses: Mutual funds typically have expense ratios that cover the fund's operating expenses. Actively managed funds, where fund managers aim to outperform the market, tend to be more expensive than passive index funds. It's important to consider the fees associated with each type of fund when making your decision.

Liquidity and Flexibility: While mutual funds offer liquidity, allowing you to buy or sell them with relative ease, there may be fees associated with early withdrawals. Additionally, the value of your investment may fluctuate, and you could lose money if you need to withdraw during a market downturn. Savings accounts, on the other hand, offer more flexibility in accessing your funds without penalties or fees.

Risk and Returns: Mutual funds, especially stock or equity mutual funds, offer higher potential returns but also come with higher risks. The performance of different categories of stock mutual funds varies, with large-cap, high-growth funds typically being more volatile than stock index funds. Bond mutual funds provide more stability but lower potential returns, while money market mutual funds offer the lowest returns but are considered one of the safest investment options.

In summary, mutual funds can be a good option for long-term growth and diversification, but they come with risks and potential fees. Savings accounts, on the other hand, offer more flexibility and stability but may not keep up with inflation in the long run. The decision between mutual funds and savings accounts depends on your financial goals, risk tolerance, and time horizon.

A Secure Guide to Insurance Fund Investment

You may want to see also

Frequently asked questions

Mutual funds are a good way to diversify your portfolio. They are simple, affordable and provide instant diversification. They are also highly liquid, meaning they are easy to buy or sell. However, whether to invest in them depends on your individual situation.

All investments carry some risk, but mutual funds are typically considered a safer investment than purchasing individual stocks. Since they hold many company stocks within one investment, they offer more diversification than owning one or two individual stocks.

It is possible to become rich by investing in mutual funds. Many investors build their entire retirement nest egg by investing in them. Due to compound interest, your investment will likely grow in value over time.

All investments carry some risk, and you can lose money by investing in a mutual fund. However, diversification is often inherent in mutual funds, meaning that by investing in one, you’ll spread risk across a number of companies or industries.