Investment product managers are responsible for developing and implementing strategies to sell investment products. This involves working closely with various teams across the organisation, such as design, engineering, marketing, and sales, to bring the product to market. They also need to have a strong understanding of finance and accounting to effectively manage budgets and analyse financial data. In addition, investment product managers are often involved in assessing competitor products, making recommendations for mergers or fund eliminations, and setting fund pricing. The role requires strong communication and leadership skills, as well as extensive knowledge of the investment field.

| Characteristics | Values |

|---|---|

| Role | Lead and motivate teams to achieve desired outcomes |

| Education | Bachelor's degree in finance, marketing, business management or a related field; Master's degree in business administration |

| Experience | 5+ years in a finance or management role |

| Skills | Accounting, budgeting, teamwork, communication, time management, project management, analysis |

| Day-to-day tasks | Reading financial news; meeting with legal, compliance, sales, marketing, and other teams; analysing competitor products; financial analysis; presenting strategies to partners and shareholders |

What You'll Learn

Developing a strategy to sell a product

Developing a strategy to sell an investment product involves several key steps and considerations. Here is a detailed guide:

Understanding the Product and Market

Firstly, investment product managers need to have a comprehensive understanding of the investment product they are tasked with selling. This includes knowing the product's strengths, unique features, and target audience. It is also crucial to conduct a thorough analysis of the market, including competitors' offerings and pricing strategies. This competitive intelligence will inform the positioning and pricing of the investment product.

Developing the Product Strategy

The next step is to develop a forward-looking and comprehensive product strategy. This involves defining the product's value proposition, target customer base, and unique selling points. Product managers must also outline the goals and potential risks associated with the product. This strategy document will guide the product's development, marketing, and distribution.

Collaborating with Internal Teams

Effective collaboration with various internal teams is essential. Investment product managers work closely with design, engineering, and marketing teams to develop and refine the product. They ensure the product meets all regulatory and legal requirements by liaising with the legal and compliance teams. Additionally, they coordinate with sales teams to create effective collateral and train them on positioning the product with potential investors.

Monitoring and Adjusting

The work doesn't stop once the product is launched. Investment product managers need to continuously monitor the product's performance, market trends, and competitor activities. By staying agile and responsive, they can make necessary adjustments to the product strategy, pricing, or distribution channels to ensure the product remains competitive and successful.

Communicating with Stakeholders

Strong communication skills are vital as investment product managers regularly interact with partners, shareholders, and clients. They present their product strategies, outline risks and opportunities, and address any concerns. Effective communication ensures that stakeholders are informed and on board with the product's direction.

Continuous Learning and Adaptation

To stay ahead in the dynamic world of investments, product managers must commit to continuous learning. This includes staying updated on financial news, market trends, and regulatory changes. By doing so, they can identify emerging trends, anticipate customer needs, and develop innovative products to meet those needs.

In summary, developing a strategy to sell an investment product requires a combination of analytical, strategic, and collaborative skills. Investment product managers play a pivotal role in bringing new investment products to market, ensuring their success, and driving the growth of their firms.

Maximizing Your Savings: Safe Investment Strategies for Beginners

You may want to see also

Leading and motivating teams

A key part of leading and motivating teams is developing strong, collaborative relationships across various departments. This means fostering good communication and alignment across leadership, design, engineering, analytics, and marketing teams. It is also important to build relationships with external partners, such as third-party vendors, to effectively sell and distribute products.

To lead and motivate teams, investment product managers need strong teamwork skills and the ability to inspire their fellow team members. This involves having excellent independent decision-making skills and the ability to manage multiple projects with short timelines. Problem-solving skills are also essential, as managers need to quickly evaluate problems, identify root causes, and create action plans.

In addition, investment product managers must possess strong communication skills to effectively present their strategies to partners, shareholders, and clients. They may also need to pitch their products to third-party vendors and potential clients, which may involve travel.

Overall, leading and motivating teams as an investment product manager requires a combination of technical expertise, strong communication skills, and the ability to foster collaboration and inspire team members to achieve their goals.

Kids' Guide to Saving, Investing, and Financial Worksheets

You may want to see also

Creating a product plan

Understanding the Market and Competitive Analysis:

Begin by conducting a thorough analysis of the market and the competitive landscape. Identify gaps in the market where new product opportunities exist. Study competitors' products to assess their strengths and weaknesses and determine how your firm's products can be positioned uniquely. This intelligence will guide your product development process and help you make informed decisions about merging or eliminating funds and setting prices.

Defining the Target Audience:

Clearly define the target audience for your investment product. Consider factors such as demographics, investment goals, risk tolerance, and investment experience. Understanding your target audience will help tailor your product to their needs and preferences, making it more appealing and successful.

Product Development and Strategy:

Work closely with cross-functional teams, including design, engineering, compliance, and legal, to develop a product that meets regulatory and legal requirements. Define the product specifications, features, and benefits, ensuring they align with the needs and preferences of your target audience. Create a clear product roadmap, outlining milestones and timelines for development, testing, and launch.

Marketing and Sales Strategy:

Collaborate with the marketing and sales teams to craft compelling promotional materials and a distribution strategy. Define the pricing structure, considering the value offered and the competition. Develop a comprehensive plan for reaching your target audience, including digital and traditional marketing channels. Ensure that the sales team is equipped with the necessary collateral and knowledge to effectively sell the investment product to potential investors.

Risk Assessment and Mitigation:

Identify potential risks associated with the product, such as market volatility, regulatory changes, or operational issues. Develop risk mitigation strategies for each identified risk to minimize their impact on the product's success. This demonstrates foresight and adaptability in your product plan.

Performance Measurement and Iteration:

Establish key performance indicators (KPIs) to measure the success of your product plan. Regularly monitor and evaluate the performance of the investment product post-launch. Use this data to identify areas for improvement and make iterative adjustments to enhance the product and optimize its performance over time.

Creating a robust product plan involves a deep understanding of the market, regulatory environment, and target audience, coupled with effective cross-functional collaboration. It is an ongoing process that requires flexibility and adaptability to ensure the investment product's success.

Key Features of an Investment Portfolio

You may want to see also

Working with other departments

Product managers are the link between the company and the market. They are cross-functional leaders who collaborate with all departments involved with the product. This includes working with the design and engineering teams to develop the product, the marketing team to market it effectively, and outside vendors to distribute and sell it.

They also need to align and motivate internal stakeholders, including researchers, analysts, and marketers, who help gather input, and developers and designers, who manage the day-to-day execution. Product managers need to be able to influence without authority and empower their team to make decisions by creating a shared brain or a set of criteria for decision-making.

Additionally, product managers need to have strong communication skills to present their product strategy to partners and shareholders and pitch their product to third-party vendors and clients. This often involves travel to meet with customers and potential clients.

Overall, the role of an investment product manager is highly collaborative, requiring strong leadership, communication, and interpersonal skills to work effectively with other departments.

Credit Union and Investment Management: What's the Link?

You may want to see also

Analysing existing offerings

To start, an investment product manager will need to have a comprehensive understanding of their company's existing products. This includes knowledge of the features, benefits, and limitations of each offering. They will assess how these products are performing in the market, evaluating sales data, customer feedback, and market trends. This analysis helps identify areas where the company is succeeding and where there is room for improvement. For instance, they might identify a product that is underperforming and recommend changes to the pricing strategy or target audience.

Competitive intelligence is another crucial aspect of analysing existing offerings. Investment product managers will study competitors' products to understand their strengths and weaknesses relative to their company's offerings. They will assess factors such as pricing, product features, marketing strategies, and target markets. This analysis helps identify opportunities to differentiate their company's products and enhance their competitiveness. For example, by understanding the pricing strategies of rival firms, an investment product manager can make more informed decisions about their own product's pricing to ensure it remains attractive to customers.

Additionally, investment product managers will also consider market trends and emerging customer needs. They will stay up to date with industry developments, regulatory changes, and economic trends to anticipate future shifts in the market. This involves regularly reviewing industry publications, financial news, and research reports. By doing so, they can identify gaps in the market that their company's products can fill. For instance, they might identify a growing demand for sustainable investment options and work towards developing products that meet these evolving customer needs.

The analysis of existing offerings also involves evaluating the performance of different distribution channels. Investment product managers will assess the effectiveness of the company's current distribution channels, which may include online platforms, financial advisors, or third-party vendors. By understanding which channels are most successful in reaching target customers, they can optimise their distribution strategies and ensure their products are accessible to the right audiences.

Finally, investment product managers will also be involved in assessing the profitability of existing products. They will analyse financial data, such as revenue, costs, and margins, to evaluate the financial performance of each offering. This analysis helps identify products that may need to be discontinued or repositioned in the market. By regularly reviewing the financial viability of their company's offerings, investment product managers can make data-driven decisions to ensure the overall success of their product portfolio.

Allocating Investment Management Fee Deductions to Unrealized Gains

You may want to see also

Frequently asked questions

An investment product manager is a professional who works in the financial services industry and is responsible for the development and launch of new investment products.

Investment product managers are responsible for creating and executing product strategies, from the initial planning stages to the final launch. This includes working with various teams such as design, engineering, marketing, and sales to develop, market, and distribute the product effectively. They also conduct financial analysis to assess the product's cost and potential margin.

Investment product managers typically need a bachelor's degree in a related field such as finance, marketing, or business management. Many individuals also pursue a master's degree in business administration (MBA) or relevant certifications like the Chartered Financial Analyst (CFA) or Chartered Alternative Investment Analyst (CAIA) programs. Additionally, strong teamwork, communication, and leadership skills are essential, along with extensive knowledge of finance and marketing.

According to Glassdoor, the average salary for an investment product manager in the United States is $194,025 per year, with salaries ranging from $146,825 to $260,464 per year.

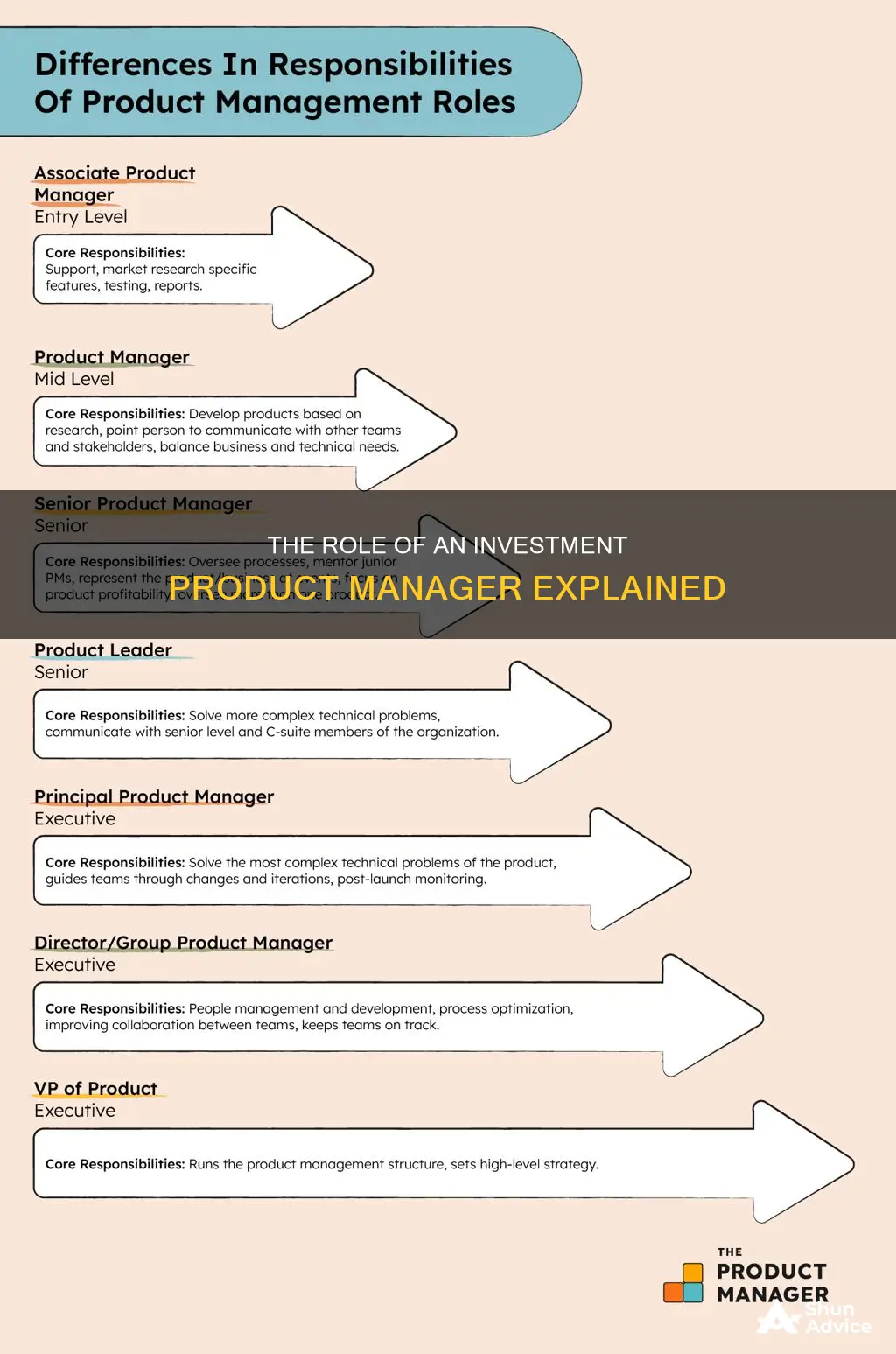

Investment product managers can find employment opportunities in various industries, including finance, insurance, consulting, and technology. They can work for investment firms, banks, asset management companies, and other financial institutions. With experience, they can advance to senior-level positions, such as senior product manager or director of product.