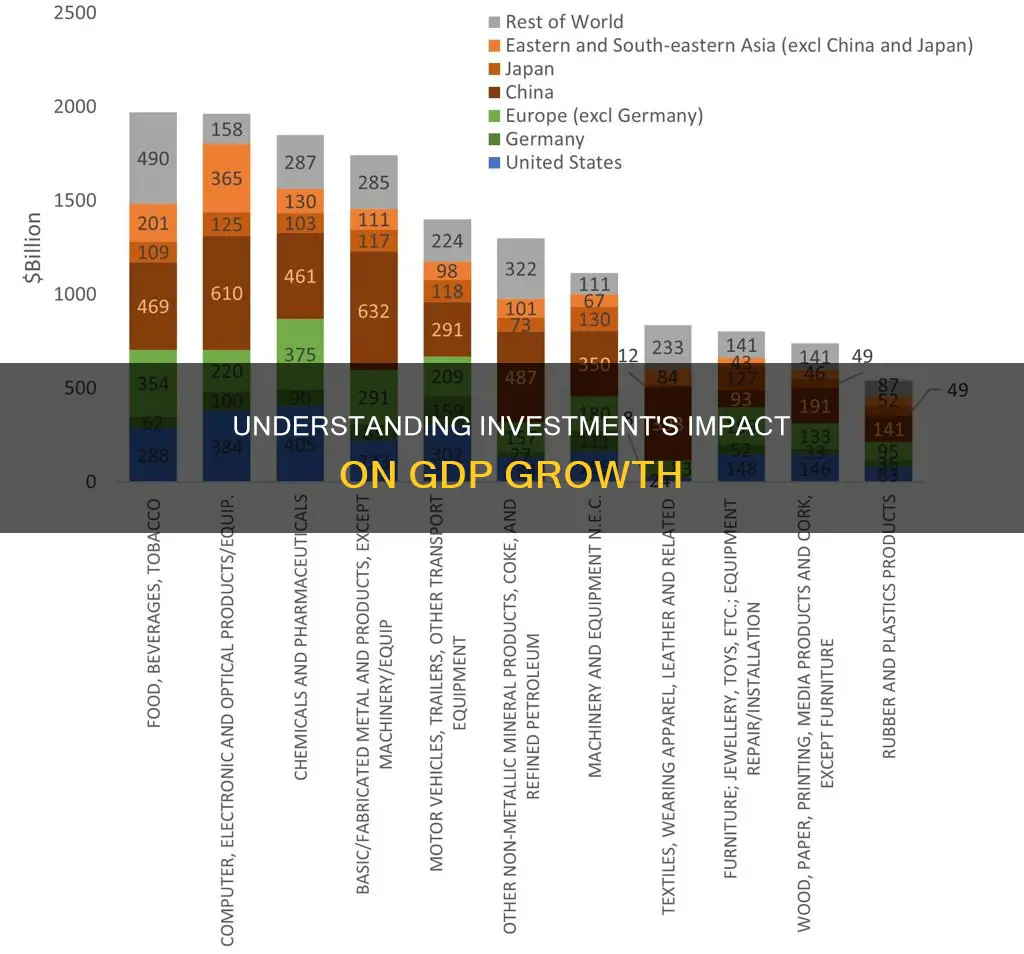

Investment plays a crucial role in understanding a country's Gross Domestic Product (GDP), which measures the total value of goods and services produced within a country in a specific time period. In the context of GDP, investment refers to the purchase of capital goods, such as machinery, equipment, and infrastructure, which are essential for the production of other goods and services. This includes both private investment, made by businesses and individuals, and public investment, funded by governments. The level of investment directly impacts a country's GDP, as it contributes to the overall economic output and can drive economic growth. Understanding the relationship between investment and GDP is vital for policymakers and economists to assess the health of an economy and make informed decisions regarding economic development and financial strategies.

What You'll Learn

- Investment in GDP: The role of capital expenditure in economic growth

- Gross Fixed Capital Formation: Measures business investment in physical assets

- Residential Investment: Spending on new homes and housing construction

- Inventory Investment: Changes in stock levels impact GDP

- Research & Development: Innovation and R&D spending contribute to GDP growth

Investment in GDP: The role of capital expenditure in economic growth

Investment is a crucial component of a country's Gross Domestic Product (GDP), representing the total amount of money spent on capital goods and services with the expectation of generating future economic benefits. In the context of GDP, investment specifically refers to the purchase of new capital assets, such as machinery, equipment, buildings, and infrastructure, which are expected to contribute to economic growth over the long term. This type of investment is a key driver of economic development as it increases the productive capacity of an economy, enhances productivity, and fosters innovation.

Capital expenditure, often referred to as capital investment, is a significant aspect of this process. It involves the acquisition of long-term assets that are used in the production of goods and services. These assets can include physical capital, such as factories, offices, and transportation systems, as well as intangible assets like patents, trademarks, and software. When businesses and governments invest in these capital goods, they are essentially increasing their capacity to produce, which can lead to higher output and, consequently, higher GDP.

The impact of investment on GDP is twofold. Firstly, it directly contributes to the value of GDP through the purchase of new capital goods. This is evident in the calculation of GDP, where investment is one of the main components, along with consumption, government spending, and net exports. Secondly, investment has a multiplier effect on the economy. When businesses invest in new capital, it often leads to increased production, which generates more income and, subsequently, more investment. This multiplier effect can stimulate economic growth and create a positive feedback loop.

In the long term, capital expenditure plays a vital role in economic growth and development. It allows for the modernization and expansion of industries, leading to improved productivity and efficiency. For example, investing in advanced manufacturing equipment can reduce production costs and increase output, making a country more competitive in the global market. Additionally, investment in infrastructure, such as roads, bridges, and communication networks, can enhance connectivity, facilitate trade, and improve the overall business environment.

However, the relationship between investment and GDP is not without challenges. The effectiveness of investment in driving economic growth depends on various factors, including the quality of investment, the business environment, and the overall economic conditions. Poorly managed investment projects or those that do not align with market demands may not yield the expected returns. Therefore, governments and businesses must carefully consider investment strategies, ensuring that they are sustainable, well-planned, and aligned with the long-term goals of economic development.

Master Long-Term Investing: A Comprehensive Guide to Building Wealth

You may want to see also

Gross Fixed Capital Formation: Measures business investment in physical assets

Gross Fixed Capital Formation (GFCF) is a crucial component of a country's Gross Domestic Product (GDP) and represents the total investment made by businesses in physical assets. This concept is essential for understanding the economic health and growth of a nation, as it directly impacts the production capacity and long-term sustainability of an economy. GFCF specifically focuses on the acquisition of tangible assets that are used in the production process, such as machinery, equipment, buildings, and infrastructure.

In the context of GDP, GFCF is a measure of the capital expenditure incurred by businesses to enhance their productive capabilities. It reflects the businesses' confidence in the economy and their willingness to invest in long-term assets. When businesses invest in fixed assets, they are essentially increasing their capacity to produce goods and services, which can lead to higher output and economic growth. This type of investment is distinct from consumption, which refers to the purchase of goods and services for personal use, and it is also separate from inventory investment, which involves the accumulation of goods in the production process.

The calculation of GFCF involves adding up the value of all new or replacement fixed assets acquired by businesses during a specific period. This includes investments in tangible assets like factories, offices, transportation equipment, and utilities. For example, if a manufacturing company purchases a new assembly line, the cost of that line is included in GFCF. Similarly, when a government invests in infrastructure projects, such as building new roads or bridges, this expenditure is also categorized as GFCF.

Analyzing GFCF provides valuable insights into the investment behavior of businesses and its impact on the economy. A steady or increasing trend in GFCF often indicates a positive business outlook and can stimulate economic growth. It suggests that businesses are confident about future demand and are investing in their operations to meet that demand. Conversely, a decline in GFCF might signal a lack of business confidence, potentially leading to reduced production and slower economic expansion.

Understanding GFCF is essential for policymakers, economists, and investors as it helps in assessing the overall investment climate and making informed decisions. By monitoring GFCF, they can evaluate the effectiveness of investment incentives, the impact of economic policies, and the potential for future economic growth. Moreover, GFCF data is vital for businesses themselves, as it allows them to gauge their investment performance and make strategic choices to optimize their production processes.

Securing Wealth: Exploring the Safest Long-Term Investment Strategies

You may want to see also

Residential Investment: Spending on new homes and housing construction

Residential investment is a crucial component of a country's Gross Domestic Product (GDP) and represents the spending on new homes and housing construction. It is an essential indicator of economic health and growth, reflecting the confidence of individuals and businesses in the housing market. This type of investment is a key driver of economic activity, creating jobs, stimulating demand for materials and services, and contributing to overall economic development.

When residential investment is high, it indicates a robust housing market, which can have a positive impact on the economy. This is because the construction of new homes creates a demand for labor, materials, and services, leading to increased economic activity. For example, building a new house requires the services of architects, engineers, construction workers, and suppliers of building materials, all of whom benefit from the increased demand. This, in turn, can lead to higher employment rates and increased income for those involved in the housing sector.

Moreover, residential investment has a multiplier effect on the economy. As the construction of new homes creates jobs and income, it also generates additional demand for goods and services, further stimulating economic growth. This process can create a cycle of positive economic activity, where the initial investment in housing leads to increased demand, which then supports further investment and growth.

The impact of residential investment on GDP is significant. It contributes directly to the value of GDP through the construction of new homes and the associated economic activity. Additionally, it has an indirect effect by stimulating demand for other goods and services, which further enhances economic growth. The quality of residential investment is also important, as it can influence the long-term value of the housing stock and the overall health of the housing market.

In summary, residential investment plays a vital role in shaping a country's GDP. It is a powerful indicator of economic health and a key driver of economic activity. By spending on new homes and housing construction, individuals and businesses contribute to the creation of jobs, the stimulation of demand, and the overall growth of the economy. Understanding and analyzing residential investment is essential for policymakers and economists to assess the strength of the housing market and its impact on the broader economic landscape.

Long-Term Investments: Assets or Liabilities? Unlocking the True Value

You may want to see also

Inventory Investment: Changes in stock levels impact GDP

Understanding the concept of investment in the context of GDP is crucial to grasping the dynamics of economic growth and business activity. Investment, in this context, refers to the purchase of capital goods, such as machinery, equipment, and structures, with the expectation of generating future income. This is a key component of the investment component of GDP, which measures the total value of goods and services produced in a country during a specific period, typically a year.

Now, let's delve into the specific area of interest: Inventory Investment. This is a critical aspect of investment that often gets overlooked but plays a significant role in shaping GDP. Inventory investment refers to the change in the stock levels of goods held by businesses. When a company decides to increase its inventory, it is essentially investing in its own stockpile of products, which can have a direct impact on GDP.

The impact of inventory investment on GDP is twofold. Firstly, it contributes to the overall value of production. When businesses build up their inventories, they are essentially producing more goods, which increases the total output and, consequently, the GDP. This is because the value of these additional goods is added to the GDP figures. Secondly, changes in inventory levels can influence the demand for goods and services. If businesses are increasing their inventories, it often indicates a positive outlook for future sales, which can stimulate further production and investment.

However, the relationship between inventory investment and GDP is not always straightforward. During economic downturns or recessions, businesses may reduce their inventory levels, leading to a decrease in GDP. This is because the reduction in stock levels can result in lower production and sales, impacting the overall economic output. Conversely, during periods of economic growth, businesses might increase their inventories to meet rising demand, thus contributing positively to GDP growth.

In summary, inventory investment is a critical component of the investment side of GDP. It reflects the decisions made by businesses regarding their stock levels and can significantly influence economic performance. Understanding these dynamics is essential for economists, policymakers, and investors alike, as it provides valuable insights into the health and direction of an economy.

Unlocking Medium-Term Wealth: Strategies for Balanced Investment Success

You may want to see also

Research & Development: Innovation and R&D spending contribute to GDP growth

Research and Development (R&D) play a crucial role in driving economic growth and contributing to a country's Gross Domestic Product (GDP). While the term 'investment' is often associated with financial outlays, in the context of GDP, it encompasses a broader range of activities that contribute to a nation's economic development. One of the key components of this investment is R&D, which involves the creation and application of new knowledge, technologies, and processes.

Innovation, a byproduct of R&D, is a powerful driver of economic growth. When companies invest in R&D, they are essentially investing in the future. This investment leads to the development of new products, services, and processes that can enhance productivity, improve efficiency, and create new markets. For instance, technological advancements in the field of renewable energy have not only spurred economic growth but have also contributed to a more sustainable and environmentally friendly economy.

R&D spending has a direct and positive impact on GDP. It stimulates economic activity by creating jobs, fostering entrepreneurship, and attracting further investment. The process of innovation often requires a diverse workforce, including scientists, engineers, and technicians, which in turn generates income and contributes to the overall GDP. Moreover, successful innovations can lead to the establishment of new businesses, further diversifying the economy and creating additional job opportunities.

The benefits of R&D extend beyond the immediate economic gains. It encourages a culture of continuous improvement and learning, which is essential for long-term economic sustainability. Countries that consistently invest in R&D are more likely to adapt to changing market demands and technological advancements, ensuring their economic competitiveness on a global scale. This, in turn, can lead to increased exports, improved trade balances, and a more robust GDP.

In summary, R&D and innovation are vital components of investment that significantly contribute to GDP growth. By fostering a culture of innovation and allocating resources towards R&D, countries can stimulate economic activity, create jobs, and enhance their overall economic performance. Understanding the role of R&D in GDP is essential for policymakers and businesses alike, as it highlights the importance of long-term strategic investments in driving sustainable economic development.

Egypt-China Investment Deal: Unlocking Africa's Future

You may want to see also

Frequently asked questions

Investment is a crucial component of a country's Gross Domestic Product (GDP) and represents the total amount of money spent on capital goods, such as machinery, buildings, and infrastructure, as well as the purchase of financial assets. It is a key driver of economic growth and development. When businesses and individuals invest, they contribute to the production of new goods and services, which in turn generates income and employment. This process helps to increase the overall output and productivity of an economy, leading to higher GDP growth.

In the long term, investment plays a vital role in sustaining and enhancing a country's economic potential. It contributes to the capital stock, which includes all the physical assets and infrastructure that are used in the production process. A higher investment rate can lead to increased productivity, as newer and more efficient equipment and technology are adopted. This, in turn, can result in higher output and income levels, boosting the GDP over time. Additionally, investment in human capital, such as education and training, can also have a significant impact on long-term GDP growth by improving the skills and productivity of the workforce.

Investment and consumption are two distinct components of GDP, each representing different economic activities. Consumption refers to the purchase of goods and services by households, governments, and businesses for immediate use. It includes day-to-day spending on items like food, clothing, transportation, and utilities. On the other hand, investment is the act of spending on assets that are expected to provide future benefits, such as capital goods, inventories, and residential structures. Investment is a key indicator of economic confidence and future growth prospects. While consumption is essential for immediate economic activity, investment is more forward-looking and contributes to the long-term growth potential of an economy, thus playing a significant role in shaping a country's GDP.