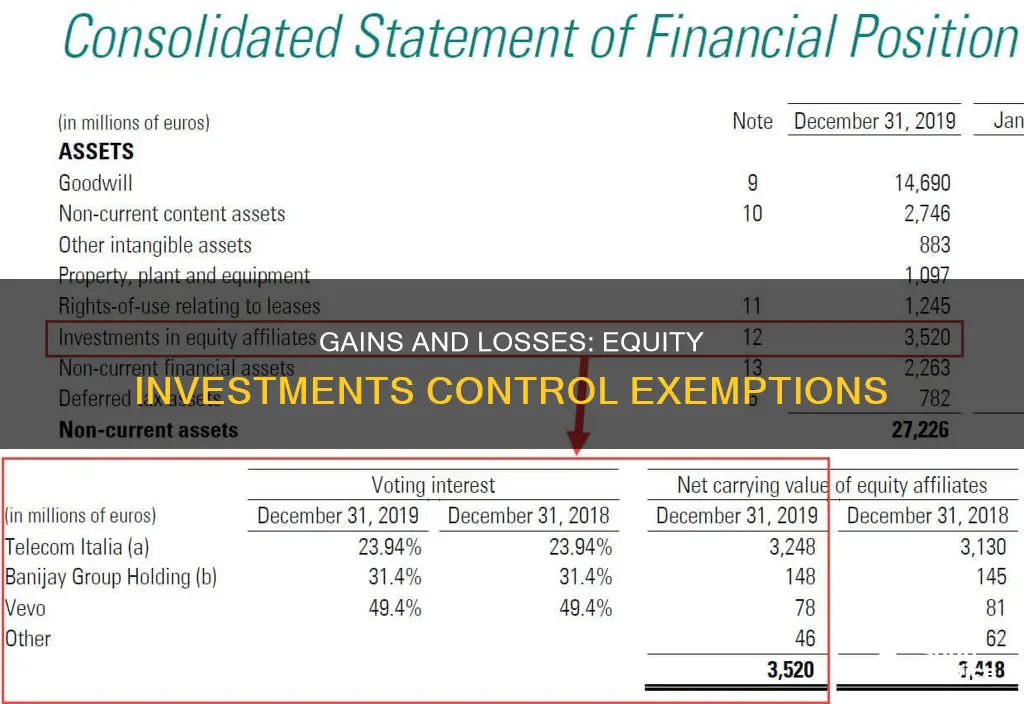

The equity method of accounting is a generally accepted accounting principle (GAAP) that allows financial statement preparers some flexibility in how they record their company's return on investments (ROI) in equity securities. Previously, it was common for such securities to be designated as available for sale, with the corresponding gains or losses on the fair value of those securities recorded through other comprehensive income. This meant that unrealized gains and losses had no real-world impact until the investment was sold. However, under the new accounting model, ASU 2016-01, equity investments (excluding those accounted for under the equity method or resulting in consolidation) must be measured at fair value, and changes in fair value are recognized in net income. This change has significant implications for controlling equity investments, as it affects the timing and recognition of gains and losses associated with these investments.

What You'll Learn

- Unrealized gains and losses have no real-world impact until the investment is sold

- Unrealized gains and losses can be calculated by subtracting the smaller number from the larger between the investment's purchase price and current market value

- Unrealized gains and losses have potential tax implications once the investment is sold

- Unrealized gains result in a capital gains tax, while unrealized losses allow investors to offset their taxes

- Unrealized gains and losses should be considered when deciding whether to sell an investment or not

Unrealized gains and losses have no real-world impact until the investment is sold

Unrealized gains and losses refer to the potential gains and losses from an investment that has not yet been sold. As the name suggests, these gains and losses are only "realized" when the investment is sold. Until then, they have no real-world impact.

The value of investments like stocks and bonds naturally fluctuates over time. This means that an investor will likely have unrealized gains or losses on their investments at any given time. However, these unrealized gains or losses only become relevant when the investment is sold, as this is when the investor must pay taxes or can reduce their taxable income.

For example, if an investor sells an asset that has unrealized capital gains, they will typically have to pay either a short-term or long-term capital gains tax, depending on how long they held the investment. On the other hand, if an investor sells an asset that has unrealized capital losses, they may be able to offset their taxes. In the United States, investors can use up to $3,000 a year to offset ordinary income on federal income taxes, and carry over the rest to future years.

The difference between unrealized gains and losses also lies in their impact on investment performance and net worth. Unrealized gains indicate that an investment has performed well since it was purchased, leading to an increase in the investor's net worth. Conversely, unrealized losses indicate that an investment has underperformed, resulting in a drop in the investor's net worth.

It is important to note that the tax treatment of unrealized gains and losses depends on various factors, such as the length of time the investment was held and the investor's income. Therefore, it is always a good idea to consult a tax professional when making investment decisions.

The Role of an Investment Product Manager Explained

You may want to see also

Unrealized gains and losses can be calculated by subtracting the smaller number from the larger between the investment's purchase price and current market value

Unrealized gains and losses reflect changes in the value of an investment that has not been sold. They are calculated by subtracting the smaller number from the larger number between the investment's purchase price and its current market value. This calculation can be done for any time period but is most useful when calculated from the time the investment was originally made.

For example, if you own 100 shares of a stock that you bought for $65 per share, and its current value is $70 per share, your investment is worth $7,000. The unrealized gain in this case would be $500. This unrealized gain becomes a realized gain once you sell the stock.

Similarly, if you bought a stock for $100 and its market value rises to $150, you have an unrealized gain of $50. This gain remains unrealized until you sell the stock and lock in the profit.

Unrealized gains and losses are important for tax planning purposes. Capital gains taxes only apply to realized gains, so calculating unrealized gains can give you an idea of how much you may have to pay in taxes if you decide to sell. Additionally, many people use losses on investments to offset capital gains or other taxable income through a strategy called tax-loss harvesting.

It is important to note that unrealized gains and losses are not taxed by the IRS and do not need to be reported on annual tax returns. They are also referred to as "paper" gains and losses because they exist only on paper and are not actual profits or losses until the investment is sold.

In the context of controlling equity investments, it is important to consider the concept of significant influence or control. If an investor loses significant influence or control over an investee, they may need to reevaluate the accounting method used for their investment. This can result in the recognition of gains or losses and changes in the fair value of the investment.

Kids' Guide to Saving, Investing, and Financial Worksheets

You may want to see also

Unrealized gains and losses have potential tax implications once the investment is sold

Unrealized gains and losses reflect changes in the value of an investment in your portfolio before it is sold. An unrealized gain is an increase in the value of an asset or investment that an investor holds, such as an open stock position. An unrealized loss is a decrease in the value of an ongoing investment.

A gain or loss on an investment is only realized when the investment is sold. Capital gains are taxed, and capital losses may be deducted only after they are realized. Until an investment is sold, its performance is not reported to the Internal Revenue Service (IRS) and has no bearing on the taxes an investor may owe.

If you have a net capital gain, a lower tax rate may apply to the gain than the tax rate that applies to your ordinary income. The term "net capital gain" means the amount by which your net long-term capital gain for the year is more than your net short-term capital loss for the year. The term "net long-term capital gain" means long-term capital gains reduced by long-term capital losses, including any unused long-term capital loss carried over from previous years.

If your capital losses exceed your capital gains, the amount of the excess loss that you can claim to lower your income is the lesser of $3,000 ($1,500 if married filing separately) or your total net loss shown on line 16 of Schedule D (Form 1040), Capital Gains and Losses. If your net capital loss is more than this limit, you can carry the loss forward to later years.

Realized capital losses can be used to legally offset taxable capital gains and, to a limited extent, ordinary taxable income. Many investors attempt to time asset sales so that they minimize their tax bill.

Blackstone REIT India: A Smart Investment Strategy

You may want to see also

Unrealized gains result in a capital gains tax, while unrealized losses allow investors to offset their taxes

When it comes to equity investments, the concept of gains and losses takes on a slightly different dimension. The rationale behind this is rooted in the nature of unrealized gains and losses and their tax implications.

Firstly, it is important to understand the difference between realized and unrealized gains and losses. A realized gain or loss occurs when an investment is sold, resulting in a profit or a loss. On the other hand, unrealized gains and losses reflect changes in the value of an investment that is still held in an investor's portfolio. In other words, the investor hasn't sold the asset yet. For example, if you bought a stock at $30 per share and its value increases to $42 per share, you have an unrealized gain of $12 per share. This gain is only on paper and is subject to change until you decide to sell the stock.

Now, let's delve into the tax implications of these unrealized gains and losses. Unrealized gains themselves are not taxed by the IRS. You only need to report and pay taxes on realized capital gains. However, unrealized gains can be useful in minimizing the taxes you owe. This is where the concept of offsetting comes into play.

Unrealized losses can be used to offset taxable capital gains. If you have an investment that has increased in value, resulting in an unrealized gain, and another investment that has decreased in value, resulting in an unrealized loss, you can use the loss to offset the gain. This strategy is known as tax-loss harvesting and can help reduce your tax burden. Additionally, if your losses exceed your gains, you can use those losses to offset your ordinary income, up to a certain limit set by the IRS. This limit is currently $3,000 for individuals and married couples filing jointly.

In summary, unrealized gains and losses can be powerful tools for investors to manage their tax liabilities. By strategically realizing gains and losses, investors can minimize the amount of taxes they owe. However, it is important to note that the tax consequences of these strategies can be complex, and it is always advisable to consult with a tax professional before making any decisions.

Equity Method Investments: Fair-Value Option Explained

You may want to see also

Unrealized gains and losses should be considered when deciding whether to sell an investment or not

Unrealized gains and losses refer to the potential gains and losses from an investment that has not yet been sold. They are an important consideration when deciding whether to sell an investment or not, as they can have a significant impact on taxes.

When an investment is sold, a capital gains tax may need to be paid, depending on the length of time the investment was held. Conversely, realized losses can be used to offset taxes. Therefore, it is essential to understand the difference between realized and unrealized gains and losses.

Unrealized gains and losses are determined by calculating the difference between the purchase price and the current market value of an investment. If the current market value is higher, there is an unrealized capital gain. If the purchase price is higher, there is an unrealized capital loss. These gains and losses are only "realized" when the investment is sold.

When deciding whether to sell an investment with unrealized gains or losses, it is important to consider the situation and investment goals. For example, an investor might sell an investment with unrealized capital gains to lock in profits or hold onto it longer to defer taxes. Alternatively, an investor might hold an investment with unrealized capital losses and wait for it to increase in value or sell it to offset other gains.

It is also important to note that the tax treatment for unrealized gains and losses depends on whether there is a gain or loss when the investment is sold. Short-term capital gains, from investments held for up to one year, are taxed as ordinary income, while long-term capital gains, from investments held for longer than a year, are generally taxed at a lower rate. If there is a net capital loss, it can be used to offset taxes, with a maximum deduction of $3,000 per year, and any remaining losses can be carried forward to future years.

In summary, unrealized gains and losses should be carefully considered when deciding whether to sell an investment or not, as they can have a significant impact on taxes and investment performance. By understanding the potential tax implications and calculating the unrealized gains or losses, investors can make more informed decisions about when to sell their investments.

Corporate Investment Management: Strategies for Business Growth

You may want to see also

Frequently asked questions

Unrealized gains and losses are potential gains and losses from an investment that has not yet been sold.

Investment values constantly fluctuate. You have unrealized gains if the asset's value has increased since you purchased it. Conversely, if the asset's value has decreased, you have an unrealized loss.

Given the frequent fluctuation in investment values, you need to do some calculations to determine whether you have unrealized gains or losses. The calculation is usually just a simple subtraction. First, determine the investment's purchase price and current market value. If the current market value is higher, you have a capital gain. If the purchase price is higher, you have a capital loss. Subtract the smaller number from the larger number to get your total capital gain or loss.

The main differences between unrealized gains and losses lie in their tax implications and what they mean for your investment performance. If you have an unrealized gain, you see this as an increase in your net worth. It also means your investment has experienced gains since you purchased it, which may indicate strong performance.

The tax treatment for unrealized gains and losses depends on whether you have a gain or loss when you sell. If you sell an investment with a capital gain that you held for up to one year, these are short-term capital gains, taxed as ordinary income. You will have long-term capital gains if you hold the investments for a year or longer, taxed at 0%, 15%, or 20%, depending on your income.