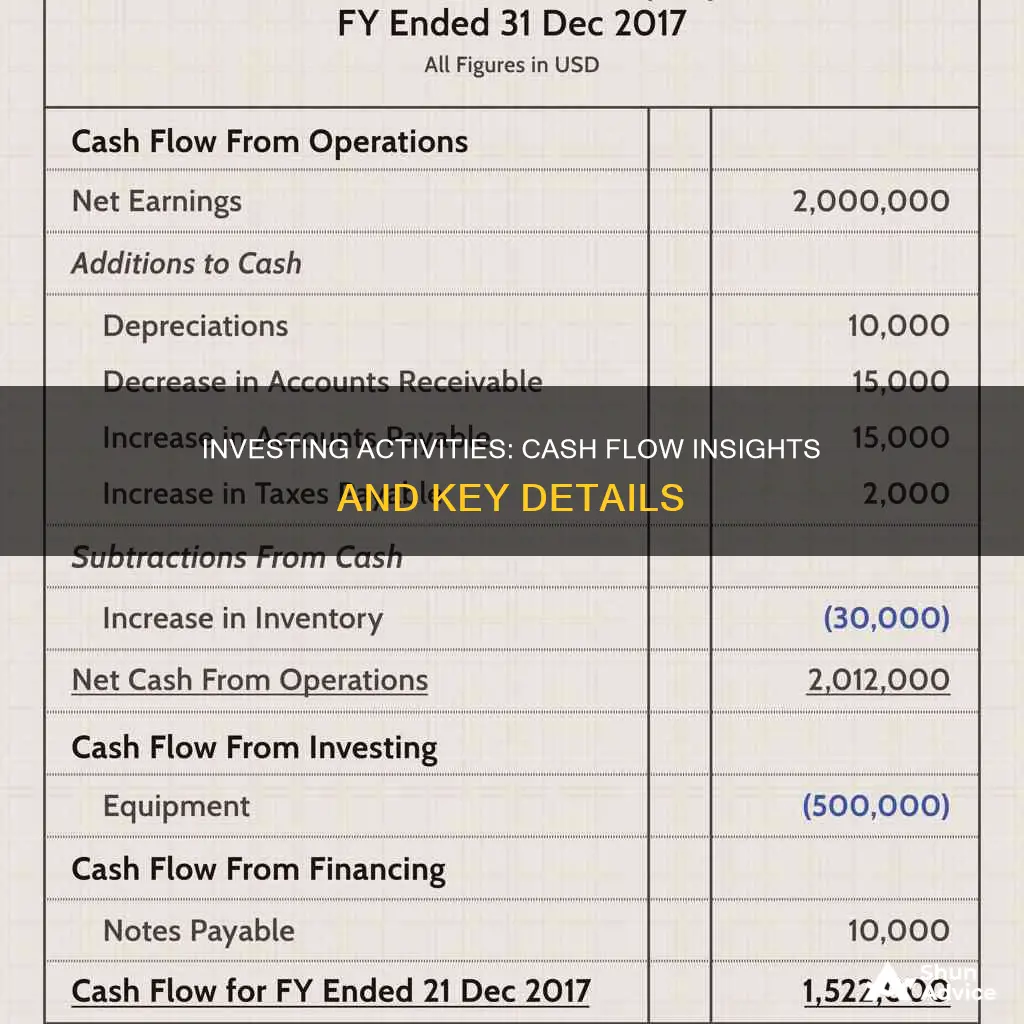

The cash flow statement is one of the three main financial statements that a business uses to provide an overview of its financial health. The other two are the balance sheet and the income statement. The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Cash flow from investing activities (CFI) is a section of a company's cash flow statement that shows the cash generated by or spent on investment activities. It includes any inflows or outflows of cash from a company's long-term investments. This covers the cash spent on or received from buying and selling assets, like buildings and equipment, as well as money from investments in other companies and securities.

| Characteristics | Values |

|---|---|

| Section of a company's cash flow statement | Cash Flow from Investing Activities (CFI) |

| Purpose | Reports how much money has been used in or generated from making investments during a specific time period |

| Type of Activities | Capital expenditures (CapEx), lending money, and the sale of investment securities |

| Purchases of long-term assets (property, plant, and equipment), acquisitions of other businesses, and investments in marketable securities | |

| Purchase of fixed assets | |

| Purchase of investments such as stocks or securities | |

| Sale of fixed assets | |

| Sale of investment securities | |

| Collection of loans and insurance proceeds | |

| Acquisition of another company | |

| Proceeds from sales of other business units | |

| Calculation | Cash flow from investing activities = CapEx/purchase of non-current assets + marketable securities + business acquisitions – divestitures (sale of investments) |

What You'll Learn

Purchase of long-term assets

The purchase of long-term assets, also known as capital expenditures (CapEx), is a fundamental component of investing activities. These purchases encompass assets such as property, plant, and equipment (PP&E), which are vital for the operations and growth of a business.

When a company invests in long-term assets, it is committing to its future by acquiring resources that will deliver value over an extended period. This can include acquiring physical assets, such as machinery, vehicles, or real estate, which are essential for the company's production, service delivery, or expansion plans.

For example, a manufacturing company may purchase new machinery to increase production capacity and efficiency. Similarly, a technology company may invest in servers, computers, or specialised software to enhance its research and development capabilities.

The purchase of long-term assets is typically considered a negative cash flow event, as it involves spending money. However, it is important to recognise that these investments are often necessary for the company's long-term growth and sustainability.

In summary, the purchase of long-term assets is a critical aspect of investing activities, reflecting a company's commitment to its future operations and potential growth. While it may result in negative cash flow in the short term, it can lead to significant benefits and value creation over the long term.

CDs: Cash or Investment?

You may want to see also

Acquisition of other businesses

Acquiring other businesses is a critical component of investing activities, as it involves the use of cash to purchase entire companies or their net assets. This strategy is often employed by larger companies aiming to expand their operations, gain a competitive edge, or diversify their product offerings.

When a company acquires another business, it essentially purchases the assets and operations of the target company. This process can involve a range of complex financial transactions, including cash payments, stock transfers, or a combination of both.

The acquisition of another business is considered an investing activity because it represents a long-term investment in the acquiring company's future operations and growth prospects. It is distinct from the day-to-day operations of the company and can have a significant impact on its financial health and performance.

The cash flow statement will reflect the cash outflow associated with the acquisition, providing transparency to investors and analysts about the financial commitment involved in such strategic decisions.

For example, in Amazon's 2017 financial statements, one of the investing activities reported was the outflow of cash related to acquisitions, net of cash acquired. This entry would capture the cash spent on acquiring other businesses during that period, contributing to the overall net cash provided by (or used in) investing activities.

It's important to note that acquisitions can also involve taking on debt or issuing equity, but these would not be reflected in the cash flow statement. Instead, they would appear in the balance sheet and impact the company's overall financial position.

Understanding the cash flow from investing activities, including acquisitions, is crucial for stakeholders to assess the company's ability to invest in growth opportunities, manage its finances, and make strategic decisions that support its long-term success.

A Guide to Investing in Cash-Flow Websites

You may want to see also

Proceeds from sales of long-term assets

Proceeds from the sales of long-term assets are an important aspect of a company's cash flow statement, reflecting the positive cash flow generated from investment activities. Long-term assets, also known as non-current assets, are those that are not expected to be converted to cash within a year of the balance sheet date. They encompass property, plant, equipment, and intangible assets.

When a company sells a long-term asset, the money received is referred to as the proceeds. This amount is recorded as a positive figure in the investing activities section of the cash flow statement. For instance, if a company sells an old piece of machinery, the cash received from the sale is considered a cash inflow from investing activities.

The proceeds from the sale of a long-term asset can also result in a gain or a loss for the company. A gain occurs when the proceeds from the sale exceed the book value or carrying value of the asset. Conversely, if the proceeds are less than the book value, the company incurs a loss on the sale.

In the context of investing activities, proceeds from the sales of long-term assets represent the positive cash flow generated from disposing of these assets. This positive cash flow is essential for understanding the overall financial health of the company and its ability to generate cash from its investments.

It is worth noting that the purchase of long-term assets, such as property, plant, and equipment, would be recorded as an outflow or negative cash flow in the investing activities section. This distinction between inflows and outflows is crucial for analysing the cash position and investment performance of a company.

Non-Cash Investing Activities: Understanding the Intangible Investments

You may want to see also

Loans made to third parties

The rationale behind recording loans to third parties as investing activities is to provide transparency and insight into the company's financial health and capital allocation decisions. By analysing the cash flow statement, stakeholders can assess the company's ability to generate cash flow, invest in growth opportunities, and manage its long-term financial health.

It is worth noting that loans made to third parties are just one component of investing activities. Other items that are included in this section of the cash flow statement are the acquisition and disposal of long-term assets, such as property, plant, equipment, and investments in marketable securities. Additionally, the investing section may also include capital expenditures, purchases of fixed assets, and acquisitions of other businesses.

Overall, understanding the cash flow from investing activities provides valuable insights into a company's investment performance and capital allocation strategies. Loans made to third parties are a crucial aspect of this, and their inclusion in the investing section of the cash flow statement helps stakeholders make informed assessments of the company's financial health and growth prospects.

Best Places to Invest Your Cash Today

You may want to see also

Proceeds from sales of investment securities

Proceeds from the sale of investment securities are an important component of a company's cash flow statement, specifically within the investing activities section. This section provides insights into the company's investment performance and capital allocation decisions.

Proceeds from the sale of investment securities refer to the money a company receives when selling its investments, such as stocks, bonds, or other financial instruments. These sales can result in positive cash flow for the company, indicating effective management of its investments. The proceeds are recorded as a positive amount in the investing activities section of the cash flow statement.

When a company sells an investment security, it must classify the transaction as either an available-for-sale, held-to-maturity, or held-for-trading security. Available-for-sale securities are those that the company intends to sell before they reach maturity or hold for an extended period if there is no maturity date. Held-to-maturity securities are those that the company plans to hold until their maturity date. Held-for-trading securities, on the other hand, are purchased with the intention of selling them in the short term to make a quick profit.

The proceeds from the sale of investment securities can vary depending on the nature of the investment and any associated costs or expenses. For example, if a company sells stocks, it may need to pay brokerage commissions, which would be deducted from the gross proceeds to calculate the net proceeds. Understanding the net proceeds is crucial for determining the appropriate selling price and for tax purposes, as capital gains taxes are paid on the net proceeds rather than the gross proceeds.

In summary, proceeds from the sale of investment securities represent the cash inflow from the disposal of investments and are an essential component of a company's cash flow statement. They provide insights into the company's investment strategies and can indicate whether the company is effectively managing its investments to enhance future growth and profitability.

Smart Ways to Invest Your Cash Wisely

You may want to see also

Frequently asked questions

This section includes any cash inflows or outflows from the purchase or sale of long-term investments, such as property, plant, equipment, and investments in other companies. It also includes loans made to and collected from third parties.

A negative cash flow in the Investing Activities section indicates that a company is investing in long-term assets or making other large purchases. This can be a positive sign of strategic investing and future growth rather than a financial problem.

A positive net cash flow from investing activities indicates that a company is generating more cash from its investing activities than it is spending. This suggests effective management of investments and potential future growth.

Cash flow from investing activities can be calculated by adding up all cash inflows from the sale of non-current assets and marketable securities, then subtracting the costs of purchasing these assets.