There are a number of investments that can offer 10% compound interest. These include stocks, treasuries, private credit, real estate, CDs, and corporate bonds. The higher the interest rate, the higher the risk. For example, corporate bonds are riskier than treasuries, which have no default risk.

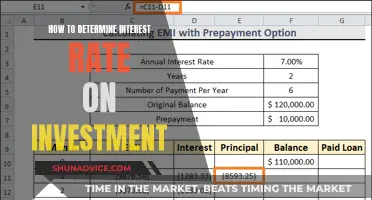

| Characteristics | Values |

|---|---|

| Investment type | Stocks, Treasuries, private credit, real estate, CDs, corporate bonds |

| Initial investment | The more the better |

| Investment returns | The higher the better |

| Historical average return for S&P 500 | 10% |

| 10-year Treasury yield | 4.29% |

| 10-year corporate bond yield | 5.31% |

What You'll Learn

Stocks

It's important to remember that investing in stocks comes with risks, and there is no guarantee of returns. However, by investing early and giving your money plenty of time to compound, you can increase your chances of earning significant returns. Additionally, making regular contributions to your stock investments can further accelerate your compound interest earnings.

Overall, stocks are a powerful tool for earning compound interest and building wealth over the long term. With the potential for high returns, stocks can be a great option for those looking to grow their investments and take advantage of the power of compound interest.

Keynesian Theory: Interest Rates and Investment Insights

You may want to see also

Treasuries

It's important to note that while Treasuries are considered a safer option, they may not provide the highest returns compared to other investments. However, they can still be a valuable part of a well-diversified investment portfolio.

When considering investing in Treasuries, it's essential to do your research and understand the current market conditions and interest rates. It's also important to remember that while Treasuries have no default risk, there are still other risks associated with investing, such as market risk and inflation risk.

Smart Strategies: High-Interest or Low-Interest Investments?

You may want to see also

Private credit

To take advantage of this power, you need three things: an initial investment and/or regular contributions (the more the better), an investment with positive returns (the higher the better), and time. The longer you leave your money, the more it will grow.

Time, Interest Rates, and Investment Strategies

You may want to see also

Real estate

To maximise your returns, it's important to choose the right property. Look for up-and-coming areas with potential for growth, or consider investing in rental properties that can provide a consistent cash flow. You can also add value to your real estate investment through renovations or improvements, increasing its market value and rental potential.

While real estate can be a lucrative investment, it's important to remember that it's a long-term commitment. It may take time to see significant returns, and there are costs associated with purchasing, maintaining, and selling property. However, with careful planning and research, investing in real estate can be a smart way to build wealth and take advantage of compound interest.

Understanding Interest Rates: Investing's Essential Knowledge

You may want to see also

CDs

Compound interest is the interest you earn on top of the interest from the previous period. For example, if you invest $1,000 at a rate of 10% compound interest, you will have $1,100 at the end of the first year, with $100 coming from interest. In the second year, your investment will grow to $1,210, with $110 in interest. The additional $10 you earned in the second year is compound interest.

When you open a CD, you agree to keep your money in the account for the specified term. This means that you cannot withdraw your money early without paying a penalty. However, this also means that your money has a chance to grow uninterrupted, earning compound interest over time.

To maximise the benefits of compound interest with CDs, it is important to consider the term length and interest rate offered. Longer-term CDs generally offer higher interest rates, which can lead to greater returns over time. Additionally, making regular contributions to your CD can further boost your earnings. By taking advantage of compound interest with CDs, you can watch your money grow steadily and securely over the long term.

Understanding Investment Interest Accrual: Semiannual Calculations

You may want to see also

Frequently asked questions

Compound interest is the 'interest on interest' – it's the interest you earn on your interest from the previous period. For example, a $1,000 investment that earns 10% interest will be worth $1,100 after the first year, with $100 coming from interest. In year two, the investment will grow from $1,100 to $1,210, or $110 in interest. The additional $10 you earned in interest in year two is compound interest.

The S&P 500 has historically returned an average of 10% since its inception. You can also invest in stocks, treasuries, private credit, real estate, CDs, and more.

Investing early and giving your money plenty of time to compound will allow your money to grow quickly. You can also take advantage of compound interest by making regular contributions to your investment.