A sample portfolio for investments is a collection of financial investments, such as stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange-traded funds (ETFs). The core of a portfolio is usually made up of stocks, bonds, and cash, but it can also include a wide range of other assets such as real estate, gold, paintings, and other art collectibles. The key to a successful portfolio is diversification, which means not putting all your eggs in one basket. By diversifying their investments, individuals can reduce the risk of losing money and improve their returns. The right mix of assets in a portfolio depends on an individual's risk tolerance, financial goals, and timeline.

Risk Tolerance

Younger investors, for instance, typically have a higher risk tolerance since they have more time to recover from potential losses and maximise the growth of their portfolio's value. As investors approach retirement, their risk tolerance usually decreases, and they shift their focus to more stable investments.

Conservative investors, who prioritise capital preservation, tend to have lower risk tolerance. Their portfolios are predominantly composed of bonds and other fixed-income securities, which offer stable returns with lower risk. On the other hand, aggressive investors are comfortable taking on greater risk in exchange for the potential for higher returns. Their portfolios are heavily weighted towards equities, including high-growth stocks and companies in their early growth stages.

It's important to note that risk tolerance is not static and can change over time due to various factors such as age, financial situation, and market conditions. As investors approach significant life milestones or experience changes in their risk appetite, they may need to adjust their portfolios accordingly.

Additionally, risk tolerance is closely tied to investment objectives and time horizon. Investors with a longer time horizon, such as those saving for retirement, may be willing to take on more risk to achieve higher returns. Conversely, those with a shorter time horizon, such as retirees, usually opt for more conservative investments to protect their capital.

Understanding one's risk tolerance is crucial for constructing a well-diversified portfolio that aligns with an investor's financial goals and personality. It helps determine the appropriate mix of asset classes, such as stocks, bonds, cash, and alternative investments, to ensure the portfolio meets the investor's needs and provides peace of mind.

Auditing Your Investment Portfolio: A Comprehensive Guide

You may want to see also

Asset Allocation

There are several investment allocation styles, which typically range from conservative to aggressive. Conservative investors generally prefer to preserve their savings and have a lower risk tolerance, so they tend to allocate a higher proportion of their portfolio to bonds and cash equivalents. On the other hand, aggressive investors are comfortable taking on greater risk to pursue higher returns and thus allocate more to stocks and higher-risk assets.

- Aggressive Portfolio: This type of portfolio seeks outsized gains and accepts the associated risks. It typically includes stocks with a high beta, or sensitivity to the overall market, which experience greater fluctuations in price. Aggressive investors often target companies in the early stages of their growth that have a unique value proposition.

- Defensive Portfolio: Defensive stocks are relatively isolated from broad market movements and tend to perform well in both good and bad economic times. This type of portfolio focuses on consumer staples—companies that produce essential products that will always be in demand. Defensive portfolios may also include dividend-paying stocks, which can help minimise capital losses.

- Income Portfolio: An income portfolio concentrates on investments that generate cash flow through dividends or other types of distributions to stakeholders. Examples include real estate investment trusts (REITs) and master limited partnerships (MLP), which return much of their profits to shareholders.

- Speculative Portfolio: The speculative portfolio is the closest to gambling, as it involves taking on the most risk. Speculative plays may include initial public offerings (IPOs) or stocks that are rumoured to be takeover targets. Technology or healthcare firms developing a single breakthrough product also fall into this category. Financial advisors generally recommend that no more than 10% of a person's assets be used for a speculative portfolio.

- Hybrid Portfolio: This type of portfolio diversifies across multiple asset classes, typically including stocks, bonds, and alternative investments such as commodities, real estate, or even art. A hybrid portfolio offers the benefit of diversification across asset classes, which historically have tended to have a negative correlation with one another.

How to Grow Your Investment Portfolio Wisely

You may want to see also

Investment Types

Investment portfolios are made up of a variety of financial assets, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, and cash or cash equivalents. Here are some common types of investments found in portfolios:

Stocks

Stocks are a type of security that represents ownership in a company. Investors buy stocks expecting them to increase in value over time. Stocks can be purchased individually or through funds such as index funds, mutual funds, or ETFs, which offer instant diversification by holding a collection of stocks from various companies.

Bonds

Bonds are loans made to companies or governments that are repaid over time with interest. They are considered a safer investment than stocks but typically offer lower returns. Bonds provide stability to a portfolio and are often used to balance the riskier investments.

Mutual Funds

Mutual funds are investment funds that pool money from multiple investors to purchase a diversified portfolio of assets, such as stocks, bonds, or other securities. They are managed by professional fund managers and offer instant diversification. While mutual funds provide a simple way to invest in a variety of assets, they also charge management fees that can reduce overall returns.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds in that they represent a basket of stocks or other securities. However, ETFs are traded on stock exchanges like individual stocks, offering more flexibility and typically lower fees than mutual funds. Like mutual funds, ETFs provide instant diversification and are a popular choice for investors.

Real Estate

Real estate investments can include physical properties, such as residential or commercial real estate, or they can be in the form of real estate investment trusts (REITs). REITs are companies that own and operate income-producing real estate, allowing investors to gain exposure to the real estate market without directly owning physical properties.

Cash and Cash Equivalents

Cash and cash equivalents provide liquidity and stability to a portfolio. This category includes cash, bank deposits, money market funds, short-term government securities, and highly liquid, short-term debt instruments. While they offer stability, they may not keep up with inflation in the long term, leading to a gradual loss in purchasing power.

Strategizing Your Investment Portfolio: A Smart Division Guide

You may want to see also

Diversification

There are several ways to diversify a portfolio:

- Distribute your investments across a wide range of vehicles, including cash, stocks, bonds, mutual funds, ETFs, and other financial instruments.

- Maintain diversity within each asset category. For stocks, this means including securities that vary by sector, industry, geographic region, and market capitalization. A similar approach can be applied to bonds by varying maturities and credit qualities.

- Invest in securities with different risk profiles. Including investments with varying levels of risk and potential returns can help balance your portfolio. This allows for the possibility that significant gains in higher-risk areas may offset losses in more stable investments.

A well-diversified portfolio is vital to any investor's success. It is not enough to simply own securities from each asset class; investors must also diversify within each class, spreading their holdings within a given asset class across an array of subclasses and industry sectors.

Mutual funds and exchange-traded funds (ETFs) are great options to help any beginner investor diversify their holdings. These investment vehicles allow individual investors with relatively small amounts of money to obtain the economies of scale that large fund managers and institutional investors enjoy.

Saving and Investing: Biblical Principles for Financial Wisdom

You may want to see also

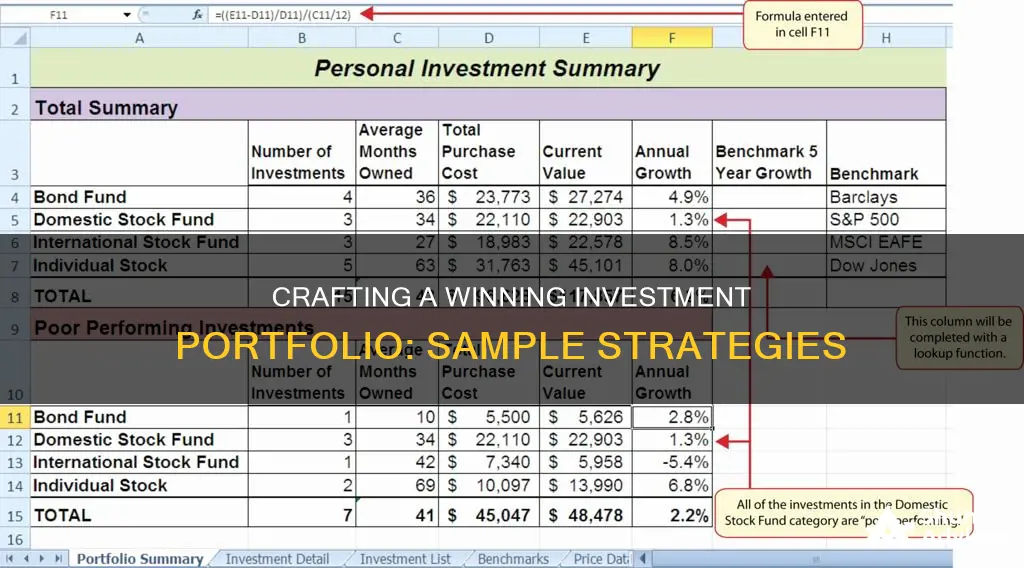

Portfolio Management

A portfolio is a collection of financial investments such as stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange-traded funds (ETFs). A portfolio may also contain a wide range of other assets, including real estate, art, and private investments.

The first step in portfolio management is determining the appropriate asset allocation for your investment goals and risk tolerance. This involves assessing your financial situation, future capital needs, and risk tolerance. The more risk you can bear, the more aggressive your portfolio will be, with a larger portion devoted to equities. Conversely, if you can't assume much risk, your portfolio will be more conservative, focusing more on bonds and other fixed-income securities.

The second step is to pick the individual assets for your portfolio. You can choose stocks, bonds, mutual funds, or exchange-traded funds (ETFs) that align with your risk tolerance and investment strategy.

The third step is to monitor the diversification of your portfolio and check how weightings have changed over time. This involves periodically analyzing and rebalancing your portfolio to ensure it remains aligned with your financial goals and risk tolerance.

The fourth step is to rebalance your portfolio strategically. This involves determining which securities are overweighted and underweighted and deciding which underweighted securities to buy with the proceeds from selling the overweighted securities.

Overall, a well-diversified portfolio is vital for consistent long-term growth and peace of mind. By following these steps and regularly reviewing and rebalancing your portfolio, you can better manage your investments and work towards achieving your financial objectives.

Equilibrium Economics: Savings-Investment Identity

You may want to see also

Frequently asked questions

A sample portfolio for investments is a collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange-traded funds (ETFs). People generally believe that stocks, bonds, and cash are the core of a portfolio, but it is not a rule. A portfolio can contain a wide range of assets, including real estate, art, and private investments.

A sample portfolio for investments can provide a diversified range of financial investments, reducing the risk of losing money. It can also help to maximize returns by investing in different areas that would each react differently to the same event.

To create a sample portfolio for investments, you need to identify your goals, risk tolerance, and time horizon. Then, research and select stocks or other investments that fit within those parameters. Regular monitoring and updating are often required, and you may need to buy and sell holdings to maintain your desired asset allocation.

Managing a sample portfolio for investments involves regularly reviewing and rebalancing your portfolio to maintain your desired asset allocation. This may involve buying and selling holdings to ensure your portfolio remains diversified and aligned with your investment strategy.