A strategic investment manager is an individual or organisation that handles activities related to financial planning, investing, and managing a portfolio for their clients. They help clients define their investment objectives and then design a customised portfolio strategy to achieve them. Strategic investment managers play a crucial role in the growth and development of businesses by providing financial resources, industry expertise, guidance, and access to valuable networks. They are focused on the long-term strategic benefits of collaborating with portfolio companies and creating synergies between their core operations and the ventures they support.

| Characteristics | Values |

|---|---|

| Industry expertise | Enhanced performance potential |

| Guidance | Comprehensive portfolio management |

| Access to valuable networks | Robust governance process |

| Long-term strategic benefits | Back-office support |

| Customized investment solutions | Wealth management |

| Financial resources | Customer service with integrity |

| Safety and protection of the client's capital | |

| Preservation of the client's purchasing power | |

| Superior long-term rate of return |

What You'll Learn

- Investment managers handle financial planning, investing and portfolio management activities

- Strategic management evaluates and reorganises company resources to achieve goals

- Strategic investors provide industry expertise, guidance and access to networks

- Investment managers devise strategies and execute trades within a financial portfolio

- Strategic investment management helps clients define investment objectives

Investment managers handle financial planning, investing and portfolio management activities

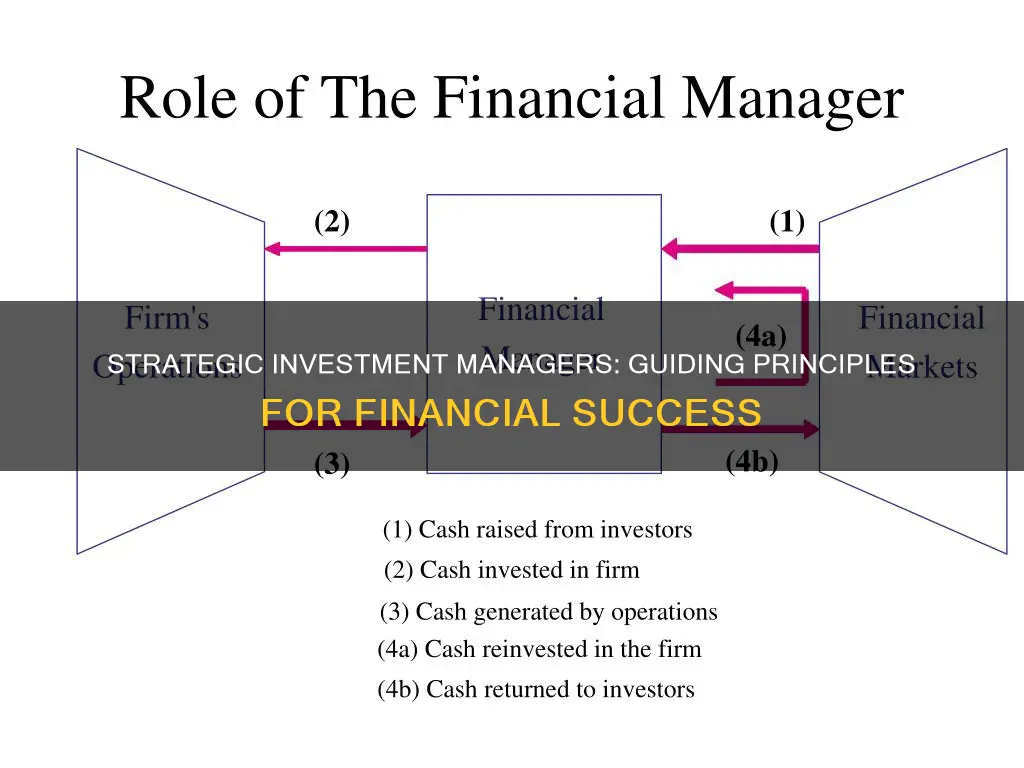

Investment managers handle financial planning, investing, and portfolio management activities. They are responsible for overseeing their clients' investments and acting on their behalf, from the day-to-day buying and selling of securities and assets to transaction settlement and performance measurement. Investment managers can be individuals or members of organisations, and they can work with both individuals and institutional investors.

The role of an investment manager is to help clients define their investment objectives and design a customised portfolio strategy to achieve those objectives. This involves devising strategies and executing trades within a financial portfolio. They closely follow market activity to inform investment decisions and may meet with clients individually or with relevant financial team members. Client portfolios can include assets in various market sectors such as technology, utilities, healthcare, or energy. Investment managers consistently strategise to expand client holdings and their fees are often based on a percentage of client assets under management (AUM).

To become an investment manager, individuals typically need a bachelor's degree in a related field such as finance, accounting, or economics, and additional qualifications such as an MBA or professional certifications are often advantageous. Excellent communication skills, analytical skills, and the ability to understand financial data and interpret market information are essential for success in this role.

Strategic investment groups or managers focus on providing investment solutions and helping clients achieve their long-term financial goals. They emphasise customisation, collaboration, and transparency in their approach. Strategic investment managers may also assist clients in navigating complex regulations and making informed decisions about their investments.

Assessing Chase You Invest: Portfolio Performance Indicators

You may want to see also

Strategic management evaluates and reorganises company resources to achieve goals

Strategic investment managers are professionals who handle their clients' financial planning, investing, and portfolio management activities. They are tasked with helping their clients achieve their financial goals and maximising the growth of their portfolios. These managers are responsible for devising strategies and executing trades within a financial portfolio.

Strategic management is a critical aspect of a strategic investment manager's role. It involves evaluating and reorganising company resources to achieve defined goals and objectives. This process includes setting clear and realistic goals, performing strategic analysis, formulating strategies, executing plans, and determining the success of implemented strategies.

Firstly, strategic investment managers assist clients in setting clear and realistic goals. This involves understanding the client's financial objectives and defining the short-term and long-term targets that will help articulate their vision.

Secondly, strategic analysis is performed to examine and understand the internal and external forces that impact the client's financial goals. Tools such as SWOT analysis can be utilised during this phase to assess strengths, weaknesses, opportunities, and threats.

Thirdly, the formulation phase involves developing a comprehensive strategy. This includes identifying the necessary resources, allocating resources based on roles and responsibilities, and gaining buy-in from stakeholders.

Once the strategies are defined, the execution phase begins. This is where the plans move from the planning stage to implementation. The allocated resources are utilised based on their designated roles and responsibilities.

Finally, the determination of success is the evaluation of the effectiveness of the implemented strategies. This involves monitoring the business landscape, internal operations, and maintaining or adjusting strategies as needed to ensure they remain effective.

Overall, strategic management is a dynamic process that involves evaluating and reorganising company resources to achieve financial goals. It is a critical function of strategic investment managers, helping their clients to maximise their investment potential and make informed decisions to reach their objectives.

Establishing a Managed Investment Trust: A Step-by-Step Guide

You may want to see also

Strategic investors provide industry expertise, guidance and access to networks

Strategic investment managers are individuals or organisations that handle activities related to financial planning, investing, and portfolio management for their clients. They help individuals or institutional investors by devising strategies and executing trades within a financial portfolio.

Strategic investors, in particular, play a crucial role in the growth and development of businesses by providing industry expertise, guidance, and access to valuable networks. They bring a wealth of knowledge and experience to the table, offering mentorship and valuable connections to their investee companies.

Industry expertise is a key advantage that strategic investors offer. As leaders in their field, they possess deep knowledge and insights into specific sectors. They can offer valuable advice and guidance on market trends, business strategies, and navigating competition. This expertise can help startups make informed decisions, seize opportunities, and overcome challenges.

Strategic investors also provide guidance and mentorship to their investee companies. They actively contribute to the growth and success of startups by offering resources and support. They may provide access to specialised labs, equipment, marketing expertise, or product development know-how. Their guidance can help startups scale their operations, build a strong market presence, and navigate complex regulations.

In addition, strategic investors offer access to their valuable networks, which can boost a startup's growth and credibility. These networks can connect startups with potential customers, suppliers, partners, and future employees. This expanded network can facilitate entry into new markets and enhance the startup's reputation and legitimacy.

The combination of industry expertise, guidance, and network access provided by strategic investors creates a symbiotic relationship with their investee companies. Their involvement can help startups gain traction, increase sales, and strengthen their market position. In return, the growth and future profitability of the startup may result in a strategic advantage for the investor's business and portfolio.

Overall, strategic investment managers bring a comprehensive set of skills and resources to their clients, going beyond financial investment to offer industry expertise, guidance, and valuable network connections.

Saving Plans: The Benefits of a Conservative Financial Strategy

You may want to see also

Investment managers devise strategies and execute trades within a financial portfolio

Investment managers are individuals or organisations that handle activities related to financial planning, investing, and managing a portfolio for their clients. They devise strategies and execute trades within a financial portfolio.

Investment managers handle the day-to-day buying and selling of securities and assets, transaction settlements, and performance measurements. They act on behalf of their clients, who can be individuals or institutional investors. Their fee is often based on a percentage of their clients' assets under management (AUM).

The role of an investment manager is to help clients define their investment objectives and then design a customised portfolio strategy to achieve them. This involves understanding their clients' individual needs and the behaviour of the world's financial markets. They closely follow market activity to inform investment decisions and may meet with clients individually or with relevant financial team members at a company.

Client portfolios can include assets in various market sectors, such as technology, utilities, healthcare, or energy. Investment managers consistently strategise to expand client holdings. They may identify the people, technology, and other resources needed to achieve their clients' goals, allocate resources accordingly, and determine performance metrics to measure success.

Some investment managers work independently, while others may be part of large firms with global offices. They often hold undergraduate degrees in business, finance, mathematics, or accounting, and may have additional professional certifications.

Strategic investment specifically refers to a type of investment management that focuses on the long-term strategic benefits of collaborating with portfolio companies. Strategic investors seek to create synergies between their core operations and the ventures they support, aiming for enhanced market positioning and competitive advantage. They bring industry expertise, guidance, and access to valuable networks, in addition to financial resources.

Strategic investment management firms, such as Strategic Investment Group (also known as Strategic Investment Partners, Inc. or SIP), provide customised investment solutions to their clients. They help clients achieve their long-term financial goals and foster healthy growth of small and mid-size portfolios.

Strategic Portfolio Weighting: Key Factors for Investment Success

You may want to see also

Strategic investment management helps clients define investment objectives

Strategic investment management is a client-centric approach that involves understanding a client's unique needs and financial context to define clear investment objectives. It is a highly disciplined and fiduciary approach, ensuring independence and objectivity in the advice given.

The process begins by building long-term relationships with clients based on trust and respect. This foundation enables investment managers to gain an in-depth understanding of their client's individual circumstances, goals, and risk tolerance. By considering these factors, they can define tailored investment objectives that align with the client's financial aspirations.

The next step involves designing a customized portfolio strategy to achieve these defined objectives. This strategy takes into account the client's risk profile, investment time horizon, and financial goals. It involves rigorous ongoing research and analysis, combining a deep understanding of the client's needs with insights into the behaviour of global financial markets.

The execution of the strategy involves selecting specific investments that align with the client's objectives. This active management style seeks to identify the best opportunities while considering the client's tolerance for market risks and fluctuations. The ultimate goal is to create a diversified asset blend that meets the client's short-term and long-term financial needs.

Throughout the process, strategic investment management prioritises the safety and protection of the client's capital. It aims to provide superior long-term returns within the client's risk parameters. By focusing on asset management, financial education, and building long-term relationships, strategic investment management helps clients achieve their investment objectives and secure their financial future.

Saving and Investing: Strategies for Future Financial Goals

You may want to see also

Frequently asked questions

A strategic investment manager is an individual or organisation that provides financial planning, investing, and portfolio management services to clients. They help clients define their investment objectives and design customised strategies to achieve those objectives.

Strategic investment managers devise and execute investment strategies on behalf of their clients, aiming to help them reach their financial goals. They offer a range of services, including financial planning, asset management, and investment advice.

Strategic investment managers follow market trends closely to inform their investment decisions. They may meet with clients individually or collaborate with relevant financial team members to align investment strategies with the client's goals.

Strategic investment managers provide expertise in financial planning and investing, allowing clients to focus on their core objectives. They offer a holistic approach, considering the client's unique needs and delivering personalised attention.

When choosing a strategic investment manager, consider their qualifications, experience, and specialisations. Evaluate their investment philosophies, performance records, and fee structures. Ensure they are registered and compliant with relevant regulatory bodies, such as the Securities and Exchange Commission (SEC).