Stash is a mobile investment app that allows users to invest with any amount of money. It offers a simple start-up process and users don't need a lot to begin investing. The app features a brokerage account and a variety of exchange-traded funds (ETFs). Stash also allows users to purchase smaller pieces of investments, called fractional shares, rather than having to pay the full price for a whole share. The app gives users access to more than 250 ETFs and stocks, and they can choose investments that suit their personal goals and risk tolerance. Stash offers two flat-fee subscription plans: Stash Growth and Stash+.

What You'll Learn

- Stash is a mobile investment app that features a brokerage account and a variety of exchange-traded funds (ETFs)

- Stash offers two flat-fee subscription plans: Stash Growth and Stash+

- Stash is a micro-investor, not a robo-advisor, so it guides you but does not invest for you

- Stash offers more than 3,800 stocks and ETFs to invest in, but narrows down your choices based on your risk level

- Stash allows you to purchase smaller pieces of investments, called fractional shares, rather than having to pay the full price for a whole share

Stash is a mobile investment app that features a brokerage account and a variety of exchange-traded funds (ETFs)

Stash is a mobile investment app that makes investing accessible to beginners and those looking for a straightforward approach to building their financial future. It features a brokerage account and a variety of exchange-traded funds (ETFs) to choose from, making it a robust investing platform with a simplified user experience.

With Stash, you can start investing with any dollar amount, selecting from over 250 ETFs and stocks. The app gives you the freedom to choose investments that align with your personal goals and risk tolerance, allowing you to easily purchase, diversify, and track your progress. It also offers cost-friendly fee options, with tiered plans starting at $3 per month.

Stash stands out for its user-friendliness and minimal start-up requirements. It simplifies the investing process by offering fractional shares, curated investment options, and educational tools. For example, with fractional shares, you can purchase a small fraction of a stock rather than paying the full price for a whole share. This makes investing more accessible, especially for those just starting with a small amount of money.

Stash also provides a personalised financial coaching tool called Stash Coach, which offers guidance and increases your investing knowledge. The app utilises robust security measures, including 256-bit bank-grade encryption and TLS layer security, to ensure the protection of your personal information.

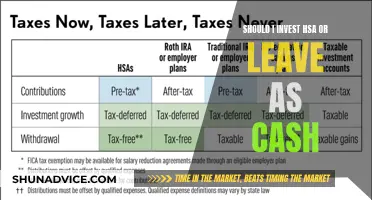

Additionally, Stash offers retirement accounts, such as Traditional and Roth Individual Retirement Accounts (IRAs), and custodial accounts for minors. It provides a range of valuable features like Smart-Stash, which analyses your income and spending patterns to identify opportunities for saving or investing.

Overall, Stash is an ideal investment app for beginners, offering a simplified investing journey with educational resources and a user-friendly interface.

Investing Inflow: The Key to Positive Cash Flow?

You may want to see also

Stash offers two flat-fee subscription plans: Stash Growth and Stash+

Stash is a mobile investment app that offers two flat-fee subscription plans: Stash Growth and Stash+. Both plans offer a range of features to help individuals build their financial futures and make investing more accessible.

Stash Growth is offered at $3 per month and includes a personal brokerage account, a retirement account (Roth or Traditional IRA), and banking services. This plan is ideal for those looking to build a foundation for a healthy financial life, with the added benefit of access to banking services, including Stock-Back® rewards.

Stash+, available for $9 per month, provides a more comprehensive suite of features to help maximise financial power. In addition to a personal brokerage account and a retirement account, Stash+ offers two custodial investment accounts (UGMA/UTMA) for minors and a metal Stash Debit Card with 2x Stock-Back® rewards. This plan also includes a monthly market insight report, making it a valuable tool for those seeking to make the most of their investments.

Both plans provide access to a diverse range of investment options, educational tools, and a simplified user experience. Stash's minimal start-up requirements, including the ability to invest with any dollar amount, make it a great choice for beginners looking to enter the world of investing. The app also offers targeted investment options, allowing users to invest with purpose in areas they are passionate about.

With its flat-fee subscription plans, Stash provides an affordable and accessible platform for individuals to take control of their financial future.

UK Cash Investment: Strategies for Success

You may want to see also

Stash is a micro-investor, not a robo-advisor, so it guides you but does not invest for you

Stash is a micro-investing app that helps individuals build long-term wealth through customised investment portfolios. It is not a robo-advisor, so it does not invest for you. Instead, it guides you through the process of investing and helps you make informed decisions. Here's how:

Educational Content

Stash provides a wealth of educational materials to help new investors understand what they're doing and invest with confidence. This includes tips, tools, and resources to help you hone your skills and simplify investing jargon.

Investment Recommendations

Stash offers investment recommendations based on your risk tolerance, goals, and areas of interest. When you sign up, you answer a series of questions to determine your risk tolerance, which can be conservative, moderate, or aggressive. Stash then provides investment options that match your risk profile and goals.

Diversification Analysis

Stash offers custom investment recommendations to help you diversify your portfolio. Diversification can help reduce risk and improve your long-term investment performance.

Fractional Shares

Stash allows you to purchase fractional shares, or smaller pieces of investments, rather than having to pay the full price for a whole share. This makes investing more accessible, especially for those with limited funds.

Stash Coach

Stash offers a personalised financial coaching tool, Stash Coach, to help you increase your investing knowledge and make more informed decisions.

Hands-on Control

Stash gives you total control over your investments. You choose the various investments that make up your portfolio, rather than having a robo-advisor build it for you. While this may sound overwhelming for first-time investors, Stash provides guidance and tools to help you make decisions.

Automatic Investing

While Stash doesn't invest for you, it does provide tools to help you automate your investing. With Auto-Stash, you can set up automatic transfers into your investing account on a schedule or round up spare change from your purchases to invest.

In summary, Stash is a micro-investor that guides you through the investing process and provides the tools and education you need to make informed decisions. However, it does not invest for you or build your investment portfolio for you.

Investing Activities: Do Cash Flows Stay Positive?

You may want to see also

Stash offers more than 3,800 stocks and ETFs to invest in, but narrows down your choices based on your risk level

Stash is a mobile investment app that offers users a simplified investing experience. It provides access to over 3,800 stocks and ETFs, but what sets Stash apart is how it guides users through the process of investing.

When signing up, users answer questions to determine their risk tolerance level, which can be conservative, moderate, or aggressive. Factors such as age, investment time horizon, and goals are considered to derive an individual's risk tolerance.

Based on this assessment, Stash then narrows down the investment options from over 3,800 to a more manageable number, making it less overwhelming for beginners. Users can choose from various investment themes, like "Clean & Green" or "American Innovators," that align with their interests and goals.

Stash also offers fractional shares, allowing users to invest in smaller pieces of stocks or ETFs rather than having to pay the full price for a whole share. This feature makes investing more accessible, especially for those with limited funds.

In addition to the wide range of investment options, Stash provides educational tools and resources to help users make informed decisions. It spells things out in layman's terms, breaking down complex investing jargon into simple language. This makes Stash ideal for beginning investors who want to learn about investing and take an active role in managing their investments.

Stash's subscription plans, Stash Growth, and Stash+, offer different features tailored to users' financial needs, whether they are just starting or looking to maximize their investments.

OPay Cash Investment: Legit or Scam?

You may want to see also

Stash allows you to purchase smaller pieces of investments, called fractional shares, rather than having to pay the full price for a whole share

Stash is a mobile investment app that allows you to purchase smaller pieces of investments, known as fractional shares, rather than paying the full price for a whole share. This feature sets Stash apart from other investment platforms and makes it more accessible to beginner investors.

With Stash, you can invest in various stocks and exchange-traded funds (ETFs) by buying fractional shares. This means that you don't have to spend a large amount of money upfront to invest in a particular stock or fund. Instead, you can purchase a fraction of a share, making investing more affordable and allowing for greater diversification.

For example, if a stock is trading at $100 per share, you can use Stash to buy 0.1 shares for $10, giving you ownership of a smaller piece of that investment. This approach enables you to invest in a wide range of assets without needing a significant amount of capital.

Stash offers two subscription plans: Stash Growth and Stash+. Each plan provides access to a personal brokerage account and a combination of financial accounts and features to help you build your investment portfolio.

Stash also provides educational tools and resources to guide you through the investment process. It simplifies investing jargon and offers tips to help you make informed decisions. The platform assesses your risk tolerance, goals, and time horizon to provide personalized recommendations suited to your profile.

By utilising fractional shares, Stash empowers individuals to start investing with smaller amounts of money, making it a great option for those looking to dip their toes into the world of investing without committing large sums upfront.

Cash or Invest: Where Should Your Money Go?

You may want to see also

Frequently asked questions

Stash is a mobile investment app that allows you to invest in stocks and ETFs. Your "Portfolio Cash" is the amount of money you have available to purchase investments, including single stocks and ETFs. You can transfer money to your Portfolio Cash from your Stash banking or external bank account.

You can transfer money to your Stash investment account by linking your bank account through the Stash app or website. You can also add money through payment apps like Venmo, Paypal, or Cash App, or through direct deposit.

Stash offers a simple, user-friendly platform for beginner investors to get started with investing. It offers a range of investment options, including stocks, ETFs, and fractional shares. Stash also provides educational tools and resources to help users make informed investment decisions.