Global direct foreign investment refers to the process of investing in businesses or assets in a foreign country by an individual or company based in another country. This type of investment involves acquiring a significant stake in a foreign enterprise, merging with or acquiring another company, or establishing a new venture abroad. It plays a crucial role in the global economy, facilitating the transfer of capital, technology, and expertise across borders. Foreign direct investment (FDI) can take various forms, including greenfield investments, where a new operation is established, or brownfield investments, which involve the acquisition of an existing business. Understanding the dynamics of global FDI is essential for businesses and policymakers as it can impact economic growth, job creation, and international trade.

What You'll Learn

- Definition: Global direct foreign investment is the acquisition of a lasting interest in a business enterprise by an entity based in another country

- Motivations: Companies invest abroad for market expansion, resource access, and cost reduction

- Impact: FDI can boost economic growth, create jobs, and transfer technology and skills

- Regulations: Governments often impose restrictions on foreign ownership and control to protect domestic industries

- Trends: FDI flows have fluctuated with global economic cycles and geopolitical tensions

Definition: Global direct foreign investment is the acquisition of a lasting interest in a business enterprise by an entity based in another country

Global direct foreign investment refers to the strategic and long-term process of acquiring a significant stake or control in a business or enterprise located in a different country. This type of investment is a powerful tool for international companies seeking to expand their operations, gain access to new markets, and diversify their portfolios. When a foreign entity, such as a multinational corporation or an investor, purchases a substantial portion of a company's shares or assets in a foreign country, it establishes a direct investment relationship. This acquisition provides the foreign entity with a lasting interest and, often, a degree of control over the target company's operations and decision-making processes.

The key aspect of global direct foreign investment is the element of 'lasting interest'. This means that the investment is not a one-time transaction but rather a long-term commitment. It involves a foreign entity becoming a substantial shareholder or acquiring management control over the target company, ensuring a sustained presence and influence in the host country's business environment. This type of investment is distinct from portfolio investments, which are typically shorter-term and involve buying and selling securities without seeking long-term control.

In the context of international business, global direct foreign investment plays a crucial role in fostering economic growth and development. It enables companies to tap into new markets, access resources, and leverage local expertise, thereby contributing to the host country's economic prosperity. For investors, it offers opportunities to diversify their portfolios, gain competitive advantages, and potentially benefit from favorable tax regulations or incentives provided by the host country.

This form of investment often involves a complex process, including due diligence, legal and regulatory compliance, and strategic planning. It requires a thorough understanding of the host country's business environment, cultural nuances, and economic policies. Successful global direct foreign investment can lead to increased market share, improved operational efficiency, and the establishment of a strong local presence, ultimately benefiting both the investing entity and the host country's economy.

Understanding the definition and implications of global direct foreign investment is essential for businesses and investors navigating the complex world of international trade and finance. It highlights the importance of strategic planning, cultural sensitivity, and long-term commitment in achieving success in the global marketplace.

Using an Investment Agent: Is It Worth the Cost?

You may want to see also

Motivations: Companies invest abroad for market expansion, resource access, and cost reduction

Global direct foreign investment (FDI) is a powerful tool for businesses seeking to expand their reach and gain a competitive edge in the international market. The primary motivations behind this strategic move are multifaceted and often interconnected. Firstly, market expansion is a key driver. By investing in foreign markets, companies can tap into new customer bases, diversify their revenue streams, and increase their market share. This is particularly appealing for industries with high growth potential in emerging economies, where local consumers may have different preferences and purchasing power compared to the company's domestic market.

Secondly, resource access is another critical factor. Many companies invest abroad to secure resources that are not readily available in their home country. This could include raw materials, specialized labor, or unique technologies. For instance, a tech company might establish a research and development center in a country with a skilled workforce to foster innovation and gain access to cutting-edge talent. Similarly, a manufacturing company may set up a production facility in a region with abundant natural resources to ensure a steady supply of raw materials for its production processes.

Cost reduction is also a significant motivator for global FDI. Companies often seek to optimize their operations and reduce expenses by establishing a presence in regions with lower production or labor costs. This can lead to increased profitability, especially for industries with high production volumes. For example, a clothing retailer might open a manufacturing plant in a country with lower labor costs, allowing them to produce garments at a reduced price while maintaining quality. This enables the company to offer competitive pricing to customers worldwide, potentially increasing sales and market presence.

In summary, global direct foreign investment is driven by a combination of market expansion, resource access, and cost reduction strategies. Companies aim to capitalize on new markets, secure valuable resources, and optimize operations to gain a competitive advantage. These motivations often intertwine, as market expansion can lead to resource access and cost savings, and vice versa. Understanding these drivers is essential for businesses looking to navigate the complex landscape of international investment and foster successful global operations.

Understanding Cash Investment: Credit or Debit?

You may want to see also

Impact: FDI can boost economic growth, create jobs, and transfer technology and skills

Foreign Direct Investment (FDI) is a powerful catalyst for economic development and has a significant impact on host countries' growth and development. When a company or individual from one country invests in a business or asset in another country, it is considered FDI. This investment can take various forms, such as acquiring a company, building new facilities, or purchasing assets. The effects of FDI are far-reaching and can have a positive impact on multiple aspects of a country's economy.

One of the most significant impacts of FDI is its ability to stimulate economic growth. When foreign investors bring capital, expertise, and access to new markets, they contribute to the expansion of the host country's economy. FDI often leads to increased production, higher output, and improved productivity. For example, a foreign company setting up a manufacturing plant in a developing nation can introduce advanced machinery and production techniques, enhancing the local industry's efficiency and output capacity. This, in turn, can lead to a higher GDP growth rate and improved economic performance.

FDI also plays a crucial role in job creation. As foreign investors establish businesses or expand their operations in a new market, they create employment opportunities for the local population. These jobs can range from skilled technical roles to unskilled labor positions, providing income and improving the standard of living for many individuals. The creation of new jobs not only reduces unemployment rates but also fosters a more skilled and productive workforce. Over time, this can lead to a more sustainable and resilient economy, as the local workforce becomes more adaptable and capable of supporting further economic growth.

Furthermore, FDI facilitates the transfer of technology, skills, and knowledge between countries. When foreign companies invest, they often bring with them advanced technologies, management practices, and expertise that can be shared with local businesses. This technology transfer can lead to innovation and the adoption of best practices, enabling local companies to enhance their productivity and competitiveness. For instance, a foreign software company setting up a development center in a developing country can train local engineers and developers, transferring valuable skills and knowledge that can be applied to other sectors of the economy.

In addition to technology transfer, FDI also encourages the development of human capital. As foreign investors establish operations, they often require a skilled workforce, which can lead to investments in education and training. This may include building vocational training centers, providing scholarships, or establishing partnerships with local educational institutions. By investing in human capital, FDI contributes to the long-term development of the host country, ensuring a more skilled and adaptable workforce capable of supporting future economic growth.

In summary, FDI has a profound impact on economic growth, job creation, and the transfer of valuable assets. It brings capital, technology, and expertise to host countries, fostering economic development and improving the overall standard of living. The positive effects of FDI can be long-lasting, creating a ripple effect that benefits various sectors and contributes to the overall prosperity of the host nation. Understanding and embracing the potential of FDI is essential for policymakers and investors alike to unlock the full benefits of international economic integration.

Growth Rate Projection: What's the Ideal Investment Benchmark?

You may want to see also

Regulations: Governments often impose restrictions on foreign ownership and control to protect domestic industries

The concept of global direct foreign investment (FDI) involves a significant aspect of international business, where companies or individuals from one country invest in assets, businesses, or projects in another country. This investment can take various forms, such as acquiring a controlling stake in a foreign company, establishing a new subsidiary, or merging with a local business. FDI is a powerful driver of economic growth, technology transfer, and job creation, as it brings capital, expertise, and access to new markets. However, governments around the world often implement regulations to manage and control foreign ownership and control, which can have both positive and negative implications.

One of the primary reasons governments impose restrictions on foreign ownership is to safeguard and promote domestic industries. Local governments may believe that allowing unrestricted foreign investment could lead to the dominance of multinational corporations, potentially threatening local businesses, jobs, and cultural heritage. For instance, a country might introduce ownership limits or licensing requirements for foreign investors in key sectors like telecommunications, banking, or natural resource extraction. These regulations aim to ensure that foreign entities do not gain excessive control, thereby preserving the competitive landscape and providing a level playing field for domestic firms.

In some cases, governments may also enforce specific conditions to encourage foreign investment while still protecting local interests. This could include mandating technology transfer agreements, local content requirements, or employment quotas for the host country's citizens. By doing so, governments strive to strike a balance between attracting FDI and fostering the growth of indigenous industries, skills development, and economic diversification. Such measures can help build a robust domestic market and reduce the country's reliance on foreign investment alone.

The impact of these regulations varies across industries and countries. In sectors where foreign investment is highly regulated, local businesses may have an advantage, but this can also lead to inefficiencies and hinder innovation. Striking the right balance is crucial for governments to ensure that FDI contributes positively to the economy without compromising national interests. Therefore, policymakers must carefully consider the potential benefits and drawbacks of foreign ownership restrictions and design regulations that are both protective and conducive to sustainable economic development.

In summary, regulations on foreign ownership and control are essential tools for governments to manage the impact of global direct foreign investment. While these measures aim to protect domestic industries and promote economic stability, they must be implemented thoughtfully to encourage FDI, foster local entrepreneurship, and ultimately contribute to the overall growth and prosperity of the host country. Understanding these regulations is vital for businesses and investors navigating the complex landscape of international trade and investment.

E*Trade Cash Balance Program: Investing Strategies for Beginners

You may want to see also

Trends: FDI flows have fluctuated with global economic cycles and geopolitical tensions

Foreign direct investment (FDI) is a significant driver of global economic growth and development, and its flows have historically been highly sensitive to the ebb and flow of the international economy and geopolitical events. The relationship between FDI and these global factors is intricate and often leads to fluctuations in investment patterns.

One of the most prominent trends in FDI is its cyclical nature, closely mirroring the global economic cycle. During periods of economic expansion, characterized by rising demand, low unemployment, and increasing market confidence, FDI tends to surge. This is because businesses seek to expand their operations globally, tap into new markets, and diversify their supply chains. For instance, the late 1990s and early 2000s witnessed a boom in FDI, driven by the dot-com bubble and the rapid growth of the technology sector, with many companies investing in IT infrastructure and software development abroad.

Conversely, when the global economy enters a downturn, FDI flows often contract. Economic recessions, financial crises, and market uncertainties can lead to a pullback in foreign investment. The 2008 global financial crisis is a prime example, as it significantly impacted FDI, with many investors becoming more risk-averse and reevaluating their international investment strategies. This trend highlights the vulnerability of FDI to global economic cycles, where investor sentiment and market conditions play a pivotal role in shaping investment decisions.

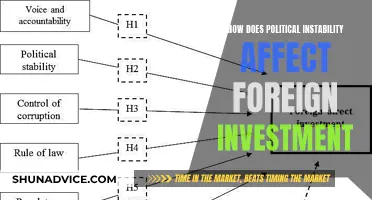

Geopolitical tensions also significantly influence FDI trends. Political instability, trade disputes, and changing government policies can create an uncertain environment for investors, prompting them to reconsider their international investments. For instance, the ongoing trade war between major economies has led to a cautious approach among investors, with many rethinking their supply chain strategies and diversifying their operations to mitigate risks. Similarly, geopolitical conflicts and regional tensions can cause FDI to shift away from affected regions, as investors seek safer havens for their capital.

In recent years, the impact of geopolitical factors has become more pronounced, with the rise of protectionist policies and the increasing complexity of international trade relationships. These factors can lead to a more volatile FDI landscape, where investors must navigate a web of interconnected risks. As a result, businesses are increasingly adopting a more strategic and flexible approach to FDI, considering not only economic factors but also geopolitical considerations in their investment decisions.

Understanding these trends is crucial for policymakers, businesses, and investors alike. By recognizing the interplay between global economic cycles and geopolitical tensions, stakeholders can better anticipate FDI flows, develop appropriate strategies, and mitigate risks associated with international investments. This knowledge is essential for fostering a more stable and predictable investment environment, which is vital for long-term economic growth and development.

Best Places to Invest Your Cash Today

You may want to see also

Frequently asked questions

Global Direct Foreign Investment refers to the financial investment made by a company or individual in a foreign country, with the aim of establishing a long-term interest in a business or asset. This can involve purchasing assets, acquiring shares, or setting up a subsidiary or branch in the host country. The primary goal is to gain a strategic advantage, expand market reach, or diversify operations across borders.

Direct Foreign Investment is distinct from portfolio investments, where investors buy and sell securities without establishing a long-term business presence. It involves a more substantial commitment and often includes the transfer of knowledge, technology, and management practices. This type of investment can lead to the creation of jobs, infrastructure development, and the transfer of skills to the host country's workforce.

Benefits include access to new markets, natural resources, and consumer bases, which can boost a company's growth and competitiveness. It can also foster economic development in the host country through job creation and technology transfer. However, challenges may include cultural and language barriers, political risks, and the complexity of navigating different legal and regulatory environments. Effective risk management and strategic planning are essential to ensure successful and sustainable foreign direct investment.