The term net OER is an important concept in the world of investing, particularly in the context of real estate. OER stands for Operating Expense Ratio, which is a metric used to evaluate the efficiency of a property's operations. Net OER, however, takes this a step further by considering the net income generated by the property after accounting for all expenses and income. This metric is crucial for investors as it provides a clear picture of the property's profitability and sustainability, allowing them to make informed decisions about potential investments. Understanding Net OER is essential for assessing the financial health and potential returns of a real estate venture.

What You'll Learn

- Net OER: The net operating expense ratio, a key metric for real estate investors

- Net OER Calculation: It's the net operating income divided by the total operating expenses

- Net OER vs. Cap Rate: Net OER is distinct from capitalization rate (cap rate)

- Net OER Analysis: Investors use it to assess property profitability and risk

- Net OER Impact: It influences property value and investment decisions

Net OER: The net operating expense ratio, a key metric for real estate investors

Net Operating Expense Ratio (Net OER) is a crucial metric for real estate investors, providing a clear picture of the operational efficiency and profitability of a property. This ratio is an essential tool for investors to assess the financial health and potential return on investment of a real estate asset.

In simple terms, Net OER measures the net income generated from a property's operations relative to its total operating expenses. It is calculated by dividing the net operating income (NOI) by the total operating expenses. The formula is as follows: Net OER = Net Operating Income / Total Operating Expenses.

Net Operating Income (NOI) is the total revenue generated from a property's operations, excluding capital expenditures and non-operating income. It represents the income that can be used to cover the property's operating costs and debt obligations. On the other hand, Total Operating Expenses include all the day-to-day costs associated with maintaining and operating the property, such as property taxes, insurance, maintenance, repairs, and management fees.

A lower Net OER indicates better operational efficiency and higher profitability. For instance, if a property has a Net OER of 0.75, it means that for every dollar of operating expenses, the property generates $0.75 in net income. This metric is particularly useful for investors when comparing different properties or evaluating the performance of their real estate investments over time.

Understanding Net OER is vital for investors as it helps them make informed decisions. It allows investors to identify properties with strong operational performance, manage cash flow effectively, and optimize their investment strategies. By analyzing Net OER, investors can assess the sustainability of a property's income and make adjustments to maximize returns while minimizing risks.

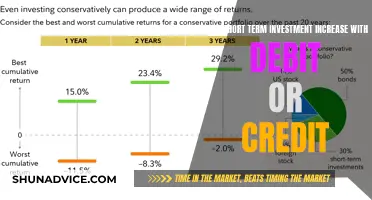

Unveiling the Potential: Is Short-Term Investment an Asset?

You may want to see also

Net OER Calculation: It's the net operating income divided by the total operating expenses

The Net Operating Expense Ratio (Net OER) is a crucial metric in real estate investing, providing a clear picture of a property's operational efficiency and profitability. This ratio is calculated by dividing the net operating income (NOI) of a property by its total operating expenses. Here's a detailed breakdown of how to calculate it:

Net Operating Income (NOI) is the total revenue generated from a property's operations minus all the expenses directly related to those operations. These expenses typically include property taxes, insurance, maintenance, repairs, and management fees. To calculate NOI, you start with the property's total rental income and then subtract all the aforementioned operating expenses. For instance, if a property generates $120,000 in annual rent and incurs $30,000 in operating expenses, its NOI would be $90,000 ($120,000 - $30,000).

Now, to find the Net OER, you divide the NOI by the total operating expenses. Using the previous example, the Net OER would be 3 ($90,000 / $30,000). This ratio indicates the efficiency of the property's operations and how well it manages its expenses. A higher Net OER suggests that the property's operations are more efficient, and it can generate more profit for the investor.

It's important to note that the Net OER is just one aspect of evaluating a property's investment potential. Investors should also consider other factors such as the property's location, market demand, and potential for appreciation. Additionally, comparing the Net OER of different properties can help investors make informed decisions about which investments are the most promising.

In summary, the Net OER is a valuable tool for real estate investors, offering a quick assessment of a property's operational efficiency. By understanding and calculating this ratio, investors can make more strategic choices, ensuring their investments are both profitable and sustainable.

Understanding Liquid Investments: A Comprehensive Guide

You may want to see also

Net OER vs. Cap Rate: Net OER is distinct from capitalization rate (cap rate)

The terms "Net OER" and "Cap Rate" are both used in commercial real estate investing to evaluate the financial performance of a property, but they represent different metrics and should not be confused. Understanding the distinction between these two concepts is crucial for investors to make informed decisions.

Net OER, or Net Operating Expense Ratio, is a measure that compares the net operating income of a property to its total operating expenses. It provides a clear picture of the property's operating efficiency and sustainability. Net OER is calculated by dividing the net operating income (NOI) by the total operating expenses. A lower Net OER indicates better efficiency, as it means the property generates more income relative to its operating costs. This metric is particularly useful for investors as it highlights the property's ability to generate profits after accounting for all operational expenses.

On the other hand, Cap Rate, or Capitalization Rate, is a metric used to estimate the potential return on investment for a property. It is calculated by dividing the net operating income (NOI) by the current market value or purchase price of the property. Cap Rate is expressed as a percentage and represents the annual rate of return an investor can expect from the property. A higher Cap Rate suggests a more attractive investment opportunity, assuming all other factors are equal.

The key difference lies in their focus. Net OER focuses on the property's operational efficiency and profitability, considering all expenses. It provides insights into the property's day-to-day financial health and sustainability. In contrast, Cap Rate is a valuation metric that estimates the potential return on investment based on the property's value and income. It is a useful tool for comparing investment opportunities but does not account for all expenses.

Investors should use both metrics in conjunction to gain a comprehensive understanding of a property's financial performance. Net OER offers a detailed view of the property's operational efficiency, while Cap Rate provides an estimate of the potential return on investment. By analyzing these two metrics together, investors can make more informed decisions, ensuring they consider both the property's profitability and its potential value in the market.

Unleash Short-Term Treasury Profits: A Beginner's Guide to Quick Wins

You may want to see also

Net OER Analysis: Investors use it to assess property profitability and risk

Net OER, or Net Operating Expense Ratio, is a crucial metric in real estate investing that provides a comprehensive view of a property's financial performance. It is a ratio that compares the net operating income (NOI) of a property to its total operating expenses. This analysis is an essential tool for investors to assess the profitability and risk associated with a real estate investment.

When conducting a Net OER analysis, investors calculate the net operating income by subtracting all operating expenses from the rental income generated by the property. Operating expenses typically include items like property taxes, insurance, maintenance costs, and management fees. The resulting net operating income represents the property's earnings after accounting for all operational costs.

The Net OER ratio is then derived by dividing the net operating income by the total operating expenses. A lower Net OER indicates that the property's operating expenses are relatively low compared to its income, suggesting higher profitability. Conversely, a higher Net OER may imply that the property's expenses are substantial, potentially impacting its overall financial health.

Investors find this analysis particularly valuable when evaluating investment opportunities. It allows them to compare the financial performance of different properties and make informed decisions. For instance, a property with a lower Net OER might be considered more attractive as it suggests better profitability and potentially lower risk. However, it's important to consider other factors as well, such as the property's location, market demand, and long-term growth prospects.

Additionally, Net OER analysis helps investors understand the property's ability to cover its operating costs. A property with a Net OER close to 100% may have a higher risk of defaulting on expenses, while a significantly lower Net OER could indicate a well-managed property with stable cash flows. This metric, therefore, becomes a vital component of an investor's due diligence process, enabling them to make strategic decisions regarding their real estate portfolio.

Crafting Your Future: A Guide to Long-Term Investment Success

You may want to see also

Net OER Impact: It influences property value and investment decisions

Net Operating Expense Ratio (Net OER) is a crucial metric in the real estate investment world, providing valuable insights into the financial health and performance of a property. This ratio is a key indicator of a property's operating efficiency and is widely used by investors to assess the profitability and sustainability of an investment.

The Net OER is calculated by dividing the Net Operating Income (NOI) of a property by its total operating expenses. NOI represents the income generated from the property after accounting for all operating expenses, such as maintenance, repairs, property management fees, and other day-to-day costs. By dividing NOI by the total operating expenses, the Net OER offers a clear picture of how efficiently a property manages its costs and generates income.

A lower Net OER indicates that the property is more financially efficient, as it means that the operating expenses are a smaller portion of the total income. This efficiency can attract investors as it suggests a more stable and potentially higher return on investment. For example, if a property has a Net OER of 50%, it means that 50% of the NOI is spent on operating expenses, leaving the remaining 50% as net income. This lower ratio can be an attractive feature for investors seeking consistent and sustainable returns.

On the other hand, a higher Net OER may raise concerns for investors. It suggests that the property's operating expenses are a significant portion of its income, potentially impacting the overall profitability. Properties with higher Net OERs might require more careful management and could be a riskier investment, especially if the expenses are not well-controlled.

Understanding the Net OER is essential for investors as it directly influences property value and investment decisions. A property with a favorable Net OER can be more attractive to potential buyers or tenants, as it indicates a well-managed and potentially profitable asset. Investors can use this metric to compare different properties and make informed choices, ensuring that their investments are aligned with their financial goals and risk tolerance. Additionally, monitoring the Net OER over time can help investors assess the property's performance and make strategic adjustments to optimize its value and return.

Unraveling Intangible Assets: Are Long-Term Investments a Wise Choice?

You may want to see also

Frequently asked questions

Net Operating Expense Ratio (Net OER) is a financial metric used to evaluate the operating efficiency of a property or a business. It represents the total operating expenses as a percentage of the net operating income.

Net OER is calculated by dividing the total operating expenses by the net operating income and then multiplying by 100 to get a percentage. The formula is: Net OER = (Total Operating Expenses / Net Operating Income) * 100.

In real estate, Net OER is a crucial indicator for investors as it helps assess the profitability and sustainability of a property. A lower Net OER suggests better operating efficiency and higher potential returns for investors.

Suppose a commercial property has a net operating income of $100,000 and total operating expenses of $30,000. The Net OER would be (30,000 / 100,000) * 100 = 30%. This means that 30% of the property's net income goes towards covering operating costs.

Industry standards for Net OER can vary depending on the type of property and market conditions. Generally, a lower Net OER is desirable, indicating better management and lower operating costs. For example, in the retail sector, a Net OER below 50% is often considered healthy.