Medium-term investments are a crucial component of financial planning, offering a balance between short-term gains and long-term growth. These investments typically span a period of 1-5 years, providing investors with a strategy to capitalize on market opportunities while mitigating the risks associated with long-term commitments. Medium-term investments often include a mix of assets such as bonds, stocks, and real estate, allowing investors to diversify their portfolios and potentially earn steady returns over a manageable timeframe. This approach enables individuals to make informed decisions about their financial future, ensuring a stable and sustainable investment strategy.

What You'll Learn

- Definition: Medium-term investments are assets held for 1-5 years, offering a balance between liquidity and potential growth

- Examples: Stocks, bonds, real estate, and mutual funds are common medium-term investment options

- Risk: These investments carry moderate risk, suitable for investors seeking stability and growth

- Tax Implications: Capital gains taxes may apply, depending on holding period and investment type

- Diversification: Diversifying across asset classes can reduce risk and maximize potential returns

Definition: Medium-term investments are assets held for 1-5 years, offering a balance between liquidity and potential growth

Medium-term investments are a crucial component of financial planning, providing investors with a strategic approach to managing their assets over the medium term. These investments are carefully selected to offer a balance between liquidity and potential growth, making them an attractive option for those seeking both flexibility and the opportunity for capital appreciation.

The term "medium-term" typically refers to a time horizon of 1 to 5 years. During this period, investors can expect a certain level of liquidity, allowing them to access their funds relatively quickly if needed, while also benefiting from the potential for growth and income generation. This time frame is often considered an ideal middle ground, as it provides a longer investment period compared to short-term investments but with less risk and uncertainty than long-term holdings.

In the context of asset allocation, medium-term investments often include a variety of financial instruments. These can range from fixed-income securities like bonds and debentures, which offer regular interest payments and principal repayment over the medium term, to equity investments in stocks or mutual funds, which have the potential for capital growth and dividend income. The key is to select assets that align with the investor's risk tolerance, financial goals, and time availability.

One of the primary advantages of medium-term investments is the ability to navigate market fluctuations while still maintaining a degree of financial flexibility. Investors can take advantage of market opportunities and adjust their portfolios accordingly without being overly constrained by short-term market volatility. This strategic approach allows for a more dynamic and responsive investment strategy.

Additionally, medium-term investments often provide a steady income stream, which can be particularly appealing to retirees or individuals seeking a consistent cash flow. The combination of liquidity, growth potential, and income generation makes medium-term investments an essential tool for investors looking to build and preserve wealth over time. It is a balanced approach that caters to various financial objectives and risk profiles.

Debunking the Myth: Short-Term Borrowings vs. Investments

You may want to see also

Examples: Stocks, bonds, real estate, and mutual funds are common medium-term investment options

Medium-term investments are financial assets or instruments that are typically held for a period ranging from a few months to several years. These investments are often chosen by investors who seek a balance between capital growth and regular income, aiming to take advantage of market opportunities while also maintaining a degree of liquidity. Here are some examples of common medium-term investment options:

Stocks (Equities): Investing in stocks means purchasing shares of a company, which represents ownership in that business. When you buy stocks, you become a shareholder and are entitled to a portion of the company's profits and assets. Medium-term stock investments often involve holding these shares for a period of 2 to 5 years. During this time, investors can benefit from capital appreciation as the company's value grows, and they may also receive dividends if the company distributes a portion of its profits to shareholders. Diversifying your stock portfolio across different sectors and industries is a key strategy to manage risk and maximize returns over the medium term.

Bonds: A bond is a debt security issued by a government, municipality, or corporation to raise capital. When you invest in bonds, you are essentially lending money to the issuer in exchange for regular interest payments (coupon payments) and the return of the principal amount at maturity. Medium-term bonds typically have maturity dates ranging from 2 to 10 years. This investment option provides a steady income stream through interest payments, making it attractive for those seeking regular cash flow. Bonds are generally considered less risky than stocks, especially government bonds, but they may offer lower potential returns over the medium term.

Real Estate: Investing in real estate involves purchasing properties such as residential homes, commercial buildings, or land. This can be done directly by buying and owning properties or through real estate investment trusts (REITs), which are companies that own and operate income-generating real estate. Medium-term real estate investments often focus on holding properties for 3 to 7 years. During this period, investors can benefit from rental income, property value appreciation, and potential tax advantages. Real estate can be a lucrative investment, but it also requires significant capital outlay and ongoing management responsibilities.

Mutual Funds: Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. By investing in a mutual fund, you indirectly own a portion of each security held in the fund's portfolio. Medium-term mutual fund investments typically hold their assets for 2 to 5 years. This option offers instant diversification, professional management, and regular liquidity, making it an attractive choice for investors who prefer a more hands-off approach. Mutual funds can be further categorized into various types, such as equity funds, bond funds, or balanced funds, each with its own risk and return profile.

These examples highlight the diverse range of medium-term investment options available to investors. Each of these instruments offers unique advantages and considerations, and the choice depends on an individual's financial goals, risk tolerance, and investment horizon. It is essential to conduct thorough research, understand the risks and potential rewards, and diversify your portfolio to manage risk effectively in the medium term.

Unveiling the World of Short-Term Investment Options

You may want to see also

Risk: These investments carry moderate risk, suitable for investors seeking stability and growth

Medium-term investments are a type of financial strategy that falls between short-term and long-term investments in terms of risk and potential returns. These investments are designed to provide a balance between capital preservation and growth, making them an attractive option for investors who want to minimize risk while still aiming for positive returns over a moderate time horizon.

The term "medium term" typically refers to a period of 1 to 5 years, during which investors can expect a steady growth in their investments while also having the flexibility to react to market changes. This time frame is often considered an ideal middle ground for those who want to avoid the high volatility associated with short-term investments but also don't want to tie up their money for an extended period as in long-term investments.

When it comes to risk, medium-term investments generally carry moderate risk. This means that while they offer the potential for growth, they are not as sensitive to market fluctuations as short-term investments, and they also carry less risk than long-term investments. Investors who opt for medium-term investments are typically looking for a stable and consistent return, often with a lower level of volatility compared to more aggressive investment options.

One of the key advantages of medium-term investments is the ability to provide a steady income stream. Many investors choose this strategy to generate a regular income, especially those who are approaching retirement or have specific financial goals in mind. These investments can include a mix of fixed-income securities, such as bonds, and carefully selected stocks or mutual funds that offer a balance between growth and stability.

For investors seeking stability and growth, medium-term investments can be a strategic choice. It allows them to benefit from market growth while also having the option to adjust their portfolio if market conditions change. This approach is particularly suitable for those who want to avoid the risks associated with short-term market swings but still aim for a positive return over a moderate investment period. By carefully selecting assets and diversifying their portfolio, investors can make informed decisions that align with their risk tolerance and financial objectives.

Unlocking Long-Term Care: A Guide to Strategic Investment in Facilities

You may want to see also

Tax Implications: Capital gains taxes may apply, depending on holding period and investment type

When considering medium-term investments, understanding the tax implications is crucial, as it can significantly impact your overall returns. Capital gains taxes are levied on the profit realized from the sale of an asset, and the tax treatment varies depending on the holding period and the type of investment.

In many jurisdictions, short-term capital gains are taxed at a higher rate compared to long-term gains. This is because short-term investments are typically considered taxable income, similar to regular income sources. For example, if you hold a stock or mutual fund for less than a year and then sell it at a profit, you may be subject to ordinary income tax rates on the gains. This can result in a higher tax burden, especially if you are in a higher tax bracket.

On the other hand, long-term capital gains often receive more favorable tax treatment. Many governments offer reduced tax rates or even tax exemptions for investments held for a specified period, usually more than one year. These tax benefits are designed to encourage investors to adopt a long-term perspective and build wealth over time. For instance, in some countries, long-term capital gains may be taxed at a lower rate, often 0%, for certain investment types, such as retirement accounts or specific tax-efficient funds.

The holding period is a critical factor in determining the tax treatment. If you decide to sell your medium-term investment before the specified holding period, you may be classified as a short-term investor, leading to higher tax rates. Conversely, holding the investment for the required duration can result in more favorable tax consequences. It's essential to review the tax laws and regulations applicable to your jurisdiction to ensure compliance and optimize your tax strategy.

Additionally, different investment types may have varying tax implications. For instance, real estate investments or certain types of collectibles may have unique tax rules. It is advisable to consult with a tax professional or financial advisor who can provide personalized guidance based on your investment portfolio and tax situation. They can help you navigate the complexities of capital gains taxes and ensure that your investment strategy aligns with your financial goals and tax efficiency.

Understanding CAPEX: Short-Term Investments and Their Role

You may want to see also

Diversification: Diversifying across asset classes can reduce risk and maximize potential returns

Diversification is a fundamental strategy in investing that involves spreading your investments across various asset classes to minimize risk and optimize returns. It is a powerful tool for investors seeking to build a robust and resilient portfolio. By allocating your capital across different assets, you can achieve a balance between risk and reward, ensuring that your portfolio is not overly exposed to any single asset or market segment.

The core principle of diversification is to avoid putting all your eggs in one basket. Different asset classes, such as stocks, bonds, real estate, commodities, and cash equivalents, have varying levels of risk and return potential. For instance, stocks are generally considered riskier but offer higher growth prospects, while bonds provide more stability and lower risk but with potentially lower returns. By diversifying, you reduce the impact of any one asset's performance on your overall portfolio. This strategy is particularly important during market downturns or economic recessions when certain asset classes may underperform, and having a well-diversified portfolio can help mitigate these risks.

To implement diversification, investors can consider the following approaches:

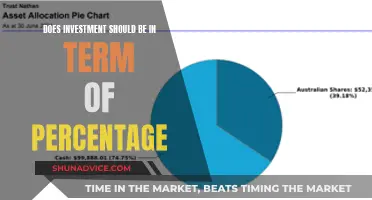

- Asset Allocation: Determine the percentage of your portfolio to be allocated to each asset class based on your risk tolerance, investment goals, and time horizon. For example, a more conservative investor might allocate a larger portion of their portfolio to bonds and cash, while a risk-tolerant investor may opt for a higher allocation to stocks.

- Geographic Diversification: Invest in assets from various countries and regions to reduce the impact of country-specific risks and economic events. This approach helps to capture opportunities in different markets and reduce the reliance on a single country's economic performance.

- Sector Allocation: Diversify across different sectors within the stock market. Sectors like technology, healthcare, energy, and consumer goods can have varying growth prospects and risks. By investing in multiple sectors, you can reduce the risk associated with any one industry's performance.

- Correlation Analysis: Study the correlation between different assets to identify those that move in opposite directions or have low correlation. Investing in assets with negative correlations can further reduce portfolio risk. For instance, real estate and stocks often have a low correlation, meaning they don't move in lockstep, and including both can provide diversification benefits.

By employing these diversification techniques, investors can create a well-rounded portfolio that is less susceptible to market volatility and individual asset risks. Diversification is a long-term strategy that aims to provide stability and potential for growth, making it an essential concept for investors to understand and implement in their investment journey. It allows investors to navigate the complexities of the financial markets with greater confidence and potentially achieve their financial objectives.

Securities: Cash Equivalent or Long-Term Investment?

You may want to see also

Frequently asked questions

Medium-term investments typically refer to assets or securities that are expected to be held for a period ranging from a few months to a few years. These investments are generally more liquid than long-term investments but offer a longer horizon than short-term ones. Examples include corporate bonds, government bonds with medium-term maturities, and certain mutual funds or exchange-traded funds (ETFs) that focus on medium-duration strategies.

Short-term investments are usually held for a period of less than a year and often include highly liquid assets like money market funds, certificates of deposit (CDs), or short-term government bonds. They are designed for quick access to capital and are less risky. Long-term investments, on the other hand, are held for several years or more and often include stocks, real estate, or long-term corporate bonds. Medium-term investments strike a balance, providing a longer investment horizon than short-term options while still offering some liquidity and potentially higher returns than long-term investments.

Medium-term investments offer several benefits. Firstly, they provide a longer time frame for potential growth, allowing investors to benefit from market trends and economic cycles. These investments often offer a higher level of liquidity compared to long-term ones, providing investors with the ability to access their funds relatively quickly if needed. Additionally, medium-term investments can provide a diversification benefit, as they may include a mix of assets, reducing overall risk.

Medium-term investments can be suitable for various investors depending on their financial goals, risk tolerance, and investment time horizon. For conservative investors seeking capital preservation and regular income, medium-term bonds or fixed-income funds might be appropriate. Aggressive investors with a higher risk tolerance may consider medium-term equity investments or ETFs that focus on growth. It is essential to assess one's financial situation, investment objectives, and risk profile before deciding on a medium-term investment strategy.