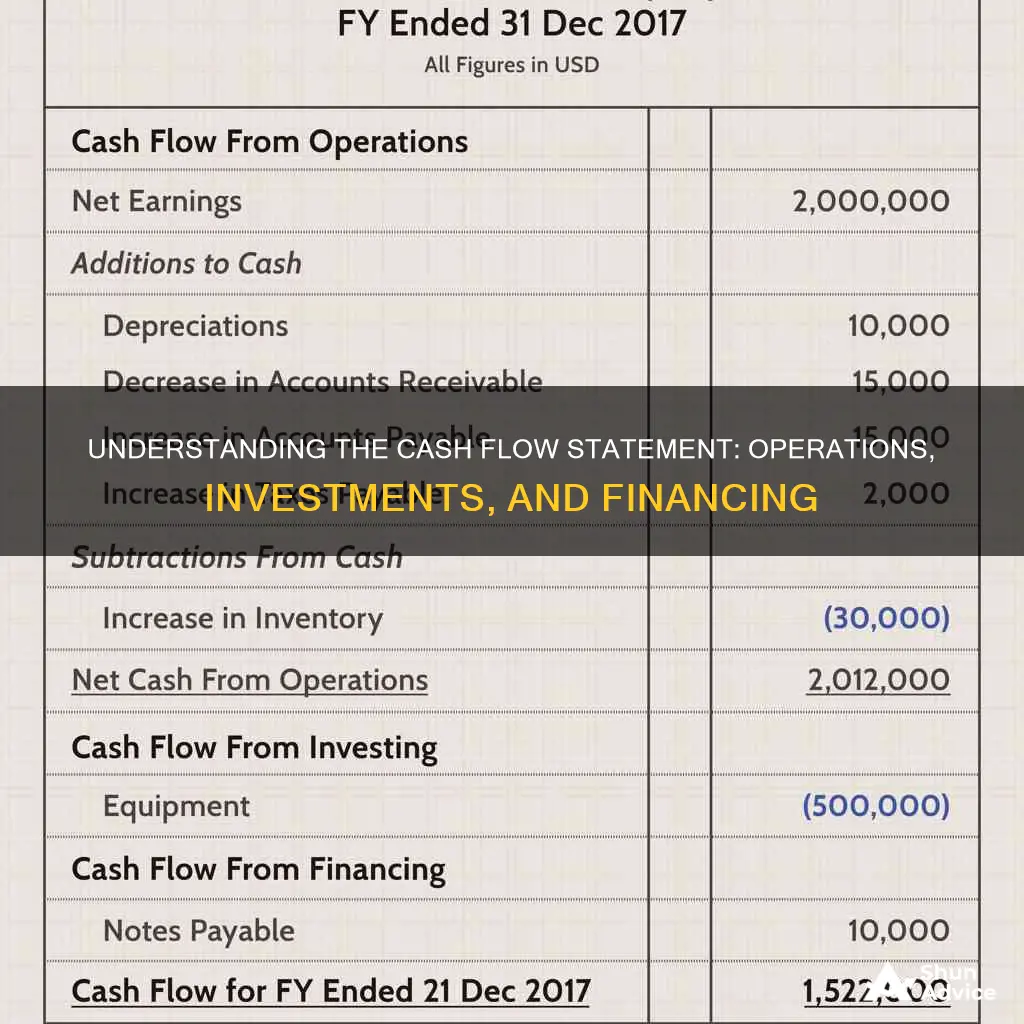

A cash flow statement is a financial report that details the inflow and outflow of cash in a company over a specific period. It is one of the three main financial statements that indicate a company's financial health, the other two being the balance sheet and the income statement. The statement of cash flows is divided into three sections: operating activities, investing activities, and financing activities. Operating activities refer to the principal revenue-generating activities of the company, including sales, purchases, and other expenses. Investing activities include the acquisition and disposal of non-current assets and other investments. Financing activities result from changes in a company's capital structure, including transactions involving debt, equity, and dividends. The cash flow statement is important as it provides insights into a company's liquidity, financial flexibility, and overall financial performance, helping investors, analysts, and management make informed decisions.

What You'll Learn

Operating Activities

The cash flow from operating activities can be calculated using either the direct or indirect method. The direct method involves listing all cash receipts and payments, including cash from customers, cash paid to suppliers and employees, interest paid, and income taxes. The indirect method starts with net income and adjusts for changes in non-cash transactions, such as depreciation and amortization, and changes in working capital.

A positive cash flow from operating activities indicates that a company's liquid assets are increasing, enabling it to cover its expenses and reinvest in its business. It also indicates that the company has enough funds coming in to pay its bills and operating expenses.

Investing Activities: Do Cash Flows Stay Positive?

You may want to see also

Investing Activities

The cash flow statement is a financial report that details how cash entered and left a business during a reporting period. It is one of the three fundamental financial statements used by financial leaders, alongside the income statement and balance sheet. It is particularly useful for investors as it provides an indication of a company's financial health.

The cash flow from investing activities section specifically includes:

- Cash spent on purchasing property, plant, and equipment (PP&E). This is known as capital expenditure (CapEx) and includes items such as new office equipment or land and buildings to house business operations.

- Cash received from selling assets.

- Cash spent on or received from investing in securities.

A positive net cash flow from investing activities indicates that a company has more cash flowing in from these activities than flowing out. This could be due to significant amounts of cash being invested in the company, such as in research and development (R&D), and is not always a warning sign.

Overall, the investing activities section of the cash flow statement provides valuable information about a company's financial health and can help investors and analysts make informed decisions.

Cash Investment Options: Exploring Safe and Smart Strategies

You may want to see also

Financing Activities

- Issuing debt or equity

- Borrowing debt from a bank or creditor

- Issuing bonds

- Repaying debt

- Repurchasing stock

- Dividend payments

The cash flow from financing activities provides investors with insight into the company's financial strength and how well its capital structure is managed. A positive number in this section means more money is flowing into the company than out, increasing its assets. Conversely, negative numbers can indicate that the company is servicing or retiring debt, or making dividend payments and stock repurchases.

For example, let's say a company has the following information in the financing activities section of its cash flow statement:

- Repurchase stock: $1,000,000 (cash outflow)

- Proceeds from long-term debt: $3,000,000 (cash inflow)

- Payments to long-term debt: $500,000 (cash outflow)

- Payments of dividends: $400,000 (cash outflow)

The cash flow from financing activities (CFF) would be calculated as follows:

$3,000,000 - ($1,000,000 + $500,000 + $400,000) = $1,100,000

This positive CFF figure indicates that the company's financing activities are contributing to its cash flow and increasing its assets.

Schwab Negative Cash: What Does it Mean?

You may want to see also

Cash Flow from Operations (CFO)

CFO is calculated by taking into account a company's net income, adjusting for non-cash items, and accounting for changes in working capital. The two main methods for calculating CFO are the direct method and the indirect method. The direct method involves tracking all cash transactions during the period, including cash inflows and outflows. On the other hand, the indirect method starts with net income and makes adjustments for non-cash items and changes in working capital to arrive at a cash basis figure. Most companies use the indirect method due to its simplicity and direct comparison to the income statement and balance sheet.

CFO is an essential tool for business owners, operators, and investors. It helps them understand the cash-generating abilities of the company's core operations, make informed financing decisions, and assess the company's liquidity and ability to meet operational needs. A positive CFO indicates that a company's core business activities are thriving, while a negative CFO may signal issues in day-to-day operations that require additional cash infusion.

Additionally, CFO is a valuable metric for comparing a company's current performance with its historical performance. It provides insights into the efficiency of the company's working capital management and can be a more reliable indicator of financial health than net income, as it is more challenging to manipulate. By analyzing CFO, investors can identify companies with strong financial positions and upward trends in cash flow, which may lead to higher share prices in the future.

Understanding Cash Equivalents: A Guide to Investing Wisely

You may want to see also

Cash Flow from Financing (CFF)

The cash flow statement is one of the three fundamental financial statements that provide crucial financial data to inform a company's decision-making. It is a financial report that details how cash entered and exited a business during a reporting period. It is also referred to as the statement of cash flows and is important for understanding a company's financial health and operational efficiency.

The cash flow from financing activities results from changes in a company's capital structure. It includes the cash flow associated with borrowing and repaying bank loans or bonds and issuing and buying back shares. Dividend payments are also treated as financing cash flow.

The cash flow from financing activities helps investors see how often and how much a company raises capital and the source of that capital. A positive number indicates that cash has come into the company, boosting its asset levels. Conversely, a negative number indicates that the company has paid out capital, such as retiring or paying off long-term debt or making a dividend payment to shareholders.

The financing activity in the cash flow statement focuses on how a firm raises capital and pays it back to investors through capital markets. These activities also include paying cash dividends, adding or changing loans, or issuing and selling more stock. This section of the statement of cash flows measures the flow of cash between a firm and its owners and creditors.

Examples of common cash flow items stemming from a firm's financing activities include:

- Receiving cash from issuing stock or spending cash to repurchase shares

- Receiving cash from issuing debt or paying down debt

- Paying cash dividends to shareholders

- Proceeds received from employees exercising stock options

- Receiving cash from issuing hybrid securities, such as convertible debt

Financing activities show investors exactly how a company is funding its business. If a business requires additional capital to expand or maintain operations, it accesses the capital markets through the issuance of debt or equity. The decision between debt and equity financing is guided by factors including the cost of capital, existing debt covenants, and financial health ratios.

Strategies for Investing Cash Without IRS Attention

You may want to see also

Frequently asked questions

The Statement of Cash Flows (also called the Cash Flow Statement) is a financial report that details the cash generated and spent by a business during a specific period. It is one of the three main financial statements, along with the income statement and balance sheet.

The three main types of cash flow activities are operating activities, investing activities, and financing activities. Operating activities refer to the cash flow generated from a company's regular business operations, including revenue and expenses. Investing activities involve the buying and selling of long-term assets, such as property or equipment. Financing activities include cash inflows and outflows related to debt and equity financing, such as issuing or repaying loans, and paying dividends.

The Statement of Cash Flows provides valuable insights into a company's financial health and liquidity. It helps investors, creditors, and analysts evaluate a company's ability to generate cash, pay its debts, and fund its operations. The statement also helps businesses make informed financial decisions and guide their strategic planning.

Cash flow can be calculated using two methods: the direct method and the indirect method. The direct method involves listing all cash receipts and payments during the reporting period. The indirect method starts with net income and adjusts for changes in non-cash transactions, such as depreciation and changes in working capital.

Cash flow refers to the movement of money into and out of a company, while profit is the amount of money left after subtracting expenses from revenues. A company can have positive cash flow but not be profitable, or vice versa.