When it comes to investing, there are two main options to consider: equity financing and debt financing. Equity financing involves selling a portion of a company's shares in exchange for capital, while debt financing entails borrowing money, typically through loans. Each option has its own set of advantages and disadvantages, and the ideal mix of the two depends on the specific circumstances and goals of the investor or business owner. Equity financing offers the advantage of no repayment obligation, providing extra capital for business growth. However, it comes with the downside of giving up ownership and control of the company. On the other hand, debt financing allows for full ownership and control, but it requires interest payments and can be risky if the business struggles to repay the loan. Ultimately, the decision between equity and debt financing depends on factors such as the type of business, creditworthiness, and the level of control desired.

| Characteristics | Values |

|---|---|

| Definition | Home equity loan: Borrowing a specific amount of money, or a lump sum, using the equity in your home as collateral. Cash-out refinance: Replacing your current mortgage with a new, larger one and taking the difference in cash. |

| Interest rates | Home equity loan: Higher interest rates than cash-out refinance. Cash-out refinance: Lower interest rates than home equity loan. |

| Repayment terms | Home equity loan: Shorter repayment terms. Cash-out refinance: Longer repayment terms. |

| Number of loans | Home equity loan: Two loans to repay (the original mortgage and the home equity loan). Cash-out refinance: One loan to repay. |

| Monthly payments | Home equity loan: Two monthly payments. Cash-out refinance: One monthly payment. |

| Closing costs | Home equity loan: Lower closing costs. Cash-out refinance: Higher closing costs. |

| Risk of losing home | Home equity loan: Higher risk of losing your home if you default. Cash-out refinance: Lower risk of losing your home. |

| Best suited for | Home equity loan: Homeowners seeking funds for targeted purposes, such as home improvements or debt consolidation. Cash-out refinance: Homeowners aiming to seize broader financial opportunities, such as lower interest rates or significant life changes. |

What You'll Learn

Advantages of equity financing

Equity financing is a method of raising capital for a company by selling shares to investors. It is often critical for financing operating expenses in the early stages of a company, but it can also be an effective tool for long-term growth initiatives in more mature companies. Here are some advantages of equity financing:

No repayment obligation

Equity financing does not create a loan to repay, reducing the financial burden on the company. This gives the freedom to channel more money into the business, especially if it is not initially generating a profit.

Access to capital

Equity financing can provide access to substantial capital, which can promote rapid and greater growth. This can make the company more attractive to potential buyers.

Valuable resources and connections

Equity financing can bring valuable resources, guidance, skills, and experience from investors. Some investors may be well-connected, allowing the business to benefit from their network.

No credit issues

Equity financing does not depend on creditworthiness, making it a preferable option for those with poor credit history or lack of financial track record.

Suitability for new businesses

Equity financing is often a solution for new businesses when established financing methods are not available due to the company being considered too new or risky by traditional lenders. Angel investors and venture capitalists are particularly interested in new businesses with growth potential.

Understanding Non-Cash Investment Gains: What You Need to Know

You may want to see also

Advantages of debt financing

Debt financing is when a company raises money by selling debt instruments to investors. It is the opposite of equity financing, which involves issuing stock to raise money.

Retain Control

When you agree to debt financing, the lender has no say in how you manage your company. You retain all the decision-making power and the business relationship ends once you have repaid the loan in full.

Tax Advantage

The amount you pay in interest is tax-deductible, effectively reducing your net obligation.

Easier Planning

You know well in advance exactly how much principal and interest you will pay back each month, making it easier to budget and make financial plans.

Low Interest Rates

Low-interest rates are available, especially with Small Business Administration (SBA) loans. SBA loans are a great option for low-cost funds for business owners looking to expand to more than one location.

Establish and Build Business Credit

Taking out a loan can help you build your small business credit, reducing the need to rely on your personal credit or other high-cost business financing options. Good business credit can also help you establish more favorable terms with vendors.

Fuel Growth

Debt financing can provide the working capital needed to keep your company running smoothly and profitably year-round. It can be used to open new store locations, buy inventory or equipment, hire new workers, and increase marketing efforts.

Investing Without Cash: Strategies for Success

You may want to see also

Equity financing vs debt financing

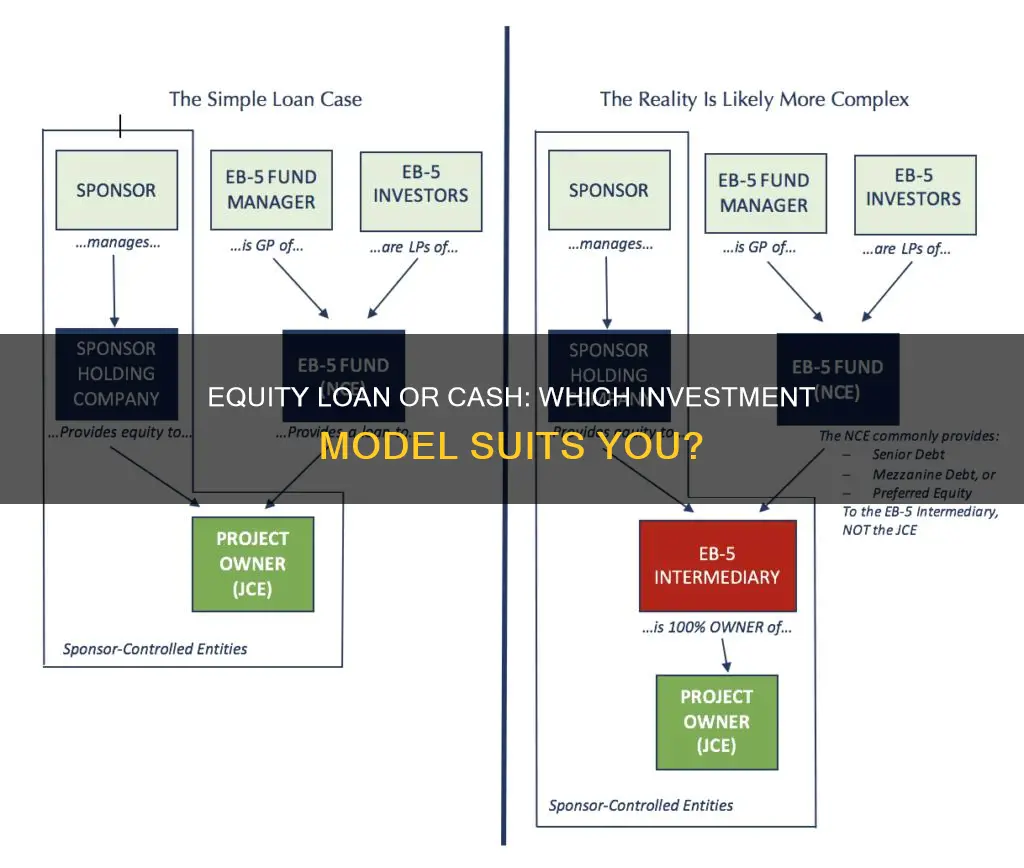

When raising capital, companies have two main options: equity financing and debt financing. Each has its own advantages and disadvantages, and the ideal combination of the two is different for every company.

Equity Financing

Equity financing involves selling a portion of a company's equity in exchange for capital. This means that the business owner gives up a percentage of their company to an investor, who then has a say in business decisions. The main advantage of equity financing is that there is no obligation to repay the money. However, the downside is that the business owner must share their profits and decision-making power with the investor. Equity financing can also be expensive, as the value of the investor's stake could increase rapidly as the business grows.

Debt Financing

Debt financing, on the other hand, involves borrowing money from a lender, which must be repaid with interest. The main advantage of debt financing is that the business owner retains full control of the company, as lenders have no say in business decisions. Debt financing can also be cheaper than equity financing, as the business does not need to give up a portion of its future profits. However, the downside of debt financing is that the business must be confident in its ability to repay the loan, as debt can be a burden on the company's ability to grow.

Key Differences

The biggest difference between debt and equity financing is the exchange of value. Debt financing requires no equity dilution, but the business must pay interest on the loan. Equity financing, on the other hand, does not require the payment of interest, but it does mean sacrificing a stake in the company and sharing future profits.

The decision between debt and equity financing depends on a number of factors, including the business's financial health, growth stage, and the importance of maintaining control. Debt financing is often favoured by businesses that want to retain full control and have the capacity to make regular repayments. Equity financing, on the other hand, may be more attractive to businesses that value input from professional investors and are less established or profitable.

Should I Withdraw My Vanguard Investments?

You may want to see also

Cash equity in real estate

Cash equity is a crucial concept in the real estate sector. It refers to the amount of a property's value that is not borrowed against via a mortgage or line of credit. In other words, it is the cash portion of the equity balance.

When purchasing a property with a mortgage, homeowners may be required to put money down as a down payment. This down payment, along with regular mortgage payments, can increase the amount of cash equity the homeowner has in the property.

For example, if a homeowner buys a $100,000 house with a 20% down payment, and the house is worth $130,000, the owner has $20,000 in cash equity and $30,000 in market equity. The owner's cash equity position increases each month as their mortgage payments chip away at the principal borrowed.

Cash equity is an important indicator of a property's financial health. It is also vital for making informed decisions regarding property valuation and refinancing opportunities. For instance, if a homeowner wants to complete a cash-out refinance, the amount of equity they have accumulated will determine how much they can borrow against their home.

It is important to note that cash equity is different from home equity. Home equity is a measure of the value of a property relative to any remaining mortgage balance. When homeowners want to utilise their home equity, they often borrow against it through a home equity line of credit (HELOC).

While cash flow is important, the primary goal of a real estate investor should be to focus on equity. This means buying properties with built-in equity, which can protect investors from the dangers of leverage and allow them to take advantage of its benefits.

A Beginner's Guide to Investing Cash in Vanguard

You may want to see also

Cash equity in trading

Cash equity trading is typically done by larger, institutional investors rather than retail investors. It is done to generate large returns from changing market conditions. Cash equity trading aims to profit from short-term stock price fluctuations through rapid buying and selling.

To start cash equity trading, you will need to meet certain requirements. Most brokers require a minimum account balance ranging from $25,000 to $100,000 or more. You will also need to open a brokerage account that offers cash equity trading services and platforms, and get approved for cash equity trading by the broker.

There are several strategies that can be used to profit from cash equity trading, including developing a solid trading strategy, capitalizing on short-term opportunities, and managing risk effectively. It is important to remember that cash equity trading involves risks and it is possible to lose money.

Understanding Net Cash Flow: Does It Include Investments?

You may want to see also

Frequently asked questions

An equity loan is a way to borrow money against the value of an asset you own, typically property or shares in a business. The amount you can borrow depends on the value of the asset and how much equity you have in it.

Equity loans can be a good way to access a large sum of money quickly. They can be used for a variety of purposes, such as renovations, large purchases, or consolidating debt. However, if you default on an equity loan, you may lose the asset. Equity loans also typically have higher interest rates than first mortgages.

A cash investment is when an investor uses their own liquid assets to purchase a stake in a business or property. This usually gives them a level of ownership and control in the business, as well as a share of the profits.

Cash investments can provide a business with much-needed capital for growth. They also give investors a stake in the business, motivating them to help it succeed. However, cash investments can be difficult to secure, as investors will usually only invest in businesses with high growth potential. Additionally, business owners may lose some control over their company and will have to share their profits.