A Roth IRA is a powerful tool for retirement savings. It allows your money to grow tax-free, and withdrawals are also tax-free if you're over 59 1/2 and have had the account for at least five years. This makes it an attractive option for those who want to maximise their savings and keep their money out of the government's hands.

However, there are some considerations to keep in mind. For example, there are income restrictions for contributing to a Roth IRA, and you need to be disciplined enough to leave the money in the account for the long term to take full advantage of the tax benefits.

So, when deciding between investing in a fund or a Roth IRA, it's essential to consider your financial goals, risk tolerance, and eligibility.

What You'll Learn

Tax-free growth and withdrawals

One of the biggest advantages of a Roth IRA is that it offers tax-free growth and withdrawals. This means that you can grow your money without paying taxes on the gains, and when you withdraw the money in retirement, you won't have to pay any taxes on it either. This can result in significant savings over time, as you avoid the drag of taxes on your investments.

With a Roth IRA, you contribute money that has already been taxed. This means that when you withdraw the money in retirement, you don't owe any additional taxes on it. This is in contrast to traditional retirement accounts, where you contribute pre-tax dollars and then pay taxes on the gains when you withdraw the money.

The tax-free growth of a Roth IRA can be especially beneficial for long-term investing. Over time, the power of compounding can lead to significant growth in your account, and with tax-free withdrawals, you get to keep more of your money. This makes Roth IRAs ideal for retirement savings, as you can let your money grow without the worry of taxes eating into your returns.

Additionally, Roth IRAs offer flexibility when it comes to withdrawals. While it's generally recommended to leave the money in the account for as long as possible, you can withdraw your contributions at any time without penalties or taxes. This makes Roth IRAs a good option for those who want access to their money without the restrictions that come with other types of retirement accounts.

It's important to note that there are some restrictions and conditions on withdrawals. For example, to take full advantage of the tax-free growth, you need to have held the Roth IRA for at least five years. Additionally, there may be age requirements, such as being at least 59 1/2 years old, to avoid penalties on withdrawing earnings.

In summary, the tax-free growth and withdrawals offered by Roth IRAs make them a powerful tool for long-term investing and retirement savings. By contributing money that has already been taxed, you can avoid paying taxes on the gains and withdrawals, allowing your money to compound and grow over time without the drag of taxes.

Hedge Funds: Are They Worth the Investment Risk?

You may want to see also

No required minimum distributions

One of the key advantages of a Roth IRA is that it offers tax-free growth on your investments. This means that if you meet the age and account age requirements (59 1/2 years old and at least five years old, respectively), you can make withdrawals without incurring any taxes. This feature sets it apart from traditional IRAs, which mandate distributions at age 73, potentially impacting your tax burden during retirement.

The absence of required minimum distributions in a Roth IRA means you can leave your investments untouched and continue to benefit from tax-free growth throughout your retirement. This flexibility can be particularly advantageous if you have other sources of income or don't need to rely solely on your Roth IRA for retirement funding. By leaving your funds in the account, you can maximise their potential for long-term growth.

Additionally, the tax-free nature of Roth IRAs makes them ideal for investing in assets that typically generate taxable income, such as dividend-paying stocks, capital gains-generating investments, and high-yield bond funds. By holding these investments in a Roth IRA, you can reinvest the income they generate without incurring additional taxes, further compounding the growth of your retirement savings.

It's worth noting that while there are no required minimum distributions during your lifetime, there are provisions that come into effect upon your death. In such cases, the designated beneficiary would need to make distributions in accordance with certain requirements. Nonetheless, the flexibility offered by Roth IRAs during your lifetime makes them a powerful tool for retirement planning, allowing you to build a substantial nest egg that remains untaxed.

Mutual Funds and ETFs: A Beginner's Guide to Investing

You may want to see also

Flexible early withdrawals

One of the most attractive features of a Roth IRA is its flexible withdrawal rules. Unlike most tax-advantaged retirement accounts, the Roth IRA allows you to access certain money at any time, while other withdrawals must meet stricter requirements.

You can withdraw your Roth IRA contributions at any time, tax-free and penalty-free. This is because you've already paid income taxes on the money you've contributed to your Roth IRA. As a result, any withdrawals that are a return of your contributions have no tax consequences.

However, the same can't be said for any investment earnings. To withdraw investment earnings, you must meet the following requirements:

- It's been at least five years since the start of the tax year of your first contribution.

- You're at least 59 1/2 years old.

- You're permanently disabled.

- You're the beneficiary of an account owner who has passed away.

- You're withdrawing up to $10,000 to buy your first home.

If your withdrawal doesn't meet the requirements listed above, it can't be considered a qualified distribution. In that case, you'll have to pay income taxes on the earnings you withdraw, as well as a 10% early withdrawal penalty.

It's important to note that you must meet both the five-year rule and one of the other requirements. Therefore, it's possible to reach 59 1/2 years old and still not be able to make qualified distributions from your Roth IRA if it hasn't been at least five years since the start of the year of your first contribution.

Withdrawing Roth conversions is also possible, but it's subject to a separate five-year rule. Each Roth conversion has its own five-year clock that's separate from your account's five-year clock. For example, if you convert $10,000 from your traditional IRA to your Roth IRA in 2024, you would be able to access that money penalty-free five years later in 2029.

When you make a withdrawal, the ordering rules will determine whether it's taxable. Here's how your distributions will be ordered:

- Regular contributions

- Roth conversions and rollovers

- Earnings on contributions

In some cases, you may have enough regular contributions in your account that, if you take a withdrawal, it won't be subject to any taxes or penalties. However, if your withdrawal amount exceeds your total contributions, you may also end up withdrawing conversion, rollovers, or earnings, which may be subject to taxes.

There are some specified exceptions that allow you to access your Roth IRA earnings early without taxes and/or penalties. As mentioned above, you can access your Roth IRA earnings tax-and-penalty-free once five years have passed if one of the following has occurred:

- You've turned 59 1/2 years old.

- You're permanently disabled.

- You're the beneficiary of an account owner who has passed away.

- You're withdrawing up to $10,000 to buy your first home.

Additionally, in the following situations, you can access your Roth IRA earnings without being subject to the 10% early withdrawal penalty:

- You withdraw up to $5,000 to pay for qualified birth or adoption expenses.

- You withdraw up to $22,000 to cover losses due to a federally declared disaster.

- You're the victim of domestic abuse and withdraw the lesser of $10,000 or 50% of your account.

- You withdraw money to pay for higher education expenses.

- You withdraw up to $1,000 to cover personal or family emergency expenses.

- You take a series of substantially equal payments.

- You're subject to an IRS levy on your Roth IRA.

- You pay for unreimbursed medical expenses of more than 7.5% of your annual gross income (AGI).

- You pay for health insurance premiums while you're unemployed.

- You're a qualified military reservist called to active duty.

Bonds vs Mutual Funds: Where Should You Invest?

You may want to see also

Tax diversification

Funding a Roth IRA in conjunction with a 401(k) can provide tax diversification. The classic 401(k) plan offered by most employers provides the same tax benefits as a traditional IRA. Although some workplaces offer a Roth 401(k) option for employees, if yours doesn’t, diverting some of those retirement savings dollars into a Roth IRA will give you more options for managing your tax burden in retirement.

The Difference Between a Roth IRA and a Traditional IRA

The main difference between a Roth IRA and a traditional IRA is how and when you get a tax break. Contributions to traditional IRAs are tax-deductible, but withdrawals in retirement are taxable as income. In comparison, contributions to Roth IRAs are not tax-deductible, but the withdrawals in retirement are tax-free.

Early Withdrawal Rules

Early withdrawal rules are much more flexible with a Roth IRA. Although early withdrawals from retirement accounts are generally discouraged, if you do have to break the seal on the cookie jar, the Roth allows you to withdraw contributions — the money you put into the account, not earnings — at any time without having to pay income taxes.

Restrictions for Retirees

Traditional IRAs require you to start taking required minimum distributions (RMDs) at certain ages. That age was previously 72; it increased to 73 in 2023 and will increase again to 75 in 2033. Unless you’re inheriting the Roth IRA, Roths have no required minimum distribution rules: You’re free to let your savings stay put in the account to continue to grow tax-free as long as you live.

The classic 401(k) plan offered by most employers provides the same tax benefits as a traditional IRA. Although some workplaces offer a Roth 401(k) option for employees, if yours doesn’t, diverting some of those retirement savings dollars into a Roth IRA will give you more options for managing your tax burden in retirement.

Tiger Global Hedge Fund: Strategies for Investment Access

You may want to see also

Estate planning

A Roth IRA is a powerful tool for estate planning. Here are some reasons why:

No Required Minimum Distributions (RMDs)

Unlike traditional IRAs and many other retirement plans, Roth IRAs have no required minimum distributions during the account owner's lifetime. This means that you can leave the money in the account to continue growing tax-free, making it an excellent vehicle for wealth transfer. The entire funds deposited, plus earnings, can be transferred to your beneficiaries.

Avoiding Probate

The money left to heirs in a Roth IRA does not have to go through the probate process, which can be time-consuming and costly. The designated beneficiary on the Roth IRA contract is sufficient for the funds to be transferred outside of probate, and they take precedence over any stipulations in your will.

Tax-Free Withdrawals for Heirs

In most cases, heirs can make tax-free withdrawals from a Roth IRA over ten years. Spouses who inherit Roth IRAs can treat the accounts as their own, with no deadlines for withdrawals. Non-spouse beneficiaries, such as adult children or other heirs, must withdraw all the money within ten years, but if the account existed for at least five years before the owner's death, the distributed money will still be tax-free.

Flexible Investment Options

Roth IRAs offer a range of investment options, including dividend stock funds, value stock funds, Nasdaq-100 index funds, real estate investment trusts (REITs), target-date funds, small-cap stock funds, and bond funds. These options provide diversification and the potential for high returns.

No Upfront Tax Break but Tax-Free Growth and Withdrawals

With a Roth IRA, you pay taxes on contributions upfront, but future withdrawals are tax-free. This can be advantageous if your marginal taxes are higher in retirement than when contributing. Additionally, there are no age limits on contributions, and you can withdraw contributions at any time without penalty.

Creating a Successful Investment Fund: Strategies for Beginners

You may want to see also

Frequently asked questions

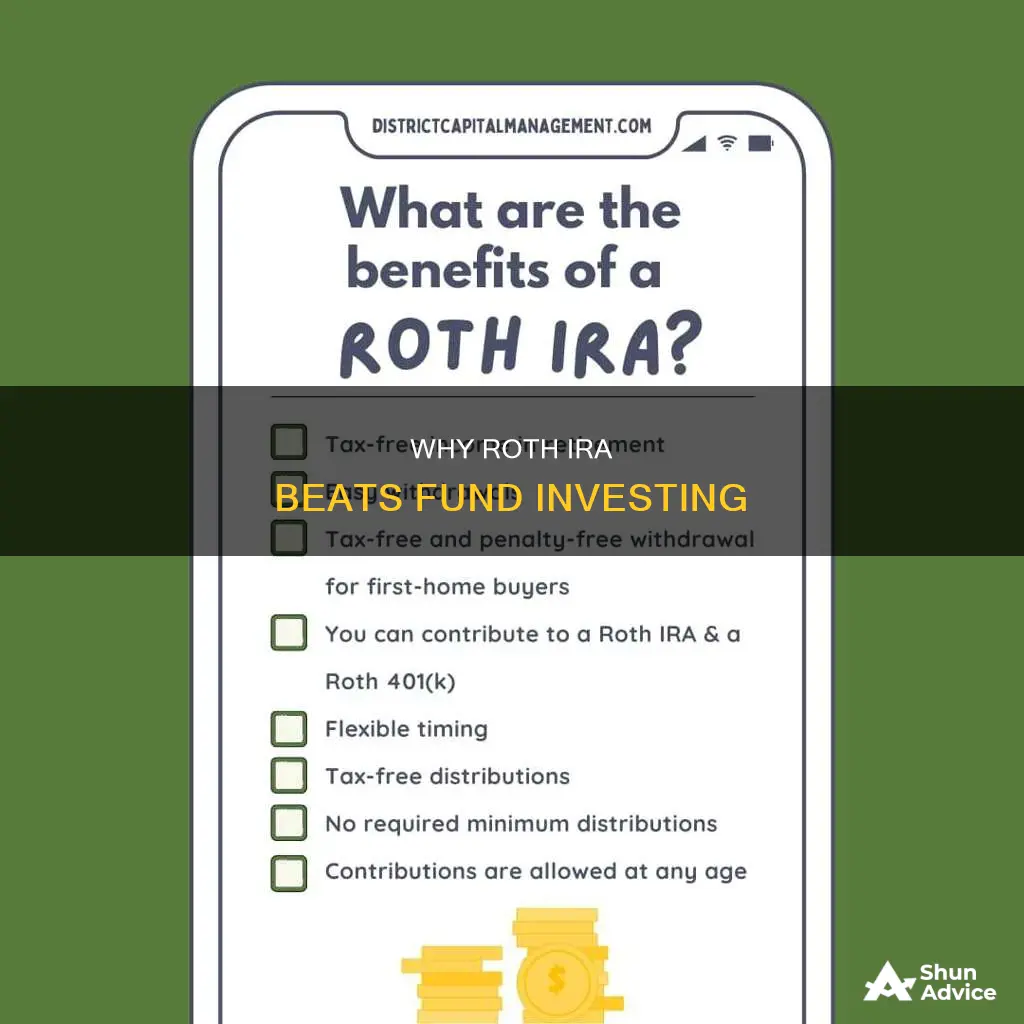

A Roth IRA offers a number of benefits, including tax-free growth and withdrawals, no required minimum distributions, and the ability to withdraw contributions at any time without penalty. Additionally, Roth IRAs can be used for estate planning and provide more flexibility with early withdrawals.

The main difference between a Roth IRA and a traditional IRA is how and when you get a tax break. With a Roth IRA, you invest money that has already been taxed, and withdrawals in retirement are tax-free. In contrast, contributions to a traditional IRA are tax-deductible, but withdrawals in retirement are taxed as income.

Some of the best investments for a Roth IRA include broad-based U.S. stock index funds, U.S. bond index funds, and global stock index funds. These investments provide diversification across different asset classes and market sectors, helping to maximize returns and minimize risk over the long term.