Saving for retirement is a daunting task, but it's important to make steady progress toward your financial goals. Most financial experts recommend saving between 10% and 15% of your pre-tax income each year for retirement. However, the specific percentage you should aim for depends on various factors, such as your age, income, current savings, and desired retirement age.

To determine how much you need to save, you can follow these steps:

- Estimate your retirement income needs by considering your current spending and saving levels, as well as your expected lifestyle in retirement.

- Use common rules of thumb, such as Fidelity's 50/15/5 rule, which suggests allocating 50% of take-home pay to essential expenses, saving 15% of pre-tax income for retirement, and keeping 5% for unplanned expenses.

- Utilize retirement calculators to get a more precise estimate by inputting your current savings rate, anticipated spending in retirement, and other relevant factors.

- Regularly revisit and adjust your retirement plans as life circumstances change.

While there is no one-size-fits-all approach to retirement savings, taking these steps can help you make informed decisions about your financial future.

| Characteristics | Values |

|---|---|

| Percentage of income to save for retirement | 10%-15% per year |

| Fidelity's guideline | Save 10x your income by age 67 |

| Fidelity's milestone targets | 1x by 30, 3x by 40, 6x by 50, 8x by 60, 10x by 67 |

| T. Rowe Price's suggested benchmarks | 1-1.5x by age 35, 3.5-6x by age 50, 6-11x by age 60 |

What You'll Learn

Save 10-15% of pre-tax income

Saving 10-15% of your pre-tax income is a general rule of thumb when it comes to retirement planning. This is because your savings rate is the most important factor in determining whether you will have enough money for retirement. However, there is no one-size-fits-all approach, and the amount you need to save for retirement will depend on your future expenses and lifestyle preferences.

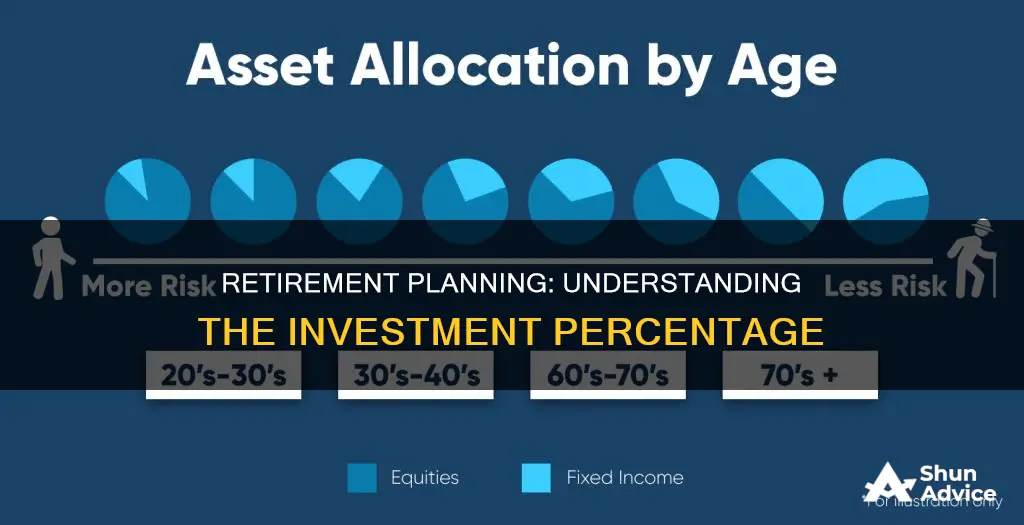

- Your age: The closer you are to retirement, the higher your savings multiple should be. For example, by age 35, aim to save one to one-and-a-half times your current salary, and by age 50, aim for three-and-a-half to six times your salary.

- Your income: Higher earners should save more, as they will get a smaller portion of their income from Social Security in retirement.

- Your current savings: If you have already saved a significant amount, you may be able to save less. For example, if you have saved two times your annual income, you may only need to save 10% of your salary to stay on track.

- Your future expenses: Consider your expected monthly expenses in retirement, such as property taxes, insurance, utilities, and healthcare costs.

- Your lifestyle preferences: Think about your desired lifestyle in retirement. If you plan to travel or have expensive hobbies, you will need to save more.

It's important to note that this rule of thumb assumes that you are saving in tax-favored retirement accounts, such as a 401(k) or IRA, which offer tax advantages and employer matching contributions. Additionally, it's crucial to start saving for retirement as early as possible to take advantage of compound interest. Even if you are older, it's never too late to start saving for retirement and there are various options available, such as 401(k)s, IRAs, and other investment vehicles.

Retirement Community Investment: A Guide to Smart Financial Planning for Your Golden Years

You may want to see also

Fidelity's 50/15/5 rule

50 percent or less of your take-home pay should be spent on essential expenses such as housing, transportation, and food. This includes "must-have" expenses like mortgage or rent payments, utilities, insurance, groceries, healthcare, childcare, and debt payments.

> Consider allocating no more than 50% of take-home pay to essential expenses.

15 percent of your pretax income should be saved into a retirement account like an IRA or a 401(k) account (including matching employer contributions, if that's offered). This is because pension plans are rare, and Social Security may not provide all the money needed for retirement.

> Try to save 15% of pretax income (including employer contributions) for retirement.

> It’s important to save for your future—no matter how young or old you are.

5 percent goes toward unexpected monthly expenses or building an emergency fund. This is good practice as it ensures you won't be tempted to tap into your emergency fund or pay for unexpected expenses by adding to an existing credit card balance.

> Save for the unexpected by keeping 5% of take-home pay in short-term savings for unplanned expenses.

> Everyone can benefit from having an emergency fund. An emergency, like an illness or job loss, is bad enough, but not being prepared financially can only make things worse.

The remaining income (approximately 30%) is usually spent on discretionary purchases like restaurant meals, entertainment, clothing, or travel. This approach allows you to avoid micromanaging every discretionary penny you spend, which can be a hassle that makes it more likely that you'll ditch budgeting altogether.

It's important to note that this rule is adjustable and serves as a starting point. It works best if you're already living somewhat comfortably, as you may need to increase your retirement savings if you want to improve your lifestyle in retirement. Additionally, if you're struggling with debt, a different budget rule like 50/20/30 or 80/20 might be a better fit.

Young Investors: Why the Hesitation?

You may want to see also

Savings benchmarks by age

Retirement savings benchmarks vary depending on the source and are influenced by factors such as age, income, and desired lifestyle in retirement. Here is a compilation of savings benchmarks by age from different sources:

Fidelity:

Fidelity's guidelines suggest the following savings benchmarks by age:

- By age 30: 1x your salary

- By age 40: 3x your salary

- By age 50: 6x your salary

- By age 60: 8x your salary

- By age 67: 10x your salary

T. Rowe Price:

T. Rowe Price offers the following benchmarks:

- By age 35: 1 to 1.5 times your current salary

- By age 50: 3.5 to 6 times your salary

- By age 60: 6 to 11 times your salary

Microsoft:

Microsoft's age-based benchmarks are as follows:

- Age 30: Half of total pre-tax income

- Age 35: 1x to 1.5x of total pre-tax income

- Age 40: 1.5x to 2.5x of total pre-tax income

- Age 45: 2.5x to 4x of total pre-tax income

- Age 50: 3.5x to 6x of total pre-tax income

- Age 55: 4.5x to 8x of total pre-tax income

- Age 60: 6x to 11x of total pre-tax income

- Age 65: 7.5x to 14x of total pre-tax income

Edward Jones:

While Edward Jones emphasizes that average savings benchmarks may not reflect an individual's unique financial situation, they provide the following generalized benchmarks:

- Age 29, income of $100,000: savings of $15,000 - $90,000 to maintain the current lifestyle

- Age 65, retirement age: savings range of $740,000 - $1,010,000

Investopedia:

According to Investopedia, the following are recommended savings benchmarks:

- By age 30: 1x your annual salary

- By age 40: 3x your annual salary

- By age 50: 6x your salary

- By age 60: 8x your salary

- By age 67: 10x your current annual salary

It's important to note that these benchmarks are general guidelines, and individual circumstances may vary. It's always a good idea to consult with a financial advisor to determine personalized savings goals and strategies.

Understanding Schedule D: Uncovering the Intricacies of Non-Retirement Investments

You may want to see also

FIRE community

The FIRE (Financial Independence, Retire Early) movement is a lifestyle movement with the goal of gaining financial independence and retiring early. The model involves saving and investing 50% to 70% of your income, or more, and is therefore an extreme savings plan. The movement is particularly popular among millennials.

FIRE followers drastically reduce their expenses, seek ways to increase their income, and invest heavily. The aim is to accumulate assets until the passive income from these assets provides enough money to cover living expenses.

There are several types of FIRE:

- Lean FIRE is about achieving financial independence earlier by living exceedingly frugally. With very low expenses, a smaller investment portfolio is needed to achieve financial independence.

- Fat FIRE is a strategy for achieving financial freedom and early retirement with a larger budget than traditional retirement planning. This approach requires saving and investing a significant portion of income to build a substantial nest egg, enabling individuals to retire early while maintaining a higher standard of living.

- Coast FIRE has at least two stages. In the first, an investor aggressively saves and builds their investment portfolio. In the second stage, the investor can stop or reduce their investing and enjoy a measure of freedom without being fully financially independent.

- Barista FIRE allows people to partially retire before they are fully financially independent. It involves switching to a less-demanding (usually part-time) job that provides some income and perhaps benefits such as health insurance.

FIRE adherents save a much higher proportion of their income than the average person. However, the amount you should save for retirement depends on a variety of factors, including your income, when you plan to retire, your retirement lifestyle, and when you started saving.

According to T. Rowe Price, by age 35, you should aim to save one to one-and-a-half times your current salary for retirement. By age 50, that goal is three-and-a-half to six times your salary, and by age 60, it's six to 11 times.

Most financial experts recommend an annual retirement savings goal of 10% to 15% of your pre-tax income. However, high earners generally want to save more, while low earners can typically save less, since Social Security may replace more of their income.

Fidelity suggests aiming to save at least 15% of your pre-tax income each year for retirement, including any employer match. This is based on research indicating that most people will need somewhere between 55% and 80% of their preretirement income to maintain their lifestyle in retirement, with some of this money coming from Social Security.

What Your Peers are Investing In

You may want to see also

Retirement calculators

There are several retirement calculators available online, often provided by financial services companies. These calculators can provide an estimate of your total retirement savings based on your current contributions, and then calculate how far your savings will stretch in today's dollars, taking inflation into account.

To use a retirement calculator, you'll need to input information such as your current age, income, and how much you've already saved for retirement. You'll also need to provide details about your retirement plans, such as your expected retirement age and budget.

For example, the NerdWallet retirement calculator asks for the following information:

- Annual pre-tax income

- Current retirement savings

- Monthly contribution

- Monthly budget in retirement

- Other retirement income (e.g. pension or Social Security)

- Retirement age

- Life expectancy

- Pre-retirement and post-retirement rates of return

- Inflation rate

- Annual income increase

After entering these details, the calculator will provide an estimate of your total retirement savings and how much you'll need to save to meet your expected retirement budget.

It's important to note that retirement calculators use assumptions and estimates, so the results may not be entirely accurate. However, they can still be a valuable tool to help you plan for the future.

In addition to using a retirement calculator, it's recommended that you save 10% to 15% of your income each year for retirement. This may vary depending on various factors, such as your desired retirement age and lifestyle. Starting to save early and taking advantage of tax-advantaged savings accounts can also help you work towards a secure retirement.

Dogecoin: Invest Now or Never?

You may want to see also

Frequently asked questions

Most investors should save at least 15% of their income for retirement. However, some experts recommend saving between 10% and 15% of your pre-tax income annually.

By age 35, you should aim to save one to one-and-a-half times your current salary for retirement.

You can calculate this in several ways, including:

- Using a retirement calculator

- Multiplying the annual income you hope to live on in retirement by 25

- Multiplying your preretirement income by 10