How much cash you should keep in your investment portfolio depends on several factors, including your financial goals, risk tolerance, and current life stage. While cash and cash equivalents can provide liquidity, portfolio stability, and emergency funds, keeping too much cash in your portfolio can result in sacrificing potential long-term returns from stocks and bonds.

A general rule of thumb is to maintain cash and cash equivalents, such as savings and money market accounts, between 2% and 10% of your portfolio. However, this can vary depending on individual circumstances, with some investors choosing to hold as much as 20% to 30% in cash.

It is essential to strike a balance between having sufficient cash reserves and investing for the long term to meet your financial goals.

| Characteristics | Values |

|---|---|

| Minimum recommended cash and cash equivalents | 2% |

| Maximum recommended cash and cash equivalents | 10% |

| Recommended cash allocation for retirees | 4 years' expenses |

| Recommended cash allocation for younger investors | 3 months' expenses |

| Recommended cash allocation for emergency funds | 6 months' expenses |

| Recommended cash allocation for investors with < $500,000 net worth and >10 years to retirement | 0% |

| Average cash allocation for investors in 2022 | 20% |

| Average cash allocation for investors in 2023 | 10% |

| Average cash allocation for investors in 2024 | 8-9% |

What You'll Learn

Liquidity and emergency funds

Emergency Funds:

It is generally recommended to maintain an emergency fund that can cover your expenses for at least three to six months. This fund should be easily accessible and kept in highly liquid forms, such as bank savings or checking accounts. This fund ensures you have financial support during unexpected situations like job loss, accidents, or medical bills. By having this cash reserve, you avoid the need to sell your assets or investments prematurely, which could result in excess taxes and suboptimal returns.

Liquidity and its Role in Your Portfolio:

Cash and cash equivalents, such as money market accounts, savings accounts, and short-term investments, provide liquidity to your portfolio. They offer stability and flexibility, allowing you to quickly take advantage of investment opportunities, especially during market disruptions or fluctuations. Liquidity is particularly important for retirees, as it provides peace of mind and ensures they have sufficient reserves to navigate uncertain economic periods or downturns.

Determining the Right Cash Allocation:

The appropriate cash allocation for your portfolio depends on various factors, including your financial goals, risk tolerance, time horizon, and current market conditions. While a general rule of thumb suggests that cash and cash equivalents should comprise between 2% and 10% of your portfolio, this can vary based on individual circumstances. For example, if you are planning a significant purchase or expense within the next few years, such as a home or college tuition, setting aside a larger portion of cash in advance may be prudent.

Advantages of Higher Cash Allocation:

Holding a more significant amount of cash in your portfolio, such as 20% to 30%, can serve as a defensive strategy if asset markets decline. It provides the flexibility to hold assets instead of selling them at a loss. Additionally, having a substantial cash reserve can be advantageous when asset prices fall, as it allows you to invest in opportunities at lower prices.

Disadvantages of Higher Cash Allocation:

While holding a large percentage of cash in your portfolio can provide stability, it is important to consider the potential drawbacks. Cash investments often provide lower returns compared to stocks and bonds over the long term. By allocating too much of your portfolio to cash, you may miss out on the higher returns associated with other investments, potentially slowing your progress toward your financial goals.

Striking a Balance:

Ultimately, the right balance of cash in your portfolio depends on your personal circumstances and financial goals. While it is essential to have sufficient liquidity and emergency funds, you also want to ensure your portfolio is positioned to achieve your desired investment returns. Regularly reviewing and adjusting your portfolio allocation, at least annually, is crucial to ensuring it aligns with your evolving needs and market conditions.

Transferring Cash to Invest on Stash: A Step-by-Step Guide

You may want to see also

Peace of mind

Emergency Funds and Living Expenses:

It is recommended to have enough cash reserves to cover your living expenses for at least six months in case of emergencies. This provides a safety net during unexpected financial difficulties, such as job loss, accidents, or medical bills. This emergency fund ensures you don't have to sell your assets at unfavourable times, incurring excess taxes and sub-optimal returns.

Age and Risk Tolerance:

Your age and risk tolerance play a significant role in determining your cash allocation. Younger investors, with a longer investment horizon, are advised to hold less cash as they can afford to take on more risk and have time to recover from market downturns. As you get closer to retirement, consider increasing your cash allocation to ensure a stable income source and peace of mind during economic downturns.

Market Conditions and Opportunities:

The current state of the market and your investment opportunities should also be considered. During volatile markets or rising interest rates, you may be tempted to increase your cash holdings. While this can provide stability, it's important to remember that cash has historically underperformed other investments like stocks and bonds over the long term. Therefore, it's crucial to strike a balance and not miss out on potential market gains.

Diversification and Liquidity:

Diversification is essential for peace of mind, and a well-diversified portfolio typically includes a mix of stocks, bonds, and cash or cash equivalents. Cash provides liquidity, allowing you to take advantage of new investment opportunities or deal with unexpected expenses. A common rule of thumb is to allocate between 2% and 10% of your portfolio to cash and cash equivalents, but this may vary depending on your circumstances.

Psychological Comfort:

Having a certain level of cash in your portfolio can provide psychological comfort and help you stick to your investment strategy during various economic, market, and political environments. It serves as a reserve capital that you can fall back on when markets are volatile, reducing the stress associated with investing.

In conclusion, peace of mind in investing comes from finding the right balance between having sufficient cash reserves for emergencies and future opportunities while also ensuring your money is working hard for you in other investments. The exact percentage of your portfolio that should be in cash will depend on your personal circumstances, risk tolerance, and financial goals.

Morris Invest: The Cash-Only Strategy Explained

You may want to see also

Risk management

The percentage of your investment portfolio that should be in cash depends on your risk tolerance, financial goals, and current life stage. While cash and cash equivalents are among the safest and most liquid investments, they offer limited returns and may not keep up with inflation in the long term. Therefore, it is crucial to carefully consider the level of cash allocation in your portfolio as part of your risk management strategy.

Advantages of Holding Cash

Holding a significant amount of cash in your portfolio can provide several benefits:

- Liquidity and Emergency Funds: Cash offers immediate liquidity, which is crucial for emergency funds and can help you weather unexpected financial difficulties without having to sell your assets. It is generally recommended to keep at least three to six months' worth of living expenses in cash reserves.

- Market Downturn Protection: Cash can provide a buffer during market downturns or volatile periods. If you are risk-averse or nearing retirement, having a larger cash position can help preserve your capital and provide stability.

- Investment Opportunities: Holding cash allows you to quickly take advantage of investment opportunities, especially during market disruptions or fluctuations. It enables you to buy assets at lower prices and add new passive income streams.

Disadvantages of Holding Cash

While cash provides safety and liquidity, there are also drawbacks to consider:

- Limited Returns: Cash offers low returns compared to other investments like stocks and bonds. Over time, cash may not be able to generate returns above the inflation rate, resulting in a loss of purchasing power.

- Opportunity Cost: Holding too much cash can lead to missed opportunities for higher returns in other investments. Historical data shows that diversified portfolios emphasizing stocks and bonds tend to outperform cash holdings over the long term.

- Reinvestment Risk: Short-term interest rates can fluctuate, and if you are not locked into a longer-term rate, you may be subject to lower yields when reinvesting.

Determining the Right Cash Allocation

The appropriate cash allocation in your portfolio depends on various factors:

- Risk Tolerance: Your risk tolerance plays a crucial role in determining your cash allocation. If you have a higher risk tolerance, you may be comfortable with a smaller cash position and invest more in stocks or other assets.

- Financial Goals: Consider your financial goals and objectives when deciding on your cash allocation. If you are saving for a significant expense, such as a house or education, you may want to hold more cash to avoid putting those funds at risk.

- Time Horizon: Your investment time horizon is another critical factor. Younger investors with a longer time horizon can generally afford to hold less cash and focus more on growth-oriented investments. As you approach retirement, you may want to increase your cash position for added stability.

- Market Conditions: While it is not advisable to make long-term investment decisions based on short-term market conditions, it is essential to consider the current interest rate environment and the potential impact on your cash holdings.

Recommended Cash Allocation

The recommended cash allocation for a portfolio typically ranges from 2% to 10%. However, this can vary depending on your personal circumstances and financial goals. Some investors may hold as much as 20% to 30% in cash, especially during volatile market conditions or when they anticipate a market downturn.

It is essential to regularly review and adjust your cash allocation as your financial situation, risk tolerance, and market conditions change. Consulting a financial advisor can provide personalized guidance on determining the appropriate cash allocation for your portfolio.

Strategizing Initial Investment: Deciding Your First Cash Flow

You may want to see also

Inflation protection

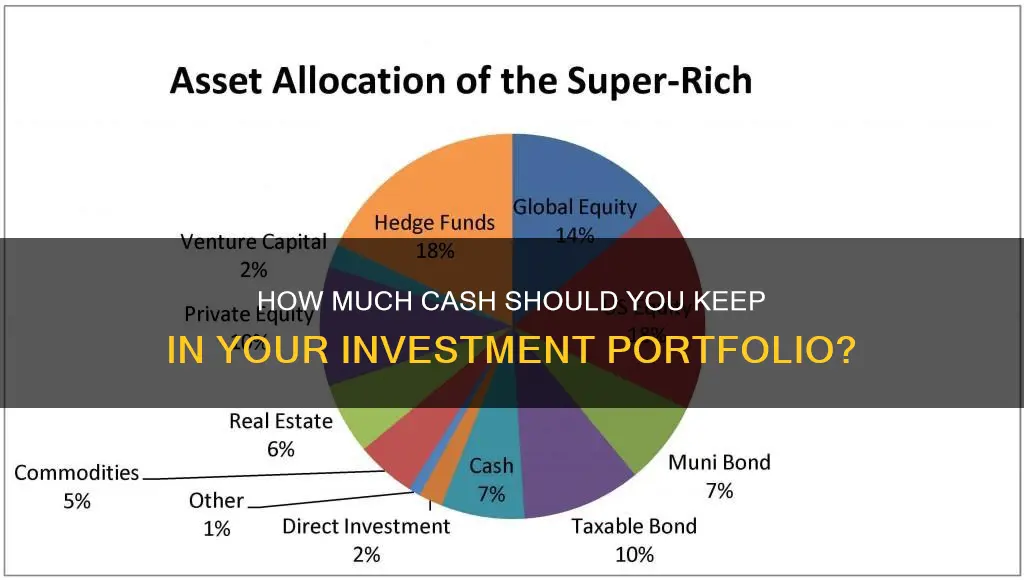

Diversify Your Portfolio

It is recommended to diversify your investments across different asset classes that can act as a hedge against inflation. This includes commodities, such as energy, industrial metals, precious metals, and agricultural products, as well as international stocks.

Invest in Inflation-Resistant Assets

Consider investing in assets that are resistant to inflation, such as Treasury Inflation-Protected Securities (TIPS). TIPS are issued by the U.S. government and provide protection against inflation as the principal amount adjusts based on the inflation rate.

Equity Investments

Equities tend to keep up with inflation better than bonds due to their ability to adjust earnings upward. Consider investing in commodity-producing equities, value stocks, and real estate investment trusts (REITs).

Fixed Income Investments

In addition to TIPS, there are other fixed-income investments that can provide inflation protection. High-yield bonds and short-term bonds have historically performed well during periods of high inflation.

Alternative Investments

Alternative tangible investments such as gold, art, wine, classic cars, and gemstones can also be considered. These investments can provide diversification benefits and protect against inflation, especially in times of economic uncertainty.

Emergency Savings

While keeping large amounts of cash is not advisable during inflationary periods, it is important to maintain adequate emergency savings to account for the rising cost of living. Ensure you have enough liquid savings to cover three to six months' worth of living expenses.

Weighing the Benefits: Cashing in on Investments

You may want to see also

Long-term investing goals

When considering long-term investing goals, it's important to remember that cash and cash equivalents, such as savings accounts and short-term investments, play a crucial role in providing liquidity, stability, and emergency funds. While it may be tempting to invest all your money in stocks, bonds, or other assets, maintaining a certain percentage of your portfolio in cash is essential for several reasons.

Firstly, cash provides liquidity, which is crucial for both emergencies and market downturns. It's recommended to have enough cash to cover at least three to six months' worth of expenses in case of unexpected events like job loss or medical bills. This emergency fund ensures you don't have to sell your assets at unfavourable times, potentially incurring excess taxes and suboptimal returns.

Secondly, cash can be used to take advantage of investment opportunities. Market fluctuations and disruptions create chances to invest in undervalued assets, and having cash on hand allows you to act quickly. This strategy, known as "dry powder," is employed by some of the best investors in history, including Warren Buffett and Charlie Munger, who have held significant amounts of cash to capitalise on attractive opportunities.

Thirdly, cash provides stability and peace of mind, especially for retirees or those close to retirement. A portion of your portfolio in cash and cash equivalents can help meet income needs over a period of a few years, ensuring stability and reducing the impact of market fluctuations. This is particularly important during periods of economic downturn or uncertainty.

So, how much cash should you keep in your portfolio for the long term? Generally, a good rule of thumb is to maintain between 2% and 10% of your portfolio in cash and cash equivalents. However, this may vary depending on your risk tolerance, life stage, financial goals, and time horizon. Younger investors, for example, may be advised to hold less cash due to their longer investment horizon, while retirees might prefer a larger cash cushion.

Additionally, consider your investment strategy. If you're a tactical investor who actively manages your portfolio based on market opportunities, you might want to hold a larger percentage of cash to take advantage of market dips. On the other hand, if you're a passive investor using a traditional asset allocation model, your cash allocation might be lower, with a focus on stocks, bonds, or other assets.

Remember, while cash provides stability and liquidity, it may not keep up with inflation over the long term. Therefore, it's crucial to regularly review your portfolio and adjust your cash allocation as needed to ensure it aligns with your financial goals and market conditions.

Amazon's Investment Strategies: Where is the Money Going?

You may want to see also

Frequently asked questions

The recommended percentage of cash in an investment portfolio varies depending on individual circumstances and goals. A common rule of thumb is to maintain cash and cash equivalents, such as savings and money market accounts, within a range of 2% to 10% of your portfolio. However, this may differ based on factors like your financial objectives, risk tolerance, and life stage.

Cash and cash equivalents offer liquidity, portfolio stability, and emergency funds. They are considered safe and liquid investments, providing easy access to funds during market downturns or unforeseen expenses. However, cash may not be a suitable long-term investment strategy as it may not generate returns above the inflation rate, potentially hindering your ability to achieve crucial financial goals.

Age is an important factor when determining your cash allocation. Generally, younger investors are advised against holding substantial amounts of cash due to their longer investment horizon. They can also take advantage of market corrections to dollar-cost average and acquire more shares. On the other hand, retired investors may require higher cash allocations to meet liquidity needs and provide peace of mind during economic downturns.

Your investment strategy plays a crucial role in deciding your cash allocation. Tactical investors who employ strategies such as value investing may adjust their cash levels based on market opportunities. They tend to increase cash positions when markets are expensive and use the reserves to invest when asset prices fall. In contrast, passive investors following a traditional asset allocation model typically maintain a fixed percentage of cash, stocks, and bonds, rebalancing their portfolio periodically.