Retirement and trading portfolios are two very different things. Retirement portfolios are designed to provide an income during retirement, whereas trading portfolios are focused on generating returns through buying and selling assets. When deciding what to invest in, it's important to consider your financial goals and risk tolerance, as well as your age and how close you are to retirement.

A well-diversified retirement portfolio should include a mix of stocks, bonds, and cash investments, with the specific allocation depending on your individual circumstances. It's generally recommended to focus on growth investments when you're younger and then shift towards income and capital preservation as you approach retirement age.

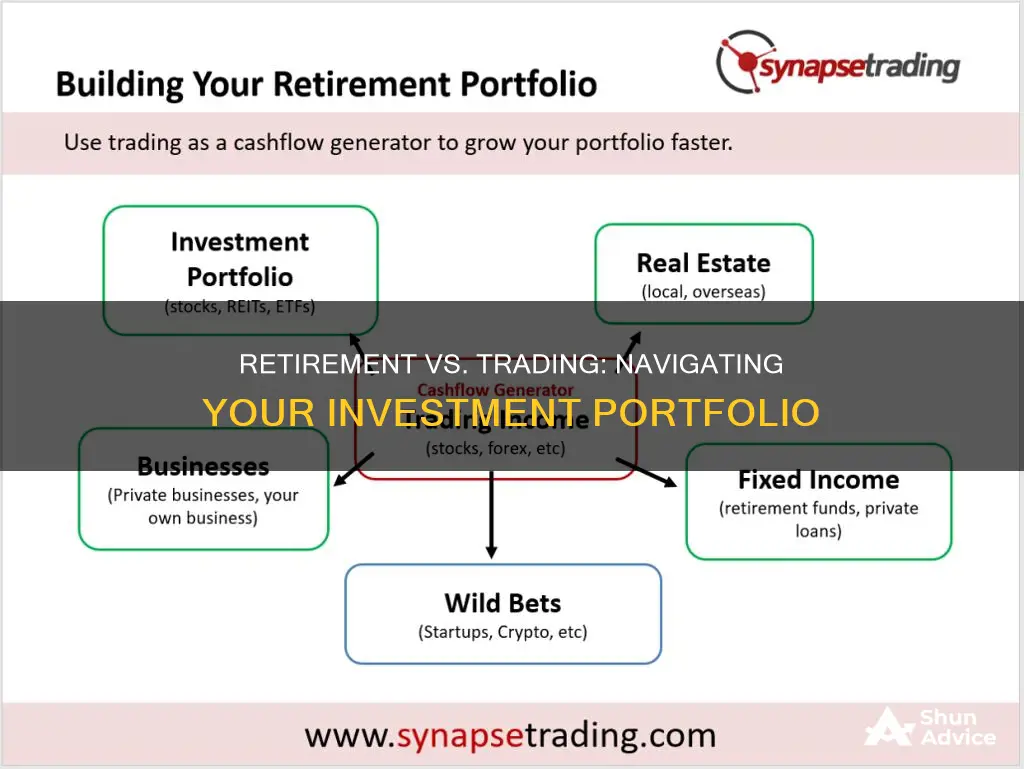

On the other hand, a trading portfolio might include a wider range of assets, such as stocks, bonds, exchange-traded funds (ETFs), mutual funds, commodities, futures, options, and real estate. The allocation of assets in a trading portfolio will depend on your investment strategy and risk tolerance.

What You'll Learn

Stocks, bonds, and cash investments

Stocks

Stocks are crucial for long-term growth potential, especially for younger investors. Historical data shows that stocks have generated higher returns over time compared to other asset classes. Therefore, it is recommended to maintain a healthy exposure to stocks throughout your working years and even into retirement. This helps protect your portfolio from the negative effects of inflation and taxes. However, as you approach retirement, you may want to gradually reduce your stock allocation and shift towards more conservative investments.

Bonds

Bonds are considered a more conservative investment option compared to stocks. They are often used to generate income and preserve capital. As you get closer to retirement, consider adding a meaningful allocation of bonds to your portfolio. This shift towards fixed-income investments helps balance your portfolio and manage risk. During your retirement years, a larger allocation to bonds can provide a steady income stream and reduce exposure to the volatility of stocks.

Cash Investments

Cash investments include holdings such as money market funds, certificates of deposit (CDs), and short-term bonds. It is recommended to set aside at least one year's worth of cash to cover living expenses and supplement other income sources during retirement. Additionally, consider creating a short-term reserve equivalent to two to four years' worth of living expenses. This reserve can be invested in short-term bonds, CDs, or other liquid accounts, providing easy access to cash during market downturns without the need to sell stocks.

Adapting Your Strategy Over Time

The allocation of stocks, bonds, and cash in your portfolio should be adjusted as you progress through different life stages. When you're younger, focus primarily on the growth potential of stocks. As you enter your peak earning years, you may want to start adding more conservative investments, such as bonds, to your portfolio. Nearing retirement, gradually shift towards a more balanced approach, with a moderate allocation of stocks, bonds, and cash, depending on your risk tolerance and income needs. During retirement, the focus shifts to income generation and capital preservation, with a larger allocation to bonds and cash.

Kyrgyzstan: The Next Construction Hub?

You may want to see also

Growth vs capital preservation

When it comes to investing, there are two primary approaches: growth and capital preservation. Each has its advantages and disadvantages, and understanding these is crucial before deciding which strategy to adopt.

Growth

Growth, or capital growth, is an investment approach that focuses on increasing the value of your investments over time. This strategy is often associated with higher risks and volatility but also offers the potential for substantial profits. Growth investors are willing to tolerate more risk and invest in stocks with high price-earnings (P/E) ratios. The main advantage of growth investing is the opportunity for large profits, as seen with successful companies like Microsoft. However, there is also a high-risk factor, as not all investments will lead to such impressive returns. Additionally, growth assets may have low liquidity, resulting in opportunity cost risk.

Capital Preservation

On the other hand, capital preservation is a conservative investment strategy that prioritises preserving capital and preventing portfolio losses. Investors employing this strategy focus on ultra-secure short-term investments, such as certificates of deposit (CDs), savings accounts, and Treasury bills. The primary goal is to cover the inflation rate, making it appealing to retirees who want to ensure their savings last throughout retirement. Capital preservation offers minimal to low-risk levels and stable returns, with many investments being government-backed. However, a significant drawback is the impact of inflation on the rate of return over time. While "safe" investments may protect your capital in the short term, inflation can gradually erode the real value of your investments.

Retirement Portfolio vs Trading Portfolio

When considering a retirement portfolio, the key is to strike a balance between preservation and growth. In the early stages of your career, it is recommended to focus on growth potential, particularly in stocks, as you have time to recover from any market downturns. As you progress through your career, you may want to maintain a healthy exposure to stocks while gradually introducing more conservative investments, such as bonds. Closer to retirement, the focus shifts towards capital preservation and income generation, with a greater allocation to bonds and cash investments. This ensures that your portfolio can support you throughout your retirement years, which could span several decades.

In contrast, a trading portfolio may be more focused on growth and short-term gains, depending on your risk tolerance and investment objectives. Trading portfolios can include a wider range of investments, such as equities, futures, options, and commodities, depending on your goals and risk appetite.

Roth IRA: Best Investments Now

You may want to see also

Risk tolerance

- Age and Life Stage: Age is often a determining factor in risk tolerance. Generally, younger investors with a longer time horizon until retirement are considered more risk-tolerant. They are more likely to invest in stocks and stock funds due to their higher risk tolerance. However, it's important to note that age is not the sole factor, and individuals can remain aggressive investors even after reaching retirement age.

- Financial Goals: Your investment goals play a crucial role in shaping your risk tolerance. If you are investing for long-term goals like retirement, you may be willing to take on more risk. In contrast, shorter-term financial goals may prompt a more conservative approach with lower-risk investments.

- Income and Net Worth: Your income and net worth can influence your risk tolerance. Individuals with higher incomes or net worth may have more financial flexibility and a greater capacity to take on riskier investments. Conversely, those with limited financial resources may need to be more cautious in their investment choices.

- Investment Experience: Your level of investment experience is another factor in determining risk tolerance. If you are new to investing, it's prudent to start with caution and gain experience before taking on more significant risks.

- Risk Capital: This refers to the amount of money you can invest or trade without significantly impacting your lifestyle if lost. A higher amount of risk capital allows for more aggressive risk tolerance, while limited risk capital may require a more conservative approach.

- Risk Tolerance Assessments: Online risk tolerance assessments, surveys, and questionnaires can help you understand your risk tolerance. These tools consider various factors, including your financial goals, time horizon, and investment experience, to provide a more comprehensive understanding of your risk tolerance level.

As you approach retirement, it's essential to periodically assess your risk tolerance and adjust your portfolios accordingly. While a certain level of risk is necessary to grow your investments, it's important to balance it with preservation, especially as you transition from saving to generating income during retirement.

Fisher Investments Pay Periods: Unveiling the Mystery

You may want to see also

Active vs passive portfolio management

Active vs. Passive Portfolio Management

There are two main investment strategies for generating returns on investment accounts: active and passive portfolio management. Active portfolio management involves frequent trades and focuses on outperforming the market compared to a specific benchmark, such as the Standard & Poor's 500 Index. It requires a hands-on approach and aims to beat the stock market's average returns by taking advantage of short-term price fluctuations. Active investing requires a deeper analysis and expertise to know when to pivot into or out of a particular stock, bond, or asset. It also entails greater risks and larger fees.

On the other hand, passive portfolio management, also known as index fund management, involves holding investments over a long period and aims to replicate a specific benchmark or index to match its performance. Passive investors tend to rely on fund managers to ensure the investments held in the funds are performing well and expect them to replace declining holdings. This strategy leads to lower management fees since it does not involve a proactive investment approach. Passive investing is more prevalent among retail investors and has historically earned more money than active investing.

While active investing may be more suitable for those who want to take advantage of short-term price fluctuations and are willing to take on greater risks, passive investing offers a buy-and-hold strategy with lower fees and less buying and selling. However, passive investing may be too limited and may not beat the market during times of turmoil.

Retirement portfolios

Retirement portfolios should be designed to meet financial needs during retirement, focusing on both preservation and growth. It is recommended to have a year's worth of spending cash and two to four years' worth of living expenses in short-term, liquid accounts to protect against downturns. The remainder of the portfolio can be allocated to a mix of stocks, bonds, and cash investments to generate income and growth. As retirement approaches, the allocation can shift towards more conservative assets, such as bonds and cash, to preserve capital and generate income.

Trading portfolios

When it comes to trading portfolios, diversification is key. A well-diversified portfolio can help maximize returns and reduce risk. Stocks, bonds, commodities, cash, and cash equivalents are considered the core of a portfolio, but other assets like real estate, gold, and art collectibles can also be included. The allocation of assets depends on the investor's risk tolerance, investment objectives, and time horizon. Aggressive portfolios, for example, assume greater risks in search of greater returns, while defensive portfolios focus on consumer staples that are impervious to downturns.

Paying Off Debt: The Ultimate Investment Strategy?

You may want to see also

Tax-efficiency

Taxes can be one of the biggest expenses on investments, so it's important to consider tax-efficiency when deciding what to include in your retirement portfolio versus your trading portfolio.

Taxable Accounts

Taxable accounts, such as brokerage accounts, offer more flexibility than tax-advantaged accounts. They are taxed depending on how long the asset was held and sold. Investments held for longer than a year are subject to long-term capital gains rates of 0%, 15%, or 20%, depending on the investor's tax bracket. Investments held for a year or less are taxed according to the individual's ordinary income tax bracket.

Tax-Advantaged Accounts

These accounts can be tax-deferred or tax-exempt. Tax-deferred accounts, such as traditional IRAs and 401(k) plans, provide upfront tax breaks. Investors pay taxes when they withdraw their money in retirement, meaning the tax is deferred.

Tax-exempt accounts, such as Roth IRAs and Roth 401(k)s, are funded with after-tax dollars, but investments grow tax-free, and qualified withdrawals in retirement are tax-free. These accounts have restrictions and penalties if individuals withdraw funds before retirement age.

Tax-Efficient Investments

Some investments are more tax-efficient than others. Municipal bonds, for example, are tax-efficient because the interest income is not taxable at the federal level and may be tax-exempt at the state and local levels. Treasury bonds and Series I bonds are also tax-efficient as they are exempt from state and local income taxes.

Exchange-traded funds (ETFs) are passively managed, making them more tax-efficient than actively managed mutual funds. ETFs are also structured to avoid generating capital gains taxes when securities are bought and sold. Investors pay capital gains tax only when they sell shares.

Tax-Efficient Strategies

A common strategy to minimize taxes is to hold tax-efficient investments in taxable accounts and less tax-efficient investments in tax-advantaged accounts. This ensures that the tax burden is reduced as much as possible.

Another strategy is tax-loss harvesting, which involves selling investments at a loss to offset taxable gains from profitable investments. Individuals can deduct up to $3,000 in losses in a tax year, and any additional losses can be carried forward to the next tax year.

Consulting Professionals

Tax-efficient investing can be complex, and it's important to consider your specific circumstances and goals. It is recommended to consult a qualified investment planner, financial advisor, or tax specialist to determine the best tax strategy for your retirement and trading portfolios.

Investor's Losing Bet: Why Double Down?

You may want to see also

Frequently asked questions

A retirement portfolio is designed to provide income and preserve capital over a long period, often 30 years or more. A trading portfolio, on the other hand, is typically focused on shorter-term gains and may involve more frequent buying and selling of assets.

A well-diversified retirement portfolio typically includes a mix of stocks, bonds, and cash investments. The specific allocation will depend on your age, risk tolerance, and financial goals. Stocks provide growth potential, bonds offer income and capital preservation, while cash provides liquidity and safety.

The ideal mix of assets will depend on your individual circumstances. As a general guideline, younger investors can afford to take on more risk by investing primarily in stocks for long-term growth. As you approach retirement, you may want to shift towards a more conservative allocation, including more bonds and cash to generate income and preserve capital.

It is recommended to regularly review and adjust your retirement portfolio as your circumstances change. This may include rebalancing the allocation between stocks, bonds, and cash to ensure it aligns with your risk tolerance and financial goals. Major life events, market conditions, and changes in your income can also trigger a review of your portfolio.

One common mistake is investing too conservatively too soon, which may hinder the growth potential of your portfolio. Another mistake is focusing solely on income-generating investments, such as dividend stocks or bonds, instead of adopting a total return investment approach that balances income and capital preservation.