In the 1970s, Venezuela seized control of foreign oil investments, nationalizing its oil industry and becoming one of the world's leading oil producers. This move had significant implications for the global energy market and international relations, as it marked a shift in the balance of power in the oil industry and led to a period of increased state control over natural resources. The nationalization of oil companies such as Exxon and Shell was a bold move that reshaped Venezuela's economic and political landscape, leaving a lasting impact on the country's relationship with the international community.

| Characteristics | Values |

|---|---|

| Year | 2007 |

| Country | Venezuela |

| Industry | Oil and Gas |

| Impact | Seized control of foreign oil investments, nationalized oil companies, and imposed strict regulations on foreign oil companies operating in the country |

| Reason | To gain more control over the country's oil resources and revenue, reduce foreign influence, and promote local ownership |

| Outcome | Led to a significant shift in the oil industry, with foreign companies facing challenges and reduced operations, while the Venezuelan government gained more control and revenue |

What You'll Learn

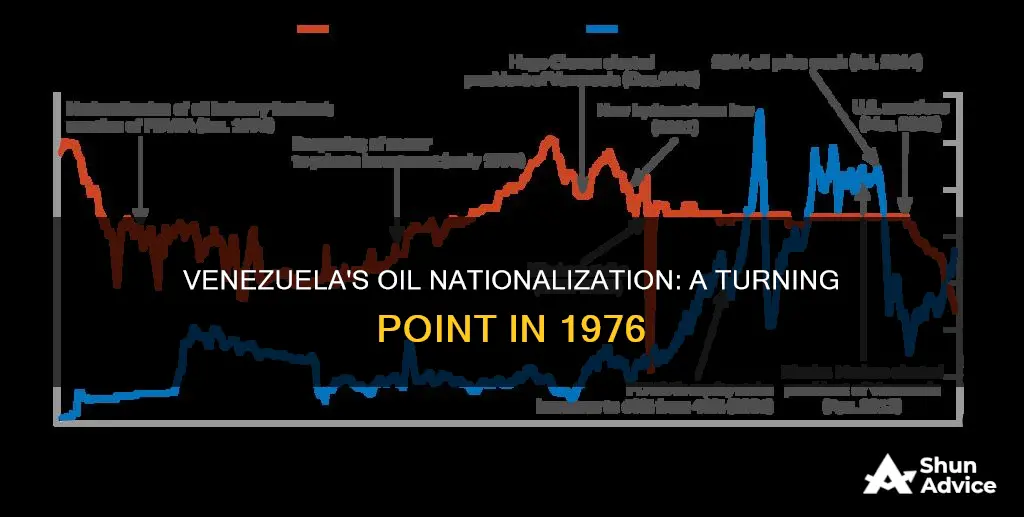

- Oil Nationalization Timeline: Venezuela's oil industry nationalization began in 1976, with key milestones in 1976, 1980, and 2007

- Foreign Investment Impact: Seizure of foreign investments led to reduced foreign investment, impacting oil production and revenue

- Economic Consequences: Nationalization caused economic instability, with oil prices and production fluctuating

- International Reactions: Global reactions varied, with some countries supporting Venezuela, while others imposed sanctions

- Political Motivations: The government aimed to gain control over oil resources and reduce foreign influence in the industry

Oil Nationalization Timeline: Venezuela's oil industry nationalization began in 1976, with key milestones in 1976, 1980, and 2007

The nationalization of Venezuela's oil industry was a significant event in the country's history, marking a shift towards state control and a pivotal moment in the global oil market. The process began in 1976, a year that set the stage for Venezuela's assertive move towards energy sovereignty. This initial phase saw the government taking control of key oil assets, primarily from foreign companies, and was a response to the global oil crisis and a desire to assert national interests. The move was a strategic decision to secure the country's oil wealth and reduce dependence on foreign investors, a decision that would have long-lasting implications.

In 1976, the Venezuelan government, under the leadership of President Carlos Andrés Pérez, initiated the nationalization process by taking over the assets of several major foreign oil companies, including Exxon and Mobil. This action was a bold statement of the country's intent to reclaim its natural resources and a significant departure from the previous era of foreign investment dominance. The nationalization was a response to the oil price shocks of the 1970s, which had a profound impact on Venezuela's economy, and the government sought to capitalize on the high oil prices to strengthen its financial position.

The year 1980 marked another critical milestone in this timeline. The Venezuelan government, now under the leadership of President Luis Herrera Campins, further solidified its control over the oil industry. This period saw the establishment of the state-owned oil company, Petróleos de Venezuela, S.A. (PDVSA), which became the primary entity responsible for the country's oil production and exports. PDVSA's creation was a significant step towards full nationalization, as it centralized control over the entire oil industry, from exploration to production and export. This move ensured that the country's vast oil resources were utilized for the benefit of the Venezuelan people, a principle that has been a cornerstone of the nation's energy policy.

The year 2007 witnessed a significant escalation in the nationalization process. President Hugo Chávez, in a series of moves, further expanded state control over the oil industry. This period saw the nationalization of additional oil assets, including the acquisition of shares in foreign-owned companies and the implementation of new regulations to ensure the state's majority ownership. Chávez's administration aimed to strengthen the country's control over its oil reserves, a move that was both a continuation of the previous nationalization efforts and a response to perceived foreign exploitation. The 2007 nationalization was a bold statement of Venezuela's commitment to energy independence and a significant chapter in the country's struggle for resource control.

This timeline highlights the gradual yet determined approach of the Venezuelan government to nationalize its oil industry. Each milestone was a strategic move, responding to global economic shifts and the government's vision for the country's energy future. The process has had a lasting impact on Venezuela's oil sector, shaping it into one of the most state-controlled industries in the world, with far-reaching consequences for the country's economy and its relationship with the global oil market.

Australia's Security Dilemma: Balancing Chinese Investment and National Interests

You may want to see also

Foreign Investment Impact: Seizure of foreign investments led to reduced foreign investment, impacting oil production and revenue

The year 2007 marked a significant turning point in Venezuela's approach to foreign oil investments. In an effort to assert national sovereignty and control over its vast oil reserves, the Venezuelan government, under the leadership of Hugo Chávez, began to nationalize and seize foreign investments in the oil industry. This decision had far-reaching consequences, impacting not only the country's oil production but also its revenue streams and overall economic stability.

Foreign investments in Venezuela's oil sector had been substantial, with numerous international companies operating and contributing to the country's oil output. However, the nationalization process led to a rapid reduction in these investments as foreign companies sought to withdraw their capital and operations. The seizure of assets and the implementation of stricter regulations created an uncertain environment for investors, causing a significant decline in new foreign investment.

The impact on oil production was immediate and severe. With reduced foreign investment, the necessary capital for exploration, development, and maintenance of oil fields was lacking. This resulted in a decrease in production rates, as many fields required regular investment to maintain their output. The decline in production had a direct effect on Venezuela's oil reserves, which are among the largest in the world, further exacerbating the country's energy-dependent economy.

Revenue generation from oil exports also took a hit. Lower production meant fewer barrels of oil could be exported, reducing the country's primary source of income. The impact on revenue was twofold; not only did the government lose out on potential earnings from foreign investors, but the reduced production also led to a decrease in the overall value of oil exports. This had a significant effect on Venezuela's ability to fund social programs and infrastructure projects, which were heavily reliant on oil revenue.

The consequences of the seizure of foreign investments extended beyond the oil industry, causing a ripple effect throughout the country's economy. The reduced investment and production led to a decrease in employment opportunities, as many oil-related jobs were directly impacted. This, in turn, affected the overall standard of living and contributed to social and political tensions within the country. The impact of this decision continues to shape Venezuela's relationship with foreign investors and its approach to economic policies.

Understanding the Right 1099 Form for Your Investments

You may want to see also

Economic Consequences: Nationalization caused economic instability, with oil prices and production fluctuating

The nationalization of foreign oil investments in Venezuela in 1976 had significant economic repercussions, particularly in the realm of oil production and pricing. This move, aimed at reclaiming control over the country's vast oil reserves, led to a period of economic instability and uncertainty.

One of the immediate consequences was the disruption of production levels. Prior to nationalization, Venezuela was a major oil exporter, with foreign companies investing heavily in exploration and production. The sudden takeover of these assets by the Venezuelan government caused a temporary halt in operations, resulting in a decline in oil output. This drop in production had a direct impact on the country's revenue, as oil exports were a significant source of income for the government. The initial instability in production led to fluctuations in oil prices, as the market responded to the reduced supply.

As the Venezuelan government took control of the oil industry, it implemented a new pricing strategy. The state-owned oil company, PDVSA, began setting prices independently, moving away from the previous system where foreign companies determined prices. This shift in pricing power had a ripple effect on the global oil market. The new pricing strategy, often influenced by political considerations, could lead to sudden changes in oil prices, causing volatility in the international market. For instance, if Venezuela decided to increase or decrease production, it would directly impact global oil supplies and, consequently, prices.

The economic instability caused by nationalization extended beyond the oil sector. The fluctuations in oil prices and production had a knock-on effect on the overall economy. Venezuela's heavy reliance on oil exports meant that any disruption in the oil industry could lead to a significant decline in government revenue. This, in turn, affected the country's ability to fund social programs, infrastructure projects, and other essential services. The economic uncertainty also discouraged foreign investment, as potential investors were wary of the political risks and the potential for further nationalizations.

In summary, the nationalization of foreign oil investments in Venezuela had far-reaching economic consequences. The initial disruption in production and the subsequent fluctuations in oil prices created a volatile environment. This instability not only affected the oil industry but also had a profound impact on the country's economy as a whole, highlighting the delicate balance between nationalization policies and economic sustainability.

Understanding Initial Investment Outlay: First Cash Outlay Explained

You may want to see also

International Reactions: Global reactions varied, with some countries supporting Venezuela, while others imposed sanctions

The international community's response to Venezuela's nationalization of foreign oil investments in 2007 was diverse and often contentious. Some countries and international organizations expressed support for Venezuela's actions, viewing them as a legitimate exercise of national sovereignty and a means to assert control over vital natural resources. These countries believed that the move was a necessary step to address the perceived exploitation of Venezuela's oil wealth by foreign corporations. For instance, the government of Hugo Chávez, the then-president, argued that the nationalization was a way to ensure the equitable distribution of oil revenue and to promote social and economic development within the country.

On the other hand, many Western nations and their allies imposed sanctions on Venezuela, citing concerns over human rights violations, political repression, and the erosion of democratic institutions. The United States, in particular, led a campaign of economic and diplomatic pressure, freezing assets and imposing travel bans on Venezuelan officials. The U.S. government also sought to isolate Venezuela diplomatically, advocating for a more aggressive approach to what it perceived as an authoritarian regime. These sanctions had a significant impact on Venezuela's economy, exacerbating existing economic challenges and contributing to the country's subsequent economic crisis.

European countries, while generally more cautious in their approach, also expressed concerns over the nationalization. Some European Union members supported the idea of dialogue and negotiation to resolve the dispute, emphasizing the importance of maintaining stable and predictable investment environments. However, others joined the U.S. in imposing sanctions, believing that the Venezuelan government's actions undermined the rule of law and international investment norms.

The response from South American neighbors was more varied. Some countries, such as Bolivia and Nicaragua, expressed solidarity with Venezuela, viewing the nationalization as a regional issue that required collective action. These countries often shared similar political ideologies and sought to strengthen their own energy security through similar measures. In contrast, others in the region, like Colombia and Peru, were more critical, arguing that the move could disrupt regional economic integration and investment flows.

International organizations, such as the Organization of American States (OAS) and the United Nations, also played a role in shaping the global reaction. The OAS, for instance, initiated a special session to address the issue, but its efforts were met with mixed reactions. Some member states supported the Venezuelan government's position, while others pushed for a more balanced approach. The UN, through its various bodies, also engaged in discussions, with some advocating for a peaceful resolution and others expressing concern over the potential impact on global energy markets.

Under Armour's Investment Strategy: Equity Method Insights

You may want to see also

Political Motivations: The government aimed to gain control over oil resources and reduce foreign influence in the industry

In the early 1970s, Venezuela's political landscape was undergoing significant changes, driven by a combination of economic, social, and political factors. The country's oil industry, a cornerstone of its economy, was at the center of these developments. The government, under the leadership of President Carlos Andrés Pérez, embarked on a mission to assert control over the oil sector and reduce the influence of foreign investors, particularly those from the United States. This move was not merely a reaction to external pressures but was deeply rooted in the country's political motivations and aspirations.

The primary objective was to nationalize the oil industry, a strategy that had been gaining traction in various Latin American countries during this period. By taking control of the oil resources, the government aimed to ensure that the wealth generated from these resources benefited the Venezuelan people directly. This was a response to the perceived exploitation of the country's natural resources by foreign companies, which often exported a significant portion of the profits without reinvesting in the local economy. The government's desire to reduce foreign influence was not just about economic benefits but also about asserting national sovereignty and political independence.

The political motivations behind this action were multifaceted. Firstly, the government sought to address the growing discontent among the Venezuelan population, who were facing economic challenges and felt that the benefits of the oil industry were not being distributed equitably. By nationalizing the oil sector, the government aimed to create jobs, improve social services, and reduce poverty, thereby gaining political capital and public support. This move was also seen as a way to challenge the dominance of foreign corporations, which were often perceived as symbols of imperialist exploitation.

Additionally, the government's strategy was influenced by the global political climate of the time. The oil crisis of the 1970s had already caused significant economic turmoil, and many countries were reevaluating their energy policies. Venezuela, with its vast oil reserves, saw an opportunity to strengthen its position in the global energy market and potentially gain more favorable terms in its oil export agreements. The government's decision was also a response to the geopolitical tensions between the United States and Venezuela, which had been escalating due to political and economic differences.

The nationalization of the oil industry in Venezuela was a bold political move, reflecting the government's determination to reshape the country's economic and political landscape. It demonstrated a clear intention to gain control over a vital resource, reduce foreign dependency, and address domestic economic and social issues. This action had far-reaching consequences, impacting not only the oil industry but also the political and social dynamics of Venezuela for decades to come.

Target's Investment Strategy: A Deep Dive into Their Style

You may want to see also

Frequently asked questions

In 2007, the Venezuelan government, led by Hugo Chávez, nationalized several foreign oil companies' assets, including ExxonMobil's operations in the heavy oil fields of the Orinoco Belt. This move was a significant shift in the country's oil industry, as it aimed to regain control over its vast oil reserves and resources.

The nationalization caused a significant backlash from foreign investors, who feared a loss of control over their assets and operations in Venezuela. Many companies were forced to renegotiate contracts and hand over a larger share of their profits to the Venezuelan state. This led to a decline in foreign investment in the oil sector, which had long been a major source of revenue for the country.

The Venezuelan government argued that the nationalization was necessary to ensure the country's energy security and to redistribute wealth more equitably among its citizens. They claimed that foreign oil companies were exploiting the country's resources and not investing enough in local infrastructure and technology. The move was also seen as a way to assert national sovereignty over the country's natural resources, which had been a key theme in Chávez's presidency.