If you're an investor, you may receive a few different 1099 forms, including:

- 1099-B, which reports capital gains and losses

- 1099-DIV, which reports dividend income and capital gains distributions

- 1099-INT, which reports interest income

- 1099-R, which reports distributions from retirement accounts

| Characteristics | Values |

|---|---|

| Form Number | 1099-DIV |

| Description | Dividends and Distributions |

| Who Receives This Form? | Investors who own stocks that pay dividends or a mutual fund that made a capital gains distribution during the year |

| Who Sends This Form? | Banks and other financial institutions |

| What Does This Form Report? | Dividends and distributions |

| How Many Boxes Are There? | Several, including boxes for ordinary dividends, qualified dividends, and capital gain distributions |

| Do You File This Form with the IRS? | No, but you need the information to prepare your tax return |

| What Are the Implications for Schedule B? | If your total dividends and interest exceed $1,500, you may need to file a Schedule B with your tax return to report this income |

What You'll Learn

1099-B: Proceeds from Broker and Barter Exchange Transactions

Form 1099-B is a tax form used by brokerages and barter exchanges to record customers' gains and losses during a tax year. It is sent by brokers to their customers for tax filing purposes.

The form itemizes all transactions made during a tax year. Individuals use the information to fill out Schedule D, listing their gains and losses for the year. The sum total is the individual's taxable gain or loss for the year.

Form 1099-B is used to report gains or losses from selling stocks, bonds, derivatives, or other securities through a broker, and for barter exchange transactions. It contains details such as a description of the item sold, purchase and sale dates, acquisition cost, sale proceeds, and any federal tax withheld by the broker.

The form also reports the fair market value of goods and services received through barter exchanges, which usually counts as taxable income. It helps individuals deal with capital gains and losses on their tax returns. Typically, gains are taxable, while losses can offset gains or reduce taxable income.

A separate Form 1099-B must be filed for every single transaction involving the sale of stocks, commodities, regulated futures contracts, foreign currency contracts, forward contracts, debt instruments, options, or securities futures contracts. Brokerage firms and those dealing in bartering activities must file separate forms even if sales of different securities took place in a single transaction.

Brokers must submit a Form 1099-B to the IRS and send a copy directly to every customer who sold stocks, options, commodities, or other securities during the tax year. The form may also be filed by companies that participate in certain bartering activities.

Investment Firms: Are They Worth Your Money?

You may want to see also

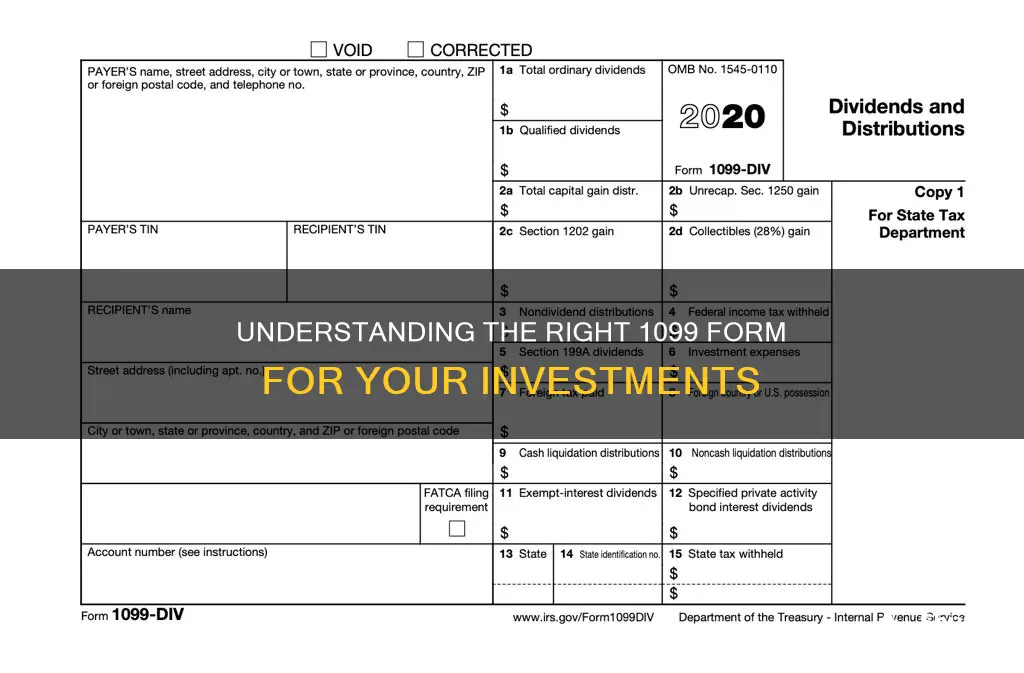

1099-DIV: Dividends and Distributions

Form 1099-DIV is used by banks and other financial institutions to report dividends and other distributions to taxpayers and to the IRS. It is a tax form required by the Internal Revenue Service (IRS).

If some of the stocks you own pay dividends, or a mutual fund you invest in made a capital gains distribution to you during the year, you'll receive a 1099-DIV form. The form includes several boxes that report different types of your income, such as ordinary dividends (Box 1a), qualified dividends (Box 1b), and capital gain distributions (Box 2a).

Your ordinary dividends are taxed at ordinary income rates, while qualified dividends and capital gain distributions are typically taxed at lower long-term capital gains rates.

You don't file the 1099-DIV with the IRS, but you need its information to prepare your tax return.

If your total dividends and interest exceed $1,500, you may need to file a Schedule B with your tax return to report this income.

Investing: Negative Cash Flow's Impact and Insights

You may want to see also

1099-INT: Interest Income

Form 1099-INT is a tax form required by the Internal Revenue Service (IRS) that reports interest income. It is used to report interest income from various sources, including savings and loan associations, mutual savings banks, credit unions, and more. The threshold for issuing a 1099-INT is $10 in interest income, or at least $600 of interest paid in the course of trade or business.

The form includes several boxes that report different types of income and expenses. Here's a breakdown of what each box on the form represents:

- Box 1: Interest Income - Enter taxable interest not included in Box 3. This includes interest of $10 or more paid or credited to an individual's account by savings and loan associations, mutual savings banks, credit unions, etc.

- Box 2: Early Withdrawal Penalty - Enter interest or principal forfeited due to early withdrawal from time deposits, such as certificates of deposit (CDs).

- Box 3: Interest on US Savings Bonds and Treasury Obligations - Enter interest on US savings bonds, treasury bills, notes, and bonds.

- Box 4: Federal Income Tax Withheld - Enter backup withholding, such as when a recipient does not provide their Taxpayer Identification Number (TIN).

- Box 5: Investment Expenses - For single-class REMICs, enter the regular interest holder's share of investment expenses.

- Box 6: Foreign Tax Paid - Enter any foreign tax paid on interest, reported in US dollars.

- Box 7: Foreign Country or US Territory - Enter the name of the foreign country or US territory for which foreign tax was paid and reported in Box 6.

- Box 8: Tax-Exempt Interest - Enter tax-exempt interest of $10 or more that is credited or paid to an individual's account. This includes interest paid on obligations issued by states, US territories, Indian tribal governments, etc.

- Box 9: Specified Private Activity Bond Interest - Enter interest of $10 or more from specified private activity bonds, generally issued after August 7, 1986.

- Box 10: Market Discount - For covered securities acquired with market discount, enter the amount of market discount that accrued during the tax year if the recipient notified you of a Section 1278(b) election.

- Box 11: Bond Premium - For taxable covered securities acquired at a premium, enter the amount of bond premium amortization allocable to the interest paid during the tax year.

- Box 12: Bond Premium on Treasury Obligations - For US Treasury obligations that are covered securities, enter the amount of bond premium amortization allocable to the interest paid during the tax year.

- Box 13: Bond Premium on Tax-Exempt Bond - For tax-exempt covered securities acquired at a premium, enter the amount of bond premium amortization allocable to the interest paid during the tax year.

- Box 14: Tax-Exempt and Tax Credit Bond CUSIP No. - Enter the CUSIP number of the tax-exempt bond or the tax credit bond for which tax-exempt interest or tax credit was reported.

- Boxes 15-17: State Information - These boxes are optional and can be used to report state income tax withheld and payer's state identification number.

It is important to note that Form 1099-INT is not required to be filed for payments made to certain exempt recipients, such as corporations, tax-exempt organizations, Individual Retirement Arrangements (IRAs), and more. Additionally, there are exceptions to reporting, such as interest on obligations issued by individuals and certain portfolio interests.

The 1099-INT form is typically received by mail in February. It is important to keep track of these forms as they are crucial for accurately reporting income on your federal tax return.

Investment Firm Apps: Choosing the Right One

You may want to see also

1099-R: Distributions from Retirement Accounts

Form 1099-R is used to report the distribution of retirement benefits such as pensions, annuities, or other retirement plans. If you received a distribution of $10 or more from your retirement plan, you should receive a copy of Form 1099-R, Form CSA 1099R, Form CSF 1099R, or Form RRB-1099-R.

Pension and annuity distributions are usually made to retired employees, disabled employees, and, in some cases, to the beneficiary of a deceased employee. If you take a loan against your pension plan and repay it with interest, it is generally not considered a distribution. However, Form 1099-R will be issued if you don't make the required loan payments on time.

Form 1099-R includes various boxes that report different types of income and distribution codes:

- Box 1 - Gross Distribution shows the total amount distributed to the taxpayer.

- Box 2a - Taxable Amount shows the portion of the distribution that is generally taxable.

- Box 2b - Contains checkboxes indicating whether the taxable amount was determined or if it was a total distribution.

- Box 3 - Capital gain (included in box 2a) reports the taxable gain for certain scenarios, such as lump-sum distributions for individuals born before January 2, 1936.

- Box 4 - Federal income tax withheld shows any federal income tax withheld and remitted to the IRS.

- Box 5 - Employee contributions/Designated Roth contributions or insurance premiums show the taxpayer's investment in the contract (after-tax contributions).

- Box 6 - Net unrealized appreciation in the employer's securities shows the distribution of employer's securities from a qualified pension plan.

- Box 7 - Distribution code(s) indicates the type of distribution, such as direct rollover, transfer to a Roth IRA, or total distribution.

- Box 8 - Other shows the value of any annuity contract included in the distribution, which is not taxable.

- Box 9a - Your percentage of total distribution indicates the percentage received by the taxpayer when the distribution was made to multiple individuals.

- Box 9b - Total employee contributions show the taxpayer's total investment in a life annuity from a qualified plan.

- Box 10 - Amount allocable to IRR within 5 years - Refer to Publication 575 for reporting instructions.

- Box 11 - 1st year of designated Roth contributions is used to determine if earnings on the distribution are subject to the 10% additional tax on early distribution.

- Boxes 14-19 - Show state and local tax withholdings, as well as the part of the distribution reported to the state.

It's important to note that retirement distributions reported on Form 1099-R can often be "rolled over" into another retirement plan or IRA within 60 days, allowing taxpayers to generally defer taxes on the rollover amount until it is withdrawn from the new plan. However, these distributions must still be reported on the tax return.

Understanding Dividends: Cash Dividends and Their Nature

You may want to see also

1099-MISC: Miscellaneous Information

Form 1099 is a tax form required by the Internal Revenue Service (IRS) for reporting investment income, usually interest or dividends. There are several types of 1099 forms, including 1099-MISC: Miscellaneous Information.

As an investor, you may receive Form 1099-MISC if you receive substitute payments in lieu of dividends. Form 1099-MISC is also used to report direct sales of at least $5,000 worth of consumer products to a buyer for resale anywhere other than a permanent retail establishment.

In general, Form 1099-MISC is used to report payments made to someone during the year, including:

- Royalties or broker payments in lieu of dividends or tax-exempt interest ($10 minimum)

- Other income payments

- Medical and healthcare payments

- Crop insurance proceeds

- Cash payments for fish or other aquatic life purchased from anyone engaged in the trade or business of catching fish

- Cash paid from a notional principal contract to an individual, partnership, or estate

- Payments to an attorney

- Fishing boat proceeds

Form 1099-MISC is not used for filing with the IRS, but the information it contains is necessary for preparing your tax return.

Wells Fargo for Investing: Is It a Good Choice?

You may want to see also

Frequently asked questions

Form 1099 is a collection of forms used to report payments that are typically not from an employer.

You should receive a 1099 form if you earned $600 or more in nonemployee compensation, rent or royalty payments, or received a state or local tax refund during the previous year.

The business that pays the money fills out the form and sends copies to the recipient and the IRS.

There are several types of 1099 forms, including:

- 1099-B: Proceeds from Broker and Barter Exchange Transactions

- 1099-DIV: Dividends and Distributions

- 1099-INT: Interest Income

- 1099-R: Distributions from Retirement Accounts